Tesla (NYSE: TSLA) CEO Elon Musk has said that the company’s valuation is tied to how it moves in its autonomous driving business. The company offers Autopilot and its advanced version termed the FSD (full self-driving) and sees autonomous driving as a key long-term earnings driver.

Speaking at the Paris VivaTech innovation conference, Musk termed valuations as “strange” and said, “Sometimes I’ve said, ‘Hey, I think the stock price is too high at Tesla,’ and then the stock price goes up. I’m like, ‘okay.’”

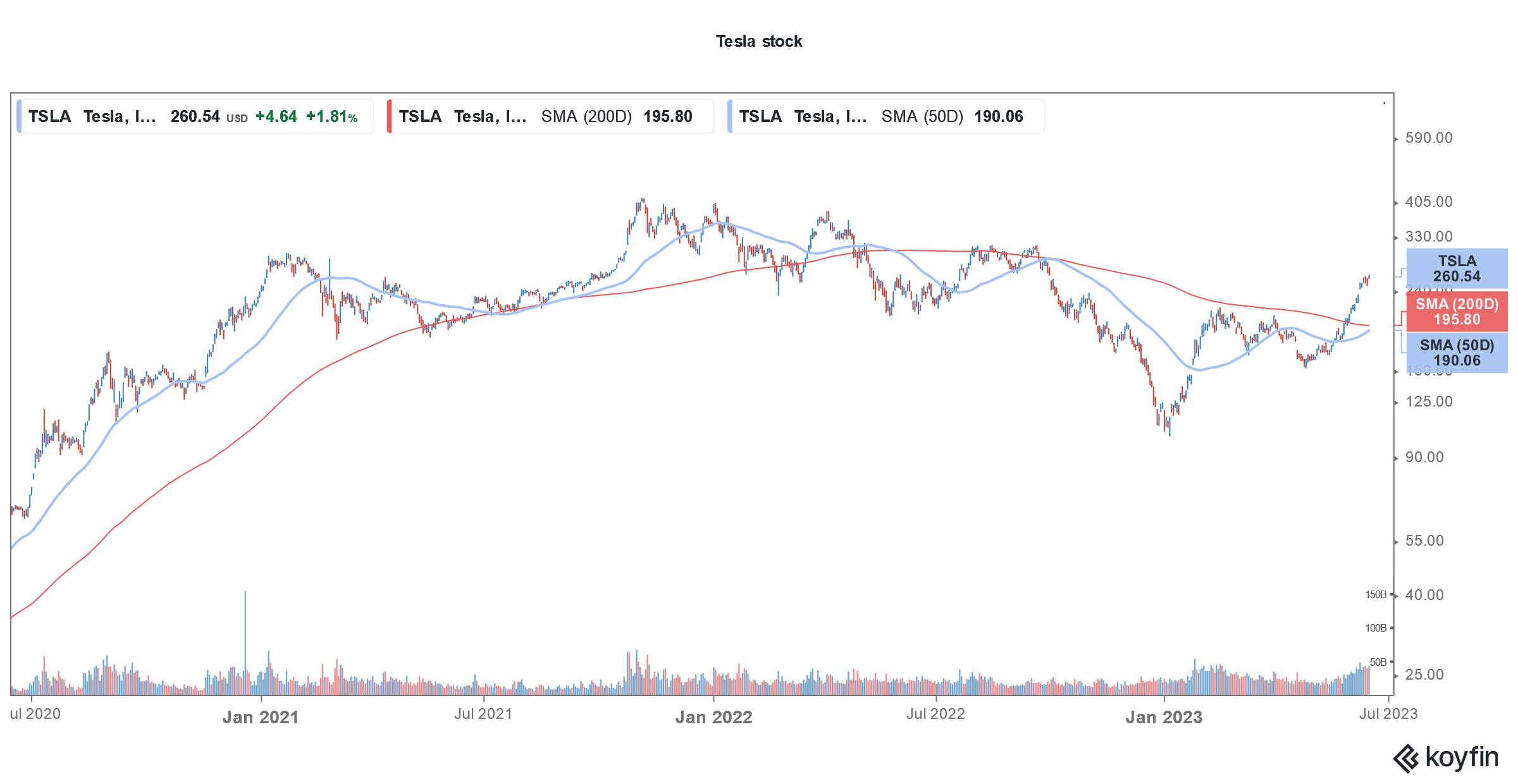

TSLA stock has more than doubled in 2023

Tesla stock has more than doubled this year and its market cap has now surpassed $800 billion. Musk, who briefly lost his position as the world’s richest person to LVHM’s founder Bernard Arnault, has reclaimed the top spot – thanks to the massive rally in TSLA stock.

At the event, Musk interacted with Bernard Arnault’s son Antoine Arnault who quizzed him on Tesla’s valuation which far exceeds that of their luxury group.

Musk responded by linking the company’s valuation to its autonomous driving and said “If you look at our total vehicle output, it’s almost 2 million vehicles this year or something like that. But that’s still only 2% of total vehicle production.”

Notably, Tesla had forecast 2023 production of 1.8 million which Musk said can rise to as high as 2 million.

Musk links Tesla valuation to autonomous driving

Musk meanwhile said that Tesla’s valuation is “primarily based on autonomy” and emphasized, “The potential for autonomy is that the value of autonomy is so high, that even if you have a discount, a percentage probability of autonomy happening, that is so incredibly valuable.”

To be sure, this is not the first time that Musk has sought to hype Tesla’s autonomous driving and link it to the company’s valuation.

Musk frequently hypes TSLA’s autonomous driving

During the Q1 2023 earnings call in April, Musk stressed multiple times how autonomous driving sets it apart from competitors.

He said, “we’re the only ones making cars that, technically, we could sell for 0 profit for now and then yield actually tremendous economics in the future through autonomy. No one else can do that. I’m not sure how many people will appreciate the profundity of what I’ve just said, but it is extremely significant.”

Last year, Tesla raised the FSD price from $10,000 to $15,00 and Musk believes that it would eventually rise to $100,000.

During the earnings call, Musk said, “I hesitate to say this, but I think we’ll do it (full autonomy) this year.” Markets meanwhile don’t seem to buy his argument as the Tesla CEO has made such comments almost every year since 2015.

Musk believes Tesla has a massive lead in autonomous driving

During the Q4 2022 earnings call also, Musk hyped up the company’s autonomous driving and said that no other automaker comes even remotely close.

Musk had previously also linked Tesla’s valuation to its software business. Using a hypothetical example Musk said during the Q4 2020 earnings call that it can generate as much revenue from Robotaxis and FSD as it is making from selling cars. He also said that all these revenues would be almost gross profit and would add to its net income.

Taking the example of annual revenues of $60 billion, Musk said, “So — and the pace you get 20 PE on that, it’s like $1 trillion and the company is still in high-growth mode. So, I think there is a way to sort of like justify the valuation of the company where it is using just the cars and nothing else, the cars with FSD.” He added, “And I suspect at least some number of investors are taking that approach.”

Musk believes Tesla can be the biggest company

Musk is known for his flamboyant comments during the earnings call and last year he forecast that Tesla could eventually become the biggest company globally with a market cap in excess of the combined market caps of Apple and Saudi Aramco – the world’s two biggest companies.

At least Cathie Wood seems to believe that TSLA stock can rise to that level and her base case target price of $2,000 would mean a market cap in excess of $6 billion which surpasses the current combined market cap of Apple and Aramco.

Musk has offered to share Tesla self-driving tech with others

Musk has offered to share Tesla’s self-driving tech with other automakers also. Notably, autonomous driving companies are burning a lot of cash and according to Ford’s CEO Jim Farley despite spending a cumulative $100 billion no player in the industry has been able to figure out a profitable business model.

Ford eventually gave up on L4 autonomous driving and wrote off its $2.7 billion investment in now-defunct Argo AI.

TSLA autonomous driving has been shrouded in controversy

Meanwhile, Tesla’s self-driving has been controversial including the very terminology FSD as the technology is nowhere near fully autonomous as the name might suggest.

In February, Tesla recalled 362,758 vehicles due to safety concerns over the FSD software.

Tesla did an over-the-air update to address the issue. Meanwhile, Musk believes that it was not a “recall” and tweeted, “The word ‘recall’ for an over-the-air software update is anachronistic and just flat wrong!”

Many accuse Tesla of deceptive marketing

During the Super Bowl earlier this year, Dawn Project released a 30-second ad that criticized FSD’s allegedly deceptive marketing. The video showed a Tesla Model 3 allegedly running on FSD and said, “Tesla Full Self-Driving will run down a child in a school crosswalk, swerve into oncoming traffic, hit a baby in a stroller, go straight past stopped school buses, ignore do not enter signs and even drive on the wrong side of the road.”

Last year, former US presidential candidate Ralph Nader called for a ban on FSD.

The NHTSA is investigating several cases of fatal crashes allegedly involving the FSD. There have been multiple instances of Tesla cars ramming into stationary emergency vehicles – including one such incident in 2023.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account