China’s exports and imports in yuan terms hit record highs in September in yet another sign that the country’s economic recovery is gaining pace.

China’s trade data is among the most followed economic indicator. Its exports are a reflection on the global economy. On the other hand, its import data provides insights into its domestic consumption.

China’s exports and imports hit record highs

According to Reuters, in yuan terms, China’s exports, as well as imports, were at record highs last month. In US dollar terms, China’s imports rose 13.2% in September far exceeding the consensus estimate of 0.3%. The country’s exports rose 9.9% in the month, in line with analysts’ estimate of 10% growth.

Overall, in the third quarter, China’s exports rose 10.2% in the third quarter while its imports rose 4.3% over the period. Supply disruptions in other parts of the world coupled with strong demand for medical equipment from other countries lifted Chinese exports in the third quarter.

“The near‑term outlook for Chinese exports is supported by the continued global recovery,” said Commonwealth Bank economist Kevin Xie. However, he added “Growth in Chinese exports may start to ease because the path of the future recovery is likely to be gradual.”

China’s exports to the US

China’s trade surplus with the US narrowed to $30.75 billion last month. In the first nine months of the year, China’s trade surplus with the US stood at $218.57 billion. China’s exports to the US are up 1.8% year over year in the first nine months of the year while its imports are up 2.8% over the period.

While China has increased its purchase of US goods following the phase one of the trade deal earlier this year, the incremental purchases wouldn’t be enough to bridge the massive trade surplus that’s currently in China’s favor. China would have to increase its purchase of US goods significantly to buy the committed additional $200 billion worth of US goods services over the 2017 level.

Analysts are bullish on Asian stock markets

Analysts are bullish on Asian stock markets. “We expect Asian equities should outperform the global equity market in next two to three years because if (Joe) Biden is elected U.S. shall have an easier relationship with China,” said Surich Asset Management founder Simon Yuen. He added, “On the other hand, if (Donald) Trump is elected, China will promote demand in terms of consumer spending in order to increase their dominance over the world.”

Last week, Andrew Tilton, chief Asia economist at Goldman Sachs also predicted a faster economic recovery in Asia as the region has better controlled the coronavirus pandemic. “We think Asia’s really the best positioned of the major regions right now, just given the good control of the virus in most of the region outside of India and some parts of Southeast Asia,” said Tilton.

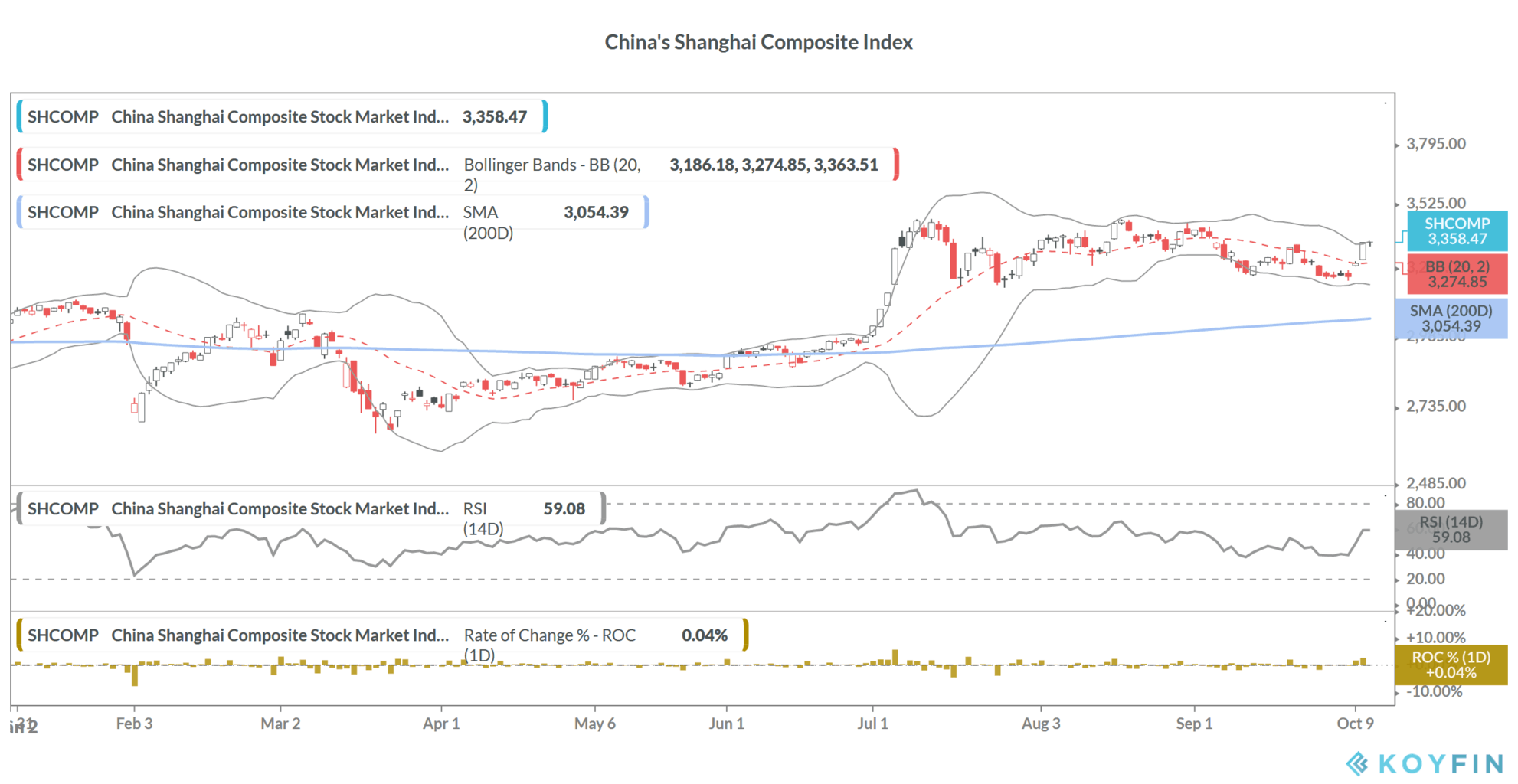

China’s stock markets today

China’s stock markets were flat in today’s trading and the Shanghai Composite Index gained 0.038% to close at 3,359.75. The Index is up 10.1% for the year. Among major stock markets globally only the US and Chinese stock markets have turned positive for the year. However, while US stock markets are trading near their all-time highs, China’s stock markets are still below their all-time highs that they had hit in 2007.

How to invest in China?

In September, the Canadian pension fund announced plans to invest in emerging markets including those in Asia over the next five years. The fund is especially bullish on Indian stock markets where it already has some investments.

Some of the brokers let you trade in Chinese market stocks. You can select from any of the best online stock brokers. You can also invest in the Chinese market indices through binary options. There is a list of some of the best binary options brokers.

If you are not well versed in investing in stocks and still want to have exposure to China’s stock markets, you can consider ETFs. There are ETFs that give you exposure to a basket of Chinese stocks as well as those focused on a single country. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account