How to Buy Vodafone Shares in 2022 – A Beginner’s Guide

Vodafone is one of the largest mobile carriers in the world, with over 300 million customers using its services across Europe and Asia. With almost €45 billion in revenues and a massive user base worldwide, Vodafone is a European telecoms leader and a strong player in the 5G domain. Vodafone shares are listed on the London Stock Exchange, and the company is a core element of the FTSE 100 Index.

This guide will discuss everything you need to know about investing in Vodafone. This includes reviews of the best UK share brokers and we cover the basics of Vodafone shares today.

-

-

Where To Buy Vodafone Shares

Before you can buy shares in Vodafone, you need to find a suitable UK broker. There are countless different stock brokers to choose from, so knowing which one is for you isn’t always easy.

To help you out, we’ve reviewed the most popular UK brokers.

1. Plus500

This popular UK broker is a specialist CFD trading platform, which means you can’t buy Vodafone shares in the traditional sense, but you can trade CFDs with up to 1:5 leverage. With no commission, very tight spreads and no withdrawal fees, Plus500 is among the most affordable brokers in the UK market.

Plus500 has its own proprietary platform that is very user-friendly and comes with a number of useful features. These include basic charting tools and custom price alerts that can be customised and sent to your mobile via the Plus500 trading app (Find out more about trading apps here). This means you never have to worry about missing an opportunity to buy Vodafone shares.

The minimum deposit for this broker is just £100, which is low in comparison to many other platforms. You can choose from a range of payment methods, including PayPal. Plus500 is licensed by the FCA and its parent company is on the London Stock Exchange, so you needn’t have any concerns about safety.

Our Rating

80.5% of retail investors lose money when trading CFDs with this provider. Sponsored ad

80.5% of retail investors lose money when trading CFDs with this provider. Sponsored adWhy Do People Buy Vodafone Shares?

Vodafone is one of the largest telecoms carriers in the world, with exposure to some of the fastest-growing markets in the world (Africa and India).

1. Strong core growth

After having divested several of its loss-making non-core divisions, Vodafone managed to renew its focus on its core and show strong growth. In the last fiscal year, Vodafone’s organic service revenue growth was 0.8% (total group revenue grew by 3%), with organic adjusted EBITDA growing 2.6%. This is primarily due to Vodafone’s efforts in reducing its operating expenses, mainly in Europe where it saved €400 million in OPEX as part of its ongoing efforts.

In addition to this year-on-year growth, Vodafone’s adjusted EBITDA margins of 33.1% mark the fifth consecutive year of margin expansion.

As Vodafone develops new solutions in the 5G, IoT and mobile payment spheres while maintaining its strong position in legacy mobile, business and fixed telecoms markets.

2. Excellent liquidity position in the medium term

At the beginning of 2020, Vodafone had a large debt balance (€54 billion) but showed no sign of liquidity issues. Indeed, the company had almost €20 billion in cash, with only €7 billion in debts maturing in the next three years.

With a large cash pile, strong free cash flow generation from its business and the bulk of the company’s debt in the distant future, liquidity is strong and allows Vodafone to weather the coronavirus crisis well.

3. Well-positioned for the 5G revolution

5G technology is expected to change our lives, from the way we communicate and work to the transportation we use and the objects we use daily. As a telecom giant and leader in several European and African markets, Vodafone has invested hundreds of millions of euros in developing a 5G network to be a European leader in the business.

At the beginning of 2020, Vodafone had launched 5G technology in over 100 cities in 11 countries, with plans to continue rolling out the technology in more cities and markets. With the game-changing technology on the brink of becoming mainstream, Vodafone and other 5G stocks are set to be the prime beneficiaries of this technological revolution.

4. A strong history of returning capital to shareholders

Beyond returning to profitability, refocusing its portfolio and growing its operations, Vodafone is famous for its generous dividend and share repurchase programs. At the time of writing, Vodafone offered a mouthwatering 6.12% dividend yield, with no stated intentions to cut it.

Beyond dividends, Vodafone has carried out several billion-euro share buybacks in the past, highlighting its commitment to shareholders.

5. Direct exposure to the fast-growing Indian market

A last and critically important dimension of the attractiveness of Vodafone shares comes from the company’s web of stakes in joint-ventures and associates. This not only includes a 50% stake in VodafoneZiggo (large player in the Dutch telecoms market) or 26.1% of Safaricom (leading Kenyan mobile carrier with >35 million customers), but 44.4% of Vodafone Idea, one of the largest mobile carriers in India.

With almost 300 million mobile customers in India and almost 28% in market share of the Indian mobile market, Vodafone Idea offers Vodafone strong exposure to the world’s largest and fastest-growing mobile telecoms market. Vodafone Idea has a tough battle ahead against other giants like Reliance Jio or Bharti Airtel, but the Indian market’s size and growth nonetheless offer a myriad opportunities to the company. With a non-controlling but significant stake, Vodafone should continue to benefit from its exposure to India.

Interested in buy shares in other companies? Check out our guides on how to buy Samsung shares, Amazon shares, and Netflix shares.About Vodafone Shares

Company History & Business Model

Vodafone is one of the UK’s largest telecom operators, with operations in Europe, Asia, Africa and Oceania. In 2018, Vodafone was the world’s fourth largest mobile operators by number of users (>300 million), behind China Mobile, Bharti Airtel and Vodafone Idea, in which Vodafone had a 45% stake.

Founded in 1991, Vodafone is based in London and listed on the London Stock Exchange and on the NASDAQ. A member of the FTSE 100 Index, Vodafone is the 5th largest company in the UK by revenues, with nearly €45 billion in 2019. At 2019 year-end, Vodafone employed over 93,000 employees worldwide.

The company’s main operations are in Europe and Africa, representing together 93% of the group’s 2019 revenues. Its business is split between three segments: Consumer, Business and Other.

Vodafone’s Consumer segment offers a range of standard mobile services including call, text and mobile data, but also fixed (i.e. landline) broadband, TV and voice services. Consumers can also access other services such as “V by Vodafone”, an IoT consumer platform to connect smart devices, and a series of security and insurance products. In Africa, Vodafone offers a mobile payments and financial services platform named M-Pesa, with over 41 million customers.

Europe is the largest Consumer sub-segment for Vodafone, representing over 100 million customers and generating 52% of the company’s overall service revenue (€38 billion in 2019). Germany is Vodafone’s largest market by far (€10.7 billion in service revenues in 2019), followed by the UK (€5 billion) and Italy (€4.8 billion). Africa is Vodafone’s fastest-growing Consumer sub-segment, with over 41 million M-Pesa users and over 82 million mobile users, but only represents 12% of service revenue.

Business is Vodafone’s second main segment, generating 28% of service revenue in 2019. Services include mobile and fixed telecoms, Internet of Things (“IoT”) platforms and services, cloud services and other various services.

Last, the “Other” segment (8% of 2019 service revenue) includes the rental of cell service to mobile virtual network operators (“MVNOs”, i.e. companies that do not own the cell towers) and associated services to MVNOs.

In 2019, Vodafone generated €38 billion in service revenues, €7 billion in equipment & other revenue, with adjusted EBITDA of €15 billion (+2.6% year-on-year).

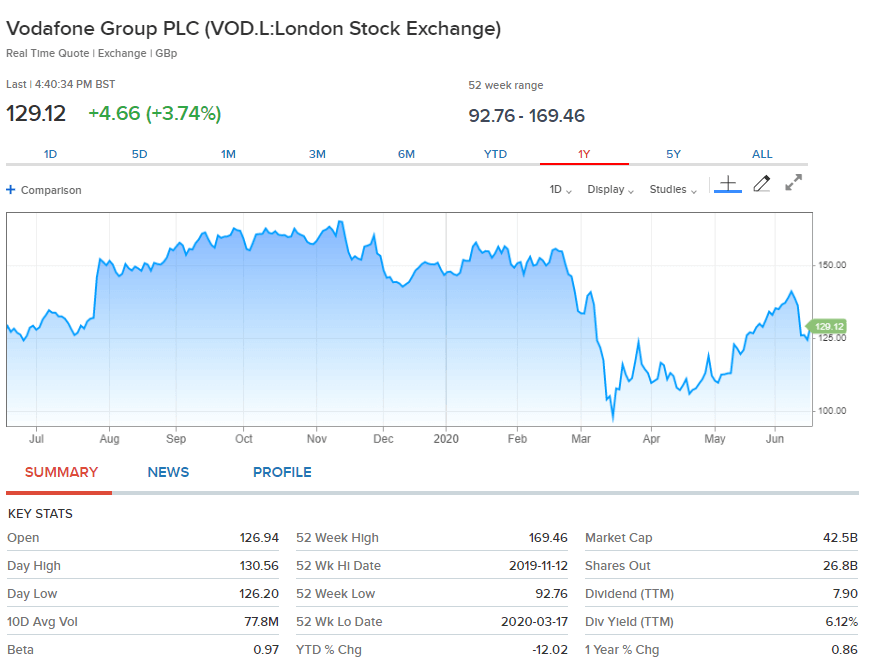

Vodafone Share Performance

Vodafone is listed on the NASDAQ (via American Depositary Shares) and on the London Stock Exchange under the VOD and VOD.L tickers.

Since February 2020, prior to the coronavirus crisis, Vodafone shares have fallen 17%, primarily due to a large debt load that raised eyebrows in a low liquidity environment. Nonetheless, Vodafone was one of the few companies whose business was not or only marginally affected by coronavirus.

While Vodafone shares suffered in the past from a series of loss-making quarters, Vodafone’s strong commitment to divesting non-core businesses and cutting operational and unnecessary capital expenditures is setting the company back on the right track.

With widening EBITDA margins, better OPEX and CAPEX management and the divestitures of loss-making operations, Vodafone continues to grow its top line and improve its bottom line, as shown by the fast-improving operating profits (€4 billion in 2019 vs. a €1 billion loss the year prior). At the time of writing, Vodafone had no intention of cutting its dividend for 2020.

How To Buy Vodafone Shares

Now we’ve explained the reasons why some investors consider buying Vodafone stocks, we’re going to show you to how to invest in stocks on a stock broker platform

If you want to buy Vodafone shares on another platform, the process remains similar.

Step 1: Search for Vodafone (VOD) shares

Using the handy search function, look for Vodafone or its ticker (VOD). You will see two search result types: Markets and People. Markets displays the tradable instruments (e.g. shares) that match your search, while People shows you other trader profiles. The ability to look up other traders, see what their performances have been and allocate money to copy them is at the core of this social trading system.

Step 2: Select “Trade” to get started

Once you have done your research, read the annual reports, understand Vodafone’s business and the specific risks, you are ready to start trading!

Make sure to use your portfolio if you want to trade with your own money, or a free demo account for free paper trading.

When you are ready, click “Trade” to open the trading window and specify the direction, amount and options of your order.

Step 3: Confirm order

In the trading window, the first step is to specify whether you want to buy or sell Vodafone shares. Stock brokers allows you to buy directly or trade and short-sell stocks via CFDs.

You can then specify how much, in dollars or in number of shares (including fractions!) you wish to buy. You will see an indicator that shows you how much of your equity is exposed in a given trade, a particularly useful tool for leveraged orders. Note that long orders that do not use leverage are executed directly, while leveraged and short orders are made via CFDs.

The next step is to decide whether you wish to execute your order at market or at a given limit. The choice of the order type is dependent on your trading strategy, and you may even want to use a stop-loss or take-profit special order types.

Last, specify the leverage (if any) that you want for your trade, review the fees at the bottom if your trade is via CFDs (no commissions on trades otherwise) and click “Open Trade” or “Set Order” outside of market hours!

Conclusion

Vodafone is one of the largest and best-known telecom companies in the world, generating gargantuan revenues and offering a high dividend to its shareholders.

FAQs

Where is Vodafone based and listed?

Vodafone’s global headquarters are in London and the company is listed on the London Stock Exchange and on the NASDAQ (via American Depositary Shares), and is part of the FTSE 100 Index.

What’s the difference between Vodafone and Vodafone Idea?

Vodafone is the diminutive for Vodafone Group PLC and is the UK-based telecoms provider discussed in this article. Vodafone Idea is one of the largest Indian telecom operators and is owned at 45% by Vodafone Group PLC.

What business is Vodafone in?

Vodafone is a classic telecom operators, with Consumer services including mobile, landline, broadband, mobile payments (in Africa only) and TV. It also offers Business mobile services and derives revenues from leasing some of its spectrum to virtual mobile carriers.

Beyond your guide, what should I read before buying Vodafone shares?

We highly recommend you to read the company’s annual reports, review its press commentary and listen to what analysts have to say to form your opinion. Make sure you understand the business and the risks before buying Vodafone shares!

Can I buy fractional shares of Vodafone?

Many of the brokers reviewed in this article allow you to buy or short fractional shares of Vodafone, mainly via CFDs.

Does Vodafone pay a dividend?

Vodafone has been a top dividend payer for years, with the current dividend yield in excess of 6%. At the time of writing, Vodafone had no intention of cutting its dividend payout for 2020.

A-Z of Shares

Alan Draper Lewis

View all posts by Alan Draper LewisAlan is a content writer and editor who has experience covering a wide range of topics, from finance to gambling.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com