Netflix (NYSE: NFLX) has rolled out its password-sharing crackdown to the US in a bid to end the practice which takes a massive toll on its subscriber count and by its extension revenues and profits.

The company has started alerting customers about its password-sharing policy in an email titled “Your Netflix account is for you and the people you live with — your household.”

Netflix rolls out password sharing crackdown in the US

In its blog post, Netflix said, “A Netflix account is for use by one household. Everyone living in that household can use Netflix wherever they are — at home, on the go, on holiday — and take advantage of new features like Transfer Profile and Manage Access and Devices.”

In the email, it says that customers should review their accounts to see what devices use the Netflix account and calls upon customers to “sign out of devices that shouldn’t have access” and also change the password.

How to share Netflix with others?

Netflix lists two ways through which one can share their Netflix account outside the household. Firstly, one can transfer the profile to a new membership in which case they would pay the fee based on the tier opted.

Currently, the streaming giant offers four tiers in the US. These include the standard ad-supported tier which it launched late last year. The tier is priced at $6.99 per month and can support two devices at a time.

Netflix recently said that the ad-supported tier has surpassed 5 million subscribers.

Looking at the other tiers, the Basic subscription costs $9.99 monthly and supports only one device at a time. The Standard subscription is priced at $15.49 per month and supports two devices at a time. The Premium plan is priced at $19.99 per month and supports up to four devices at a time.

Meanwhile, Netflix also gives the customer an option to buy an extra member under their subscription in which case the monthly fee would be $7.99.

NFLX password sharing crackdown

Last year, Netflix said that according to its estimates nearly 100 million households used shared passwords to watch its content. It has started to crack down on password sharing and introduced “paid sharing” and began testing the feature in Latin America.

The company expanded the feature to Canada in the first quarter and said that it would roll out the feature in the US this quarter.

It added that in Canada which it believes is a “reliable predictor for the US” the paid subscriber base is now higher than what it was before the rollout of paid sharing.

It said, “While we could have launched [paid account sharing] broadly in Q1, we found opportunities to improve the experience for members. We learn more with each rollout and we’ve incorporated the latest learnings, which we think will lead to even better results.”

It added, “While this will shift some of the membership growth and revenue benefit from Q2 to Q3, we believe it will result in a better outcome for our members and our business.”

Password sharing crackdown might lead to subscriber loss in the short term

During their Q3 2022 earnings call, Netflix acknowledged that the decision to crackdown on password sharing will not be “universally popular.”

It added, “We’ll see a bit of a cancel reaction to that. We think of this as similar to what we see when we raise prices. So, we get some increased churn associated with that for a period of time.”

However, it said that the subscriber count rises in the medium to long term as many of those who watched Netflix through borrowed passwords also eventually sign up.

Netflix sees ad-supported tier as a key long-term driver

Amid slowing growth, Netflix last year announced a password-sharing crackdown and an ad-supported tier. It was quite a U-turn for the streaming giant as it always spoke against ads on streaming platforms.

During the Q4 2022 earnings call, Netflix said that the average revenue per user on the ad-supported tier is higher than the Standard plan. It stressed, “While it’s still very early days, we continue to be pleased with our progress across all key dimensions: member experience, value to advertisers, and incremental contribution to our business. Engagement on our ads tier is above our initial expectations and, as expected, we’ve seen very little switching from our standard and premium plans.”

NFLX partnered with Microsoft

It also said, “Given current healthy performance and trajectory of our per-member advertising economics, particularly in the U.S., we’re upgrading our ads experience with more streams and improved video quality to attract a broader range of consumers.”

Netflix partnered with Microsoft for its ad-supported tier. In its shareholder letter, it said that it is launching a “programmatic private marketplace” which it said would create “more buying options for Netflix ad inventory using Microsoft’s sales platform.”

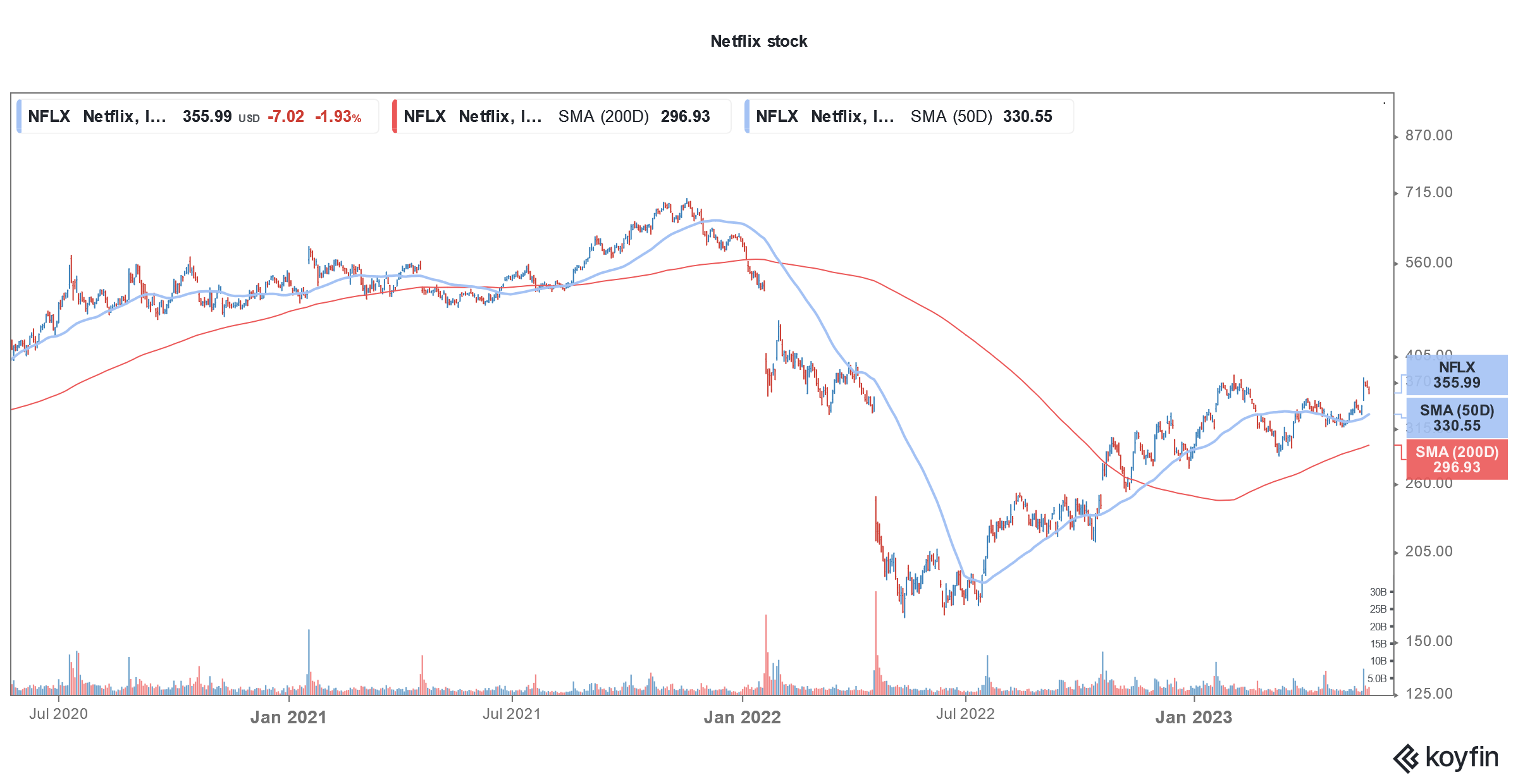

Meanwhile, NFLX stock is trading flat in US premarket today. It has gained 20% for the year which makes it the worst-performing FAANG stock of the year.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account