ACE Cash Express Loan Review 2020 – READ THIS BEFORE Applying!

But before you take out a loan from the lender, you might want to know how it works and whether it is right for you. In this in-depth review, we take a look at everything about the lender and help you make the best choice.

Check out the list of best payday providers in 2020 and beyond.

-

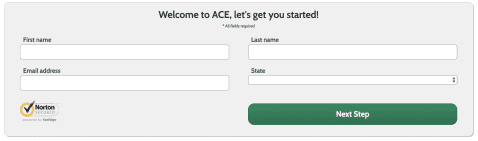

- 1. Visit the official ACE website and get started by entering your name, email address and the state where you live.

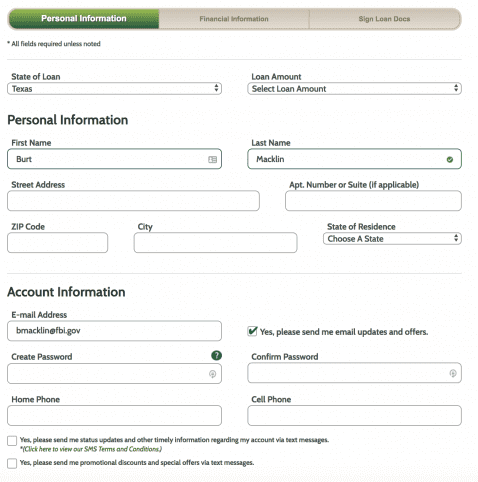

- 2. Enter the amount you want to borrow, fill in your address and then create an account.

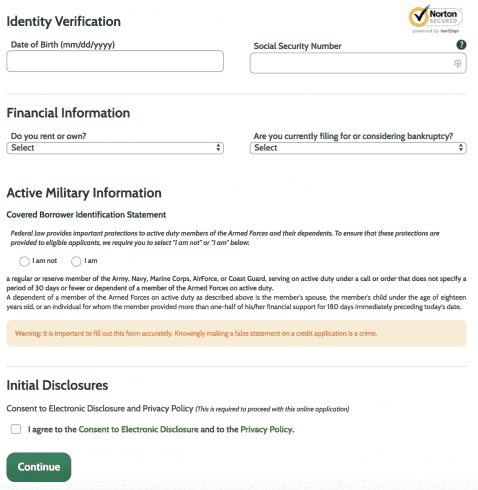

- 3. Enter the required personal information including your date of birth and social security number.

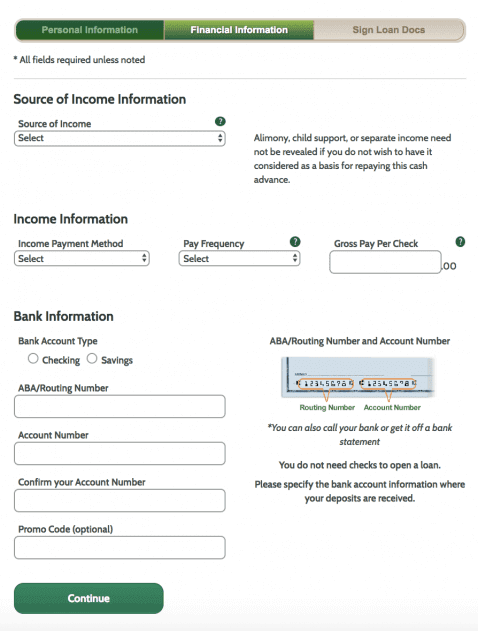

- 4. Enter required details on your source of income and details about the bank account where you would like the lender to send your funds.

- 5. Submit your application for processing and if your loan gets approved, you will e-sign the documents.

-

- 1. Visit the official ACE website and get started by entering your name, email address and the state where you live.

- 2. Enter the amount you want to borrow, fill in your address and then create an account.

- 3. Enter the required personal information including your date of birth and social security number.

- 4. Enter required details on your source of income and details about the bank account where you would like the lender to send your funds.

- 5. Submit your application for processing and if your loan gets approved, you will e-sign the documents.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Offering a variety of short-term financing options and services, ACE Cash is a reputable loan service provider operating in 23 states. It is registered with various fair practice financial institutions. However, not all of its products are available in all states where it operates.What is ACE Cash Express?

ACE Cash Express specifically targets individuals who cannot get loan approvals in traditional institutions. Founded in 1968, its specialty is in short-term loans and other alternative funding methods outside the traditional scope.

Though it specializes in three main types of loans, it also offers a variety of other financing services. Like other short term lenders, its fees are hefty, but that is understandable given that they often lend to high-risk patrons.

The lender offers in-person services in a limited number of states, but in other states, it only offers online services. It currently boasts more than 950 stores across the US in 23 states.

Pros and Cons of a ACE Cash Express loan

Pros

- 72-hour guarantee lets borrowers return all funds within 3 days without having to pay fees or face negative consequences

- No collateral required for installment and payday loans though for auto title loans, your car will serve as collateral

- You do not need to fax any documents to the provider as the process relies on online document verification

- Loan processing is straightforward and fast and you can get funds on the same day you apply

- No fees for repaying your loan early

- Does not report to traditional credit bureaus but uses alternative reporting to help borrowers create credit histories

- A mobile loan app makes it easy to access funds on the go

Cons

- In some states like Texas and Ohio where the lender does not have an operating license, it acts as an intermediary connecting you to other lenders and charges broker fees

- Not all of the lenders’ products are available in every state where it operates

- High interest rates as expected from any short term lender

- The lender is not transparent about fees and rates making it hard to make a comparison before a loan application

Ace Cash Express vs the competition, how does it compare?

Ace Cash express comes off as one of the best payday loan service providers due to their co-credit check policy. But how does it compare to equally competitive payday loan services like Speedy Cash, Check ‘n’ Go, and Advance America. We compared their borrowing limits, credit score requirements, loan costs in fees and interest, and the expected loan repayment periods. Here is the comparative guide:

Ace Cash Express

- Borrowing from $100 – $2,000 (varies by state).

- Credit score requirements of NIL (does not check)

- Fee rate on $100 starts from $25 (State dependent)

- Term of Loan 1 to 3 months

Speedy Cash

- Borrowing from $100 – $500 (varies by state).

- Credit score requirements of NIL (does not check)

- Fee rate on $100 starts from $26 (State dependent)

- Term of Loan 14 to 30 days (for payday loans)

Advance America

- Borrowing limits $100 up to $1,000

- Credit score requirements of NIL(Does not check)

- Fee rate on $100 starts from $15 (state dependent)

- Term of Loan 3 to 36 months

Check n’ Go

- Borrowing limits $100 to $1,500

- Credit Score Required 500 FICO

- Fee Rate on $100 starts from $25 (state dependent)

- Term of Loan 10 to 31 days

How does a ACE Cash Express loan work?

Much about how this lender works depends on the borrower’s residential state and the regulations that apply. However, there are some factors that borrowers from the entire range of the spectrum would do well to keep in mind.

The platform specifically targets creditors who have no rating due to a short financial history or those who have a poor rating. Not only does it give them access to funding but it also helps them to create a credit history.

But unlike other lenders who offer this facility, ACE does not report to the traditional agencies. Rather, it reports to alternative bureaus for the benefit of such borrowers.

You can go through the entire application process online or through the platform’s mobile loans app. If you are in a hurry to access funding, the best option would be to apply at one of their stores where you can get immediate funding.

The terms of every loan are state-specific and the lender will typically debit repayments from your account on the due dates. For anyone who does not submit to automatic debiting, you will get a one-day grace period after the due date to repay.

Here is a list of the best same day payday providers in 2026

What loan products does ACE Cash Express offer?

Based on your needs and circumstances, ACE offers a variety of loan products to cover them. All of these products target short-term emergency situations but are far from ideal as long-term financing options.

- Payday loans

Payday loans from the lender range from $100 to $1,500. You would need to repay the principal amount as a lump sum. The amount for which you qualify will depend on the state in which you live because loan regulations vary from state to state.

It might also depend on whether you make your application in-store or online.

- Short-term installment loans

For someone who needs a longer repayment time, the short-term installment loan might be ideal. As the name suggests, it differs from a payday loan in that you can pay it back in installments.

The loan amounts in this case range from $200 to $5,000 and just like the payday loan, will vary according to the state of residence and where you make your application.

- Auto title loans

These have a much more limited reach than the other two types of loans. They are only available in select states. Once again, the amount will depend on your state of residence. But in this case, the worth of the car you use as collateral will also play a role in determining the amount.

Another factor to consider is that you can only qualify for this loan if the car is clear and free of any other loan commitments. If you already have a loan on its title, consider using either of the other two options.

Furthermore, you have to be on the title so as to use it as collateral. In case there are two names on the title, that is also fine. But the second party also has to be present when you apply for funding.

What other store services does ACE Cash Express offer?

In addition to its short term financing options, ACE Cash also provides a number of other financial services. These are:

- Money orders

- Prepaid debit cards

- Bill pay

- Money transfers

- Business and tax services

- Check cashing

- Prepaid mobile phones

- MoneyGram money transfers

- MetaBank checking and savings account

ACE Cash Express Account Creation and Borrowing Process

If you happen to live in an eligible state, you can apply for any one of the loans in person. But you can also make your application online for payday and installment loans. In both cases, here is what you need to do:

1. Visit the official ACE website and get started by entering your name, email address and the state where you live.

2. Enter the amount you want to borrow, fill in your address and then create an account.

3. Enter the required personal information including your date of birth and social security number.

Next, fill in your housing and bankruptcy details as well as your military status.

4. Enter required details on your source of income and details about the bank account where you would like the lender to send your funds.

5. Submit your application for processing and if your loan gets approved, you will e-sign the documents.

If you want the cash immediately, you can pick it up at a nearby store. If however you choose to wait for the bank transfer, you may have to wait for 1 to 3 business days.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for ACE Cash Express Loan

Here are some of the requirements you need to meet to qualify for a loan on ACE Cash Express:

- At least 18 years of age

- US Citizen

- Verifiable source of recurring income

- Telephone number

- Must not be a reserve or regular member of the Navy, Coast Guard, Air Force, Army or Marine Corps

- Reside in the state where you make application

- Have an active bank account which has been open for at least a month

Information Borrowers Need to Provide to Get ACE Cash Express Loan

When submitting your application for the loan, here is the information you will need to provide:

- Government-issued photo ID

- Email address

- Social security number

- Proof of bank account

- Proof of income

- Housing and bankruptcy details

What states are accepted for ACE Cash Express loans?

ACE Cash Express has over 950 locations in 23 states. Unlike most other providers though, its products vary from state to state. Take a look at the states in which it operates and the services it offers in each one:

- Arizona – title loans

- Arkansas – no loans, but offers other in-store services

- Colorado – installment loans

- California – payday and title loans

- Florida – payday loans

- Georgia – title pawn loans

- Kansas – payday loans

- Indiana – payday loans

- Louisiana – payday loans

- Missouri – installment loans and payment loans

- North Carolina – no loans, but offers other in-store services

- Oklahoma – installment loans

- Ohio – title installment loans and installment loans

- Oregon – title loans and payday loans

- South Carolina – payday loans

- Pennsylvania – no loans, but offers other in-store services

- Tennessee – title loans and payday loans

- Texas – title loans, installment loans and payday loans

- Washington DC – no loans, but offers other in-store services

- Virginia – payday loans

- Minnesota – payday loans

- Maryland – no loans, but offers other in-store services

- New Mexico – installment loans

ACE Cash also offers short-term online loans to borrowers in the following states:

What are ACE Cash Express loan borrowing costs?

An interesting fact to note is that the amount you pay in fees for whatever loan you take out will depend on a number of factors. These include:

- Your state of residence

- The type of loan, and

- Your financial history

With this in mind, here are some estimates of the costs you might incur in the process:

- Late payment fees – $15 to 25

- Insufficient funds fees – $10 to $30

- APRs – 65% to 1,400%

ACE Cash Express Customer Support

Based on customer reviews posted online, the ACE Cash support team has a less than stellar reputation. A good number of customers complain that the team is not helpful in addressing their account problems.

It comes as no surprise that it holds a D- rating with Better Business Bureau (BBB).

Is it safe to borrow from ACE Cash Express?

ACE Cash is a legitimate lender who adheres to regulations on lending. It only operates in states where it is licensed to do so.

The lender is a member of the Financial Services Centers of America (FISCA) as well as the United States Hispanic Chamber of Commerce (USHCC). Both of these organizations require their members to exercise complete disclosure and follow fair lending practices.

True to this, you will get access to all applicable charges and fees on your loan contract which you can accept or reject.

In addition to the above, ACE Cash has a valid security certificate for safeguarding users’ personal data and regulating its use.

However, there are lots of online reports about scammers taking out loans in users’ names. Users also complain about getting requests for upfront fees though the lender claims not to charge upfront fees.

It would be best to check out these allegations before signing up for one of their loans.

ACE Cash Express Review Verdict

ACE Cash Express is an experienced and relatively reputable player in the short term lending arena. It offers lots of services though these vary significantly from state to state. Reports on its poor customer support team leave a lot to be desired.

Furthermore, allegations of scammers taking out loans in valid borrowers’ names and requests for upfront fees are disturbing enough to warrant further research.

Overall, it would be best to do your own thorough research before taking out a loan from ACE Cash Express.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Glossary of Loaning Terms

FAQ

How can I reach the ACE Cash customer support team?

They are reachable via email or phone and you can get the contact details from their website.

Does ACE Cash offer banking services?

ACE has a product known as the ACE Flare Account provided by MetaBank, which is a checking account with an optional savings account and direct deposit.

What’s the difference between an auto title loan and a title pawn loan?

These terms refer to more or less the same product, but the product goes by different names in different states hence the variation.

How soon can I get funding after loan approval?

If your loan gets approved by noon, you can get funds in one business day. But if it gets approved after that time, you will likely need to wait two business days.

When should I repay my payday loan?

The lender will likely automatically deduct the funds from your account on the next payday unless you indicate otherwise.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up