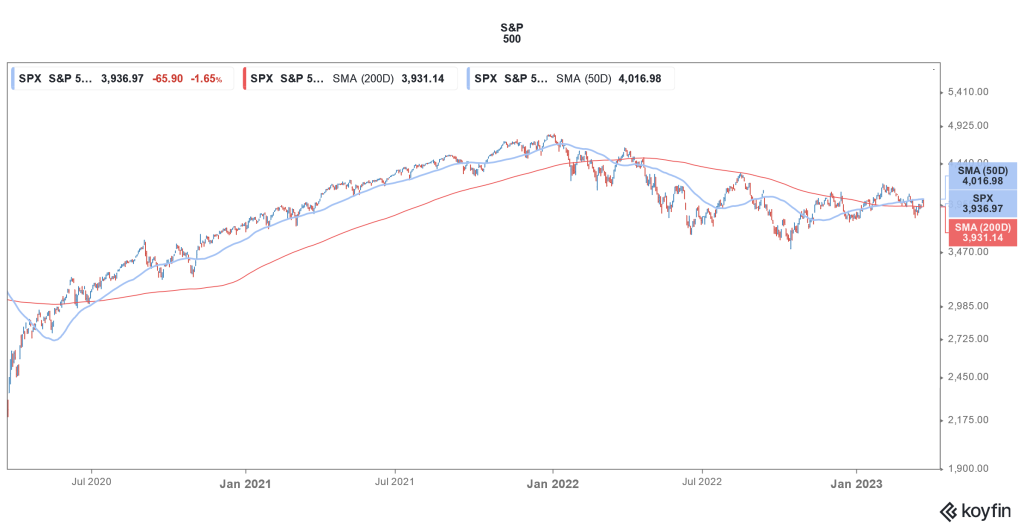

The US Fed raised its policy rates by 25 basis points yesterday. US stocks whipsawed but eventually major indices closed with losses of over 1.5%.

After the 25-basis point rate hike, the Fed raised interest rates to 4.75-5.0%. At the meeting that concluded on February 1 also the Fed had raised rates by 25 basis points. The Fed has now completed one full year of rate hikes and since March 2022 it has raised rates at every meeting.

It started with a 25 basis point rate hike in March 2022 and graduated to a 50 basis point rate hike at the next meeting. Thereafter the US central bank raised rates by 75 basis points at four consecutive meetings before lowering the pace to 50 basis points in December.

Market expectations from the Fed meeting whipsawed

Market expectations from the Fed’s March meeting whipsawed over the last couple of weeks. Before Fed chair Jerome Powell’s Congressional testimony, markets priced in a 25-basis point rate hike in March.

In his Congressional testimony, Powell said, “Although inflation has been moderating in recent months, the process of getting inflation back down to 2 percent has a long way to go and is likely to be bumpy.”

He also emphasized that if needed the Fed was prepared to increase the pace of hikes. After Powell’s testimony, the odds of a 50-basis point rate hike at the Fed’s March meeting increased and it looked like the most likely outcome.

US bank failures complicated the scenario

Meanwhile, after the collapse of SVB and Signature Bank, markets adjusted their expectations from the Fed meeting and at one point in time most traders bet that it won’t raise rates at all in March.

Goldman Sachs predicted that the US Fed would not raise rates at its upcoming March meeting.

Ed Hyman of Evercore ISI also said that the Fed should take a breather on rate hikes for now. Mark Zandi of Moody’s Analytics also forecast that the Fed would not raise rates in March.

That said, over the last couple of weeks, markets started bracing for a 25-basis point rate hike after the US government provided a backstop to depositors to SVB and Signature Bank.

Fed kept the terminal rates unchanged

Notably, the Fed’s dot plot shows that it would hike rates by only another 25 basis points in 2023 which would take the terminal rates to 5.1% or a target rate of 5.0%-5.25%. The terminal rate projection is similar to the previous dot plot.

Incidentally, at his Congressional testimony, Powell said, “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.”

While the March rate hike was largely in line with expectations, Powell’s commentary spooked markets.

Key takeaways from the Fed statement

In the March statement, the Fed said that policy rates would need “some additional firming.” In the previous meeting, it talked about “ongoing increases.” Also, the statement alluded to the recent bank failures.

The Fed tried to calm nerves and said “The U.S. banking system is sound and resilient.”

It however cautioned “Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain. The Committee remains highly attentive to inflation risks.”

Powell rules out rate cuts in 2023

For the last many months, markets have misjudged the Fed. Around July last year, markets believed that the US central bank would soon pivot to rate cuts. However, on multiple occasions, Powell said that a pivot is not something that the Fed is considering and warned against premature policy reversal.

Powell reiterated similar views at the March press conference and said, “We are committed to restoring price stability and all of the evidence says that the public has confidence that we will do so, that will bring inflation down to 2% over time. It is important that we sustain that confidence with our actions, as well as our words.”

He also ruled out rate cuts in 2023 and said “Participants don’t see rate cuts this year. They just don’t.”

How analysts reacted to the Fed meeting?

Peter Boockvar, chief investment officer at Bleakley Financial Group said, “the market’s in a tough spot. Are we going to celebrate the end of Fed rate hikes because things have started to hit the fan?”

He added, “Not only are things hitting the fan, and the Fed acknowledged it, but he said we’re not cutting rates either. To say, we have credit challenges ahead, and we’re not cutting interest rates, that’s not the best combination.”

While US stocks crashed after the Fed meeting, NatWest Market’s John Briggs believes that Powell was actually quite dovish, referring to the new statement.

He said, “the market is saying they might get one more in but they’re pretty much done and will be cutting by the end of the year.”

Briggs added, “I think they are signaling they are likely done – because they expect credit conditions to tighten, which can take the place of policy hikes.”

Powell faces a tough balancing act

All said, Powell faces a tough balancing act in 2023. While US inflation is still running at around 6%, the recent bank failures have increased the probability of a recession. In the past, Fed said that while its rate hikes might lead to a recession, it is not trying to deliberately enforce one.

While the US economy started to feel the pain from Fed’s rate hikes in 2022 itself, things might worsen further as credit market conditions tighten after the recent bank failures.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account