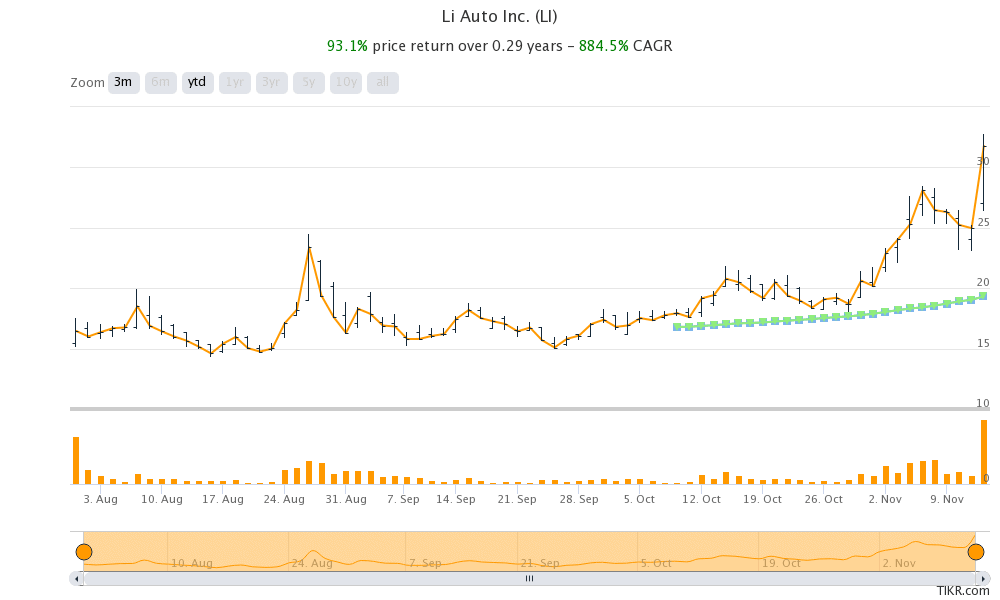

Li Auto was trading over 20% higher in pre markets today after its third quarter earnings beat expectations. XPeng, another Chinese electric vehicle maker, had also surged yesterday after posting better than expected third quarter earnings.

XPeng’s earnings led to a spike in other Chinese electric vehicle stocks also. Li Auto closed over 27% higher yesterday. Li Auto is up 58% so far in November and looks sets to increase its gains further looking at the pre markets’ price movement. Both Li Auto and XPeng listed this year only. Li Auto priced its IPO at $11.5 per share and has risen almost three-fold from the IPO price.

Key takeaways from Li Auto’s Q3 earnings

Li Auto delivered 8,660 cars in the third quarter which is similar to the 8,578 cars that XPeng delivered in the quarter. It reported revenues of $369.8 million in the quarter which was 28.4% higher as compared to the previous quarter.

Li Auto’s gross profit margin increased 91% over the previous quarter to $73.2 million. Its gross profit margin was a handsome 19.8% in the quarter as compared to 13.3% in the previous quarter.

XPeng also posted a positive gross profit in the third quarter which was the first quarterly gross profit for the company. NIO posted a positive gross margin for the first time in the second quarter of 2020 and expects its vehicle gross margins to rise in double digits by the end of the year.

Meanwhile, Li Auto posted strong double-digit gross profit margins in the quarter. Its gross margins are now getting near Tesla’s gross margins.

Li Auto posts a profit

Li Auto posted a non-GAAP profit of $2.4 million in the quarter. However, it posted a GAAP loss of $15.7 million. That said, posting a non-GAAP loss also is no mean achievement for the company. Tesla was barely profitable on the GAAP level in its first decade on the GAAP level.

Tesla

However, Tesla has posted a GAAP profit in the last five consecutive quarters. After years of posting losses, Tesla now looks like a sustainably profitable venture. It had also posted positive free cash flows last year. To augment its liquidity and increase flexibility, it has raised over $7 billion from stock issuance this year. The cash would help it expand its operations as it invests in its plants in Texas and Berlin.

Li Auto also posted free cash flows of $110.4 million in the quarter, up almost 150% from the previous quarter.

Expressing happiness over the results said Xiang Li, Li Auto’s founder, chairman, and CEO said, “this is our first quarterly earnings release as a public company, and we are pleased to announce robust third quarter results reflecting not only our strong growth momentum driven by the outstanding value proposition of our products, but also our relentless pursuit of operating efficiencies.”

Strong cash position

Thanks to its IPO, Li Auto had cash and cash equivalents of $2.79 billion at the end of the third quarter. The company also sounded optimistic about the outlook and says that it expects to deliver between 11,000-12,000 cars in the fourth quarter. At the upper end of the guidance, it would mean a 38.6% increase over the third quarter.

The company expects its revenues to be between $457.8-$499.4 million in the fourth quarter which would mean an increase of 35.1% over the previous quarter at the upper end of the range.

Should you buy Li Auto

Electric vehicle stocks have been red hot this year. Tesla is up almost 400% for the year and now has a market capitalization above the combined market capitalization of leading automakers. NIO’s market capitalization has also moved past that of General Motors. Li Auto has an NTM (next 12-month) enterprise value to sales multiple of 17.2x which is slightly lower than NIO. However, the multiple is almost twice what Tesla trades at.

While Li Auto is expected to witness strong growth, the valuations multiples have started to look quite stretched.

How to buy Li Auto stock?

You can buy Li Auto stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

If you are not well versed in investing in stocks and yet want to have exposure to newly listed companies like Li Auto, you can consider investing in ETFs that invest in IPOs or those investing in clean energy stocks.

By investing in an ETF, you get returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account