The United States, Canada and Europe registered the largest gross volumes in the UK lending marketplace. These regions accounted for a total of $36,016 million in gross volume in the last 12 months. The United States and Canada registered $24,228 million in volume while Europe handled $11,788 million.

UK Marketplace Lending Index

The UK Marketplace Lending Index measures the returns available from tech-enabled lending in the UK. In order to create this index, they gather data from Funding Circle, Market Invoice, Rate Setter and Zopa. According to data provided by Brismo, North America and Europe accounted for 95% of the total gross volume in the UK lending marketplace.

In the last 12 months, the largest consumer lender in the United Kingdom was Zopa, with a volume of £929.3 million. The top business lender was Assetz Capital with £229.9 million. Finally, LendInvest became the largest property lender in the UK with a volume of £780.3 million.

In the European Union (EU) things changed. For example, in the last 12 months, P2P lending platform Mintos registered a volume of €2,261.1 million in the consumer lending business. The top business lender was Fifty Finance with a volume of €364.4 million. Furthermore, the largest property lender was EstateGuru with a volume of €69 million. Finally, in terms of receivable financing, Credimi handled €405.9 million.

In the United States and Canada, the market is much more focused on just a few companies. LendingClub accounted for $11,614.9 million as a consumer lender followed by Sofi with $6,666.7 million. The leading business lender was OnDeck with $1,511 million and the top property lender was Sharestates with a volume of $972.5 million in the last 12 months.

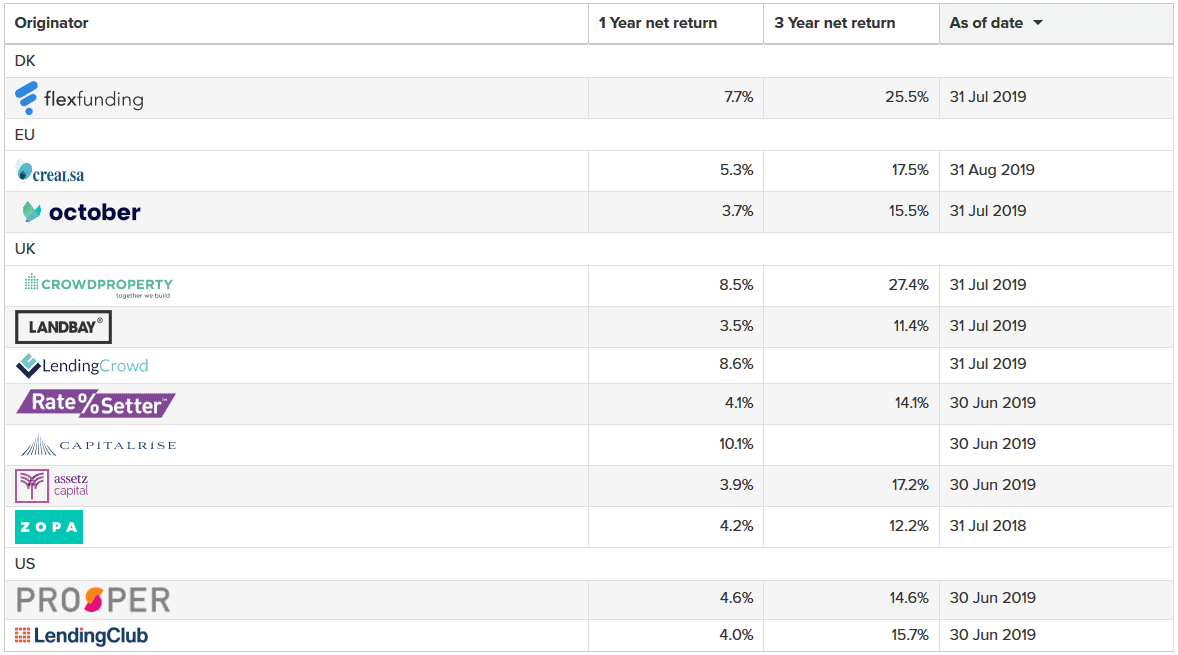

Originator Returns

In the European Union, Crealsa was able to register a 17.5% return in the last three years, followed by october with 15.5% returns.

In the United Kingdom, Crowdproperty accrued a return of 27.4% in the last three years, followed by Assetz Capital with 17.2% return in the same period.

In the United States, both Prosper and LendingClub registered similar returns of 14.6% and 15.7% respectively in the last 3 years.

This data provides a clear snapshot of tech-enabled origination volumes across different regions. At the same time, the information gathered by Brismo shows valuable information about the UK lending marketplace.

The lending market in the United Kingdom shows a clear dominance of North America. Investors from Europe represent the second-largest participants in this market. Other jurisdictions handle very small volumes.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account