Best Credit Repair Credit Cards 2020

If you’re currently in possession of a bad credit rating, then you likely struggle to obtain financing in all areas of life. Whether its loans, mortgages, car leases, or even a cell phone contract – having bad credit can create ongoing financial roadblocks.

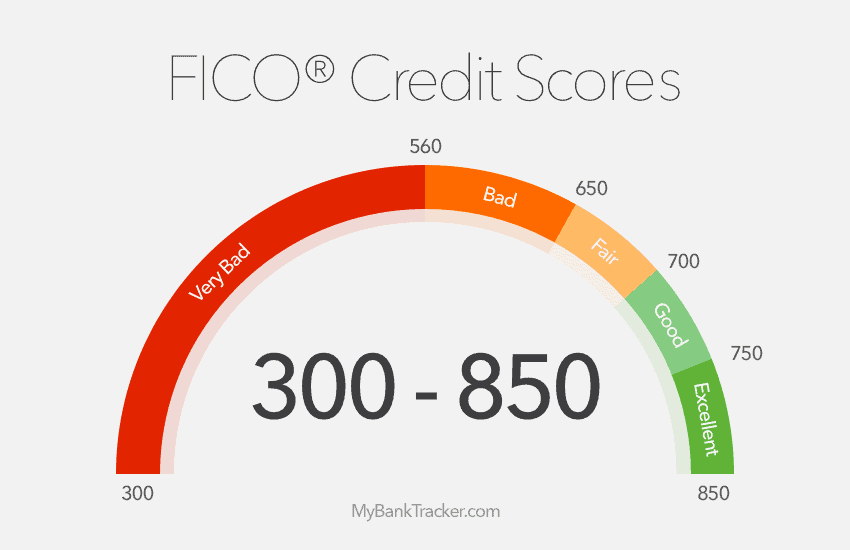

However – although this might sound counter-intuitive – did you know that by obtaining a specialist credit card it can actually help you repair your credit profile? Essentially, by obtaining a credit card that accepts applicants with bad credit, and by always repaying your balance on time, then you stand a very good chance of rebuilding your FICO score.

If this is something you are looking to achieve, then be sure to read our guide on the Best Credit Repair Credit Cards in 2019. We’ll explain how the credit repair process works, why it’s important, what you need to avoid, and finally – the best credit card providers to go with.

What is credit repair?

As the name suggests, credit repair refers to the process of repairing bad credit. The overarching concept is that by obtaining a new credit product, and always meeting your repayments when they are due, you stand the chance of rebuilding your financial profile. In fact, this is the only way that you can improve your FICO credit score.

However, and as you’ve probably found out for yourself, how can you repair your credit when you are constantly rejected for credit-based financial products? Well, the only way that you will be able to do this is to use a bad credit lender. These come in a range of shapes and sizes, such as bad credit loan providers, credit cards, and even Payday loans.

💳 You see, credit institutions will typically report your payment performance to the main three credit rating agencies.

💳 This includes Equifax, Experian, and TransUnion.

💳 Although each credit rating agency will have its own processes, every time a lender reports a late or missed payment, the respective rating agency will mark your score down.

💳 On the contrary, every time you make a payment on time, the respective rating agency will mark your credit score up!

How does the credit card repair process work?

If you’re here reading this guide, then it’s likely that you are currently in possession of poor to bad credit. Your first step will depend on whether or not you are still holding debts, or if you are debt-free and simply looking to repair your credit. If it is the former, you will first need to engage in a debt consolidation plan. You can either do this via a debt consolidation loan or a 0% interest credit card. Once you’ve consolidated your debts, you can then proceed to start repairing your credit.

Step 1: Obtain a credit card that accepts borrowers with bad credit

First and foremost, you will need to find a credit card provider that accepts borrowers with bad credit. Although such providers will typically fall outside of the main financial institution lending circuit, some established lenders do offer specialist credit cards for credit repair.

Step 2: Make purchases that you would ordinarily make

This step is absolutely crucial in the credit repair process. Essentially, the only way that you can improve your credit score is to make repayments on time each and every month. However, you won’t be able to do that unless you have a balance to pay. As such, you will need to use your repair credit card to make some purchases.

Crucially, you must only use the card to buy things that you would have otherwise used cash to pay for. Otherwise, you will be wasting money on things you don’t need and thus – stand the chance of getting yourself into further financial trouble. Think along the lines of groceries, gas, and work-related travel.

Step 3: Transfer cash into a separate bank account

Just as important as the previous step, you need to ensure that you have the required cash to meet your monthly payment in full. The best way to do this is to keep the cash in a separate checking account. In fact, every time you use your card to make an everyday purchase, try to transfer the exact amount to your dedicated checking account.

In doing so, you will always ensure that you have the funds to clear your monthly credit card bill. If you don’t put the cash to one side, you stand the chance of living beyond your means. Don’t forget, failing to meet your repayments will hurt your credit score even further!

Step 4: Set up an electronic debit agreement

Leading on from the above step, it is imperative that you set-up an electronic debt agreement with your credit card provider. You can do this through your online account portal. Although you also have the option of this doing this when you initially make the application, it is likely that this will only be to cover the minimum payment.

Under no circumstances do you only want to cover the minimum. On the contrary, you need to pay your balance in full each and every month. When you log in to your account dashboard, make sure that you tick the option that says something along the lines of ‘Automatically Pay Balance In Full Each Month”.

Step 5: Repeat the above process every month

You won’t be able to repair your credit profile by making a single monthly repayment. On the contrary, it typically takes around 3-6 months for your repayments to feed through to your credit score. As such, it is important that you repeat the above steps each and every month.

As a handy tip, some repair credit card providers will give you free access to one of the main credit rating agencies. This means that you can keep tabs on how your credit repairing endeavors are going after each monthly payment is made.

Repair credit cards: What to consider?

Although the credit repair process can be a seamless one if you follow the above steps, this isn’t to say that you should just apply for the first card that you come across. Instead, there are a number of factors that you need to consider before making an application. Essentially, obtaining the wrong card could lead to further financial difficulties.

✔️ Eligibility

While it is true that specialist lenders will accept applicants with bad credit, this doesn’t mean that approval is guaranteed. As such, although the specific eligibility requirements will vary from lender-to-lender, there are some clear minimums that you will likely need to meet.

First and foremost, you need to ensure that you are no longer holding outstanding debts. If you are, then you first need to concentrate on engaging in a debt consolidation plan before obtaining new credit products. Nevertheless, you will likely need to be employed, and depending on the state you live in, have a minimum monthly income.

You will also need to have a valid checking account with the ability to set-up an electronic debit agreement, a social security number, and a form of government-issued ID.

✔️ APR Rates

On the one hand, the specific APR rate that your repair credit card comes with is irrelevant, insofar that you will always repay your outstanding balance in full each and every month. In doing so, you’ll never be required to pay any interest. However, we would suggest that you still make some considerations regarding the APR rate.

The reason for this is that you just never know what the future holds. If the unfortunate does happen and you are unable to meet your monthly payments in-full, then you will want to ensure that you pay the lowest interest rate possible.

✔️ Credit Limit

It is always beneficial if you can obtain a repair credit card that comes with a high enough credit limit to cover your monthly expenses. As we noted earlier, you will want to use your card at every possible opportunity – as long as it is a payment that you would have otherwise made in cash.

For example, if your monthly expenses amount to around $2,000, then you will want to try and obtain a repair credit card with a high enough limit to cover this. If the limit is too low, then the monthly repayments that you make won’t have as much of an impact in improving your credit score.

✔️ Free Access to Your Credit Report

We would also suggest that you try and stick with credit card providers that offer free monthly access to your individual credit report. If they do, then make sure it is with one of the three main credit rating agencies – Equifax, Experian, or TransUnion.

In doing so, you will get to keep tabs on how your credit repair efforts are going. Alternatively, you will need to sign-up to a monthly subscription with one of the above reporting agencies, which is yet another cost that you will need to manage.

The Pros The Cons

Criteria used to rank the best repair credit cards

❓ What APR rate the card comes with

❓ Whether you need to pay any annual fees

❓ Minimum eligibility requirements

❓ Credit limit offered

❓ Whether you get free access to your credit report

❓ Which credit agencies your payment performance is reported to

The Discover It Secured credit card is absolutely ideal if you are looking to follow the step-by-step credit repair process we discussed earlier in our guide. Firstly, the card is suitable for credit scores of 300+, meaning that you’ll need to at least sit within the ‘Poor’ credit threshold. Most importantly, the card does not come with any annual fees, which is great. What we also like about the Discover It Secured credit card is that it comes with ongoing rewards. This includes 2% cash back on your monthly spending, up to $1,000. As such, by engaging in a credit repair spending plan, you can actually make a bit of money. In terms of the fundamentals, you will be required to put-up $200 as a security deposit, which is used in the event that you miss a payment. The card comes with a regular APR rate of 24.99%, although this shouldn’t matter as you will be repaying your balance in full each month. [one_half] Key Points: 💳 24.99% APR 💳 2% cash back rewards upto $1,000 in spending 💳 No annual fees 💳 Credit scores of 300 and above considered 💳 Required to put up a $200 security deposit

The next credit repair option that you might want to consider is that of the OpenSky Secured Visa. This particular repair credit card is ideal if your credit profile is crippled. In other words, you fall within the bad credit spectrum. The reason for this is that the credit card provider does not perform a credit check when you apply. Instead, the lender has a set of minimum income requirements that you will need to meet. Interestingly, the OpenSky Secured Visa doesn’t require you to have a checking account, as you can make your monthly repayments with a debit card or money order. On the flip side, this particular credit card does come with an annual fee of $35. Although this isn’t too unreasonable, you need to factor this into your costs. Finally, the card comes with a standard APR rate of 19.64% APR. [one_half] Key Points: 💳 19.64% APR 💳 No cashback or rewards 💳 $35 annual fee 💳 No credit checks 💳 No bank account required

Although we noted that the APR rate attached to your repair credit card is somewhat irrelevant, it’s still a notable consideration to make – just in case you are unable to clear your balance in full on a particular month. With that being said, the Green Dot Primor Visa comes with a very respectable APR rate of 9.99%. In fact, this is much lower than the average US consumer pays, so it is surprising that the issuer will accept applicants with a credit score of just 300+. The main drawback of the card is that it does carry an annual fee of $49. Moreover, the card doesn’t come with any credit card rewards. Finally, the Green Dot Primor credit card comes with a very impressive maximum credit limit of $5,000, and you won’t be accustomed to a late payment fee if you do end up missing a payment. However, this still might be reported to the main three credit agencies – so avoid this at all costs. [one_half] Key Points: 💳 9.99% APR 💳 No cash back or rewards 💳 $49 annual fee 💳 Credit scores of 300 or more considered 💳 Limit of up to $5,000

DCU Visa Platinum is a noteworthy option if you are looking to control your credit repair endeavors to the ‘t’. Essentially, the credit limit that you are given will be matched depending on the size of the security deposit that you put up. For example, if you are happy to put up $500, then your credit limit will be matched like-for-like at $500. In this sense, the DCU Visa Platinum is probably best suited for those of you with very bad credit. On the other hand, the card does come with a very competitive APR rate of 13.75%, which will kick-in should you fail to pay your monthly balance off in full. Moreover, the card does not come with any annual fees, which is great. As a final note, you will need to be a member of the Digital Federal Credit Union to get this particular card, although if you aren’t, the application process is super easy. [one_half] Key Points: 💳 13.75% APR 💳 No cash back or rewards 💳 No annual fee 💳 Bad credit scores considered 💳 Your credit limit will match your security deposit

As the name suggests, the Credit Builder Secured Visa is a credit card that was designed specifically for the purpose of credit repair. Backed by the Armed Forces Bank, the card is suitable for credit scores of 300 or more. Similarly to the DCU credit card, the Credit Builder Secured Visa allows you to set a custom credit limit. In other words, your credit limit will match your security deposit. This starts at just $300, up to a maximum of $3,000. On the flip side, the card does come with a rather pricey APR rate of 23.24%. As such, you should only take this particular card out if you are confident you can pay your balance off in full every month. Finally, the card also comes with an annual fee of $35. [one_half] Key Points: 💳 23.24% APR 💳 No cash back or rewards 💳 $35 annual fee 💳 Bad credit scores considered 💳 Your credit limit will match your security deposit

FAQs

What is credit repair?

How can I rebuild my credit if I have bad credit?

Why do I need to make purchases with my repair credit card?

What is a secured repair credit card?

How long does it take to apply for a repair credit card?

What happens if I miss a payment on my repair credit card?