2020 is turning out to be among the best years for US IPOs. Online gaming platform Roblox, that’s quite popular among children and preteens, filed its IPO yesterday.

The total number of IPOs this year is already 396 this year, only one short of what we had in 2000. The IPO boom is not done yet and has in fact gained traction after the election uncertainty ended.

2020 has been the year of the IPO boom

Along with the traditional listings, many companies including Fisker, Nikola, and Lordstown have listed through the SPAC (special purpose acquisition company) route. Data analytics company Palantir took the direct listing route shunning the traditional listing mechanism.

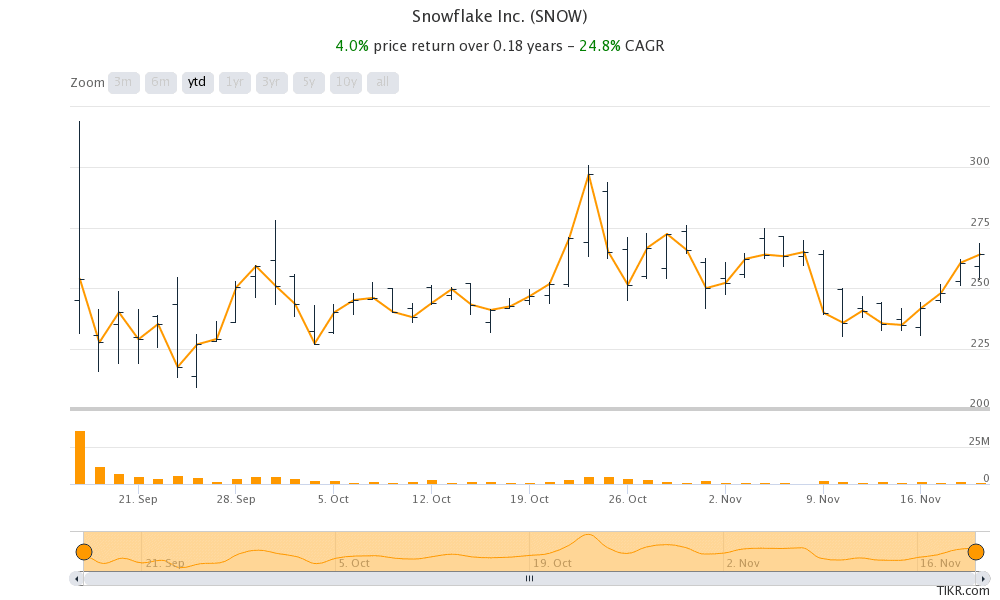

Most IPOs have done well this year and the Renaissance IPO is outperforming the S&P 500. Even Berkshire Hathaway, whose chairman Warren Buffett has stayed away from tech stocks and has had very pessimistic view of IPOs, co-invested in the IPO of cloud company Snowflake.

Many see the record number of listing as a reminder of the soaring valuations. However, investors have ignored such warnings and IPOs of tech and electric vehicle companies have received a good response. Roblox is the latest company to file for its IPO.

Roblox IPO: Key highlights

Roblox was founded in 2006. The company’s growth has increased multi-fold this year as pandemic has led to higher demand for gaming companies. The company’s daily active users more than doubled to 36.2 million in the third quarter. The hours engaged also surged to 8.7 billion.

In the third quarter, Roblox reported revenues of $242.2 million which were 91% higher than the corresponding quarter. However, its losses also more than doubled to $48 million over the period.

“We have experienced rapid growth in the three months ended June 30, 2020, September 30, 2020 and for a portion of the three months ended March 31, 2020, due in part to the COVID-19 pandemic given our users have been online more as a result of global COVID-19 shelter-in-place policies,” said the company in its release.

Through its IPO, Roblox intends to raise $1 billion. Meanwhile, in its filings it admitted that it might not be able to continue the growth rates that it is witnessing this year in the future.

How to invest in Roblox IPO

To invest in Roblox IPO, you would need to have a trading account with a broker. You may choose from any of the best online stockbrokers. Alternatively, you can look at ETFs like the Renaissance IPO ETF that invests in newly listed companies.

Through an IPO ETF, you can diversify your risks across many companies instead of just investing in a few IPOs. While this may mean that you might miss out on “home runs” as we saw in Snowflake IPO, you would also not end up owning the worst performing IPOs in your portfolio.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account