Ford (NYSE: F) stock is trading lower despite posting better-than-expected earnings for the first quarter of 2023. Here are the key takeaways from the earnings report.

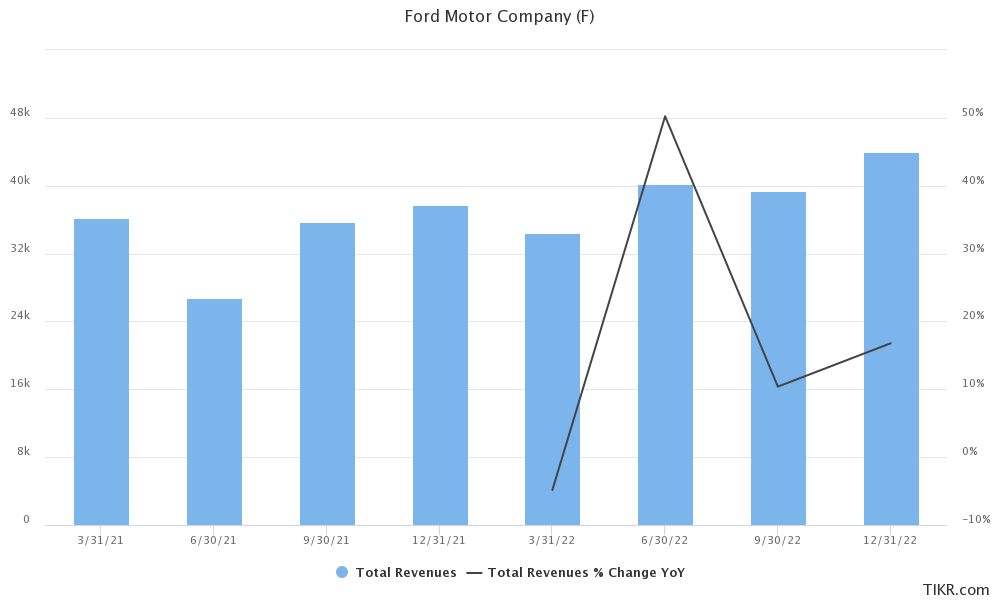

Ford reported revenues of $41.5 billion while the automotive revenues came in at $39.09 billion – way ahead of the $36.08 billion that analysts expected.

Its adjusted EPS of 63 cents also surpassed analysts’ estimate of 41 cents. The company’s adjusted EBIT came in at $3.4 billion while analysts were expecting the metric at $2.4 billion.

Ford posts better-than-expected Q1 earnings

Notably, this is the first quarter where Ford provided a breakdown of revenues by its business segments. Ford Blue, which is the legacy ICE (internal combustion engine) posted an adjusted EBIT of $2.6 billion while Ford Pro which is the commercial vehicle business reported an adjusted EBIT of $1.4 billion. Both the business segment reported double-digit margins which is encouraging.

However, the Model e which is the company’s EV business, lost $722 million in the quarter as compared to $380 million in the corresponding quarter last year.

Ford Model e posted a massive loss in the quarter

The losses are not surprising though as earlier this year Ford predicted that the business would lose $3 billion this year – a guidance that it reaffirmed during the Q1 2023 earnings call.

Commenting on the earnings, Ford CEO Jim Farley said, “Ford Pro is leading the way on profitable growth, our big investments in iconic Ford Blue vehicles and derivatives are winning with customers, and Ford Model e’s different approach to EVs is significantly reducing costs on our first high-volume products while rapidly developing breakthrough next-generation vehicles from the ground up.”

Farley on execution

Notably, during the previous earnings call, Farley had rued “execution issues” which cost the company around $2 billion in profits.

He sounded relatively upbeat this time around and talked about “solid execution and some really thrilling progress advancing our Ford+ plan.”

He added, “And I hope that becomes a trend at Ford, boringly predictable when it comes to execution and delivering financials but extremely ambitious and dynamic in creating the forward of the future.”

Farley said that Ford Blue and Pro were profitable in all the regions where they operate. Notably, as part of the turnaround plan, Ford has exited several unprofitable markets.

Ford is ramping up EV capacity

Ford is ramping up its EV capacity and said that the nameplate capacity to produce F-150 Lightning should double to 150,000 this year. Overall, the company is targeting an annual EV capacity of 600,000 by the end of 2023 and 2 million by 2026.

Rival General Motors is targeting a 2025 EV production capacity of 1 million.

The EV operations of both companies are posting losses though. Ford said, “We’re on track this year toward a contribution margin approaching breakeven in Model e and for our first-generation products to be EBIT margin positive by the end of next year.”

The company expects Model e to post an EBIT margin of 8% in 2026.

F lowered Mach e prices

Ford separately announced that it would lower Mach e prices by as much as $5,000 – its second price cut of 2023 and reflective of the price war in the EV industry. Farley said that is that F is “not going to price just to gain market share. We will always balance a healthy profit road map.”

He however talked about how higher volumes and lower production costs would help the company. The company’s CEO John Lawler said, “It’s a competitive segment, and we’re working on cost reductions.”

Notably, Tesla CEO Elon Musk also said during the Q1 2023 earnings call that the company would prioritize volume growth.

He was upbeat that the company can make profits by selling software even if it sells cars at breakeven.

Tesla is also prioritizing volume growth

In its shareholder deck, Tesla took a swipe at competitors and said, “As many carmakers are working through challenges with the unit economics of their EV programs, we aim to leverage our position as a cost leader.”

He said, “we’re the only ones making cars that, technically, we could sell for 0 profit for now and then yield actually tremendous economics in the future through autonomy. No one else can do that. I’m not sure how many people will appreciate the profundity of what I’ve just said, but it is extremely significant.”

Last year, Tesla raised the FSD (full self-driving) price from $10,000 to $15,00 and Musk believes that it would eventually rise to $100,000.

Ford maintained its guidance

Meanwhile, despite the massive earnings beat in the first quarter, Ford maintained its 2023 adjusted EBIT guidance of $9-$11 billion. Notably, General Motors raised its annual guidance during the Q1 earnings call.

Commenting on the guidance, Ford said, “This guidance includes headwinds that reflect global economic uncertainty, higher industrywide customer incentives as vehicle supply and demand rebalance, lower past service pension income, exchange, and investments in growth such as customer service and connected services.”

Markets were spooked by the management’s commentary on the guidance and the stock fell despite the earnings beat.

Fed’s rate hikes are not helping matters for automakers as it is negatively impacting car sales. Markets expect the US central bank to hike rates by 25 basis points at the May meeting also and then signal a pause in future rate hikes.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account