Oil Exchange-Traded Funds (ETFs), equity instruments that hold a basket of oil futures, are seeing large capital inflows despite the plunge in the price of oil futures below zero for the first time in history.

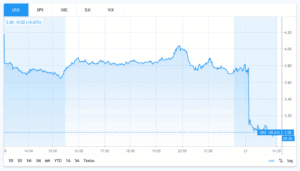

According to data from ETF.com, a website that tracks statistics on ETFs, the United States Oil Fund (USO), one of the most popular oil ETFs, saw capital inflows of more than $2bn in the past few days, as investors take long positions on oil based on a potential future recovery. Also, ETFs that focus on services, storage or refineries are faring relatively well in the current climate.

USO has lost 70% of its value year-to-date as a result of the recent oil crisis, while other similar ETFs such as Invesco’s DB Oil Fund (DBO) and the United States Brent Oil (BNO) have lost 43.2% and 61.6% respectively.

As a result of this recent volatility, ETF managers have been hedging their exposure to oil by as much as 50% of the fund’s portfolio by buying US Treasury Bills, an investment-grade bond issued by the US federal government, and other short-term financial instruments to hedge from these declining prices to protect their funds from losing their entire value.

ETFs are investment vehicles managed by large financial companies such as BlackRock, Barclays, and Invesco, that allow investors to gain exposure to certain assets such as commodities, real estate, stocks, or bonds, by mimicking the portfolio composition of a certain index such as the S&P 500 or the Dow Jones Industrial Average.

A drop in the global demand for oil caused by the coronavirus health emergency, combined with increased production from Saudi Arabia and Russia as a result of their recent oil price war, has sent the price of oil to its lowest point in decades, threatening an industry-wide shock that could end up shutting down hundreds of oil rigs around the world.

Even though the recent drop in the price of May’s futures contract may have been unprecedented, experts warn that the situation may roll over to June’s futures, which are due on 19 May, if no action is taken to contain the situation.

The global head of commodities for RBC Capital, Helima Croft, said: “There is still a lot of crude on the water right now that is going to refineries that do not need it”.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account