Price Action Trading UK Guide 2022

Price action trading is a fast-paced method of trading used by many day traders and swing traders. This style of trading relies heavily on studying price charts and interpreting patterns. UK price action trading is often seen as an alternative to relying heavily on technical indicators, which are far from perfect at predicting future price movements.

Want to get started with price action trading in the UK? We’ll explain how price action trading systems work and highlight some popular price action trading strategies. We’ll also review five of the popular price action trading platforms you can use to start trading today.

-

-

What is Price Action Trading?

Price action trading in the UK is a style of trading that uses at an asset’s recent price movements to determine where it’s headed. A price action trading system will typically look at a price pattern and, based on that pattern, make a determination about what the asset price will do next.

What’s unique about price action trading strategies is that they use price almost exclusively. There is no consideration of fundamental data (such as the book value of a stock) and little consideration of technical indicators that are derived from price action. This is in contrast to most technical day trading, which relies heavily on indicators.

What’s unique about price action trading strategies is that they use price almost exclusively. There is no consideration of fundamental data (such as the book value of a stock) and little consideration of technical indicators that are derived from price action. This is in contrast to most technical day trading, which relies heavily on indicators.The main factors that price action trading systems consider, then, are price, volume, and the velocity of price changes. These reflect the aggressiveness of buying and selling action, which can provide insight into whether a price movement will continue or fade away.

Importantly, UK price action trading is relatively subjective. It’s possible for two traders to look at the same price chart and interpret in two different ways. This means that traders have plenty of opportunity to craft a custom price action trading strategy.

What Assets are More Suited to Price Action Trading?

A price action trading system can be used to trade just about any asset. However, this style of trading is more suited to assets that have high liquidity and relatively volatility. The more price movements an asset experiences, the better it will be for a price action trading in the UK.

That means that many of the most widely traded assets are ideal for trading with price action. Price action forex trading is particularly popular since forex pairs typically trade with very high liquidity.

Stock trading in the UK and commodity trading can also be done using a price action trading system, although it’s important to keep in mind that the prices of these assets may be more affected by market news. You will want to be careful if using a price action trading system for ETF trading, since some ETFs trade with low liquidity.

Price Action Trading Strategies

One of the neat things about UK price action trading is that there is an infinite number of trading strategies you can use. Price action trading strategies are often highly personalized and based on traders’ own experiences and tweaks.

In general, it’s a good idea to have several price action trading strategies in your arsenal. That way, you can more quickly find potential setups in any market conditions. With just a single trading strategy, it’s possible that you won’t find enough trading opportunities to make your price action trading system worthwhile.

To help you get started, let’s take a look at several popular price action trading strategies:

Bull Flag Breakout

The bull flag is a popular price action forex trading strategy in part because it’s simple to interpret. The setup consists of a strong upward price movement, which constitutes the flag pole, followed by a choppy sideways or slightly downtrending price movement, which constitutes the flag.

At the end of a flag, a bullish breakout may or may not develop – it’s up to you to determine, based on trading volume and the quality of the pattern, whether that will happen. If a breakout does happen, the price will move sharply above the top of the flag and continue up. The breakout typically continues upward for the length of the flag pole, offering a profit target for your trade.

Engulfing Candlestick Pattern

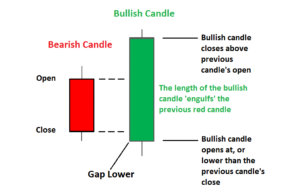

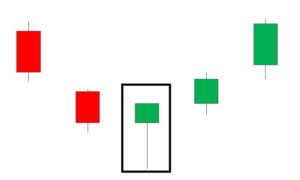

The engulfing candlestick pattern is another popular price action trading system derived from looking at candlestick price charts. A candlestick ‘engulfs’ the candlestick before it when the body of the second candlestick extends beyond both wicks of the first candlestick.

In a bullish pattern, an engulfing candlestick pattern occurs when the price gaps lower at the interval open before moving sharply higher. If this happens on strong trading volume, it indicates significant buying pressure for the asset.

Hammer Candlestick Pattern

A hammer price action trading system also relies on candlestick charts. A hammer candlestick forms when the open and close price of an interval are relatively close in price, but the candlestick’s wick is very long. The resulting candlestick looks like a mallet or hammer.

In a bullish scenario, a hammer candlestick’s wick will stick out far below the body of the candlestick (the hammer head). That indicates that quite a bit of selling action happened during the trading interval, but that it ultimately could not be sustained and bulls won out by the end of the interval. This type of pattern suggests that bulls will continue to dominate price action, so the asset’s price will rise over the next several trading intervals.

Range-based Trading

Range-based trading is particularly useful for price action forex trading, since currency pairs often trade in ranges. A range forms when the price of an asset bounces between a floor and ceiling repeatedly. As a price action trader, you can either trade those bounces inside the range or wait for an opportunity to trade a breakout from the range. Often, these breakouts can be significant and may be signaled by a bullish candlestick pattern.

Benefits of Price Action Trading UK

Price action trading in the UK offers some worthwhile benefits over other types of trading, like scalping trading or algorithmic trading.

First and foremost, trading with price action is flexible. You can deploy multiple trading strategies to fit different market conditions or to look more broadly for trading opportunities. When you do a spot a setup, there is plenty of room for interpretation about whether the setup is worthwhile. This flexibility works well for traders who want to tightly control risk in some situations, but are more willing to take risks when the potential payoff is high.

Another benefit to price action trading is that since you’re using price rather than technical indicators, you’re at the leading edge of the market. Most technical indicators are derived from price data, so they necessarily lag price changes by several trading intervals.

By trading on price directly, you’re taking in the latest available information and making decisions about entry and exit points in real time. In many cases, this means that the entry and exit points from UK price action trading are more favourable compared to those derived from trading with indicators.

Price Action Trading Risks

The downside to price action trading is that it can be riskier than other types of trading. As for any type of trading, price action trades can go against you.

The subjective nature of this type of trading means that it is easily possible to misinterpret a pattern or setup. When that happens, you might lose money on your trade. Some people include stop loss levels as part of every trade so that a potential loss from a trade is controlled.

In addition, trading psychology plays a heavy role in price action trading. One of the main reasons to use technical indicators is that they provide clear signals and remove the emotion and subjectivity from trading decisions. Price action trading, on the other hand, relies on gut feelings to some extent since no two setups are the same. While this can work well, it also makes it easier to get lured into bad trades.

Another thing to consider about price action trading in the UK is that it doesn’t lend itself to automation or the use of trading signals. This type of trading requires paying close attention to the market and taking a very disciplined, hands-on approach to every trade.

Price Action Trading Platforms

The trading platform you choose for price action trading will have a big impact on your success. Your trading platform must offer advanced price charts and drawing tools so you can quickly identify setups. Better yet, the ability to trade directly from a chart can help you enter orders faster and stay ahead of the market.

It’s also important to keep in mind that your choice of broker will determine what assets you can trade and how much you’ll pay for each trade. Some trading platforms offer high leverage so you can place bigger bets, while others focus on trader education or customizability.

With all that in mind, let’s take a look at some popular trading platforms for price action trading in the UK:

Plus500

Plus500 is one of the most cost-effective CFD brokers in the UK for price action trading. This platform charges no commissions and has some of the lowest spreads we’ve seen in the industry. You get access to a wide range of assets, including stocks, forex, commodities, and cryptocurrencies.

Better yet, Plus500 offers high leverage to allow you to get more out of your trades. You can trade CFDs for major forex pairs at up to 300:1, and many share CFDs trade at 10:1. That’s huge if you only want to commit a small amount of money to price action trading.

We also like Plus500’s proprietary trading platform. It’s easy to use and includes dozens of drawing tools that you can use to annotate your charts. Plus, you get access to price alerts that can be pushed to your phone through the Plus500 mobile investment app (Find out more about some of the investment apps in the UK. The only thing we found ourselves wishing for was the ability to place trades using these chart annotations. Instead, you have to open an order form to place a trade – which slows down time-sensitive trades by a few seconds.

Our Rating

80.5% of investors lose money when trading CFDs. Sponsored ad

80.5% of investors lose money when trading CFDs. Sponsored adForex.com

If you’re primarily interested in price action forex trading, Forex.com offers one of the most capable trading platforms around. This UK forex broker offers more than 80 currency pairs, including some highly volatile exotic pairs. You can also trade popular commodities like gold and silver along with cryptocurrencies.

Forex.com offers multiple trading platforms, including the powerful MetaTrader 4 platform. This software is ideal for price action forex trading because it offers a huge suite of drawing tools and strategy backtesting. So, you can easily evaluate what conditions work better for a particular price action trading strategy using historical price data. MetaTrader 4 also allows you to enter trades right from your price charts.

Trading at Forex.com is completely commission-free, although forex spreads are slightly higher than the industry average. The upside is that you get lightning-fast order routing, which is key to staying ahead of the market when price action trading.

Our Rating

There is no guarantee you will make money with this provider. Sponsored ad

There is no guarantee you will make money with this provider. Sponsored adIG

IG offers some of popular trading tools for price action trading in the UK. This well-established broker offers both ProRealTime and MetaTrader 4, both of which are capable of backtesting strategies. They also each offer plenty of chart annotation tools and order entry straight from your price charts.

Even better, you can create custom trading alerts to help you spot opportunities before they disappear. Both ProRealTime and MetaTrader 4 come with mobile apps for iOS and Android, so you can also stay on top of the market on the go.

IG offers several choices for trading, including CFDs, spread betting, share dealing, and options. CFD trades and spread bets are free, but you’ll pay a small commission on options trades. Unfortunately, IG can still be somewhat expensive for high frequency trading since its spreads are higher than most other online brokers.

There is no guarantee you will make money with this provider. Sponsored ad

There is no guarantee you will make money with this provider. Sponsored adAvaTrade

AvaTrade is a popular CFD broker with a lot to offer for price action trading in the UK. This broker gives traders access to stocks, forex, commodities, and cryptocurrencies. Better yet, AvaTrade lets you take advantage of high leverage for your trades – up to 30:1 for major forex pairs.

What really sets AvaTrade apart, though, is that it has a trading platform dedicated specifically to options trading. You can easily sort through more than a dozen options trading strategies for any asset and customize the parameters to change your risk and potential profit. The AvaOptions platform is available on mobile, too, making it easy to take your trading on the go.

For CFD trading, AvaTrade gives you access to both MetaTrader 4 and MetaTrader 5. These platforms are extremely powerful for price action trading since they allow you to backtest strategies and trade right from your charts. The only thing AvaTrade is missing is access to news and professional analysis – services that most other online brokers include for free.

Our Rating

There is no guarantee you will make money with this provider. Sponsored ad

There is no guarantee you will make money with this provider. Sponsored adPrice Action Trading Broker Commission Deposit Fee Inactivity Fee Withdrawal Fee Plus500 £0 (variable spread) £0 £8 after 3 months £0 Forex.com £0 (variable spread) £0 £15 after 1 year £0 IG £0 (variable spread) £0 (0.5% on credit cards) £9 after 2 years £0 AvaTrade £0 (variable spread) £0 £40 after 3 months 3.5% How to Start Price Action Trading

Ready to dive into price action trading in the UK? We’ll show you how to get started, which offers trading on a wide variety of assets and a vibrant social trading network.

Step 1: Open a Price Action Trading Account

To open a new price action trading account, head to the broker’s homepage and click ‘Join Now’. Create a new username and password, then enter personal details like your name and email address.

Brokers egulated by the UK’s Financial Conduct Authority require that you verify your identity to start trading. You can verify your identity online by uploading a copy of your passport or driver’s license and a copy of a bank statement or utility bill.

Step 2: Fund Your Trading Account

You can make a deposit by debit or credit card, using an e-wallet like Neteller or Skrill, or through a bank or wire transfer. Just keep in mind that you must deposit at least £140 when you first open your account.

Step 3: Place Your First Price Action Trade

Now you’re ready to start price action trading. You’ll need to find a potential setup to trade.. Just click on or search for any asset and go to the ‘Chart’ tab.

Once you’ve found a trading opportunity, click the ‘Trade’ button at the top of the asset’s page to open a new order form. Enter how much money you want to trade and how much leverage you want to apply to your trade. You can also enter a stop loss or take profit price according to your price action trading strategy.

When your order is ready, click ‘Trade’ to complete your first UK price action trade.

Conclusion

Price action trading in the UK is an exciting way to trade that offers more flexibility than other styles of trading. Instead of relying on technical indicators, price action traders look directly to price movements to predict where an asset’s value is headed next. Price action trading systems can be highly dynamic, but it’s important to always keep one eye on risk when using this style of trading.

FAQs

What is the price action equation?

The Price Action Trading Equation is a trading method created by UK trader Julie Hatch. The price action equation isn’t actually a single equation, but rather a set of price patterns that Hatch developed to spot trading opportunities.

How do candlestick charts work?

A candlestick chart breaks price action down into four parts: the open, close, high, and low. The open and close prices form the body of a candlestick, while the high and low form wicks on either end. Many price action trading strategies use candlestick charts to spot patterns.

Can I use price action trading to trade options?

Yes, but it’s important to focus on price action in the underlying asset rather than the options contract for that asset. Price action in the underlying asset will indicate future price movements, and the price of the options contracts will follow.

Can I automate a price action trading strategy?

It is possible to automate some price action trading systems, but this type of trading doesn’t generally lend itself to automation easily. That’s because every trade setup is slightly different, and price action trading relies on the judgement and interpretation of the trader rather than on a specific set of conditions.

Should I use technical indicators when price action trading?

You can use technical indicators when price action trading, but many traders do not. The problem with technical indicators is that they typically lag price movements, so they may not reflect the leading edge of the market. Technical indicators can provide extra data points for making trading decisions, but they shouldn’t be the basis for a price action trade.

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up