Amazon along with Apple, Facebook, and Alphabet would release their quarterly earnings on 29 October. What’re analysts projecting for Amazon this quarter and should you buy it before the earnings release? Let’s discuss this.

A third of S&P 500 companies are reporting this week

We’re into the busiest week this earnings season with a third of Dow Jones Industrial Average and S&P 500 companies releasing this week. Four of the FAANG stocks (Facebook, Amazon, Apple, Netflix, and Google-parent Alphabet) are releasing this week. The FAANG earnings started on a dismal note as Netflix reported fewer than expected subscribers in the third quarter.

US tech stocks are priced for perfection after the sharp rise this year and markets have punished stocks on the slightest hint of a growth slowdown. However, they have rewarded stellar growth numbers with a sharp increase in stock prices also.

Amazon’s quarterly guidance

Amazon posted better than expected earnings in the second quarter as the pandemic lifted sales for the eCommerce giant. It did take a $4 billion dollar hit due to the pandemic related costs. The company expects pandemic related costs to total more than $2 billion in the third quarter.

During their second quarter earnings release, Amazon said that it expects sales to rise between 24% and 33% in the third quarter. Interestingly, while many companies including Apple have refrained from providing quantitative guidance due to the uncertainty, Amazon continues to provide guidance.

Amazon’s third quarter earnings estimates

Analysts polled by Tikr expect Amazon’s revenues to increase 32% year over year to $92.5 billion. Analysts are forecasting the company’s revenues to rise near the top end of its guidance. Wall Street analysts expect Amazon’s adjusted earnings per share to rise 70% over the corresponding quarter in 2019 to $7.16.

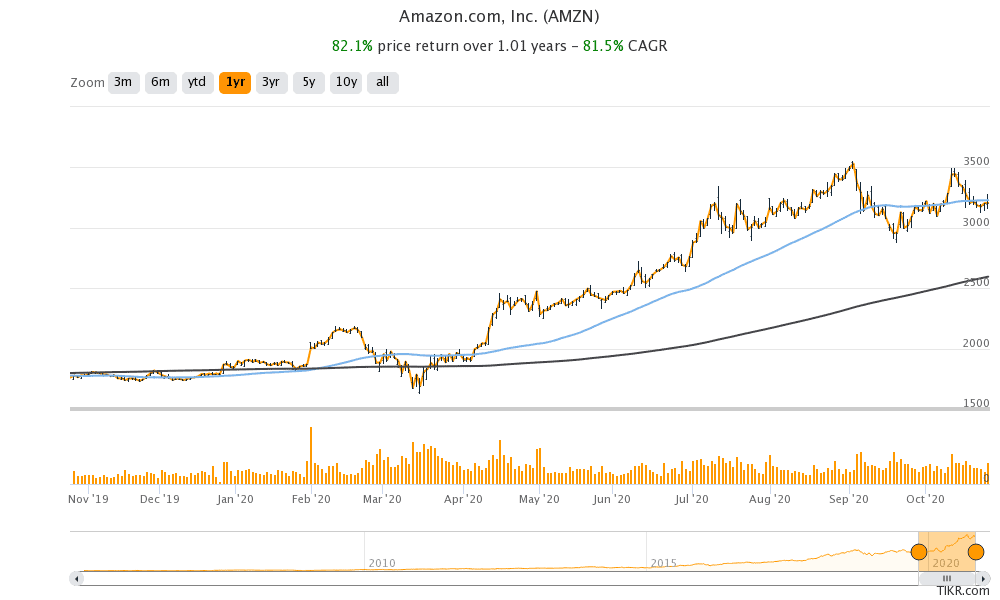

How has Amazon stock fared in 2020?

Amazon stock has gained over 73% so far in 2020 and is among the top 15 gainers in the S&P 500. It is also the best performing FAANG stock this year. Alphabet has gained the least among the FAANG stocks this year. While stocks like Amazon and Netflix have rallied this year amid the spike in the so-called “stay-at-home” stocks, lower ad rates have taken a toll on Alphabet.

Is Amazon stock expensive after the spike?

After the rally in Amazon stock this year, it might look expensive to some investors. Amazon trades at an NTM (next-12 months) PE multiple of 91x. However, we should see the high valuation multiple in conjunction with the high growth that the Jeff Bezos-run company is consistently delivering. In a stock market devoid of growth, Amazon gives the scale and growth that many investors are looking for.

Also, some of the recently listed cloud companies have an even higher valuation multiple than Amazon. Amazon Web Services (AWS) is the world’s largest cloud infrastructure platform and has a one third market share in that market.

Price target and analysts’ ratings

According to the consensus estimates compiled by MarketBeat, Amazon has an average 12-month price target of $34,59.59 which is a premium of 9% over the current prices. Its highest price target is $4,500 while its lowest price target is $1,850.

Of the 49 analysts covering Amazon stock, an overwhelming majority of 46 have rated it as a buy or some equivalent. Three analysts have a hold rating on the stock. Most analysts see any fall in Amazon’s stock price as a buying opportunity.

This month, several brokerages have raised Amazon’s price target. Pivotal Research raised Amazon’s target price from $3,925 to a street high of $4,500 while Societe Generale lifted its target price from $2,730 to $3,660. Mizuho also raised its target price from $3,700 to $4,000.

Amazon stock: Key technical levels to watch

Amazon stock is currently trading slightly below its 50-day SMA (simple moving average) of 3,228.77 which is a sign of short-term bearishness. If the stock convincingly breaks above the 50-day SMA then the uptrend might continue.

Amazon stock has a 52-week trading range between $1,626.03 and $3,552.25. It is currently trading 9.6% below its 52-week highs. The stock closed slightly in the green yesterday despite the sharp sell-off on Wall Street. It was trading flat in pre markets today while S&P 500 futures point to an opening in the green today after yesterday’s turmoil.

You can buy Amazon stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account