The US dollar – as reflected by the US dollar index (DXY) – is advancing 0.36% this morning at 93.69 ahead of today’s meeting of the Governing Council of the European Central Bank (ECB) as the reintroduction of lockdowns in the continent could push regulators to increase the levels of monetary stimulus.

Today’s positive performance seen by the greenback would make this the fourth straight green session, as the North American currency keeps surging on the back of a risk-off attitude from market players amid a resurgence of the virus in key nations within Europe.

Most major currencies including the euro, the pound sterling, and the Australian dollar are losing roughly 0.3% against the greenback during early forex trading activity as traders predict that more fiscal and monetary stimulus will be needed for the region now that lockdowns have been reintroduced – although to a lesser extent compared to March.

On the other hand, although a faltering economic recovery in Europe could prompt the ECB to take further measures, traders also believe that rather than making any decisions on that front now, the ECB is likely to provide a signal of what may come during November and December.

Edward Moya, senior market analyst for Oanda, said: “Europe’s deteriorating outlook due to COVID-19 has turned the spotlight on the [European Central Bank] and that is sending the euro into freefall”.

That said, the greenback’s advance is somehow capped as the Federal Reserve could also take a similar approach by expanding its already massive balance sheet amid what could be the third wave of the virus in the United States – with cases already reaching record levels in the past few days.

Moreover, yesterday’s sell-off in equity markets around the world could help lift the greenback as well as a result of the typical flight-to-safety trade – especially if more losses are to come in the next few sessions ahead of the election.

What’s next for the US dollar?

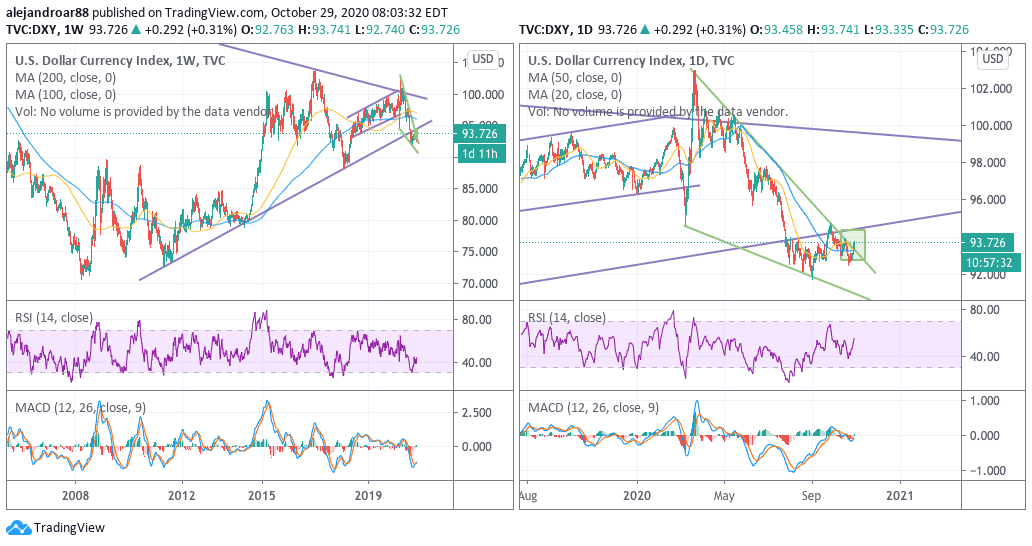

The chart above shows how the latest price action seen by the US dollar index has pushed the benchmark above a falling wedge formation that can be traced back to March’s highs and lows, with both trend lines serving as support and resistance multiple times in the weeks that followed.

This move could be the starting point of a bull run that might lead to the retest of a long-dated lower trend line – the purple line.

This confluence is very interesting since the possibility that the greenback could climb back to that previous upward trend line could signal that traders believe that dollar still holds value against its peers despite the recent debasement, as European authorities will be forced to push for more stimulus to contain the fallout of another wave of lockdowns.

That said, the MACD is climbing to positive territory once again, although a clear buy signal has not yet been sent by the oscillator.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account