Apple stock (NYSE: AAPL) hit an all-time closing high yesterday and its market cap is now a tad short of $3 trillion. While some analysts see the rally as backed by fundamentals, UBS downgraded the stock saying it sees tepid demand for iPhones.

Apple’s market cap hit $3 trillion on the first trading day of 2022 and it became the first company ever to achieve that feat – just as it was the first company to cross $1 trillion and $2 trillion market cap.

Tech stocks crashed in 2022

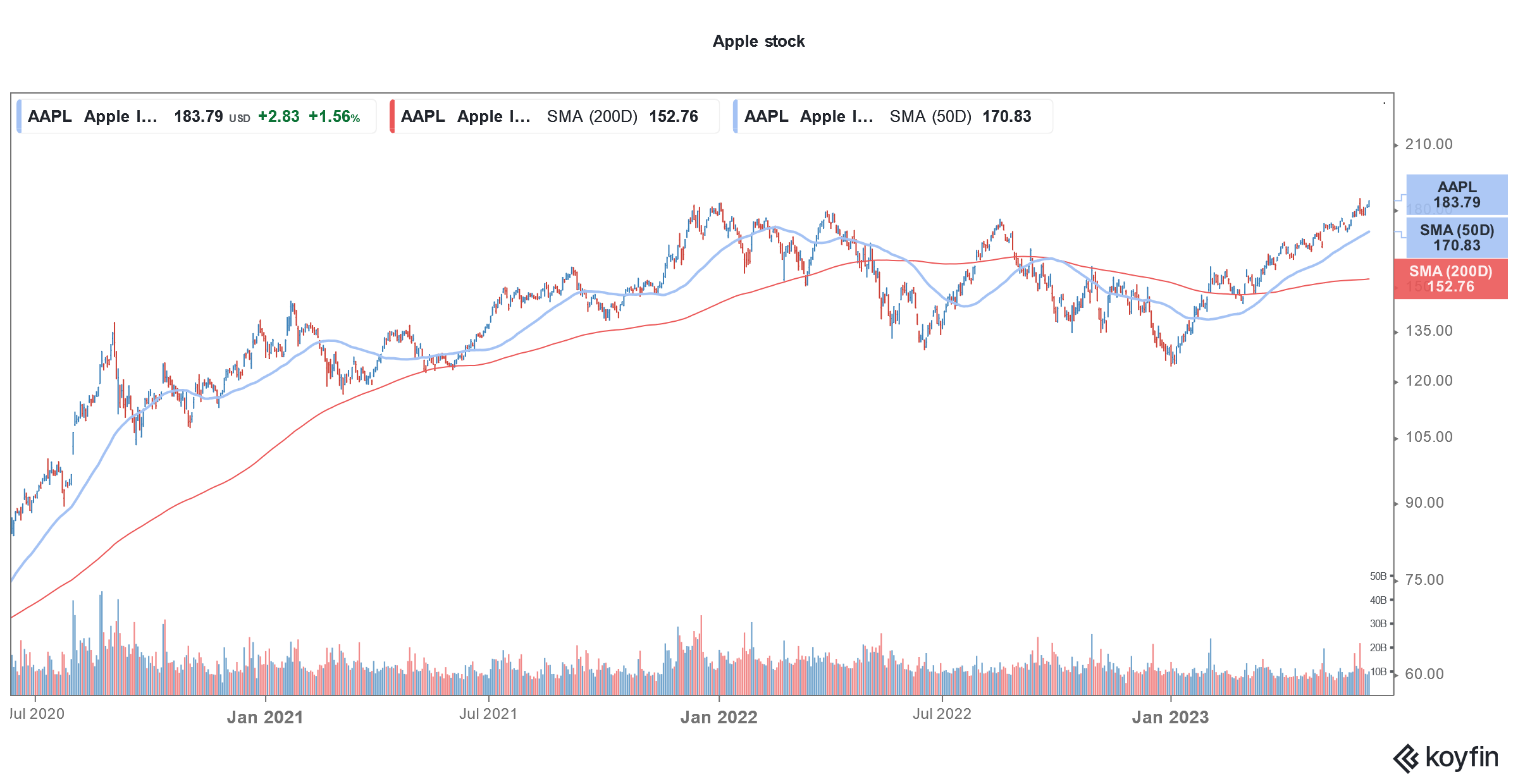

However, 2022 turned out to be a tough year for tech stocks and the tech-heavy Nasdaq lost 33% which was worse than the nearly 20% drawdown in S&P 500.

Apple incidentally was the only FAANG stock that outperformed the Nasdaq last year but even the iPhone maker underperformed the S&P 500. It lost $846 billion in market cap last year amid the tech sell-off.

Apple’s woes looked set to continue in 2023 and its market cap fell below $2 trillion on the first trading day of 2023. It joined Amazon on the list of companies that lost over $1 trillion in market cap.

Apple stock is outperforming the markets

However, it has since rebounded amid a broad-based rally in tech stocks and is up 41% for the year – outperforming the Nasdaq 100’s 35% gains.

Notably, Apple was the best-performing FAANG stock in 2019 and 2020. It lost the position to Alphabet in 2021 and fell to the second rank but reclaimed the top spot last year.

So far in 2023, Meta Platforms is outperforming FAANG peers by a wide margin and the stock has more than doubled this year making it among the top five S&P 500 gainers. Meta was however the worst-performing FAANG stock last year and lost almost two-thirds of its market value.

It has impressed markets with its cost-cut initiatives this year. The company’s revenues also rose YoY in Q1 2023 for the first time in a year.

Apple stock has soared after the WWDC

Apple stock has soared after the WWDC earlier this month. At the event, the company made several announcements including the new AR headset named Vision Pro which is priced at $3,499.

It was the first new product from Apple in decades and its CEO Tim Cook termed Vision Pro “a revolutionary new product.”

The company also revealed new features of the upcoming iO7 and announced the new 15-inch MacBook Air.

How analysts reacted to Apple Vision Pro

Wall Street had a mixed response to the Apple Vision Pro. JPMorgan Chase analyst Samik Chatterjee maintained his overweight rating on the stock.

“While Vision Pro might not drive significant volumes given its premium price point, it could be the potential catalyst for the the AR/VR market as Apple has proven in the past that consumer engagement can deliver willingness to pay premium pricing and Apple’s focus is clearly to hit a home-run on consumer engagement as opposed to volumes with the first device in what admittedly will be a multi-year journey for the platform,” said Chatterjee in his note.

Not all were impressed by the Vision Pro’s product proposition though and Bernstein’s Toni Sacconaghi doubted the viability of the product given its high price tag.

Notably, Meta offers its Quest Pro at $999 and had reduced the price of the newly-launched device by $500 earlier this year.

D.A. Davidson also downgraded the stock from a buy to neutral after the Vision Pro launch and said that the product announcement was already priced in the stock.

UBS sees demand headwinds for iPhone

Yesterday, UBS analyst David Vogt downgraded Apple stock from a buy to neutral citing demand headwinds. He predicted that iPhone unit growth would fall in the second half of the year.

To be sure, the broader smartphone industry is battling a severe slowdown. In Q1 2023, overall global smartphone shipments dipped 14%. Apple was incidentally the best performer among major smartphone companies and its shipments were largely similar to the corresponding quarter in 2022.

Meanwhile, Vogt is also apprehensive of Apple’s valuation and said, “At 29x our [next 12 months] EPS forecast of $6.22, a one-year high, and a ~50% premium to the S&P 500, a multi-year high, we do not believe Apple shares offer a compelling risk/reward particularly in light of soft iPhone, PC, and App Store fundamentals over the next 6-12 months.”

Apple is a cash-rich company

Apple is a cash-rich company and has proven its mettle across business cycles. It is the largest holding for Warren Buffett’s Berkshire Hathaway and the conglomerate is now the second largest Apple shareholder.

Buffett has praised Apple on multiple occasions, most recently during the company’s annual meeting last month.

The Oracle of Omaha said, “Apple has a position with consumers where they’re paying 1,500 bucks or whatever it may be for a phone. And the same people pay $35,000 for having a second car, and [if] they had to give up a second car or give up their iPhone, they give up their second car. I mean, it’s an extraordinary product. We don’t have anything like that that we owned 100% of, but we’re very, very happy to have 5.6 or whatever-it-may-be percent, and we’re delighted every 10th of a percent that goes up.”

AAPL is diversifying its supply chain

Apple’s supply chain is concentrated in China but the company has been taking steps to diversify its supplier base. It is looking to increase sourcing from India and also sees the country as the next major market.

Earlier this year, it set up two retail stores in India – which corroborates the importance that it attaches to the market.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account