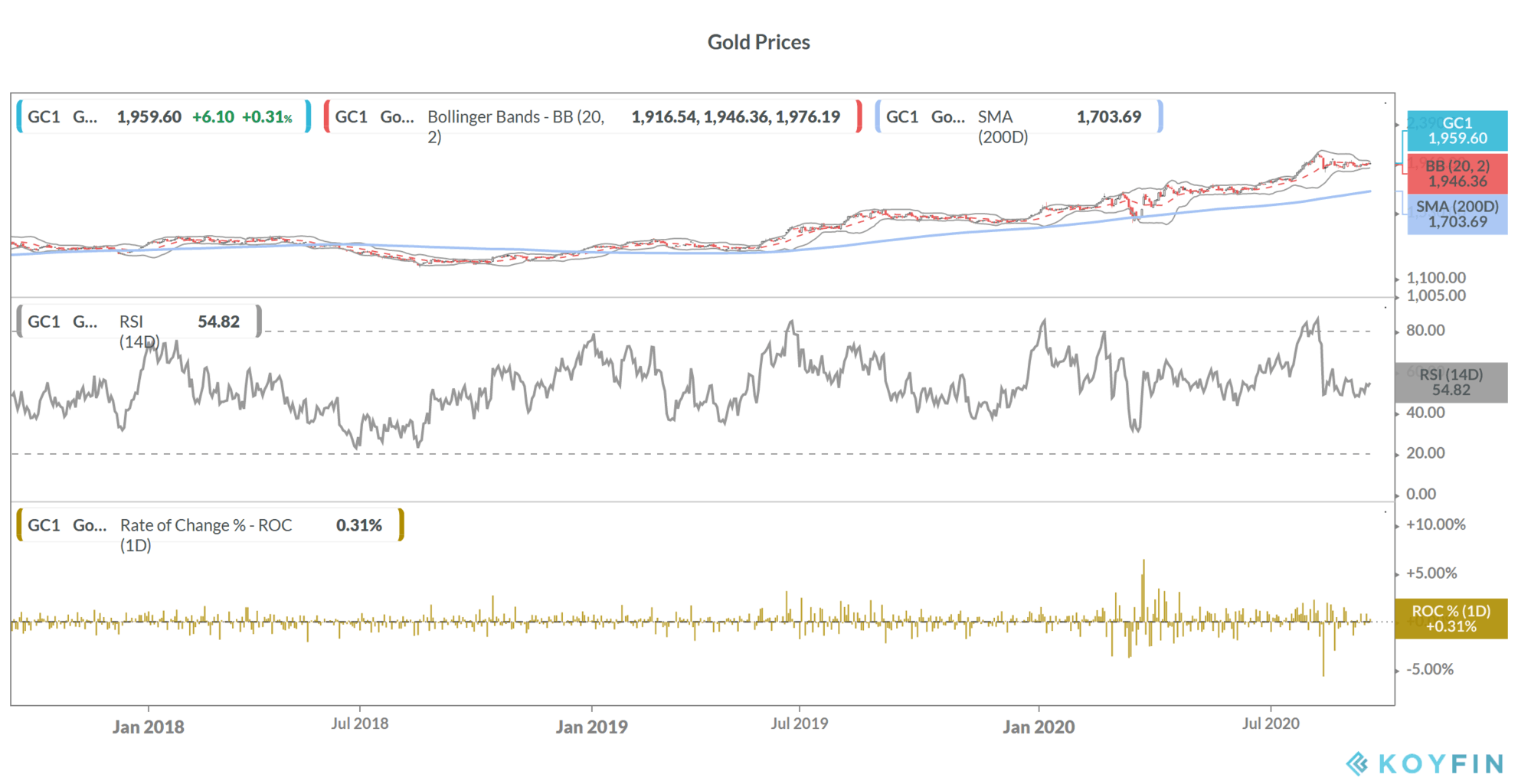

At its policy meet on Wednesday, the US Federal Reserve signaled that it does not intend to raise rates at least until 2023. Lower interest rates and macroeconomic uncertainty is positive for gold that’s anyways among the best performing asset class this year. Gold prices rose 0.31% yesterday and closed at $1,959.6 per ounce.

Last month, Federal Reserve chairman Jerome Powell (pictured above) outlined a new approach of “average inflation targeting.” The approach meant that the Fed would let the US inflation rate run “moderately” above 2% “for some time.”

Fed expects rates at zero until at least 2023

On Wednesday, Powell outlined Federal Reserve’s inflation expectations. In his speech, Powell said, “The median inflation projection from FOMC (Federal Open Market Committee) participants rises from 1.2% this year to 1.7% next year and reaches 2% in 2023.”

This basically means that the Fed does not see itself raising rates until 2023. Also, given the average inflation targeting, rates could stay at current levels even a couple of years after 2023. Incidentally, after the US Fed lowered rates to zero bound in 2008 in the wake of the Global Financial Crisis, they stayed at those levels for seven years until the then-Fed chair Janet Yellen raised rates in December 2015.

Fed’s rate hike cycle

Powell took the baton from Yellen and continued the rate hike cycle much to President Trump’s displeasure. Powell raised rates four times in 2018 even amid concerns of slowing growth in the US economy. However, the Fed started to cut rates in 2019 and this year slashed them to zero bound in March amid the pandemic.

The Fed’s swift actions helped propel the US economy and especially supported the credit markets. Bond issuance surged after the Fed’s easing and helped companies hit by the pandemic to raise capital. US stock markets also soared in the wake on increased liquidity.

Gold prices also boosted by Federal Reserve’s accommodative monetary policy

As a non interest bearing instrument, gold has a negative correlation with interest rates. Gold prices tend to do well when interest rates are low and vice versa. Along with the economic uncertainty, the Fed’s rate cuts and accommodative monetary policy helped gold prices move higher.

The outlook for the US dollar is also bearish given the low interest rates in the US coupled with the country’s surging fiscal deficit that is set to reach the highest level since World War 2. Given the fiscal easing, which is not expected to overturn anytime soon, US debt to GDP looks set to breach the psychologically crucial 100% in 2021.

Federal Reserve’s easing could keep the dollar weaker

Higher fiscal deficits and the massive money printing by the US Federal Reserve could pressurize the US dollar. Gold, like other commodities, has a negative correlation with the US dollar and tends to do well when the greenback is weak. In a nutshell, a weaker dollar makes commodities that are priced in the dollar cheaper in other currencies and lifts demand.

That said, after hitting their all-time highs last month, gold prices have come down. Gold made its all-time high of $2,063 per ounce last month. It is now down % from its all-time highs but is still up 29% for the year.

Time to add gold after the recent sell-off?

Frank Holmes, chief executive at investment firm US Global Investors expects gold prices to rise to $4,000 per ounce, doubling from the current levels. Most other brokerages are also positive on gold given the economic turmoil, rising fiscal deficits, and low interest rates. Goldman Sachs and Bank of America are bullish on gold expect gold prices to rise from these levels.

The recent sell-off in US tech shares is another reminder of the surging valuations in stock markets. If the sell-off deepens, investors might find solace in safe-haven assets like gold.

You can buy gold through any of the reputed brokers for gold. You can also trade in gold through CFD (Contract for difference). We’ve compiled a list of some of the best CFD brokers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account