Over the last two weeks, US tech stocks have looked weak and driven down markets from their record highs. Is a sector rotation underway from tech stocks, and can you benefit from it?

The Nasdaq 100 index lost almost 1.5% yesterday and closed at 11,080. This month, the index has closed with losses in seven trading days and gains in five. The index fell by 5.2% on 3 September, marking its worst day since March. It made a closing high of 12,420 on 2 September and is now down 10.7% from those levels. Also, last week was the worst for the index since March.

Is a sector rotation underway?

The Nasdaq is down over 10% from its recent highs signaling that it is in the correction zone. A fall of 20% from highs signals a bear market. Interestingly, the Nasdaq has looked weak even as all recent tech IPOs have received tremendous response from investors.

Berkshire Hathaway backed cloud data storage company Snowflake more than doubled on debut. This was despite the company increasing its estimated IPO price twice from the original estimate.

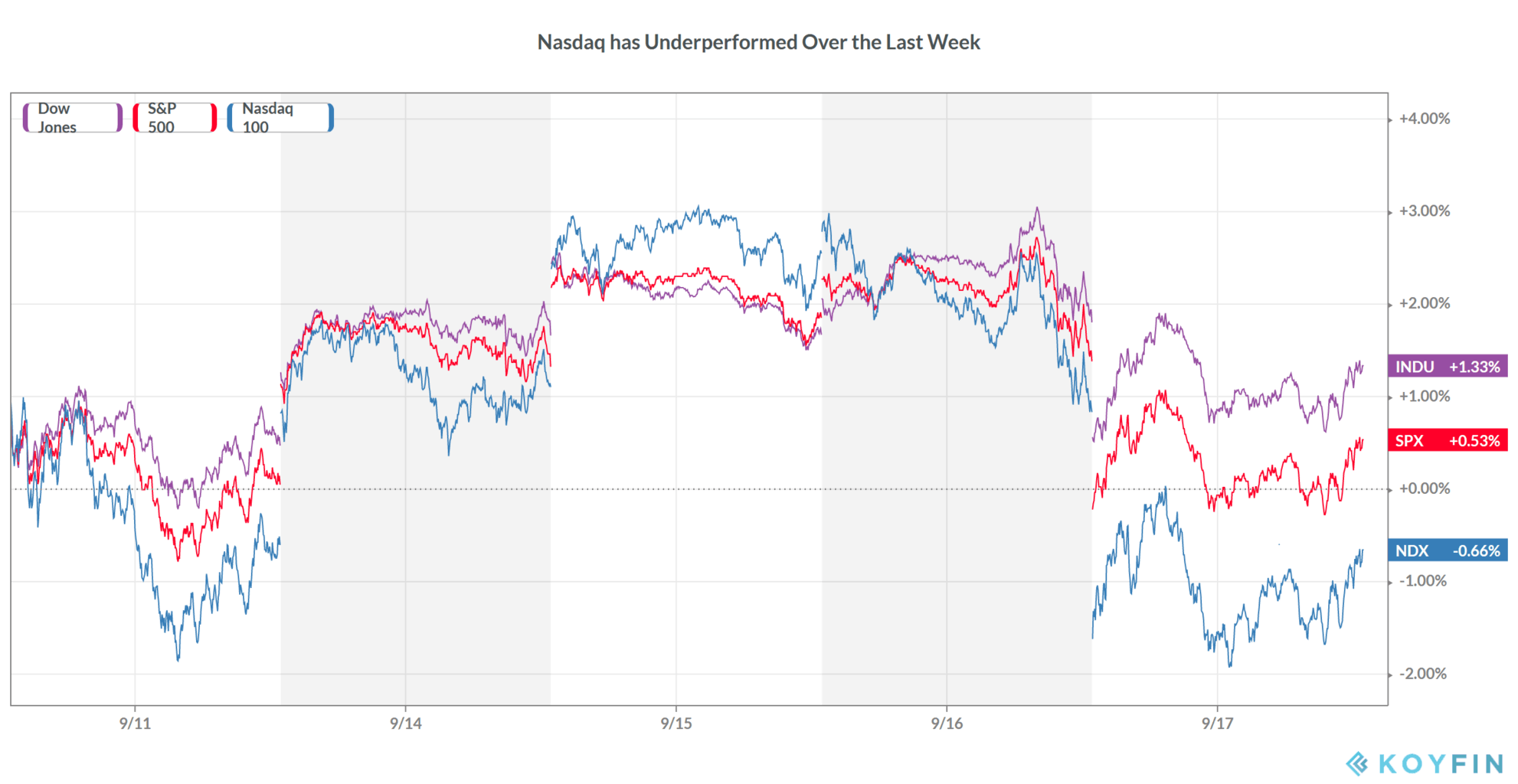

While tech stocks have looked weak over the last few trading days, cyclicals especially industrials have outperformed. So, is a sector rotation from tech stocks into industrials underway?

Jim Cramer’s views on sector rotation

Jim Cramer, the host of the Mad Money show on CNBC, also sees a sector rotation. “I expected a correction, and that’s exactly what we’re getting here,” said Cramer. He added, “I think it’s time to start putting cash to work. Instead of tech, though I recommend picking up some of [the] historically cheap stocks that are being brought down by the entire averages.”

Cramer pointed to value cyclical stocks like Caterpillar, Dow Inc, and 3M. All these stocks rose above 2% on Thursday. US steel stocks also closed with sharp gains after better than expected guidance from Nucor and Steel Dynamics.

Steel companies see demand coming back

“Construction continues to show its resiliency. The customer order backlog for the company’s steel fabrication platform remains strong, and customers are optimistic concerning non-residential construction projects,” said Steel Dynamics in its earnings release. Nucor also sounded “cautiously optimistic” on the outlook and said, “We have seen an uptick in demand and pricing for raw materials and sheet steel late in the third quarter.”

Both Nucor, that’s the largest US-based steel company, and Steel Dynamics rose above 2.5% while US Steel Corporation gained 8.4%. ArcelorMittal, the world’s largest steel company rose over 6% yesterday.

Steel companies have increased steel prices

US steel companies have recently hiked steel prices that signal that demand is coming back. An uptick in steel demand reflects the recovery in the economy as steel is a raw material for many industries including construction and automotive.

US steel stocks are still down sharply this year and the recent outperformance could signal a possible sector rotation into beaten down stocks.

Billionaire investor Howards Marks is also betting on beaten down sectors

Earlier this month, billionaire investor and chairman of money manager Oaktree Capital Howards Marks also echoed similar views. “You get to a point where everything is selling at a fair price relative to the very low interest rate but still at very low prospects of returns. And I think that’s where we are.” “So where are the opportunities today? The opportunities are in the things that are out of favor,”

Marks sees opportunity in beaten down sectors like real estate and stocks in the hospitality and entertainment sectors. With many analysts projecting a sector rotation from tech to other sectors, there are a couple of ways you can play the shift.

Can you benefit from the sector rotation?

There are several strategies through which you can play the sector rotation theme from tech stocks. One is of course that you go short on tech stocks using instruments including CFD or Contract for Difference. We’ve compiled a list of some of the best brokers for CFDs. However, shorting can be risky and you would stand to lose if tech stocks rally.

The second way is by buying stocks of cyclical companies that trade at reasonable valuations You can buy stocks through any of the best online stockbrokers.

Also, if you are not well equipped to research stocks or want to avoid the hassle of identifying and investing in stocks, you can pick ETFs that invest in value stocks, cyclicals, and industrials to play the sector rotation from tech.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account