King of Kash Loan Review 2020 – READ THIS BEFORE Applying!

King of Kash has created a niche for itself by targeting bad creditors or those with poor financial history to get them out of a financial crisis. Thanks to its focus on a previously marginalized group, it has managed to gradually expand operations and become a reliable financing company.

King of Kash has created a niche for itself by targeting bad creditors or those with poor financial history to get them out of a financial crisis. Thanks to its focus on a previously marginalized group, it has managed to gradually expand operations and become a reliable financing company.

Like any other company out there, it has its strengths and weaknesses. In our comprehensive review of the lender, we will take an objective look at both sides of the coin. By the end of it all, you will have the information you need to make an informed decision on whether or not to use the service.

-

- 1. If you are applying over the phone, simply call 800-892-3006 and follow the instructions from a representative.

- 2. Alternatively, you could visit the King of Kash website and fill out an application online.

- 3. Once you do so, the site will take you to a page labeled “Get an Online Loan Today.”

- 4. On this page, you need to fill out your contact information, identification details, employment details and banking details.

- 5. Follow the prompts on your screen to upload any documents if necessary and then review the information and sign the loan agreement.

-

- 1. If you are applying over the phone, simply call 800-892-3006 and follow the instructions from a representative.

- 2. Alternatively, you could visit the King of Kash website and fill out an application online.

- 3. Once you do so, the site will take you to a page labeled “Get an Online Loan Today.”

- 4. On this page, you need to fill out your contact information, identification details, employment details and banking details.

- 5. Follow the prompts on your screen to upload any documents if necessary and then review the information and sign the loan agreement.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

King of Kash specializes in providing access unsecured personal installment loans as well as lines of credit. As is the case with most providers of such loans, the rates are relatively high. But since they require no collateral or credit checks, they hold appeal for the target group.

King of Kash specializes in providing access unsecured personal installment loans as well as lines of credit. As is the case with most providers of such loans, the rates are relatively high. But since they require no collateral or credit checks, they hold appeal for the target group.What is King of Kash?

Founded in 1978, King of Kash is a financial services firm which specializes in installment loans. It has its headquarters in Missouri, Kansas. But over the years, it has expanded operations to cover a number of additional states.

The company is fully licensed and regulated in each of the states where it operates. Hence, it strives to comply with all the regulations and laws that apply in different jurisdictions.

Pros and Cons of a King of Kash Loan

Pros

- Allows borrowers with bad credit to access funding

- Offers flexible repayment terms

- The lender offers a refund policy under which borrowers can return loans within a span of 24 hours and will not have to pay any fees or rates on the principal amount

- You can access loans from this lender even if you are not employed so long as you have proof of verified, fixed income

- There is no origination fee for the loan

- You can use multiple repayment methods to pay off the loan including money order, debit or credit card and direct withdrawals from your bank account

- Fully licensed and regulated in all the states where it operates

- Offers same-day turnaround

- Ideal for emergency expenses thanks to its no-credit-check policy

- No extra charges for early loan repayment

Cons

- Only available in a handful of states

- Only has brick and mortar branches in Missouri

- Charges high interest rates

- Does not disclose its fees online

- Low loan ceiling of $3,000

- Short loan terms of up to 14 months

- First-time borrowers can only get a loan maximum of $800

- The lender only offers services from Monday to Saturdays meaning that you cannot access emergency funding on Sunday

King of Cash vs online short term loan providers, what are its key features?

King of Cash has been around since 1978. Throughout this period, it has gone to position itself as a market leader in the online loan provision niche where it specializes in such type of loans as payday loans, personal loans, signature loans and student loans. The lender is nonetheless most popular for its short term installment loans. Other key benefits its clients get to enjoy include extended loan repayment periods, straightforward loan application, and attractive minimum loan amounts. In testing this effectiveness, we have held it against other equally popular installment loan providers like LendUp, Oportun, and Advance America and summed their key features in this table.

King of Cash

- Borrow loans of between $100 and $3,000

- No minimum credit score (soft check)

- Loan APR ranges from 100% to 1,200%

- Loan repayment period ranges from 11 to 14 months

LendUp

- Loan amount of $100 – $1,000

- No credit score check

- An annual payment rate of 30% to 180%

- Loan repayment period of 1 to 12 months

Advance America

- Loan limit starts from $100 to $5,000

- Requires a Credit Score of above 300

- For every $100 borrowed an interest of $22 is incurred

- Loan paid back in monthly installments of 2 weeks to 24 months

Oportun

- Loan limit starts from $300 to $9,000

- No minimum credit score required

- Annual loan APR of 20% – 67%

- Loan should be repaid in a span of 6 to 46 months

How does a King of Kash loan work?

The lender offers a range of short term loan facilities to suit various users in different circumstances. Its signature loan is the most popular option and refers to an installment loan which is open to all types of credits.

In most of the eligible states, applicants can fill out applications online or even apply over the phone. For Missouri residents, however, it is possible to make an application at one of the brick and mortar branches within the state. Similarly, these applicants can make repayments in person.

Users who apply in person stand a higher chance of getting funds as soon as on the same day. The same applies to applicants who submit their applications early in the day or by early afternoon at the latest.

Repayment terms typically range from 11 to 14 months. During this period, you can pay back the loan without attracting any extra charges. Moreover, if you choose to repay early before your term is due or before its expiry, there will be no extra charge.

King of Kash has a friendly refund policy. Under this provision, borrowers can return the full loan amount within 24 hours. If you do so, you will not have to pay any fees or interest rates on the loan.

The lender does not require applicants to be employed. For as long as you have a reliable source of fixed income, with documentation to prove it, you can apply and get approval. What sets its installment loans apart from most others is the fact that it does not charge an origination fee.

If you take out a loan with this lender, you will get an opportunity to use multiple repayment options. These include credit and debit card payments as well as money orders. Additionally, you can make arrangements to have them withdraw the required amount directly from your bank account.

Though the loan amounts range from $100 to $3,000, first-time borrowers have a distinct disadvantage. They can only get a maximum of $800 for the initial loan and then qualify for higher amounts on subsequent occasions.

Unfortunately, the fee system is not at all transparent as the website does not reveal any APRs or interest rates. The customer service team is also not forthcoming with this information. And this makes it difficult for a potential borrower to compare rates before settling on a lender.

In most cases, installment loan providers withhold such information if their rates are high. But high rates are to be expected from the lender since there are no credit checks on borrowers. Furthermore, the loans it offers are unsecured which means that borrowers do not have to put up collateral to back up the loan.

There is no minimum credit score specified for borrowers. However, your score will to a great extent determine the interest rates applicable as it indicates the level of risk for the service provider. Loans are typically approved in minutes but will in most cases be deposited within one business day.

Once you get full approval for a loan, the lender will issue funds using a physical check which you can pick up at any physical branch. You can also get the funds through ACH transfer or wire transfer.

In the case of a wire transfer, you will get the amount on the same day between 9:00 AM and 3:00 PM. However, if it is approved after 3:00 PM, you will get it on the next day. ACH transfers also take place on the next day.

Once you get a loan from King of Kash, the next step you need to think about is paying it back. Note that you will have to pay a $25 fee for any payment that bounces. Additionally, you will need to pay a late payment fee which varies.

Furthermore, in the future, your ability to borrow will be limited and the amount of credit for which you can qualify will reduce.

What loan products does King of Kash offer?

The official website lists a number of loan products which borrowers can access. These are:

- Personal loans

- Signature loans

- Lines of credit

- Installment loans

- Student loans

- Home improvement loans

- Private school loans

- Debt consolidation loans

- Small business loans

What other store services does King of Kash offer?

King of Kash focuses on providing various types of loans and lines of credit.

King of Kash Account Creation and Borrowing Process

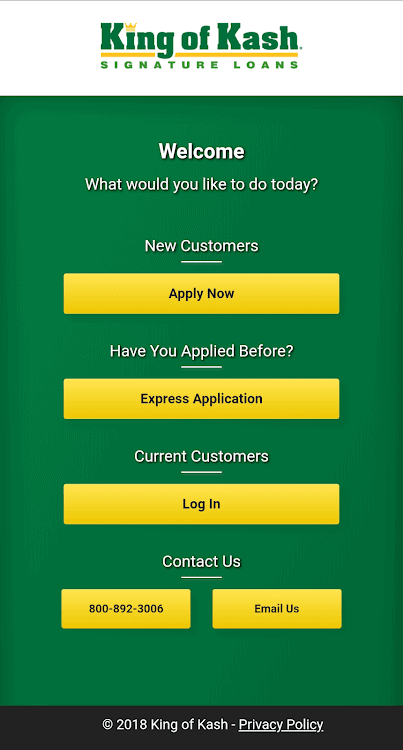

Creating an account with King of Kash and borrowing funds is quite seamless. Here are the steps you need to follow:

1. If you are applying over the phone, simply call 800-892-3006 and follow the instructions from a representative.

2. Alternatively, you could visit the King of Kash website and fill out an application online.

To get started, click the “Apply Online” tab at the top of the screen.

3. Once you do so, the site will take you to a page labeled “Get an Online Loan Today.”

4. On this page, you need to fill out your contact information, identification details, employment details and banking details.

Once you are done, click “Submit Application” at the bottom of the page.

5. Follow the prompts on your screen to upload any documents if necessary and then review the information and sign the loan agreement.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for King of Kash Loan

The eligibility criteria for a loan from this lender are quite simple and straightforward. Here is what they require from borrowers:

- Have a regular income

- If employed, you need to have a full-time job, working at least 36 hours per week in a permanent position

- An active savings or checking account that has been open for a minimum of 30 days

- A debit or credit card (MasterCard or Visa) linked to your checking or credit card account

- Be a US citizen (a permanent resident is not eligible for the service)

- Age of majority – while in most states the age is 18, in Mississippi it is 21 while in Alabama it is 19

Information Borrowers Need to Provide to Get King of Kash Loan

Here are some of the details you will have to submit during the application process:

- Current proof of employment e.g. an award letter or pay stub

- A verifiable cell phone number or home phone number

- A verifiable social security number

- A valid photo ID such as a passport or driver’s license

- Information about bank account including account number, routing number and when you opened the account

What states are accepted for King of Kash loans?

What are King of Kash loan borrowing costs?

King of Kash is not transparent on borrowing costs. However, based on research, these are the fees and rates that are likely to apply when you take out a loan from the provider:

- Interest rates – 100% to 1,200%

- Late payment fees – vary

- Bounced payment fees – $25

King of Kash Customer Support

According to the official site, customer services are available from Monday to Friday between 8:00 AM and 6:00 PM. On Saturday, they are available from 9:00 AM to 1:00 PM. The same applies for its VIP phone center.

Additionally, the site features a contact us page on which you can send queries and get responses.

However, there is very little information online about the reliability or lack thereof of the support team. Likely, this has to do with the fact that it has a limited reach. Furthermore, since they offer in-person and on-phone services, customers may not always post their experiences.

The site does not have a Trustpilot page either and has no mentions on such popular online forums as Reddit. It is therefore difficult to tell how good the team is.

Is it safe to borrow from King of Kash?

Generally speaking, it is safe to borrow from King of Kash. The lender is not only licensed in every state where it operates but also operates under regulatory oversight. As such, it affords patrons of legal protection and this contributes to safety.

Additionally, the website makes use of SSL encryption to protect all the data that users submit through the site. As always though, there is usually no absolute guarantee of security when it comes to submitting data online. But the lender plays its role adequately.

It is of course much safer to make an application in person than to submit details over the internet. But unfortunately, the only physical branches are in Missouri. Alternatively, if you are uncomfortable with the thought of making an online application, you can do so over the phone.

Note however that the lender’s privacy policy varies significantly from one state to the next. Therefore, it would be wise to read through the relevant one carefully before applying for a loan.

King of Kash Review Verdict

As a regulated and licensed entity, King of Kash seems to be a reliable financial service provider. It offers different solutions to suit the needs of various users and is easy to use. Fast approval and funding are among the main selling points of the lender.

However, since it is not transparent about fees and rates, it is difficult to compare service affordability to other providers. There aren’t many online customer reviews on the service either.

But based on available information, it seems like a reliable choice when you need emergency cash and don’t have an any alternative.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ

What is origination fee?

This is a fee that most lenders charge when issuing a loan to cover the processing charges.

What is a line of credit?

A line of credit is a lending facility that lets you borrow incrementally, repay and borrow again for the duration during which the line remains open.

Does King of Kash offer title loans?

Yes. But this financing option is only accessible to Missouri residents.

When are King of Kash physical branches open?

They are open from Monday to Friday from 10:00 AM to 6:00 PM CT and Saturday 10:00 AM to 1:00 PM.

What is the King of Kash signature loan?

The signature loan is a personal or installment loan for which no collateral is required and no credit check is carried out. It simply needs the borrower’s signature and their promise that they will repay the loan balance.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up