How to Buy Norwegian Cruise Line Stock

The travel industry has been hit hard by the COVID-19 pandemic. Cruise liners are sitting in port, aeroplanes are parked on runways, and hotels are operating at a fraction of their normal capacity.

It, therefore, should come as no surprise that the stock prices for most companies in the travel industry have plummeted in recent months.

But, that plunge could also be presenting you with the most viable buying opportunity. Companies like Norwegian Cruise Line were reporting huge business success before the wave of lockdown. Today, and as a result of the lockdown, NCLH stock has shed more than 80% value when compared to its 2018 and 2019 share price peaks.

For long-term investors who believe that the travel industry will eventually make a comeback, this is the best time to buy.

If you’re considering whether to buy Norwegian Cruise Line stock right now, this guide will help bring you up to speed with everything you need to know about NHLC. We’ll also highlight our favourite online brokers for building a stock portfolio before exploring the argument that touches on why it’s worth adding NCLH stock to your portfolio.

-

-

Buy Norwegian Cruise Line Stock in 3 Quick Steps

Want to buy Norwegian Cruise Line stock right away? Just follow these three steps and add NCLH to your portfolio in minutes.

[three-steps id=”201777″]Where to Buy Norwegian Cruise Line Stock?

In order to buy NCLH stock, you’ll need a licensed stock broker that offers NYSE listed companies. Here are our top recommended online brokers for building your portfolio:

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

How to Buy Norwegian Cruise Line Stock from Toro: Step-by-step guide

eToro is our favourite broker for trading stocks. The broker allows you to own shares outright, makes it fast and simple to set up an account, and offers social trading so you can see what other traders are buying.

Let’s take a look at the steps required to buy NCLH stock from eToro after you’ve created a new account. If you chose another broker, the steps should be very similar.

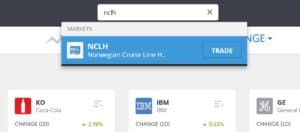

Step 1: Search for Norwegian Cruise Line Stock

In the search bar at the top of the page, enter ‘Norwegian Cruise Line’ or ‘NCLH’. Then, click on Norwegian Cruise Line when it appears in the drop-down menu.

Step 2: Click on ‘Trade’

You’re now on the NCLH stock page, where you’ll find charts and other information about the stock. To open an order form to buy shares, click the ‘Trade’ button at the top of the page.

Step 3: Buy Norwegian Cruise Line Stock

You need to fill out the order form in front of you in order to tell eToro how much NCLH stock you want to buy and how your trade should be executed. By default, eToro lets you enter your trade according to how much money you want to invest. But, you can hit ‘Units’ if you’d rather buy a specific number of shares.

It’s good to also consider whether you want to set stop loss or take-profit levels. A stop loss is a price below the current price at which eToro will automatically sell your shares if the markets go against you. It’s highly recommended to specify a stop-loss for every trade since they protect you from big losses if the stock price drops. A take-profit price is above the current price and tells eToro to sell your shares if the stock price rises to lock in your profits.

When your order is ready, click ‘Open Trade’ to buy NCLH stock.

Why Invest in Norwegian Cruise Line?

Is Norwegian Cruise Line a worthwhile investment? The Coronavirus pandemic has created a lot of uncertainty in the travel industry, so the future of NCLH stock largely depends on how the industry bounces back over the next few years. Here, we’ll dive into some of the reasons why we think Norwegian Cruise Lines is a good buy right now.

Rock Bottom

There’s no way to paint Norwegian Cruise Line’s current situation in a positive light. Currently, all cruises from US ports have been cancelled, and they’re not likely to resume for some time now.

Even then, don’t expect travellers to come back in droves. Any cruise ships that sail for the rest of 2020 will be booked well below capacity in all likelihood.

That means that Norwegian Cruise is going to bleed money for the rest of 2020, and probably for a lot of 2021 as well. Costs for maintaining ships and retaining staff are fixed, and it takes a certain number of passengers per sailing for the company to break even.

The good news is, the stock price reflects this bleak reality. Norwegian Cruise Line stock is trading around $12 per share right now, up from an all-time low of $7.03. Now compare that against the $58 per share price in January, and you can see that NCLH price has already been discounted by close to 80%.

It’s worth noting that these rock-bottom share prices are unprecedented for Norwegian Cruise Line. Until March, the stock had never traded below $24 per share in its seven-year history as a public company.

For bargain hunters, this kind of pricing drop is an opportunity that may only come once in a lifetime. If Norwegian Cruise Line can return to its pre-pandemic levels in a few years’ time, there’s no reason why the stock wouldn’t also return to the level it pre-Covid trading levels.

NCLH Can Survive

With that in mind, the biggest threat to Norwegian Cruise Line is its short-term cash flow. In order for the company to retain all its assets and be ready for when tourists return in significant numbers, Norwegian Cruise Line needs to stay out of bankruptcy.

Can it manage that for two years or so? The answer is far from certain, but there are some positive signs indicating that the cruise line can weather this storm.

Things looked scary just a few days ago, when Norwegian Cruise Lines indicated in its financial filings that it could be forced to file for bankruptcy. But just afterwards, the company received an additional $2 billion in fresh financing. That should allow the cruise line to get by for more than a year without any revenue.

Equally important, it should help alleviate fears that the cruise line will go bankrupt. That will encourage tourists with cancelled cruises to take credit for a future cruise rather than demand a cash refund. The more Norwegian Cruise Line can do to keep the cash it’s holding rather than issue refunds, the better the chances the company stays out of bankruptcy.

Tourism Will Rebound

The big assumption in all of this is that tourism will eventually return to its pre-pandemic levels. The Norwegian Cruise Line pegs its hope of breaking even on its cruises and making enough profit to offset the billions it owes in debt on the resumption of no-conditions global tourism.

So, is that a fair assumption? It depends on what analyst you listen to, but many are bullish that tourism will get back to normal levels around 2022 or 2023. The idea of a ‘V-shaped’ recovery seems less and less likely, but 2022 seems like the current best guess for when the global economy will make a full recovery.

With disposable income back in people’s pockets, the next thing that Norwegian Cruise Line needs is for people to be willing to spend it on cruises. The company managed to stay away from the negative Covid-19 spotlight during the pandemic, which bodes well for it when future tourists are thinking about booking a cruise. If anything, the company’s policy of offering cash refunds at all has earned them the much-needed goodwill from future seafarers.

While some lingering concerns about safety and social distancing on cruise ships are likely to remain, NCLH and the world at large is hopeful that current vaccine tests prove successful.

About Norwegian Cruise Line Stock

Norwegian Cruise Line was founded in 1966 as Norwegian Caribbean. The company began with a single cruise ship ferrying passengers between the UK and Gibraltar but quickly expanded to offer cruises around the Caribbean.

Over the course of 40 years, the company acquired more and increasingly larger cruise ships, expanding service to Alaska, Hawaii, Europe, Bermuda, and even Australia. Since the early 2000s, Norwegian Cruise Line has also offered trips in Hong Kong and China.

Norwegian Cruise Line became a public company trading on the New York Stock Exchange in 2013. At that time, Norwegian Cruise Line and sister lines Oceania Cruises and Regent Seven Seas Cruises were reorganized under a single company called Norwegian Cruise Line Holdings.

As of 2020, the company owns 28 cruise ships and, prior to the pandemic, was the third-largest cruise line in the world. It made over $6 billion in revenue in 2018 and controls about 9% of the total passenger sailing market in the world.

Given that Norwegian Cruise Line debuted on public markets well into the recovery from the 2008 financial crisis, the company’s stock has performed relatively well until recently. Shares IPO’d at $25 per share and topped $60 per share by 2015. Between 2017 to 2019, the share price was relatively consistent at $55 to $60.

However, that changed quickly when news about COVID-19 began to affect tourism around the world. The stock began falling gradually in late January 2020, then lost nearly 80% within a few days in late February and early March. The stock reached an all-time low of $7.03 per share mid-March and is now trading, albeit, high volatility around $12 per share.

Should I Buy Norwegian Cruise Line Stock?

Without a doubt, buying Norwegian Cruise Line stock at this time is quite risky. The company has been knocked down hard by the Coronavirus pandemic and it’s unlikely that revenue will increase to a breakeven point for at least two years. Additionally, there’s still more uncertainty about how many travellers will return to cruise lines and how quickly the recovery will take place.

But, for long-term investors, the risk of adding Norwegian Cruise Line to your portfolio is more than offset by the potential reward. If NCLH stock eventually rebounds to the level it was sitting at comfortably before the pandemic, around $55, you would staring at roughly 225% profits.

In the next few months, investors will be watching every move and announcement the company makes keenly, and there will probably be some wild swings. In that sense, NCLH is best for risk-tolerant long term investors.

It may take a few years to see a profit from NCLH stock, but it’s incredibly rare to find any stock offering the kind of potential gain that we see in Norwegian Cruise Line.

Conclusion

Norwegian Cruise Line has been hit hard by the Coronavirus pandemic along with the rest of the travel industry, but this cruise line still has all its assets and the stock can easily return to its pre-pandemic price level as long as the company staves off bankruptcy.

For long-term investors who don’t mind taking on some risk, now may be the time to buy Norwegian Cruise Line stock. If you think it’s the right investment for you, use one of the recommended brokers to make sure you get a smooth trading experience.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

What is Norwegian Cruise Line’s ticker symbol?

Norwegian Cruise Line trades on the New York Stock Exchange under the ticker symbol ‘NCLH’.

Is Norwegian Cruise Line profitable?

Norwegian Cruise Line was profitable before the Coronavirus pandemic. In 2019, the company reported a bottom-line profit of $930 million. It’s likely that the company will lose at least several hundred million dollars in 2020, however.

Does Norwegian Cruise Line have competitors?

Yes, Norwegian Cruise Line competes with other major cruise ship companies like Carnival and Royal Caribbean. Both of these companies have also been hit hard by the coronavirus pandemic and have opened up credit lines worth several billion dollars. It remains unclear whether these competitors are more or less financially suited to weather the next few years than Norwegian Cruise Line.

When is Norwegian Cruise Line planning to restart cruises?

All Norwegian Cruise Line sailings are on hold at the moment, and the earliest they may restart is in June 2020. However, the Centers for Disease Control and Prevention has announced that, unless something changes, all US ports are closed until at least mid-July. Norwegian Cruise Line has not announced any plans to restart cruises as of early May.

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up