SoFi Loan Review 2020 – READ THIS BEFORE Applying!

The modern-day consumers have been aggressively moving towards digital lending and online investing services. Companies like SoFi, Lending Club, Prosper and money more have built billions of dollars business in the last few years alone.

The massive growth in online lending and banking services is evidence from TransUnion data – which shows that fintech lenders are now accounting for almost a third of overall personal loan origination by volume.

With the substantial growth in online lending, banking and investing platforms, Choosing the right platform that fulfills all of the consumer’s financial needs under a single umbrella looks like the biggest challenge.

To help you with that, we have reviewed SoFi – which is one of the big names in the emerging online lending, banking and investing industry.

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

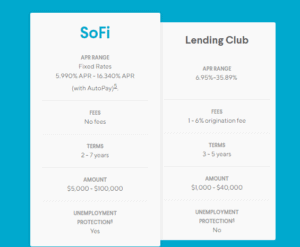

SoFi is slightly different from other platforms like Lending Club and Prosper because it offers online lending, banking, investing services. Lending Club and Proper are only working as P2P lending platforms.What is SoFi?

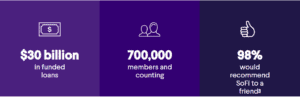

SoFi is built to help people attain financial independence. Its products include borrowing, spending, saving and investing. Whether people are looking to buy a home, save money on student loans, grow in their careers, or invest in the future, SoFi works to empower its customers to attain the goals they set. SoFi initially started working as a small business with only one product – the student loan refinancing. However, the company grew significantly in the past few years and it now offers a variety of products.

Comparing Sofi P2P lender with other online installment loan providers

SOFI loans is a peer-to-peer lending platform that connects borrowers to different individuals and institutional lenders. It not only has some of the most extended maximum loan limits and repayment periods but also boasts of maintaining one of the widest base of online loans. But how does it compare to such other personal and installment loan providers like Oportun, Opploans, and Rise credit?

SOFI

- Borrow loans of between $5,000 and $10,000

- Minimum credit score of 680

- Loan APR starts from 5.99% to 20.91%

- Loan repayment period of 2 to 7 years

Oportun

- Loan amount starts from $300 to $9,000

- No minimum credit score required

- Annual rates fall between 20% to 67%

- Loan should be repaid in a span of 6 to 46 months

Opploans

- Borrow limit $1,000 to $4,000

- Bad credit score is allowed

- Annual payment rate starts from 99% to 199%

- Payment period of 9 to 36 months

Rise Credit

- Offers loan from between $500 to $5000

- Bad credit score is allowed

- Annual rates starts from as low as 36% to as high as 299%

- Depending on the state, the repayment term ranges from 7 to 26 months

How Sofi Works?

Unlike other popular platforms such as Lending Club and Funding Circle, SoFi doesn’t match borrowers with lenders. These P2P lending platforms make money through fees. On the other hand, SoFi generates funds from private investors. It is more similar to lending providers like Speedy Cash and Zippy Loan. Investors like pension and insurance funds, as well as other asset managers, provide cash for lending purposes. It currently offers several types of loans ranging from mortgages to personal loans and auto financing.

And beyond lending, the company also offers wealth management and life insurance products. The company generates money through fees and commissions for wealth management and life insurance products. Moreover, the firm also offers checking account service. They earn a small amount of interest on the money in the accounts.

What Types of Loans Offered by SoFi?

Student Loan Refinancing – SoFi is popular for providing student loan refinancing services. It has refinanced $18 billion of student loans since it was founded in 2011. On top, 98% of students who refinanced student loans recommended this platform to a friend – which is a big achievement for a new startup in the complex lending industry.

The platform offers both variable and fixed interest rate loans. Its fixed-rate loans begin at 3.69% with the maximum potential rate of 8.074%. It offers 5, 7, 10, 15, and 20-year repayment plans to borrowers.

The variable rate loans are presently set at 2.49% to 6.650%, and they are tied to the LIBOR rate. The interest rate is capped at 8.95% or 9.95% depending upon the loans. The firm provides long-term fixed-rate loans on 15-year and 20-year repayment plan.

Like other lenders, SoFi consolidates private loans with federal loans. It has set the minimum credit score at 650 for student loan refinancing. It uses MOHELA or (the Missouri Higher Education Loan Authority) for serving loans.

The student loan consolidation occurs when borrower combines numerous loans into a single loan. On the other hand, student loan refinancing occurs when the student gets a new term. You can refinance both federal and private loans.Student Loan Refinancing Eligibility Criteria

It’s always essential to check the eligibility criteria before you decide to fill the form. Below are the eligibility criteria for SoFi Student Loan Refinancing:

- You must be 18 years old to get student loan refinancing facility from SoFi or you must be of the age to make binding contracts.

- You should be a US citizen or permanent resident. They do not grant a loan to a permanent resident if the visa living status expires within 2 years or less.

- It’s also necessary to live in a state where SoFi is authorized to operate.

- You must be employed as well as have adequate income from other sources.

- You must be graduated with an associates’ degree or higher from a Title IV school.

SoFi Refinancing Pros and Cons

Pros:

✅Enables faster repayment

✅Discloses requirements, limits costs

✅Serves a range of borrowers

✅Offers payment flexibility

✅Supports customers

Cons:

❌ More than 12 months of forbearance

❌ Co-signer release

❌ No refinancing option for borrowers who didn’t earn a degree

Undergraduate Student Loans – Though SoFi is planning to offer graduate and parent loans in the coming days, it currently only offers undergraduate loans. It helps undergraduates to pay their college fee without any hassle. The firm offers student loans on both variable and fixed long-term rates. It charges no fee on loan origination and they also don’t charge fees on late payments, and insufficient funds.

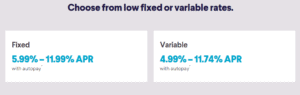

The variable rates stand around 4.99% – 11.74% APR while the fixed rate is between 5.99% – 11.99% APR depending on the amount and length of the loan.

Above all, the company offers fixable repayments options. The student is allowed to make deferred payments, which means the student is liable to pay principal and interest payments six months after they leave school. Other choices include interest only, Partial and Immediate.

Undergraduate Student Loans Eligibility Criteria

The eligibility criteria for undergraduate loans are almost the same with few exceptions that we have listed below:

- The loan should only be used for Higher Education Expenses at an Eligible Institution.

- The student must be enrolled at least half-time in a degree-granting program at an Eligible Institution.

- The student must be showing Satisfactory Academic Progress (SAP) to get a loan.

Pros and Cons of SoFi Undergraduate Loans

✅Enables faster repayment

✅Lower interest rates

✅Discloses requirements, limits costs

✅Serves a range of borrowers

✅Offers payment flexibility

✅Supports customers

✅Personal Loan Eligibility

Cons

❌No Lending to international students.

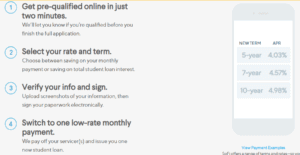

Personal Loans – SoFi is basically looking to offer personal loans to recent college graduates with a decent income. Its personal loans are 100% fee-free with flexible payments and lower rates. One can apply for SoFi personal loan in a few minutes. They will transfer funds to your account in a few days once your loan is approved. The borrower can also get discounted APR if the borrower enrolls in SoFi’s AutoPay program.

The platform claims to offers the best rates. Your APR depends on various factors, such as income, professional experience, and credit history. You can choose a loan on both fixed and variable terms according to your requirement.

With the autoplay discount, variable rates are standing between 5.74% to 14.70% while fixed rates are ranging between 5.99% to 16.24%. The lending platform does not charge any origination fees, early repayment fees or closing fees.

When you borrow money for your personal needs it is termed as a personal loan.Eligibility Criteria for Personal Loans

The eligibility criteria for a personal loan are quite different from student loans. Below are the requirements to get a personal loan.

- The borrower must be a US citizen. It is also a permanent resident or visa holder (E-2, E-3, H-1B, J-1, L-1, or O-1).

- The permanent resident is required to show an image or scan of a permanent residency card (Green Card). The card must also have a validity of more than two years.

- The borrower must be employed, or have significant financial resources to pay installments.

- In the case of personal loans, the eligibility also depends on other factors such as financial history, career experience, credit score, and monthly income vs. expenses.

Pros and Cons of Sofi Personal Loans:

Pros:

✅Virtually no fees

✅Competitive interest rates

✅Lots of perks

✅Fast Turnaround time

Cons:

❌ Eligibility requirements can be cumbersome

❌ Requires excellent credit for the best APR

SoFi Home loan – SoFi has started disrupting home loan and mortgage industry. Along with its strategy of offering the lowest possible interest rate on student loans and personal loan, it is seeking to offer the best rate on home loans with flexible repayment options. The company offers mortgages only on 10% down payment with no hidden fee and charges.

The mortgage application process is simple. It generally takes 30 days to transfer funds in your account. SoFi’s mortgage rate depends on the borrowed amount and the length of the loan period. It offers loan amounts of up to $3 million.

Home Loans Eligibility Criteria

Along with U.S. citizenship or permanent residency, you must be 18 years old to get a home loan. Below are the other requirements that one needs to fulfill:

- You are not financing an investment property.

- You are purchasing or refinancing a primary residence or second home in specified states.

- The property you seek to obtain through loan should be your primary residence or second home for at least 12 months.

- It does not offer loans in several states including Arkansas, Alaska, Iowa, Hawaii, Kentucky, Louisiana, Maine, Missouri, Mississippi, Massachusetts, Nebraska, Kansas, New Hampshire, New Mexico, New York, Ohio, Oklahoma, South Dakota, or West Virginia.

Pros and Cons of Home Loan:

Pros:

✅Lowest down payment

✅No lender fee

✅No need for private insurance

✅Availability of fixed or adjustable rate

Cons:

❌ The loan is not available in all states

❌ You cannot use Mortgage loans for investment purpose

What is SoFi Money?

Though SoFi is known for offering the best loans, it has also started expanding footprints as challenger banks. SoFi Money is a digital checking account. It is also called a hybrid account because this account contains features of both current and savings account. It offers a top-of-the-line interest rate on deposits along with no monthly or overdraft fees. The firm also does not charge any ATM fee. SoFi money account offers the following features:

- Strong interest rate: The account holder can earn an impressive 2.25% annual percentage yield on the account balance. Since it is working as a digital online bank, you can make transfers, photo check deposit, and customer service directly through mobile. The user can send money both to SoFi account and to those who have accounts in other banks.

- Free ATM access: the ATM is free of charge. It reimburses any third-party fees you get charged.

- Free physical checks. This platform also offers a free occasional check for payments. SoFi makes checks available for free – which is rare in online banks.

- Insurance for up to $1.5 million balance: Your deposits are safe with SoFi.

- No overdraft fees: You are not liable to pay an overdraft fee. SoFi Money plainly cancels any transaction in case you don’t have enough funds.

- Useful spending tracker: The company offers spending tracker both on the website and mobile apps – the spending tracker is called Relay, which helps you in linking accounts that you have with SoFi and other financial institutions.

Pros and Cons of SoFi Money:

Pros:

✅No minimum balance requirement with 2.25% APY

✅No overdraft fees and no monthly fees

✅Free ATM

✅Spending tracker

Cons

❌ No branches

What is Sofi Investment?

Sofi has recently launched an investment product, named SoFi Invest – which offer automated and active trading services to investors. The social finance management platform permits investors to trade stocks and ETF’s from its platform with active investing. SoFi offers all these services for $0 in management fees and $0 in transaction fees.

SoFi Automated Investing

Similar to many other robo-advisors, SoFi also offers the diversification, goal planning, auto-rebalancing, and portfolio management. With the minimum balance of $100, SoFi offers free sessions with the certified financial planners.

Once the investor completes the registration form, the platform will ask to select the investment account from a variety of account types, including Roth, Traditional, 401(k) rollover, and SEP IRAs. Like other robo advisors, it will also ask you to complete a questioner which includes information such as your investment preferences, goals, financial information, and risk tolerance.

Its robo advisors use modern portfolio theory for trading. Its automated investment platform provides innovative features such as performance tracker both on the website or app. It also uses a passive investment strategy for making maximum gains; it makes adjustments actively according to the market environment. Its financial advisors review your automated portfolio on a daily basis to make sure that the portfolio is strong enough to tackle market uncertainties.

Its investment instruments include a range of exchange-traded funds and more than 20 indexes. Its ETF’s include U.S. stocks, real estate, international stocks, and high-yield bonds.

SoFi Active Investing

The platform allows an investor to trade stocks and ETFs on this platform according to their investment strategies. SoFi offers several features to investors such as real-time investment market news and an app that lets you do it all from your phone. SoFi Wealth is a regulated platform. It is registered with SEC. SoFi has also taken other actions to strengthen investors security and information. It uses encryption and two-factor authentication.

Pros and Cons of SoFi Invest

✅Free of fee and commissions

✅Human Financial Advisors

✅The SoFi App

✅Strong Customer Service

Cons:

❌ No Tax-Loss Harvesting (Yet)

❌ Few Investment Options

❌ Lack of history in trading

Is Sofi safe?

Yes, SoFi is safe for borrowing and investing. It is a registered and licensed platform like Upgrade Loans. Although soFi is authorized to lend money to students in all states, it can only issue and refinance mortgages in the few states that we mentioned above. Sofi has strong brand recognition and it is strongly complying with regulatory policies. Its strong feedback score of 9.2 out of 10 on Trustpilot based on over 1,800 reviews shows that the platform is safe and legit for borrowing and investing.

SoFi Customer Support

SoFi has set up strong customer support. The company offers customer support in various ways, including phone call, live chat, and email. It has also developed a Twitter account for customer support. Most reviewers look extremely happy with its customer support based on customer’s reviews on Trustpilot.

Conclusion

Sofi has been successfully expanding its business over the years. This is evident from the substantial growth in loans. It has refinanced almost $18 billion of student loans since 2011. The platform has expanded its business towards other products to expand its profitability and customer base. It now offers several types of loans and mortgages. Indeed, its recent launch of wealth management business and SoFi Money indicates the management’s confidence in their future fundamentals. On the whole, SoFi appears like a good place for lenders and savers and investors.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ:

Who will service student loan?

Student loan refinances will be serviced by MOHELA. The borrower should contact MOHELA for queries once refinance goes into repayment.

What does the borrowers' loan statement should include?

The loan statement must include name, token numbers of the loans or the account, current principal balance, the interest rate, and name of the current servicer.

Can the borrower change due date?

Yes, the borrower can change due date by visiting www.SoFi.Mohela.com. The borrower needs to fill the form for changing the due date.

What is the AutoPay discount?

It is a type of discount that SoFi offers to borrowers. The AutoPay discount of 0.25% starts working when the borrower authorizes SoFi to automatically deduct payments from a bank account.

Does applying for a student loan impacts credit score?

Applying for SoFi student loans would not impact the credit score. This is because SoFi conducts a soft credit pull, which does not have an effect on credit score. On the other hand, when the borrower continues with the application and SoFi requests your full credit report from reporting agencies, which could impact your credit score.

What types of properties are eligible for home loan?

Sofi only permits Mortgages for owner-occupied primary residences and second homes.

US Payday Loan Reviews - A-Z Directory

Siraj Sarwar

Based in Saudi Arabia, Siraj has a strong understanding of and passion for accounting and finance. He has worked for international clients for many years on several projects related to the stock market, equity research and other business, accounting and finance related projects. Siraj is a published financial analyst on the world's leading websites including SeekingAlpha, TheStreet, MSN, and others.View all posts by Siraj SarwarWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up