The IMF (International Monetary Fund) has warned of a “sharp adjustment” in markets even as it increased its 2020 global GDP growth forecast. Several other analysts have been warning about a stock market crash pointing to the soaring valuations despite the economic slump caused by the COVID-19 pandemic.

IMF warns of a market crash

“There is a risk of a sharp adjustment in asset prices or periodic bouts of volatility,” said the IMF’s director of the monetary and capital markets department Tobias Adrian. He added, “A disconnect persists, for example, between financial markets — where there have been rising stock market valuations (despite the recent repricing) — and the weak economic activity and uncertain outlook.”

Stock market valuations are stretched

US stock market valuations have been running far ahead of their long-term trend. While corporate earnings are expected to fall sharply this year, US stock markets have soared to record highs. As a result, the valuations as measured by the price to earnings multiple have risen. According to a FactSet report dated 9 October, the S&P 500’s NTM (nest 12-month) price to earnings multiple is 21.9 which is higher than the five-year average of 17.2 and the 10-year average of 15.5.

IMF talks of policy support

“As long as investors believe that markets will continue to benefit from policy support, asset valuations may stay elevated for some time. Nonetheless, and especially if the economic recovery is delayed, there is a risk of a sharp adjustment in asset prices or periodic bouts of volatility,” wrote Adrian on his blog post on the IMF website.

Notably, government support is crucial for the economic recovery to continue. While the US Federal Reserve unleashed record liquidity that helped prevent a collapse of the financial system, chairman Jerome Powell has called upon the Congress for more stimulus. The previous round of stimulus helped prevent many layoffs while also helped keep many companies afloat.

However, layoffs have mounted this month. US airline companies have furloughed thousands of employees while Disney has announced 28,000 layoffs spread across its various divisions. Stimulus talks have been stalled due to the differences between the Democrats and Republicans.

IMF raises global growth forecast

Along with warning of a possible pullback in asset prices, the IMF has also revised its 2020 economic growth forecast. It now expects the global economy to contract 4.4% in 2020 as compared to its June forecast of 4.9%. Under the IMF’s new methodology, the June forecast stands revised ay 5.2%. However, the IMF lowered its 2021 global growth forecast from 5.4% to 5.2%

“We are projecting a somewhat less severe though still deep recession in 2020, relative to our June forecast,” said Gita Gopinath, the IMF’s chief economist.

“While the global economy is coming back, the ascent will likely be long, uneven, and uncertain,” said Gopinath. She added, “prospects have worsened significantly in some emerging market and developing economies.”

IMF on targeted shutdowns

“With renewed upticks in COVID-19 infections in places that had reduced local transmission to low levels, re-openings have paused, and targeted shutdowns are being reinstated. Economies everywhere face difficult paths back to pre-pandemic activity levels,” said the IMF

Many countries including the UK are contemplating a second shutdown amid rising infections. However, the Trump administration had previously denied the possibility of a second round of shutdowns. US President Donald Trump, who had caught the virus earlier this month, has now been cured and is back in the White House. However, the monoclonal antibody vaccine that Trump was administered has come under scrutiny after Eli Lilly’s vaccine candidate trials were halted yesterday. Johnson & Johnson’s vaccine candidate trials were also temporarily paused earlier this week.

IMF warns of soaring debt

The IMF also talked about soaring global debt. It expects the debt to GDP of advanced economies to reach 125% by the end of the next year while it expects the ratio to rise to 65% in emerging markets. The IMF also suggested that “to ensure that debt remains on a sustainable path over the medium-term, governments may need to increase the progressivity of their taxes and ensure that corporations pay their fair share of taxes while eliminating wasteful spending.”

Are US stock markets in a bubble?

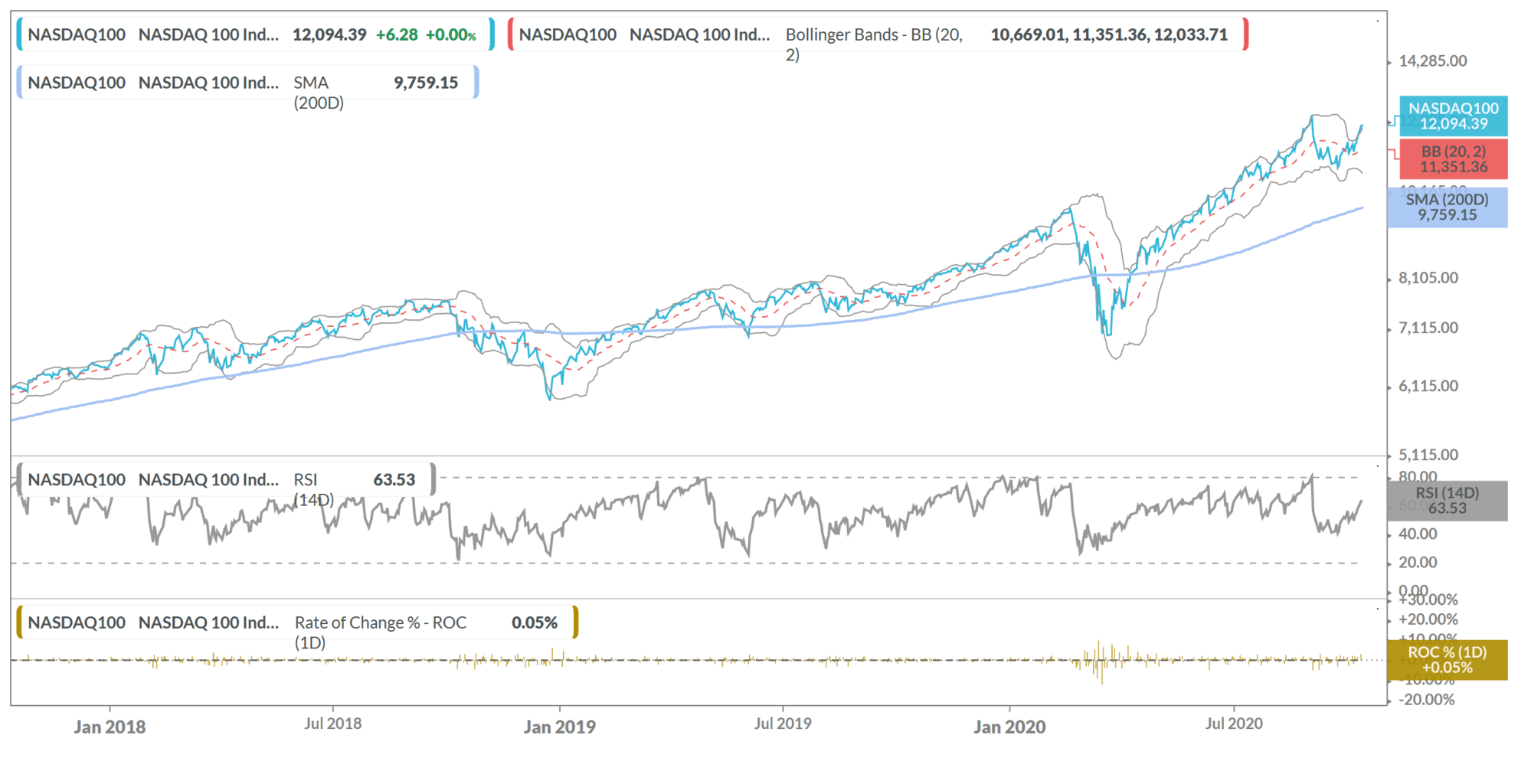

The Nasdaq 100 Index has surged over 38% this year led by strong gains in tech stocks like Apple and Amazon. The opinion is quite divided on whether we have a tech bubble. Mark Mobius is among those who see a bubble in tech stocks and specifically pointed to the sharp rally in Tesla stock. Leading brokerage Berenberg also compared the sharp rally in US tech stocks to the dot com days. However, many others see the rise in tech stocks as an affirmation of the increased pace of digitization during the pandemic.

Can you benefit if the bubble in tech stocks burst?

You can go short on the Nasdaq using several instruments including CFD or Contract for Difference. We’ve compiled a list of some of the best brokers for CFDs.

If you are not well equipped to research stocks or want to avoid the hassle of identifying and investing in stocks, you can pick some inverse ETFs. These ETFs rise in value when the markets fall while they fall with a rise in the underlying index.

By investing in an ETF, you get returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account