DEGIRO Broker Review | Platform, Fees, Pros, and Cons

DEGIRO is an online broker that offers every asset class imaginable. Not only does this include traditional share dealing services across dozens of financial markets, but also ETFs, futures, bonds, options, and more. The platform is known to offer super-competitive fees, even if you’re looking to start off with smaller amounts.

With that said, we would recommend reading our in-depth review prior to joining DEGIRO. We cover everything you need to know about the broker, such as fees and commissions, dealing charges, the types of assets you can invest in, payments, and regulation.

-

-

Best UK Trading Platform 2021

- Trade Crypto, Forex, CFDs and More

- FCA Regulated

- Only £200 Minimum Deposit

- Accepts Paypal

75% of retail investors lose money when trading CFDs with this provider.

75% of retail investors lose money when trading CFDs with this provider.What is DEGIRO?

Launched in 2008, DEGIRO is a relatively new entrant to the UK brokerage space. Since its inception a mere 12 years ago, the platform has since amassed a customer based on more than 400,000 traders, across 18 countries. The overarching benefit of using DEGIRO is that it offers some very competitive share dealing charges when you invest in traditional stocks. This averages £1.75 per trade, plus 0.014% in commission.

Launched in 2008, DEGIRO is a relatively new entrant to the UK brokerage space. Since its inception a mere 12 years ago, the platform has since amassed a customer based on more than 400,000 traders, across 18 countries. The overarching benefit of using DEGIRO is that it offers some very competitive share dealing charges when you invest in traditional stocks. This averages £1.75 per trade, plus 0.014% in commission.DEGIRO is also popular with investors because of the sheer number of markets that you will have access to. This includes listed companies in the UK, Europe, North America, Asia, and Oceana. You’ll also get to trade more sophisticated financial instruments, such as ETFs, bonds, options, futures, and leveraged products. In terms of the platform’s regulatory standing, DEGIRO is licensed by the UK’s FCA, as well as the AFM in the Netherlands.

It is important to note that DEGIRO should be viewed as a Do-It-Yourself stock brokers, meaning that you will be responsible for choosing your own investments. The platform will not, and cannot, give you financial advice or trading tips, so it’s best that you have an understanding of how investments work. If you don’t, it might be worth considering a mutual fund.

Pros and Cons of DEGIRO

Pros:

- Very competitive share dealing charges

- Tens of thousands of stocks listed

- Dozens of global financial markets covered

- Regulated by the FCA

- Access to other financial products like bonds, ETFs, and options

Cons:

- Sign up process is somewhat slow

- Still relatively new in the online brokerage scene

What can you Trade at DEGIRO?

DEGIRO offers one of the most extensive brokerage platforms in the online space. With that said, the platform isn’t suitable for those of you that are looking to engage with forex or CFD trading. Instead, all of the assets hosted at the platform can be bought and sold in the traditional sense. That is to say, you will own the underlying asset, so you’ll be entitled stocks and coupon payments, if applicable.

Below we have listed the main asset classes that you can trade at DEGIRO:

Stocks and Shares

The main asset classes offered by DEGIRO is that of traditional stocks and shares. Not only does this cover the UK markets, but more than 30 international exchanges. Regarding the latter, this includes companies listed on the London Stock Exchange (LSE), as well as the Alternative Investment Market (AIM).

If you’re looking to broaden your horizons by buying shares on foreign markets, you’ll have access to exchanges based in:

- The US

- Switzerland

- Australia

- Singapore

- Japan

- Hong Kong

- Canada

- Germany

- Spain

- Finland

- And many more

ETFs

Exchange-traded funds (ETFs) allow you to invest in a group of assets through a single trade. For example, if you wanted to invest in the FTSE 100, which consists of the largest 100 firms listed on the London Stock Exchange, you could do this with an ETF at DEGIRO.

ETFs are also available in a number of other European markets, as well as Hong Kong and Singapore. Unusually, DEGIRO does not permit ETF trading on the two major US exchanges, the NYSE and NASDAQ.

Bonds

If you’re looking to earn some passive income in the form of bonds, DEGIRO gives you access to several marketplaces. This doesn’t include the UK and the US, but European-listed bonds based in France, Germany, the Netherland, Portugal, and Belgium.

Options

Options allow you to speculate on the future price of an asset without you needing to take ownership. Instead, by paying a small non-refundable premium, you are given the option, but not the obligation, to purchase the asset at a later date. Take note, options are not for the newbie trader, as they are more suited to seasoned investors. Nevertheless, if you do want to engage with options trading at DEGIRO, the platform supports several US and European markets.

Futures

In a similar nature to options, futures contracts offer a more sophisticated way to access the financial markets. DEGIRO supports futures trading on the European and US exchanges.

Mutual Funds

DEGIRO also offers a good select of mutual funds. This is where a large-scale investment house will manage your money on your behalf. This is ideal if you have little no experience of online trading, and you simply want an expert advisor to buy and sell assets for you.

Payments at DEGIRO

One of the biggest pain points of using DEGIRO is that the platform does not support traditional debit/credit cards. As such, the only way that you can get money into and out of the broker is to use a bank account. In fact, you will need to transfer funds from your UK bank account as part of the verification process, which is why it can take a few days before you are completely set-up. This might not work for you if you have your eye on a particular stock and you want to invest on a same-day basis. After all, a lot can happen in the financial markets in a 3-5 day period.

The minimum deposit amount at DEGIRO is set at just £0.01, and there are no deposit or withdrawal fees to contend with. A major benefit that is also worth noting is that your base currency will mirror that of your home county. So, if you’re in the UK, deposit funds in pound sterling and then buy UK shares; you don’t need to worry about currency conversions.

Fees, Spreads, and Commissions at DEGIRO

In a nutshell, if you’re an everyday trader that is looking to buy shares in a cost-effective manner, DEGIRO is well worth considering. With that said, we need to unravel exactly how the fee structure works, DEGIRO charges a variable commission and flat fee.

Trading Commissions

If you’re looking to invest in shares or ETFs, the exact trading commission is based on two key metrics, the size of your trade and the specific market you want to access. For example, those of you based in the UK can buy domestic shares at £1.75 per trade, plus 0.014%. In even better news, the maximum all-in share dealing charge that you can pay at the platform is £5. In comparison, industry competitor Hargreaves Lansdown charges just under £12 per trade.

DEGIRO provides some real-world examples of how much you will pay when buying shares from the platform, which we have listed below:

- If you were to buy £1,00 worth of Tesco shares, you would pay just £1.89. Halifax charges £12.50 for the same trade.

- A £5,000 investment in Vodaphone would cost just £2.45 at DEGIRO, and £12.50 at Halifax.

As cheap as this is, DEGIRO really excels when you start buying shares on the American stock exchanges. For example, a £2,000 investment in Apple would cost you just £0.44, while a £10,000 investment in Amazon costs the same. HSBC, for example, would charge a whopping £29.95 for the same trade!

Don’t forget, the above charges will need to be paid at both ends of the trade, i.e. once when you invest and then again when you sell. This is the industry standard in the share dealing space nonetheless.

All in all, DEGIRO notes that it is 84% cheaper than its market rivals on shares, and 90% on ETFs.

Mutual Funds

When it comes to mutual funds, the fee structure works in a slightly different way. This works out at 0.1% of the total investment amount, and then a flat fee of €7.50. You will also need to pay an annual maintenance fee of 0.2%.

As such, were you to invest the GBP equivalent of £5,000 into a mutual fund, you would initially pay €12.50 (€5 + €7.50). Then, for as long as you keep your funds with the provider, you will pay an annual fee of €10. Once again, this offers tremendous value.

Inactivity Fee

As DEGIRO does not offer short-term day trading or swing trading services, there is no need to worry about inactivity fees. Instead, you can keep your long-term investments at the platform without ever been classed as dormant.

Which Regulators Govern DEGIRO?

DEGIRO is regulated by the UK’s FCA, as well as the Netherlands Authority for the Financial Markets (AFM) and the Dutch Central Bank.

UK – Financial Conduct Authority (FCA)

If you are based in the UK, then you will fall under the remit of the Financial Conduct Authority (FCA). This means that DEGIRO is required to verify your identity before you are able to trade. In order to do this, you will need to upload a copy of your government-issued ID. You will also need to transfer a minimum of £1 from your UK bank account. This ensures that you are who you say you are.

Crucially, FCA regulated brokers like DEGIRO are also required to keep your client funds in separate bank accounts from their own. In theory, this means that in the event that DEGIRO collapsed, your funds should be safe.

UK – Financial Service Compensation Scheme (FSCS)

Although DEGIRO is regulated by the UK’s FCA, it is actually a Dutch company. What this means for you is that were to the platform to go bust, you would not be covered by the FSCS. Instead, you would need to take your claim up with the AFM in the Netherlands.

Getting Started with DEGIRO

Like the sound of what DEGIRO offers and wish to get started with a stocks and shares account today? If so, follow the step-by-step guidelines outlined below.

Step 1: Open an Account

Head over to the UK DEGIRO homepage and select to open an account. If you visit the global site by mistake, you should be redirected automatically based on your IP address. As is the case with all online brokers, you will first need to provide some basic personal information.

This should include your:

- First and Last Name

- Home Address

- Date of Birth

- Nationality

- National Insurance Number

- Contact Details

Note: Every now and then, you will be presented with a ‘Register on the Waiting’ list banner when you attempt to open an account with DEGIRO. This is due to the broker receiving an unrepresented number of registration requests. As per discussions in the public domain, most users have noted that a wait of no more than a few days was required.Step 2: Financial Information and Trading Experience

DEGIRO will now ask you for some information about your financial background. This includes your employment status, annual income, and the name and address of your employer. You will also need to provide some information about your prior trading experience. This is to ensure that you have a firm grasp of the risks of trading, and you are aware you can lose money. You won’t be refused an account based on the answers you give. Instead, it’s to gauge whether or not certain financial products should be offered to you.

Step 3: Verify Your Identity

As an FCA regulated broker, DEGIRO will now need to ask you for some ID. As noted earlier, this needs to be a government-issued document such as a passport or driver’s license. You can upload the document straight into the DEGIRO portal.

Step 4: Deposit Funds

As part of the account verification process, you will also need to deposit some funds from your UK bank account. Take note, you need to specify what account number and sort code you will be using at the platform. If you try to deposit funds from a different account or an account registered in a name different to your own, DEGIRO will reject it and send the money back.

What some people prefer to do is start off by depositing the minimum of £0.01. Once the funds arrive and DEGIRO confirms your account, you can then transfer a large amount. With that said, bank account deposits at DEIGRO can take 3-5 working days before the funds are credited, so do bear this in mind if you are looking to make a fast investment.

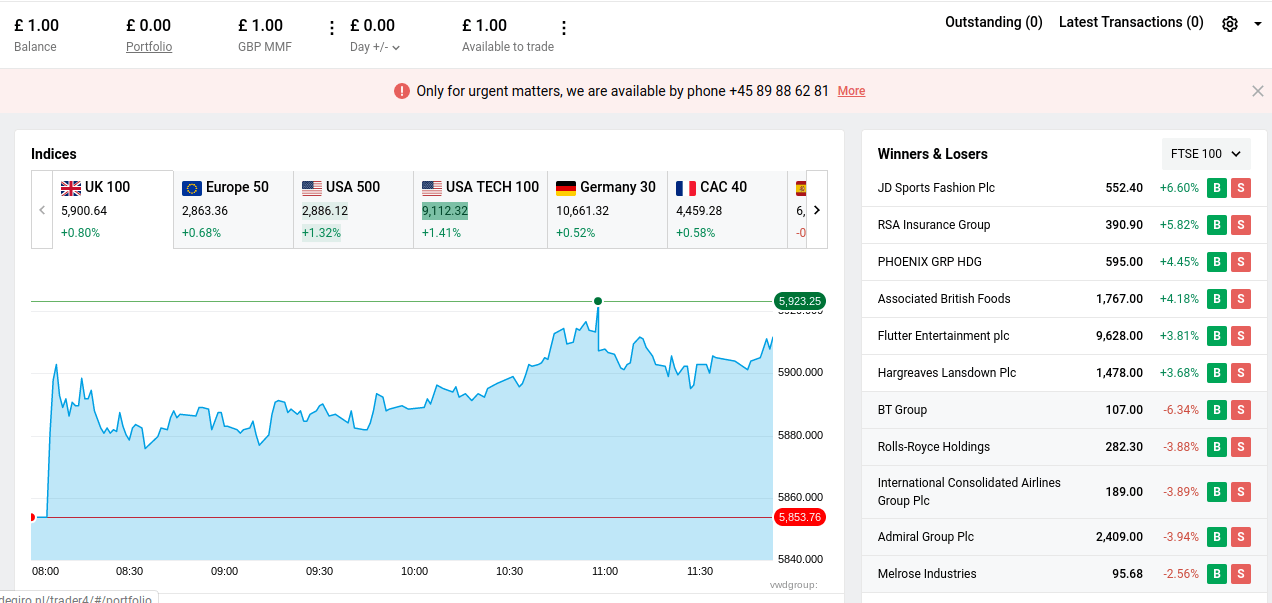

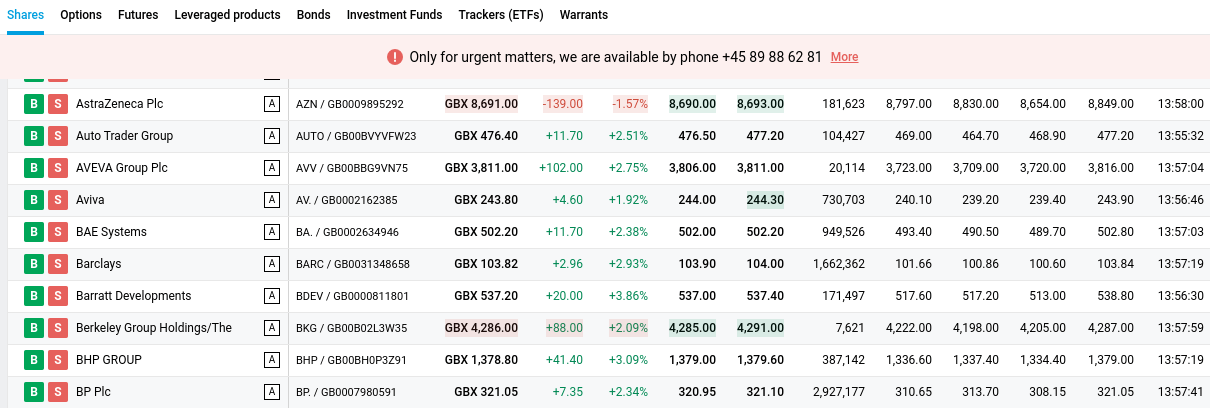

Step 5: Find Shares

With tens of thousands of stocks and other financial instruments hosted at DEGIRO, you might be best to search for the specific share you want to buy. If you want to have a browse, click on the search box anyway, and choose the market you want to explore (shares, ETFs, etc.). By default, you will be presented with a list of UK companies that are based on the London Stock Exchange.

For illustrative purposes, we click on BAE Systems to be brought to the main investment page for the company.

Step 6: Make an Investment

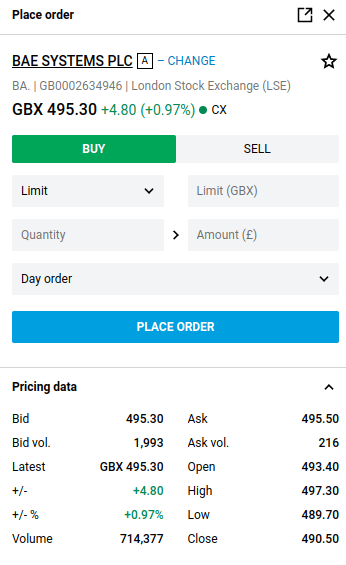

To complete the process, you will now need to place a market order. First, click on the ‘Place Order’ button, which you will find at the top-right hand side of the screen. Then, you will see a small ‘B’ and ‘S’ button. Click on the ‘B’ button to place a buy order.

You will then see an order box pop-up on the right of the page – like below.

This part of the process can appear somewhat intimidating, as there is a lot to take in. If this is your first time buying shares online, we would suggest changing the order box from a ‘limit order’ to a ‘market order’. This means that you will be given the next available stock price. As such, all you need to do is enter the number of shares that you wish to by.

For example, BAE Systems is priced at 495.00p per share, so if we were to buy 10 shares, this would cost £49.50. Finally, complete your order and the funds will be debited from your balance.

Step 7: Dividends and Share Splits

If a company that you invest in pays dividends, the funds will be credited into your DEGIRO cash account once the broker receives them. Similarly, if the company initiates a share split, this will also be reflected in your account.

Platform Features

So now that you know how to get started with DEGIRO, we are now going to explore some of the platform’s main features and benefits.

Trading Platforms

Up until recently, DEGIRO was an absolute nightmare to use, regardless of your experience in the online investment space. Much of this centred on an inability to browse through the many different markets offered by the platform in a clear and concise manner. Instead, everything was jumbled together, so unless you knew the exact financial instrument you wanted to buy, the process was cumbersome.

The good news is that DEGIRO recently re-optimized its entire site, so buying and selling investments at the broker has never been easier. For example, let’s say that you are interested in blue-chip companies listed on the US markets. All you need to do is click on shares, and then select the US from the drop-down box. Once you do, everything is laid out nicely.

Devices

In terms of the types of devices that you can trade on; DEGIRO supports a web trading platform. This means that there is no requirement to download or install any software to your desktop computer. Instead, everything can be accessed through your standard web browser.

You will also be pleased to know that DEGIRO recently launched a mobile app. The app is available on both iOS and Android devices. As per ratings on the Apple and Google Play stores, the app has been well-received. The mobile app allows you to access the same features that you will find on the desktop site – such as depositing and withdrawing funds, checking the value of your portfolio, and of course, opening or closing an investment.

Order Types

DEGIRO offers an extensive number of order types to suit both newbie and seasoned traders. Regarding the former, you simply need to select the number of shares you want to buy, followed by the ‘Fast Order’ button. This will execute your order at the next available price. If you want a bit more flexibility, DEGIRO also offers limit, stop-loss, stop-limit, and day orders.

With that said, it is somewhat disappointing that DEGIRO does not support ‘Guaranteed’ stop-loss orders. This means that regardless of how volatile market conditions are, the broker will automatically close your losing position. However, as this is not supported by DEGIRO, you do need to tread with caution. A traditional workaround to this is to install an alert at just above your stop-loss price. Unfortunately, alerts are not supported by DEGIRO, either!

Chart Reading Tools

In terms of technical analysis, DEGIRO is limited in the chart reading department. Although you do have access to the basics – including 20+ indicators, this might not be sufficient if you are an experienced trader. There is also a lack of customizability on your main trading screen. All in all, you might need to utilize a third-party platform for your technical analysis requirements.

Alerts and Notifications

We can’t quite understand why DEGIRO would go through the long ad cumbersome process of re-optimizing its desktop trading suite, as well as launch its own mobile app, only to refrain from offering real-time alerts. This is a hugely crucial tool for traders to have access to – especially during volatile market conditions. The only notifications that the broker will send you is when you place an order.

Demo Account

DEGIRO also falls short in the demo account department – with no such facility on offer. The broker might be missing a trick here, as we know a lot of newbie traders like to play around with the demo account feature before committing to real-world stakes.

Research and Analysis

The research department is a mixed bag at DEGIRO. If you are an absolute beginner, you might find the DEGIRO Academy useful. This contains a number of Layman’s guides that explain the ins and outs of brokers, trading, and general investment terms. We also like the blog section of the site, which contains a number of opinion-led publications linked to the fundamentals.

But, you’ll be lucky to get 2-3 blogs per month at best, which is minute. You won’t find any trading ideas at DEGIRO either, which is something that traders of all shapes and sizes often find useful. All in all, the research department, both in terms of the technicals and fundamentals, is relatively poor.

Customer Support

The DEGIRO customer service teams work between Monday and Friday, 7 am through to 9 pm. No support is offered over the weekend. You can call the UK telephone support line on +020 3695 7834. Alternatively, you can email the team at [email protected]. Unfortunately, there is no live chat facility.

Conclusion

DEGIRO certainly comes with more good points than bad. For example, if you’re looking to gain access to shares at a super-competitive price, it really doesn’t get much better than DEGIRO. This comes out at just £1.75 per trade, plus 0.014% in commission – and you will never pay more than £5. US stocks are even cheaper, with a £10,000 trade costing you less than 50p. We also like the fact that you will have access to companies listed on over 50 different exchanges, so you’ll have no issues creating a highly diversified portfolio of shares.

It is a bit frustrating that DEGIRO doesn’t support debit or credit cards, so it’s only a UK bank account that you can use. While this might be fine if you’re in no particular rush, it won’t be if you want to make an investment straight away. DEGIRO also falls short in the technical and fundamental research department, and there is no ability to set pricing alerts or notifications.

All in all, if you are looking for a user-friendly UK broker that allows you to buy stocks and shares without breaking the bank; DEGIRO is for you.

Best UK Trading Platform 2021

- Trade Crypto, Forex, CFDs and More

- FCA Regulated

- Only £200 Minimum Deposit

- Accepts Paypal

75% of retail investors lose money when trading CFDs with this provider.

75% of retail investors lose money when trading CFDs with this provider.FAQs

How much does it cost to trade at DEGIRO?

The exact fees will depend on the type of asset that you wish to buy, and the market it is listed on. If you’re looking for UK shares, this comes out at just £1.75 + 0.014% in commission, which is very cheap. Similarly, US stocks rarely cost more than £1 – even on larger trades. There are no fees to deposit funds, either.

Is DEGIRO regulated?

Yes, DEGIRO is regulated on two fronts – the UK’s FCA, and the AFM in the Netherlands. Take note, the broker is not part of the FSCS compensation scheme. As such, if the broker was to collapse, you would need to take your claim up with the AFM. Hopefully, it wouldn’t come to this, as DEGIRO keeps client funds in segregated bank accounts.

How do I verify my DEGIRO account?

The DEGIRO verification is a bit drawn out, as you will need to send a minimum of £0.01 from your bank account before you can start trading. This can take a few days. You will also need to upload a copy of your passport r driver’s license.

What payment methods can I use at DEGIRO?

Unlike most other brokers in the UK investment space, DEGIRO does not accept debit or credit cards. Instead, you can only deposit funds with a UK bank account.

Does DEGIRO offer a mobile app?

Yes, DEGIRO recently launched a mobile app on both iOS and Android devices. The app is free to download from the Apple and Google Play stores.

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up