US stock futures and European markets are retreating this morning as US Treasury yields have reversed the downtrend seen in the past couple of days during early bond trading activity, with the 10-year benchmark climbing above the 1.6% threshold for the first time since Monday.

Investors have been spooked by a sustained climb in US Treasury yields lately as such a development forces market participants to adjust the discount rate applied to riskier assets like equities – a situation that depresses their valuation.

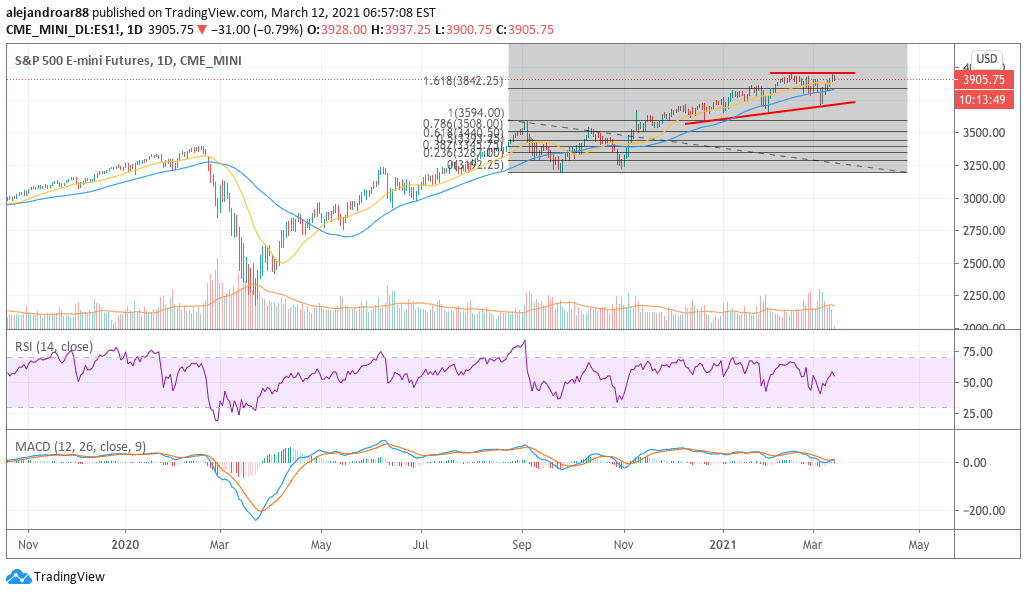

This view is reflected by the market’s response today, as US stock futures are retreating sharply, led by the tech-heavy Nasdaq 100 index, which is dropping 1.8% at 12,814, followed by E-mini futures of the S&P 500, which are sliding 0.8% at 3,905 after the index notched a fresh all-time high yesterday although it settled near its mid-February record level.

Meanwhile, E-mini futures of the Dow Jones Industrial Average are declining only 0.4% at 32,351 as virus-battered stocks have outperformed former high-flying tech stocks during the first quarter of 2021.

Prior to today’s uptick, 10-year yields had been retreating below the 1.5% mark as inflation fears eased a bit once the CPI index for the past month was released on Wednesday, with prices advancing in line with the market’s expectations.

However, this downtrend seems to have been reversed this morning as yields have climbed to their highest level since Monday only hours after President Joe Biden signed the $1.9 trillion COVID stimulus bill that will put another $1,400 in the pocket of American families.

This upward move in yields has also pushed the US dollar higher – as reflected by Bloomberg’s US dollar index – with the benchmark notching a 0.5% gain at 91.914 in early forex trading activity.

European markets have also responded negatively to today’s uptick in bond yields, as most stock indexes in the region are retreating during mid-day stock trading activity.

The German DAX is leading the drop today, sliding 0.7% at 14,461, followed by the regional STOXX600 index, which is retreating 0.5% at 421.93.

What’s next for US stock futures?

The prospect of a double-top in the S&P 500 is a worrying sight for traders if this morning’s downtick were to accelerate once the opening bell rings.

This is an entirely possible scenario if tech stocks were to drop sharply during the day, as they would drag the performance of the S&P 500 deeper into negative territory.

Meanwhile, we have an RSI dangerously close to the 50s while the MACD sent a buy signal yesterday after the 3,900 level was broken.

For now, traders should wait until the American trading session starts before making a decision in regards to the faith of S&P 500 futures.

If the downtrend were to continue during the day, chances are that this could be an early rejection of the 3,900 threshold, which should lead to another pullback on short notice.

On the other hand, if the price action ends up reversing these losses later in the day, the odds of a sustained jump towards the 4,000 level will increase dramatically.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account