Apple (NYSE: AAPL) would release its earnings for its fiscal second quarter of 2023 on Thursday after the close of markets. It’s been a dull earnings season for FAANG peers so far and only Meta Platforms managed to please markets with its quarterly earnings.

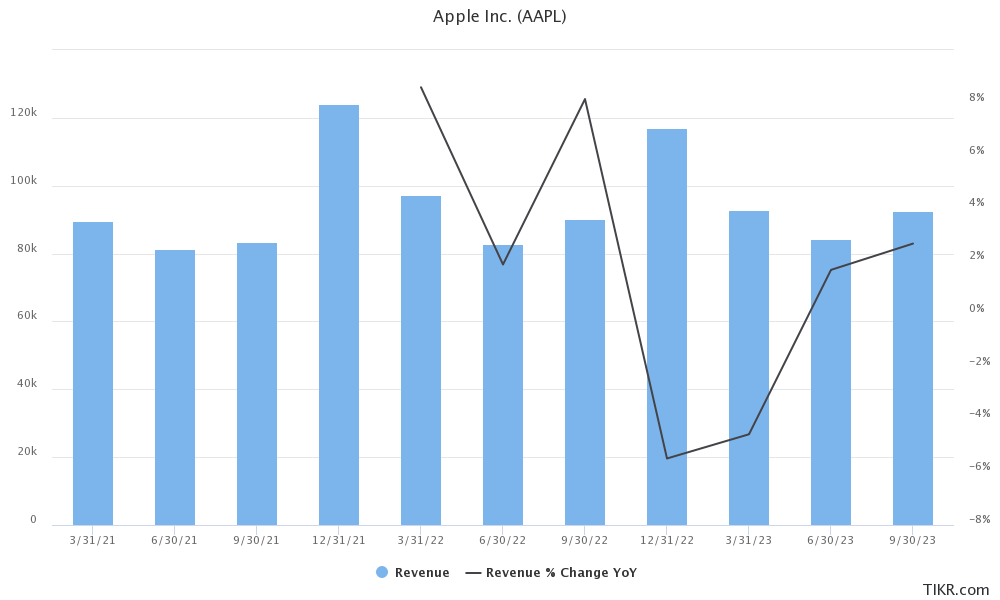

Analysts polled by Tikr expect Apple to post revenues of $92.8 billion in the March quarter – a YoY fall of 4.6%. The company’s revenues fell YoY in the previous quarter also and if analysts estimate turn out to be true, it would be the second consecutive quarter of negative revenue growth for the iPhone maker.

Analysts expect Apple to post a decline in revenues

The revenue decline is not surprising given the slump in PC and smartphone sales. Mac sales for instance fell 30% in the March quarter which was the worst decline among all major companies.

Global smartphone shipments also likely dropped in the quarter – as was the case in the previous quarter.

During its previous earnings call, Apple said that its revenue performance in the March quarter would be similar to the December quarter.

Analysts expect Apple to post an adjusted EPS of $1.43 in the March quarter, 5.9% below the corresponding quarter last year.

FAANG earnings season

It’s been a lackluster earnings season for FAANGs so far. Netflix was the first FAANG to report its earnings. The streaming giant posted mixed results for the quarter and while its subscriber count was in line with estimates, its revenues were slightly short of estimates.

It forecast revenues of $8.242 billion in the second quarter which is below the $8.476 billion that analysts were expecting and implies a YoY growth of 3.4% – lower than the growth in the first quarter.

The company forecast an EPS of $2.86 in the quarter which was again lower than the $3.05 that analysts were expecting. Netflix posted an EPS of $3.20 in the second quarter of 2022.

It however raised the full-year free cash flow guidance to $3.5 billion – up from the previous projection of $3 billion.

Netflix stock fell after the earnings release – so did Alphabet and Amazon. While Alphabet’s earnings were better than expected, it spooked markets with commentary on the outlook with CFO Ruth Porat saying “the outlook remains uncertain” due to the challenging market environment.

Meta Platforms stock surged after the earnings release

Meta Platforms reported revenues of $28.65 billion in the quarter which was ahead of the $27.65 billion that analysts expected. The revenues rose 3% YoY and were ahead of the company’s guidance.

It expects to post revenues between $29.5 billion-$32 billion in the second quarter. The guidance was better than expected and even the lower end implies a revenue growth of 2.4%.

Meta stock soared in double digits after the earnings release and so far, it is the only FAANG stock that rose after releasing earnings for the March quarter.

Amazon stock meanwhile crashed following the Q1 2023 earnings release on slowing growth in its cloud segment.

What to expect from Apple earnings?

All eyes would now be on Apple which would wrap up the earnings season for FAANG stocks this week.

During the earnings call, markets would especially watch the iPhone revenues as well as the progression in the Services segment.

Appel has scaled up the Services business and recently also launched its savings account. The segment’s revenue growth was meanwhile in the low single digits in the previous quarter as a slowing economy dampened sales.

Recently, an appeals court decided nine of the ten cases in Epic Games’ lawsuit in Apple’s favor which is a big victory for the iPhone maker.

Apple charges a hefty fee – at times upto 30% on app store purchases. While the meaty fee has helped scale up the company’s services business, which generated over $78 billion in Apple’s fiscal year 2022 which ended in September, it also eats into developers’ earnings.

Apple opened stores in India

Recently, Apple opened two retail stores in India which signals the country’s growing importance for the company. Apple sees India as a big opportunity even as its current market share in the country is minuscule.

Apple has also increased sourcing from India as it tries to diversify its supply chains from China.

Analysts on Apple earnings

Last week, Deutsche Bank reiterated Apple as a buy ahead of the company’s earnings release. In a client note, it said, “We expect AAPL to report F2Q (Mar) results in line with DB/Street estimates, with strength in iPhone offsetting incremental weakness in other areas.”

Morgan Stanley also reiterated the stock as overweight even as it said that it expects its March quarter earnings to be in line with street estimates.

Fed meeting to be another key event this week

Along with Apple’s earnings, the Fed’s May meeting would be another key event to watch this week. The US central bank has raised rates by 25 basis points each in the previous two meetings this year and analysts expect a hike of similar quantum this time around as well.

Fed’s May meeting would come at a time when annualized CPI has fallen to 5% while the rate hikes have compounded the economic woes.

A slowing economy has also hurt sales of smartphone makers like Apple and we’ll get more updates on the company’s finances when the company releases its earnings on Thursday.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account