Big Picture Loan Review 2020 – READ THIS BEFORE Applying!

If you ‘re in the search for a short term loan but you’re credit is less than ideal, then you will need to consider a bad credit lender. With the internet is now jam-packed with such companies, the likes of Big Picture Loans claims to offer fast and confidential financing to those that need a payday boost.

If you’re thinking about using the lender for your short term loan requirements, then be sure to read our in-depth Big Picture Loans review. We’ve covered everything that you need to know, such as fees, eligibility, loan terms, and more.

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Make sure that you understand the risks of taking out a high-interest loan. Failure to repay your loan on time can result in crippling fees and charges.

Make sure that you understand the risks of taking out a high-interest loan. Failure to repay your loan on time can result in crippling fees and charges.What is Big Picture Loans?

Big Picture Loans is an online lender that specializes in short term loans. The lender’s main target market is those that have poor credit. Big Picture Loans is a somewhat unconventional lender, insofar that the company is organized and licensed under local Tribal laws, as opposed to state laws.

This shouldn’t cause any immediate problems, as the platform operates in the same way as any other online loan provider. However, you might need to make considerations regarding potential disputes, as this needs to be dealt with via the Tribal dispute process.

Nevertheless, the lender claims that those with bad credit are able to apply for a loan, and thus, the eligibility requirements are much lower in comparison to other online providers. This does mean that you will likely pay a hefty APR rate, which can be as high as 699%. In terms of the loans available, Big Picture Loans allow you to borrow from $200, up to $1,500.

What are the Pros and Cons of Big Picture Loans?

Big Picture Loans Pros:

✅Suitable for those with poor or bad credit

✅91% of approved loans funded the next day

✅Very simple application process

✅Pay your loan off early without being penalized

✅Good selection of education resources to help with personal finances

Cons:

❌ High interest rates

❌Operates under Tribal laws

❌ Maximum loan size is $1,500

Big Picture Loans Vs the Competition, how Does it compare

Big Picture is an online lender focusing on those with poor credit score. Unlike traditional personal loan lenders, Big Picture is regulated by Tribal laws, making it less strict in terms of policies. They offer loans to both tribal and non-tribal borrowers across selected states in the USA. Below is highlight of this loan provider’s loan limit, credit score requirement, interest rate and payback period; in comparison to other lenders worth considering such as Opploans, Speedy Cash, and Opportun Loans:

Big Picture

- Loan limit from $200 to $1,500

- No credit score check

- Interest rates may go as high as 699% depending on state of residence

- Loan repayment term ranges from 4 to 18 months, with a fee amounting to $20 on each missed payment

OppLoans

- Borrow limit $500 to $5,000

- Bad credit score is allowed

- Annual payment rate starts from 99% to 199%

- Payment period of 9 to 36 months

Speedy Cash

- Loans from $100 to $5,000 ( collateral security may be required)

- Accepts bad credit score

- Payday loans should be paid within 7 to 14 days depending on your pay schedule

- Annual rates of 459.90% but varies depending on state of residence

Opportun Loan

- Loan limit starts from $300 to $9,000

- No minimum credit score required

- Annual rates fall between 20% to 67%

- Loan should be repaid in a span of 6 to 46 months

How Does Big Picture Loans Work?

As is often the case with an online lender like Cash Net USA or Elastic, you can complete the entire loan process via your desktop or mobile device. Firstly, you’ll need to head over to the Big Picture Loans homepage. Once you click on the Apply button, you’ll then need to provide the platform with some information. This will initially include your full name, address, telephone number, date of birth, and social security number.

When you apply for a loan with Big Picture Loans, the initial application is based on a soft credit check. As such, applying will not have an impact on your FICO score, irrespective of whether or not you are approved.Moreover, you will also need to verify your identity by entering your driving license or state ID number. Next, you’ll need to provide some information about your financial background. Notably, this will include your employment status and annual income, and what debt you currently have outstanding.

Once you submit the application, you should receive a pre-approval decision within 15 minutes, alongside your individual financing rates. If the company needs more information from you, then they will either call you or send you an email – within business hours.

How Much do Big Picture Loans Cost?

On of the most, if not the most important factors to consider when using a bad credit lender is the amount of interest payable on your loan. The key problem with Big Picture Loans is that they are not upfront with their APR rates. In other words, the only way that you will know how much you will pay on your personal loan is to actually go through the initial pre-approval application.

After you receive your pre-approval APR rate, you are under no obligation to proceed with the loan.Nevertheless, the general consensus is that you can pay up to 699% APR on your loan. This is actually much higher than the average Payday Loans APR rate of 400%, so do bare this in mind.

On the other hand, you might be able to qualify for a lower rate if your credit profile isn’t too hampered. In assessing your rates, the lender will look at a range of variables, which we’ve listed below.

✔️ Previous relationship with debt

✔️ Your current debt-to-income ratio

✔️ Your employment status and annual income

✔️ How much debt you currently have outstanding

Other Fees or Charges

The good news is that Big Picture Loans does not charge any application of origination fees when you apply for a loan. Bad credit lenders are usually notorious for this, so it’s a notable move that Big Picture Loans doesn’t implement these charges.

However, you do need to remember that you are likely to have a huge APR rate attached to your loan. As such, while you won’t pay an application or origination fee, you do need to evaluate the overall costs of the loan.

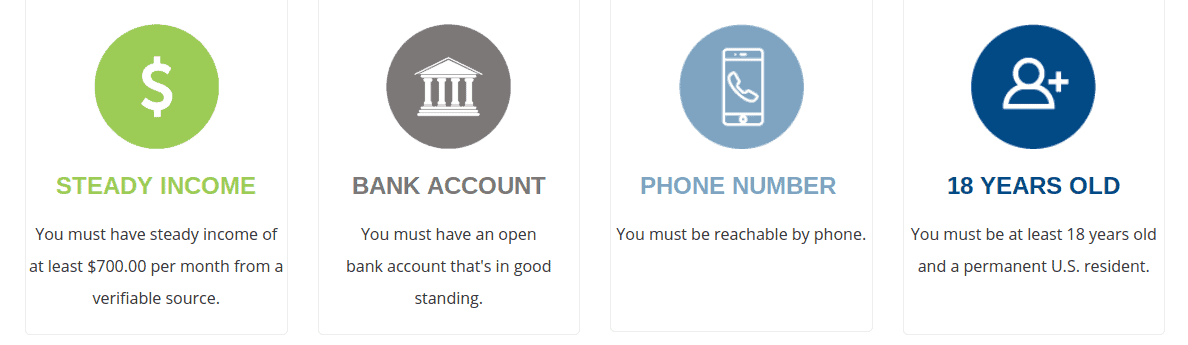

Am I Eligible for a Big Pictures Loan?

First and foremost, eligibility requirements are somewhat different with Big Picture Loans in comparison to other online lenders, not least because they operate under local Tribal laws. Ordinarily, online lenders – especially those offering bad credit loans, are required to hold a license in each of the states they operate in. On the contrary, Big Picture Loans are able to accept applications throughout the US.

In terms of the fundamentals, Big Picture Loans will expect you to have a monthly income of at least $700. This is extremely low, especially when you consider state laws surrounding minimum incomes (this is usually $1,500 per month, although can be as high as $3,600 in California).

When it comes to your FICO credit score, although the platform is essentially a no credit check lender, they might be able to view your credit background from sources other than the three main credit rating agencies. As such, it is likely that you will need a FICO score of at least 350 to be approved.

Finally, you’ll also need to make sure that you have a US checking account that is in good standing, a valid social security number, a valid telephone number, and of course, be at least 18 years old.

How Much Can I Borrow and for how Long?

Big Picture Loans allow you to borrow between $200 and $1,500. You might not be able to borrow the maximum amount if the lender deems your credit profile to be too high risk. On the other hand, a number of prior customers have claimed that they have been offered a higher amount than the $1,500 limit upon making the initial application. As such, you might be able to borrow more than the stated amount.

In terms of the loan duration, you’ll be able to choose a period of between 4 months and 18 months. Taking the high interest amounts in to account, you are best off keeping the loan duration as short as possible.

Paying Your Loan back

Before the funds are transferred in to your checking account, you will need to read through your digital loan agreement. Within it, you will be able to see the monthly repayment date, alongside the amount that you need to pay back each month. This will always be the same date of each month, for example the 6th of May, June, and July, etc.

In terms of making a payment, you will need to link your checking account via a standing order. This means that Big Picture Loans will automatically take the money from your account each month. This is beneficial, insofar that you won’t stand the risk of forgetting to make a payment.

If you want to pay more than your monthly payment amount, or you want to pay the loan off early, then you can do this by contacting the customer support team by telephone. You might have the option of paying with your debit card, although, do check this out with the lender first.

What if I Miss a Payment?

Assessing what happens in the event of a missed payment on your Big Picture Loans agreement is crucial, not least because the company operates under local Tribal laws. This is fundamental, because US laws have certain protections in place to ensure that lenders don’t charge more than they are supposed to. This, however, doesn’t exist in Tribal law.

If you feel that the chances of you missing a payment are likely, you should not be taking a loan out with Big Picture Loans. Not only will you encounter financial penalties, but it could have a negative impact on your already-poor credit score.As per the Big Picture Loans website itself, the lender states that:

Returned payments, late payments, and non-payments may result in additional fees, charges, or collection activities pursuant to the terms of your loan agreement and as allowable under Tribal and applicable federal law

Upon further exploration, it appears that Big Picture Loans will charge you $20 per late payment. However, the bigger consequence is whether or not the lender reports the missed payment to the main credit agencies. Although they don’t state this on their website, it is best to you assume they will.

Customer Service at Big Picture Loans?

If you need to contact the customer service team at Big Picture Loans, you have a number of options available to you.

📱Phone: 1.800.584.4880

📧 Email:

✍️ In Writing: Big Picture Loans, Customer Support, P.O. Box 704, Watersmeet, MI 49969

The customer service team work around the clock – 24 hours per day, 7 days per week. Similar customer services are provided on most reliable loan providers such as Cash USA.

Is it Safe to Borrow from Big Picture Loans?

Although Big Picture Loans is able to operate under local Tribal laws, and thus, do not fall under the remit of state laws, they must still abide by federal regulations surrounding lending practices. As such, your information is safe when using the Big Picture Loans website to make an application.

However, you should still make sure that you have a firm grasp of the loan agreement that you are entering in to. Notably, the fees must be understood before you proceed.

Big Picture Loans Review: The Verdict

In summary, Big Picture Loans does exactly what it says on the tin. On the one hand, if you are currently in possession of poor to bad credit, but you really need short term financing, then it’s likely that Big Picture Loans will be able to help. Sure, you still need to ensure that you earn at least $700 per month and have a checking account in good standing, however, the overall eligibility requirements are very low. In fact, as a no credit check lender, your credit profile would need to be in significantly bad standing to be refused.

However, it is also likely that you will pay very high fees with Big Picture Loans. With rates as high as 699% APR, this is considerably higher than other short term loan providers operating online. Moreover, as the lender abides by local Tribal laws as opposed to state laws, this could also have an impact on the fees you pay.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ:

💸 Will Big Picture Loans check my credit score?

The platform claims to be a no credit check lender, and thus, they won’t check your FICO score with the main three rating agencies. However, they might request information from secondary sources. Nevertheless, the initial pre-approval application will not have an impact on your credit score – regardless of whether or not you are approved.

💸 How long does it take for Big Picture Loans to transfer my funds?

According to the lender themselves, 91% of approved loans are transferred the very next working day. However, if the lender needs to obtain further information from you, then this can cause delays. It’s a good idea to have supported documents to hand, such as your passport/driver’s license and recent pay stub.

💸 Does Big Picture Loans charge an origination fee?

Big Picture Loans does not charge an origination or application fee, which is great. However, do bare in mind that this is countered by the likelihood of a very high APR rate.

💸 What happens if I miss a payment with Big Picture Loans?

Big Picture Loans are not crystal clear with the consequences of a late payment. The platform does state that you will pay a $20 fee for each missed payment, although as the company operates under Tribal law, they could technically charge more if they wanted to. Moreover, the company does not state whether or not they report late payments to the main credit agencies.

💸 How much interest does Big Picture Loans charge?

Big Picture Loans charge a maximum APR rate of 699%, which is very high. However, you might get a lower rate if your credit profile is in a healthier state. Ultimately, you won’t find out what your rate is until you actually apply.

US Payday Loan Reviews – A-Z Directory

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up