Tesla (NYSE: TSLA) is under investigation for a fatal collision in February when a Model S car collided with a stationary firetruck. Separately, regulators are investigating its Model Y over a potential issue related to the steering wheel.

In February, a TSLA Model S collided with a stationary firetruck. While it is not known whether the car was on the driver assistance system, there have been multiple instances of Tesla cars colliding with stationary emergency vehicles.

After the February accident, the driver died while a passenger was critically injured. Four firefighters were also taken to the hospital after the incident.

Both the NHTSA (National Highway Traffic Safety Administration) and CHP (California Highway Patrol) are investigating the crash.

Tesla under investigation for Model S crash

After the collision, CHP said, “It is unclear if drug or alcohol influence is a factor in this crash. It was unable to be determined at the scene if the Tesla was being operated with any driver assistance or automation activated at the time of the crash.”

The NHTSA has now initiated a special investigation into the collision. Both the NHTSA and CHP want to investigate whether the vehicle was on Tesla’s driver assistance system.

Tesla vehicles come with Autopilot which is the standard driver assistance system. In addition, Tesla offers what it calls FSD for $199 per month or a one-time payment of $15,000. Last year, the company raised the FSD price by 50%.

The software has always been controversial and regulators find the very name misleading. While the name suggests that the FSD is fully autonomous, it is not. Even Tesla advises drivers to keep their hands on the steering all the time.

Autopilot faces multiple investigations

Criticism of Tesla FSD is not new though. The NHTSA is investigating several cases of fatal crashes allegedly involving the FSD. In January, TSLA disclosed that the US Department of Justice asked for documents related to the FSD.

Last year, former US presidential candidate Ralph Nader called for a ban on FSD. Nader said, “I am calling on federal regulators to act immediately to prevent the growing deaths and injuries from Tesla manslaughtering crashes with this technology.”

He said that the FSD is “one of the most dangerous and irresponsible actions by a car company in decades.”

Musk meanwhile has been quite upbeat about FSD and previously said that the software’s price would eventually rise to $100,000. He has also pointed out that a large part of Tesla’s valuation comes from the software business, which includes the FSD.

Tesla Issued a Recall Over FSD

Last month, Tesla recalled 362,758 vehicles due to safety concerns over the FSD software. The recall affected 2017-2023 Model 3, 2020-2023 Model Y, and 2016-2023 Model S/X. According to the NHTSA, the affected vehicles can “act unsafe around intersections, such as traveling straight through an intersection while in a turn-only lane, entering a stop sign-controlled intersection without coming to a complete stop, or proceeding into an intersection during a steady yellow traffic signal without due caution.”

Tesla said that it would do an over-the-air update to address the issue. Meanwhile, Tesla CEO Elon Musk believes that it is not a “recall.” Musk, who also owns Twitter, tweeted, “The word ‘recall’ for an over-the-air software update is anachronistic and just flat wrong!”

Elon Musk has been at loggerheads with several agencies

Musk has been at loggerheads with several government agencies as well as the SEC. He paid a $20 million fine to the SEC over his controversial “taking Tesla private” tweet. However, he recently won a class action lawsuit over the issue.

Now, Musk wants to end the gag order from SEC under which Tesla’s lawyers need to vet his tweets.

NHTSA investigating Tesla Model Y over steering issue

Meanwhile, troubles might further mount for Tesla as the NHTSA is investigating its Model Y after two vehicles had their steering wheels fall off.

The agency said, “The Office of Defects Investigation (ODI) is aware of two reports of complete detachment of the steering wheel from the steering column while driving in 2023 Model Year Tesla Model Y vehicles. Both vehicles were delivered to the owners missing the retaining bolt (P/N1036655-00-A) which attaches the steering wheel to the steering column.”

The NHTSA has been in touch with Tesla over the issue and said that both the cars had an “end-of-line repair” which warranted the removal of the steering.

EV Competition is Rising

The competition has increased in the EV industry while demand growth has come down. Tesla has been aggressively slashing vehicle prices in a bid to increase sales.

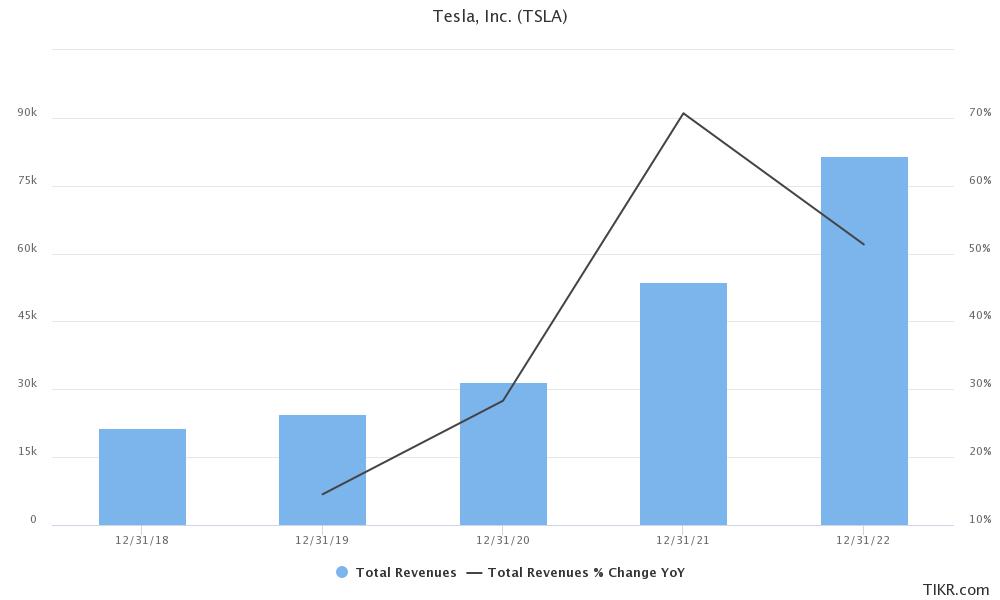

In the fourth quarter of 2022, TSLA delivered 405,278 vehicles, a YoY rise of 31.3%. In the full year, its deliveries rose 40% to 1.31 million.

The company’s 2022 deliveries fell short of what the company initially predicted. Initially, Tesla said that its 2022 deliveries would rise 50% YoY while Musk said that deliveries would surpass 1.5 million. Tesla expects to produce 1.8 million EVs in 2023. Musk said that Tesla has the capacity to produce around 2 million cars in 2023.

Meanwhile, Tesla stock has come off its 2023 highs. Its investor day on March 1 disappointed markets as the company did not provide many details on its upcoming models. Tesla is working on a new vehicle whose production cost would be around half of the Model 3.

How analysts reacted to Tesla investor day?

Wall Street analysts were also not impressed by Tesla investor day. Deutsche Bank analyst Emmanuel Rosner said, “Walking away from Tesla’s investor day, we were admittedly disappointed with the overall lack of details on its next-gen platform, including launch timing, vehicle segments and price points, and financial implications.”

Rosner meanwhile maintained his buy rating on Tesla stock. Bernstein analyst Toni Sacconaghi who is a long-time Tesla bear called the event “somewhat disjointed and fairly technical.”

He added, “Musk’s Master Plan 3 was more a message of hope for widespread electrification than a roadmap for Tesla, and executive updates — while informative — didn’t necessarily follow linearly.”

TSLA stock fell 3% yesterday and is trading lower in US pre-market price action today also.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account