Wizzcash Review 2021 – Direct Lending and Brokerage Services

Finances are not always smooth sailing. This is one of the toughest lessons in life. If you happen to find yourself in a rough patch, a payday loan from Wizzcash Loans could sound like your perfect solution.

Finances are not always smooth sailing. This is one of the toughest lessons in life. If you happen to find yourself in a rough patch, a payday loan from Wizzcash Loans could sound like your perfect solution.

But before you rush to sign up for the service, how well do you understand it? We have undertaken a thorough review of the platform to help you determine whether it is the best choice for you.

Our review takes a look at the important features of the platform, as well as its highlights and downsides.

Read on to find out everything you need to know about the lender then make an informed decision whether you’ll get a loan from it or not.

-

- 1. To get started on the application process, visit the Wizzcash website. Specify the amount you want in the box on the right side of the screen and then click on “Get Started.”

- 2. Start by filling in your personal details which include your name, date of birth, marital status, number of dependents and whether or not you are a UK resident.

- 3. Next, enter your address details starting with the postcode, how long you have lived there and your residential status.

- 4. Next, enter your contact details which include your email address, home phone number and mobile phone number.

- 5. Fill in the loan details, specifying the amount, length or term, purpose and your repayment plan.

- 6. Click “Continue” to get to the next page and complete the application process, then submit the online form.

-

- 1. To get started on the application process, visit the Wizzcash website. Specify the amount you want in the box on the right side of the screen and then click on “Get Started.”

- 2. Start by filling in your personal details which include your name, date of birth, marital status, number of dependents and whether or not you are a UK resident.

- 3. Next, enter your address details starting with the postcode, how long you have lived there and your residential status.

- 4. Next, enter your contact details which include your email address, home phone number and mobile phone number.

- 5. Fill in the loan details, specifying the amount, length or term, purpose and your repayment plan.

- 6. Click “Continue” to get to the next page and complete the application process, then submit the online form.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.What is Wizzcash Loans?

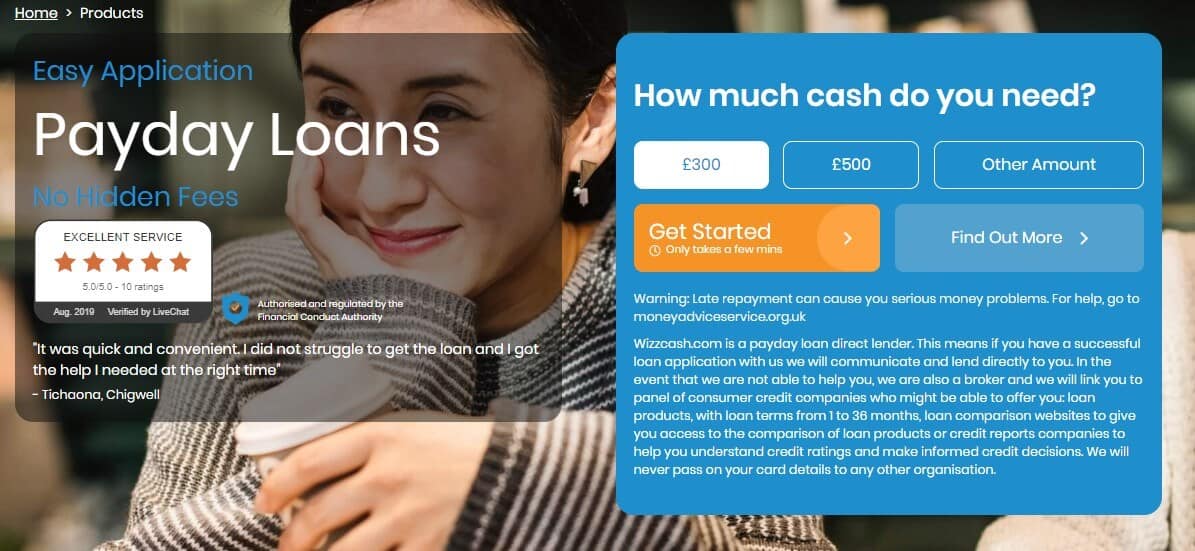

Wizzcash functions as both a direct lender and a broker service. Founded in 2012, the lender operates on a simple model for responsible lending. As direct lenders, they communicate with you directly without any intermediaries.

Wizzcash functions as both a direct lender and a broker service. Founded in 2012, the lender operates on a simple model for responsible lending. As direct lenders, they communicate with you directly without any intermediaries.But if they are unable to offer you a financial solution, they act as brokers to match you to an alternative service provider, with your consent.

Wizzcash is a trading style of Emergency Cash Ltd. and is authorized and regulated by the Financial Conduct Authority (FCA). They are also members of the Consumer Credit Trade Association (CCTA).

During the length of their existence, they have provided over 26,000 loans to assist borrowers out of emergency financial situations.

Wizzcash is both a direct lender and a broker. When they are unable to offer you funding, they match you to alternative lenders, with your consent. They have been in the market for a long time and are a regulated entity with a focus on responsible lending.Pros and Cons of a Wizzcash Loans Loan

Pros

- Offer both direct lending and brokerage services

- The site has a quick quote feature using which you can get the estimated cost of borrowing before applying

- Their online application process is simple and straightforward

- They do not charge early repayment fees

- You can get loan terms of up to 36 months when using their brokerage services

Cons

- On their eligibility criteria, they set a monthly income minimum

- They charge late repayment fees

- They offer low loan limits

- Loan terms are considerable short

How does a Wizzcash Loans loan work?

Wizzcash Loans seeks to offer a transparent and seamless service to customers. Not only do they outline their fees and costs clearly but they are also one of very few lenders to introduce their team to customers on the website.

Between the team members, they have almost five decades of experience in the financial services industry.

As a direct lender, they offer loans ranging from £200 to £1,000. The typical repayment period is 3 months, during which you pay back the loan plus interests in three equal installments. You may, however, also opt to make the repayment in one lump sum.

Loan fees

While most payday lenders are more focused on giving out credit and raking in profits, this lender shows evidence of responsible lending. They do not offer continuous lines of credit that have been known to foster poor financial habits.

Additionally, they do not charge early repayment fees as they want to encourage healthy habits. There are no hidden charges for accessing funding on the platform. And if you make a late payment, you will have to pay the penalty, which further reinforces responsibility.

Credit checks

Before approving any loan application, the lender undertakes multiple credit checks. The aim of this is to confirm beyond doubt the creditworthiness and suitability of candidates. Only when they feel confident that you can afford to make repayments do they approve your application.

They highlight the fact that FCA regulations require mandatory credit checks on borrowers applying for funding from authorized lenders. Therefore, they advise borrowers to avoid lenders who do not perform credit checks.

The application process is 100% online and there are no phone conversations required. Filling in the required details should take no more than 10 minutes as it is a simple and straightforward application form.

Similarly, you can get a provisional decision almost instantaneously following submission of the application. If your application is approved, you can receive funding on the same day.

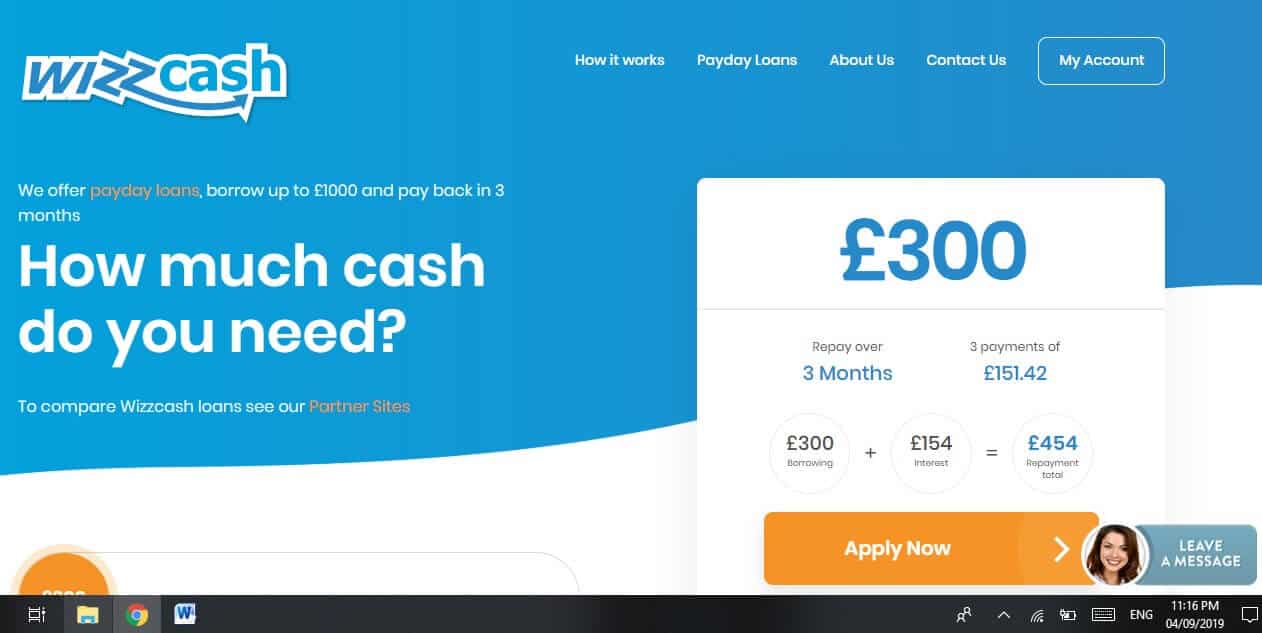

Before you fill out the application, you can use the platform’s online calculator to get an estimate cost of the loan. Simply select the loan amount you require and it will give you an estimate quote for the repayment amounts. Payment will be due every 30 days and you will get the exact interest amount as well as the total repayment amount.

When acting as a broker, they offer even greater flexibility as they get access to a wide pool of potential lenders. They will try to find a suitable match for you using the information you provide. The loan term in this case will range from 1 to 36 months.

Alternative, when they are unable to offer you their services, they might connect you to a loan comparison website. On such a site, you can assess the different lending companies in the UK and find one better suited to your needs.

They might also help you by offering you access to credit report companies. Here, you could get the opportunity to understand how credit ratings work. With this information, you might be in a better position to make an informed credit decision.

Lending to bad credit borrowers

Wizzcash services are not limited to applicants with good credit ratings. They also offer loans to people with poor credit or no credit at all. In order to do this, they assess affordability on the basis of your monthly income and outgoings.

Like most other loan service providers, they collect repayments using a continuous payment authority (CPA). When you authorize a CPA, you are basically giving the lender permission to withdraw money from your bank account.

They use the debit card information you provide to collect funds on the due date. In case they fail on the first attempt, they will make a second attempt later on the same day. But in case this fails too, they will not make any additional attempts unless you give express consent.

Though the lender is strict on responsible lending and making timely repayments, they understand that things do not always go as planned. Therefore, if you realize that you will not make a repayment on time, they offer an opportunity to talk things out.

Simply call the support team before the due date and together, you can work out an alternative repayment plan.

What loan products does Wizzcash Loans offer?

Wizzcash offers the best payday loans. According to the standard definition, these are usually low-value loans (not exceeding £1,000) with short repayment periods. Typically, you would need to pay it back by the next payday, which explains the name.

But the lender offers a slightly more flexible approach to their offering, with a longer repayment period of up to 90 days.

Wizzcash Loans Account Creation and Borrowing Process

1. To get started on the application process, visit the Wizzcash website. Specify the amount you want in the box on the right side of the screen and then click on “Get Started.”

2. Start by filling in your personal details which include your name, date of birth, marital status, number of dependents and whether or not you are a UK resident.

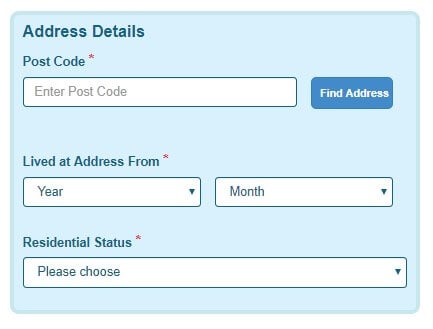

3. Next, enter your address details starting with the postcode, how long you have lived there and your residential status.

4. Next, enter your contact details which include your email address, home phone number and mobile phone number.

5. Fill in the loan details, specifying the amount, length or term, purpose and your repayment plan.

6. Click “Continue” to get to the next page and complete the application process, then submit the online form.

You will only need to wait a few minutes to get a response in most cases. And if approved, you could have the funds in your account in a matter of minutes. In case of a delay, the funds typically reflect in your account within 1 business day.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Wizzcash Loans Loan

In order to qualify for a loan on the platform, here are the requirements you need to meet:

- Be more than 18 years of age

- Be a legal resident of the UK

- Be currently employed

- Have a minimum monthly income of £750

Information Borrowers Need to Provide to Get Wizzcash Loans Loan

Wizzcash makes use of a simple application process and only requires the following information from you:

- Name

- Date of birth

- Email address

- Phone number (mobile and home)

- Postcode

- Number of years at residence

- Residential status

- Marital status

- Number of dependents

- Purpose of the loan

- How you plan to repay the loan

- Bank account details

Following the submission of your application, they might require additional information for identity verification. If that is the case, they will request for more data or supportive documentation.

What are Wizzcash Loans loan borrowing costs?

Wizzcash seeks to be transparent and lays bare all costs before you sign the loan agreement. Here are some of the costs you might expect to pay:

- Late payment fee – £15

- Fixed interest rate – 292% per annum

- Daily interest rate – 0.8%

- Representative APR – 1,265%

Representative Example:

- Total loan amount – £300

- Loan duration – 90 days

- Installment amounts – £151.42

- Total amount repayable – £454

Wizzcash Loans Customer Support

Wizzcash has a friendly team behind its services and has taken the pains of introducing team members to the customer. They offer support services over the phone and email, both of which are only accessible during work hours from Monday to Friday.

There are very few online reviews about the platform. The few that are there on TrustPilot are all negative but are not related to customer support.

Is it safe to borrow from Wizzcash Loans?

Wizzcash Loans is regulated by the FCA and is a member of the CCTA. They also make use of advanced encryption protocol with SSL certificates to protect user data.

Though they may share your information with third-party lenders in case they do not approve your application, they only do so after you give express consent.

Wizzcash Loans Review Verdict

Wizzcash Loans is one of few lenders who seem to care about the impression customers have of short term lenders. With this in mind, they attempt to offer a different service model to alter this perception.

They are strict about the approval process and loan repayment. Moreover, they carry out thorough identity, affordability and credit checks on all applicants. In the spirit of responsible lending, they do not offer loan extensions. And they charge for late repayments.

When they cannot offer you their services, they will refer you to other lenders or comparison sites.

Their loan limits and loan durations are very low and the rates are high, as is typical of similar lenders.

But overall, if you have no other way out of your financial fix, they might be a reliable choice.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.Glossary of loaning terms

Credit Score

Credit ScoreA credit score shows your creditworthiness. It's primarily based on how much money you owe to loan or credit card companies, if you have ever missed payments or if you have ever defaulted on a loan.

Guaranteed Approval

Guaranteed ApprovalGuaranteed Approval is when, no matter how bad, your credit score its, your loan application will not get declined.

Credit Limit

Credit LimitA Credit Limit is the highest amont of credit a lender will lend to the borrower.

Collateral

CollateralCollateral is when you put up an item against your loan such as your house or car. These can be repossessed if you miss payments.

Cash Advance

Cash AdvanceA Cash Advance is a short-term loan that has steep interest rates and fees.

Credit Rating

Credit RatingYour Credit Rating is how likely you are to fulfill your loan payments and how risky you are as a borrower.

Fixed Interest Rate

Fixed Interest RateFixed Interest Rate is when the interest rate of your loan will not change over the period you are paying off you loan.

Interest

InterestThe Interest is a percentage based on the amount of your loan that you pay back to the lender for using their money

Default

DefaultIf you default on your loan it means you are unable to keep up with your payments and no longer pay back your loan.

Late Fee

Late FeeIf you miss a payment the lender will charge you for being late, this is known as a late fee.

Unsecured Personal Loan

Unsecured Personal LoanAn Unsecured Personal Loan is when you have a loan based solely on your creditworthliness without using collateral.

Secured Loan

Secured LoanA Secured Loan is when you put collateral such as your house or car up against the amount you're borrowing.

Prime Rate

Prime RateThis is the Interest Rate used by banks for borrowers with good credit scores.

Principal

PrincipalThe Principal amount the borrower owes the lender, not including any interest or fees.

Variable Rate

Variable RateA Variable Rate is when the interest rate of you loan will change with inflation. Sometimes this will lower your interest rate, but other times it will increase.

Installment Loan

Installment LoanAn Installment Loan is a loan that is paid back bi-weekly or monthly over the period in which the loan is borrowed for.

Bridge Loan

Bridge LoanA Bridge Loan is a short term loand that can last from 2 weeks up to 3 years dependant on lender.

AAA Credit

AAA CreditHaving an AAA Credit Rating is the highest rating you can have.

Guarantor

GuarantorA Guarantor co-signs on a loan stating the borrower is able to make the payments, but if they miss any or default the Guarantor will have to pay.

LIBOR

LIBORLIBOR is the London Inter-Bank Offered Rate which is the benchmarker for the interest rates in London. It is an average of the estimates interest rates given by different banks based on what they feel would be the best interest rate for future loans.

Home Equity Loans

Home Equity LoansHome Equity Loans is where you borrow the equity from your property and pay it back with interest and fees over an agreed time period with the lender.

Debt Consolidation

Debt ConsolidationDebt Consolidation is when you take out one loans to pay off all others. This leads to one monthly payment, usually with a lower interest rate.

Student Loan

Student LoanIf you obtain a Student Loan to pay your way through College then you loan is held with the Department for Education U.K.

Student Grants

Student GrantsFinancial Aid in the form of grants is funding available to post-secondary education students throughout the United Kingdom and you are not required to pay grant

FAQ

Does Wizzcash contact my employer?

Wizzcash will contact your employer but not to discuss your loan application. They will only verify that you work there but will never discuss loan application details. They might also call your workplace when unable to reach you on the contacts you provide.

Do I need to send any documentation?

In most cases, you will not need to send any documents as the application process is 100% online. But they may request for backup documentation in some cases for verification purposes.

What happens if they decline my application?

The lender will pass your details to a third-party lender who might be a better fit. But if you do not want this option, simply close the window.

Can I apply if I have a bad credit history?

Yes, you can. However, note that the lender will take this under consideration too before loan approval. In case they decline the application based on the credit score, they will let you know and refer you to a reference agency.

Will a loan from this lender affect my credit history?

Yes. We will perform a credit check before approval which will affect your score. Similarly, your repayments may affect the score for better or worse.

What other store services does Wizzcash Loans offer?

The lender does not offer any other store services.

UK Payday Loan Reviews- A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up