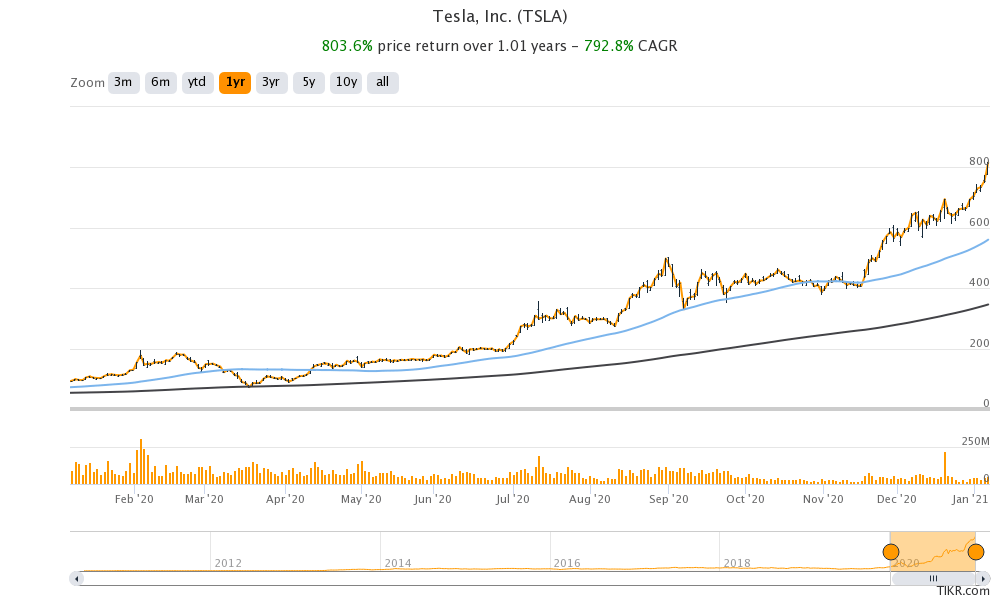

Tesla stock rose almost 8% on Thursday to made a new record high. Its CEO Elon Musk became the world’s richest person yesterday amid the surge in Tesla stock.

Many retail investors who believed in the Tesla story and Elon Musk have also accumulated decent wealth after the 740% spike in Tesla stock last year. It is looking strong this year and gained 15.6% so far in the year.

Tesla stock rises sharply

To get an idea of how huge Tesla has become, it has added almost $100 billion to its market capitalization this year which is roughly the combined market capitalization of Ford and General Motors combined. Ford’s market capitalization is now less than 5% of Tesla’s, a crude reminder of how markets are valuing legacy automakers and electric vehicle producers.

Those who have become millionaires riding the rally in Tesla stock have earned the nickname “Teslanaires.” Many such stories are floating around on credible platforms. The Wall Street Journal has cited the example of Mr. Burnworth, a civil engineer in Incline Village, Nevada who bet $23,000 on Tesla options that made him a $2 million windfall gain.

He used the proceeds from the sale of his house to buy Tesla options. While options are a risky and leveraged instrument, the rise in Tesla stock has ensured those who bet on the company have turned out winners. “Before, I wasn’t doing particularly well financially. Now, I’m well beyond where I wanted to be for retirement,” said Burnworth.

Teslanaires

The Wall Street Journal also cites the example of Mary Roberts who made her biggest investment in Tesla in 2019 and made massive gains. Tesla’s CEO Elon Musk is among those who benefited from the rise in the company’s stock. Musk has a net worth of a little above $27 billion at the beginning of 2020. However, his net worth has increased by over $150 billion over the last year and yesterday it soared above $185 billion making him the world’s richest person.

Tesla shorts are hurting

Meanwhile, while the rise in Tesla stock has made many millionaires, those who bet against the company are hurting. Last year, Tesla short-sellers lost almost $40 billion in 2020 amid the meteoric rise in the company’s stock. Jim Chanos who is among the most prominent Tesla bears squared off some of his bets against the company last year calling the position “painful.” However, Michael Burry, whose bet against the CDO (collateralized debt obligations) brought him fame during the 2008-2009 financial crisis said later last year that he is short on Tesla stock.

Chamath Palihapitiya on Tesla

Billionaire investor Chamath Palihapitiya expects Tesla stock to triple from even these levels and advises against selling the stock even after the tremendous rally. “I don’t understand why people are so focused on selling things that work,” said Palihapitiya. He added, “When things are working, you’re paid to stay with people that know what they’re doing. And this is a guy who has consistently been one of the most important entrepreneurs in the world. And so why bet against him?”

He expects Musk to become the world’s first trillionaire riding the clean energy wave. “I tweeted this a while ago that I thought the world’s first trillionaire would be a person fighting climate change,” said Palihapitiya. He added, “It very well could be Elon. But if it’s not him, it’ll be somebody like him.

Gene Munster on Apple and Tesla

Gene Munster, the co-founder of Loup Ventures, expects Tesla’s market capitalization to cross above $2 trillion over the next three years. So far, Apple is the only company that crossed the $2 trillion in market capitalization.

Munster correctly predicted the rise in Apple stock last year and expects it to be the best performing FAANG stock in 2021 also. “We think that there will be a further fracturing of FAANG,” said Munster. He expects Netflix and Facebook to underperform Apple and Amazon.

“I think for 2021, the performance is going to come again from Apple. It may seem tone deaf for a company to lead FAANG for three straight years, but I think that in fact will happen. I think this has a track to $200 [per share],” said Munster.

How to play the electric vehicle theme?

Green energy and electric vehicle stocks have been the most popular and promising investing theme over the last year. You can invest in green energy stocks like Tesla through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

An alternative approach to investing in the green energy ecosystem could be to invest in ETFs that invest in clean energy companies like Tesla and NIO.

Through a clean energy ETF, you can diversify your risks across many companies instead of just investing in a few companies. While this may mean that you might miss out on “home runs” you would also not end up owning the worst performing stocks in your portfolio.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account