Blue Trust Loans Review 2020 | APR, Eligibility and More

But before you jump in and take out a loan with the provider, it would be wise to take a few minutes and find out all you can about it. Our comprehensive review of the service seeks to provide all the information you need to make your decision.

Read on to find out everything you need to know about Blue Trust Loans and assess whether it is the provider for you.

-

- 1. To get started, visit the official website and click “Apply Now.”

- 2. Fill in the customer information details which include the loan amount, name, address, email address, homeownership and military status.

- 3. After this, you need to enter bank information indicating the account type, account number, routing number and number of months with the bank.

- 4. Next, give your date of birth, driver’s license number and social security number under the security information tab.

- 5. Once you are done, hit the “Submit” button and wait for the team to approve or reject the application.

-

- 1. To get started, visit the official website and click “Apply Now.”

- 2. Fill in the customer information details which include the loan amount, name, address, email address, homeownership and military status.

- 3. After this, you need to enter bank information indicating the account type, account number, routing number and number of months with the bank.

- 4. Next, give your date of birth, driver’s license number and social security number under the security information tab.

- 5. Once you are done, hit the “Submit” button and wait for the team to approve or reject the application.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Blue Trust Loans is a financial service provider that operates under Tribal Law. It is not a lender, but rather, it provides funding through third-party financiers. Its rating system is not transparent and making a comparison before a loan application is impossible.What is Blue Trust Loans?

Founded in 2014, Blue Trust Loans is a company based in Hayward, WI and operates under Hummingbird Funds LLC.

Blue Trust Loans is a loan company operating as a tribal lender operating in 37 US states. Its owners are the Lac Courte Oreilles Band of Lake Superior Chichewa Indians of Wisconsin. This is an American Indian tribe which is federally recognized as a sovereign government.

Notably, even though the tribe claims that it is immune to the laws of the state, customers who feel they have fallen victim to predatory lending have legal recourse. They can file complaints with the Consumer Financial Protection Bureau.

The company offers loans of between $400 and $2,500 and provides funding within as little as 1 business day.

Note that the company itself is not a lender, but plays the role of a loan facilitator. Its systems are integrated with multiple lenders allowing users access to funding from a wide variety of providers.

But it simply requires a single application online to get an online decision almost immediately. Approval is almost instantaneous.

Pros and Cons of a Blue Trust Loans Loan

Pros

- Fast application processing

- Offers access to financing without having to check credit history

- Available in a good number of states

- Since it operates under Tribal Law, it offers services even in regions where state regulations are restrictive

- Its lender matching service provides access to a wide range of services from different providers

- The service does not charge loan application or prepayment fees

Cons

- The company is not a lender and therefore cannot predict fees and rates of any loans and you can only view rates after loan approval

- Low financing ceiling of $2,500

- Lack of transparency in applicable fees and rates makes it impossible to compare the service before applying for a loan

- It shares user information starting 30 days from the day you submit information and says it will keep sharing even after you cease being a customer

- Since Blue Trust Loans is not a lender, it has no control over its lenders’ strategies, terms or conditions

Blue Trust Loans Vs it’s Other Competitors

Blue Trust loan is an online lender founded by American Indian tribe. As such it operates under Tribal laws and often offers installment loans though they still have payday loans in their portfolio. All loans process are done via their website and the approval takes less than 1 business day. Let’s compare this company with similar lenders such as Check n Go, Ace Cash, and Advance America; based on loan limit, credit score requirement, fees rate and repayment period metrics:

Blue Trust

- Loan limit starts from $400 to $2,500

- No minimum credit score requirement

- Interests rates of around 400% to 500%

- Weekly, bi-weekly semi-monthly, and monthly repayment period depending on when you get paid

Check n’ Go

- Borrow from $100 to $500

- Requires a credit score of 300 to 850 points

- Fee rate for $100 starts from $10 to $30( depending on the State)

- 3 to 18 months repayment period

Ace Cash

- Borrowing from $100 – $2,000 (varies by state).

- No credit score check

- Fee rate on $100 starts from $25 (State dependent)

- Loan repayment period of 1 to 3 months

Advance America

- Loan limit starts from $100 to $5,000

- Requires a Credit Score of above 300

- For every $100 borrowed an interest of $22 is incurred

- 30 days loan repayment period

How does a Blue Trust Loans loan work?

For first time customers, Blue Trust Loans offers maximum funding of $2,000. But for returning customers, the amount can go as high as $2,500. The provider does not require a credit score from its applicants.

That makes it suitable for all types of borrowers including those with no credit score due to a short financial history and those with bad credit. However, it does inquire whether a borrower has plans to file for bankruptcy. It rejects applicants with such intentions as well as debtors win current bankruptcy cases.

Its loan applications take place online and are simple and straightforward. Once you enter the required details and submit your application, a customer support representative will contact you. While this could take mere minutes, it could also take up to an hour.

The main objective of the call is to confirm the details and assess eligibility for approval. You might then get approved immediately and the funds could reflect in your account by the next business day.

Though the site does provide limited information on applicable interest rates and fees, it does not transparently reveal borrowers’ financial responsibility. You can only access the full details of the borrowing costs after completing the application and getting approval.

A major downside to the service provider is the fact that it shares customer information with other companies. According to its privacy policy, it reserves the right to this 30 days after it receives information.

It also explicitly states that it will keep sharing information even after you are no longer a customer. Though there is a phone number you can use to limit the type of information shared and how it is shared, that only applies for specific types of sharing.

Another downside is that since the company is not a lender, it cannot control the actual lenders’ terms and conditions. As per a legal disclaimer on the site, there is no guarantee that all its lenders can offer up to $2,500. Each of its lenders works on its own terms and adheres to their own strategies.

Note that even if you meet all the requirements that the service lists on its website, you might be subject to other eligibility demands from the lender processing your request.

What loan products does Blue Trust Loans offer?

Blue Trust offers what it refers to as the lender matching service. Under this service, it offers a number of products including:

- Tribal loans

- Installment loans

- Payday loans

- Personal loans

- Short-term loans

What other store services does Blue Trust Loans offer?

Blue Trust Loans does not offer any other store services.

Blue Trust Loans Account Creation and Borrowing Process

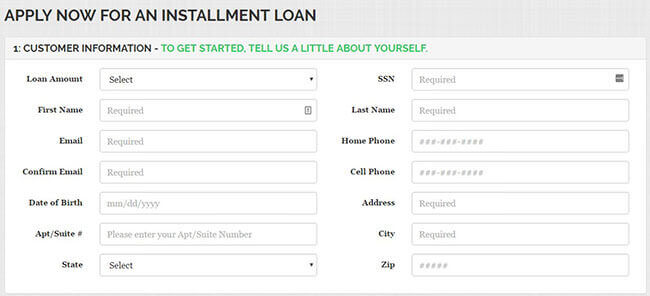

1. To get started, visit the official website and click “Apply Now.”

It will take you to a page with an online application form.

2. Fill in the customer information details which include the loan amount, name, address, email address, homeownership and military status.

Next, enter the required employment information which includes the type and frequency of income, employer’s details, months in employment and upcoming pay date.

3. After this, you need to enter bank information indicating the account type, account number, routing number and number of months with the bank.

4. Next, give your date of birth, driver’s license number and social security number under the security information tab.

5. Once you are done, hit the “Submit” button and wait for the team to approve or reject the application.

Note that you can also apply over the phone by calling 702-956-5631

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Blue Trust Loans Loan

- Age 18 and above (or state minimum, whichever is higher)

- US citizen or permanent resident

- Not involved in an active bankruptcy case or planning to file for bankruptcy

- Have a verifiable income source

- Have a checking account

- Minimum income of at least $800 monthly

- Other requirements as set out by the fast cash lender processing your request

Information Borrowers Need to Provide to Get Blue Trust Loans Loan

- Contact information

- Residential address

- Email address

- Homeownership details

- Military status

- Type of income

- Employer’s name and phone number

- Pay frequency and upcoming pay date

- Bank information

- Social security number

- Driver’s license number

What states are accepted for Blue Trust Loans loans?

Blue Trust Loans operates in the following states:

[one_third]- Arizona

- Alabama

- Alaska

- Delaware

- Colorado

- California

- Idaho

- Florida

- Washington

- Illinois

- Iowa

- Indiana

- Kentucky

- North Carolina

- New Mexico

- Oklahoma

- Ohio

- Rhode Island

- Oregon

- Kansas

- Maine

- Louisiana

- Michigan

- Maryland

- Missouri

- Mississippi

- Nebraska

- Montana

- Nevada

- New Jersey

- New Hampshire

- North Dakota

- South Dakota

- South Carolina

- Texas

- Tennessee

- Utah

- Wyoming

The company does not offer financing services in the following states in which little dollar loans are illegal:

- Arkansas

- Connecticut

- Hawaii

- Georgia

- Massachusetts

- Minnesota

- Pennsylvania

- New York

- Virginia

- Vermont

- Washington

- Wisconsin

- West Virginia

What are Blue Trust Loans loan borrowing costs?

Blue Trust Loans is not very forthcoming with regards to its borrowing costs. It explains on its website that this is because it facilitates financing from third-party lenders but is not itself a lender. That means that a borrower can only know the full terms of their loan once they apply and get approval.

But here are some of the borrowing costs that we managed to find:

- APRs – 471% to 841%

- Origination fee – nil

- Late payment fee – applicable but unknown

- Prepayment fees – nil

Blue Trust Loans Customer Support

The company seems to take customer support seriously and has provided numerous ways to reach them. You can get access to a representative on the phone, via email or using a mailing address. It also provides a physical address as well as an online form using which you can contact customer support.

Though it has plenty of negative reviews, many of them concern the high rates and fees on the platform. Some negative reviews in fact say that customer service is excellent before proceeding to voice their complaints about costs.

The company’s Better Business Bureau rating is a D, due to the abundance of poor reviews as well as the time they take to handle complaints. Note that high rates are the norm for short-term loans. Therefore, it is upon you to review the terms of the contract before signing the contract.

Is it safe to borrow from Blue Trust Loans?

Blue Trust Loans claims to make use of bank-level encryption for all its users’ data. For this, it uses 256-bit SSL encryption to scramble personal data during transmission. This applies both when sending data to the lender network and when data is en route to the company’s servers.

Moreover, the company is a member of the Online Lenders Alliance (OLA) and the Native American Financial Services Association, which attests to its credibility.

However, it is noteworthy that the service provider operates under Tribal Law and not state regulations. As such, it claims immunity to state laws. But according to a 2014 ruling by a US District Judge, the FTC is authorized to regulate some arms of Indian tribes. These include payday loan companies that operate under Tribal Law.

To be sure you obtain necessary legal protection in case of predatory lending or other unfair practices, make sure you understand this aspect of its operations before signing up for services.

Blue Trust Loans Review Verdict

Blue Trust Loans is a unique financial service provider in the sense that even though it operates a lending business, it is not a lender. Rather, it seeks to connect its users to third-party lenders so that they can access funding.

While this can provides widespread access to its services, it is also a cause for concern. This kind of service entails sharing private financial data with other providers which some users may not find reassuring.

It also differs from most traditional short-term lenders in the sense that it operates under Tribal Law and not state law. As such, it does not adhere to the same regulations as other lenders and is not as easy to sue in case of unfair practice.

Like other short-term lenders, it offers costly borrowing services, but that comes as no surprise. All in all, if you decide to take a loan on the platform, ensure that you take all these matters into consideration to avoid nasty surprises.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ

Does Blue Trust Loans perform credit checks on borrowers?

Yes. The company could perform a credit check to assess a borrower’s credit worthiness. However, it does not do this through the three main credit bureaus Equifax, Experian or TransUnion. As such, the check will not negatively impact your score.

Do the lending laws of the state where I live apply to the company?

No. The only laws that apply are the Lac Courte Oreilles Band of Lake Superior Chippewa Indians sovereign tribe laws.

How can I get to see the Tribal Laws that govern the company?

You can check online for the Lac Courte Oreilles Band of Lake Superior Chippewa Indians Tribal Consumer Financial Services Regulatory Code to view the laws.

What if I have questions about a loan I have taken out?

Since Blue Trust Loans is not a lender or an agent or broker of any lender, you should address any queries you have to your actual lender. The company simply works as a bridge to a vast network of lenders and might not have the answers you seek.

How fast will I access funds after approval?

Though approval may only take minutes, you will likely have to wait at least 1 business day for the funds to reflect in your account.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up