Meta Platforms has laid off around 4,000 employees as part of its second round of job cuts that it announced last week. The company’s CEO Mark Zuckerburg did not rule out more layoffs in the future.

The layoffs are part of round two of layoffs that the Facebook parent announced last month when it said that it would eliminate 10,000 positions.

It laid off 11,00 employees last year also and once the current round of layoffs is completed the company’s workforce would be around 25% lower than what it was prior to the layoffs.

Meta Platforms has completed 4,000 layoffs

Zuckerburg interacted with Meta employees in a virtual Q&A session and said that going forward the company won’t grow its headcount by more than 1-2% annually.

He said, “I just kind of think that for where we are in the efficiency that we’re able to get from new technologies, that’s probably the right model to expect going forward and that will be a different operating model and I think we can do it well.”

Mark Zuckerburg did not rule out layoffs in the coming years and said “I generally feel good about the position here, but just given the volatility, I don’t want to kind of promise that there won’t be future things in the future.”

Zuckerburg has touted 2022 as the “year of efficiency”

Zuckerburg has touted 2023 as the “year of efficiency” and amid slowing growth, the company has been looking to cut costs. It now expects its total 2023 expenses to be between $86 billion-$92 billion which is $8 billion lower than its original guidance.

When Meta announced the layoffs last month, In his blog announcing the layoffs, Zuckerburg said that as part of the “year of efficiency” Meta wants to become a “better technology company.” The second goal per Zuckerburg is “to improve our financial performance in a difficult environment so we can execute our long-term vision.”

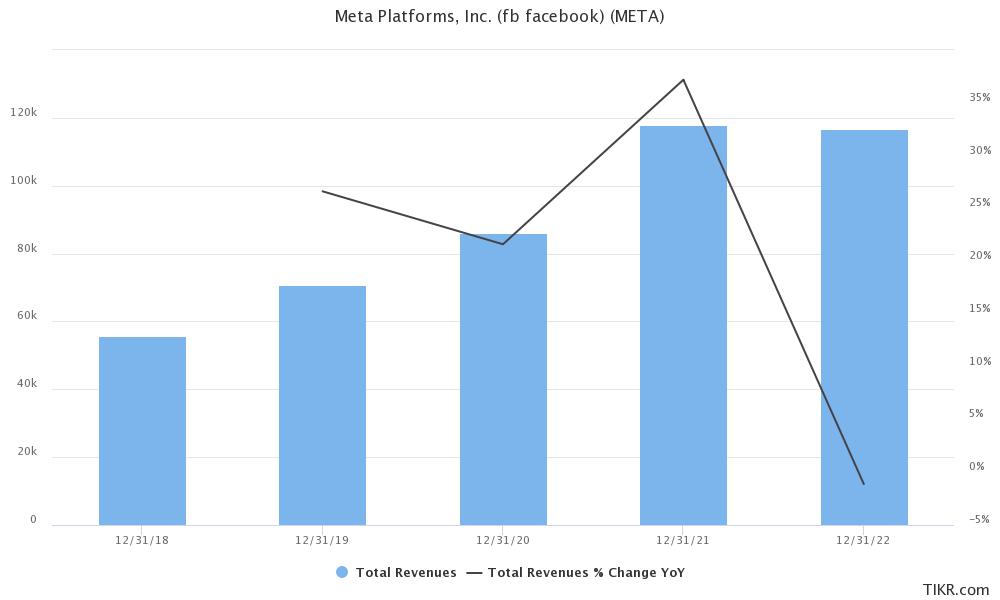

He warned that the slowdown might continue for a couple of years. Last year, Meta posted revenues of $116.6 billion – 1% lower than the previous year.

Meta Platforms revenues fell in 2022

It was the first time ever that the company’s revenues fell YoY. At the same time, its net income plunged 41% to $23.2 billion. Along with a general rise in costs, massive losses towards building the metaverse took a toll on Meta Platforms’ 2022 profitability.

Its Reality Labs business, which is building the metaverse posted operating losses of $13.7 billion last year on revenues of a mere $2.15 billion. While the segment’s revenues fell YoY last year the losses ballooned by over $2.5 billion.

Zuckerburg has defended the metaverse investments multiple times and said that the business would be a key long-term driver. In the short term though, he termed AI as a key focus area.

Meta Platforms is facing multiple headwinds

Meta Platforms is facing multiple headwinds like the Apple iPhone privacy rules which it estimates shaved off nearly $10 billion from its 2022 revenues. To make things worse the global digital ad market is slowing down. Facebook is also facing competition from players like TikTok and last year the combined market share of Google and Facebook in the US digital ad market fell below 50% for the first time since 2014.

Also, Facebook has reached saturation in many markets and has also been losing popularity among teens. Zuckerburg talked about saturation during the Q3 2022 earnings call.

Tech giants are facing increased regulatory

Another trouble for Big Tech companies like Meta Platforms is the growing regulatory scrutiny across the world. In the most recent such case, Italy’s antitrust authority said that it has taken measures against Meta over the alleged abuse of power over the music posted on its platforms.

Globally there is a furor over targeted ads – something which helped Meta scale up its profits in recent years.

Meta is the best-performing FAANG stock of 2023

Meta fortunes have turned for the better this year though. It was the worst-performing FAANG stock and among the biggest S&P 500 losers last year as it shed around two-thirds of its market cap.

However, with gains in excess of 75%, it is not only the best-performing FAANG stock but also the second-best S&P 500 stock as well.

Some analysts still see more upside in the stock and JPMorgan’s Doug Anmuth said in a client note earlier this year that “While Meta shares have more than doubled off the early November lows, we still think there’s meaningful upside ahead driven by accelerating revenue growth, continued cost efficiencies, and still attractive valuation.”

Wall Street is also constructive on Meta’s cost cuts which are arguably among the most aggressive among tech peers.

FAANG earnings season

Twitter would be an exception there as under Elon Musk, the company has taken drastic measures to reduce costs. These include firing 80% of the employees as well as not paying some of the bills – which have led to multiple lawsuits.

As for Meta, the company would release its earnings for the first quarter of 2023 next week. The FAANG earnings started on a negative note as Netflix posted mixed earnings for the quarter.

Tesla too crashed after the Q1 2023 earnings as its margins crashed amid the price war.

Over the next two weeks, all the other FAANG names would release their earnings which would provide more insights into the health of Big Tech companies.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account