How to Buy Deliveroo Shares UK – Invest with 0% Fees Today!

Deliveroo was tipped to be the hottest UK IPO (Initial Public Offering) since Royal Mail. Unfortunately for early backers – the ‘unconditional’ IPO saw Deliveroo shares plummet by 30% by end of its first day of trading.

If, however, you think that this represents a way to buy Deliveroo shares at a discount – read on. In this guide, we show you how to buy Deliveroo shares online in the UK and which brokers you can invest on.

-

-

Deliveroo IPO: Current State of Play

Deliveroo had its unconditional IPO on March 31st, 2021. This was tipped to be the biggest IPO since Royal Mail’s 2013 listing. After all, at an issue price of 390p – this valued Deliveroo at £8.8 billion.

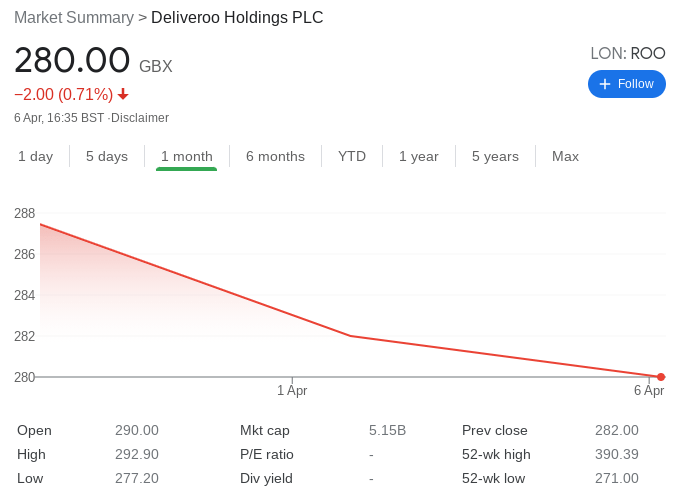

What was to follow was one of the worst IPO listings of all time – with Deliveroo shares dropped to lows of 271p – a decline of 30%. At the time of writing on April 7th – the shares have recovered to a mere 280p. It is important to note that as an unconditional IPO, access was only given to the institutional space.

As such, if you’re a casual investor, you won’t be able to buy Deliveroo shares in the UK until they hit the secondary market. When they do, you will be able to buy and sell Deliveroo stocks at the click of a button through your chosen stock broker.

How Much are Deliveroo Shares?

At the time of writing, Deliveroo shares are trading outside of the secondary market at 280p each. This amounts to 28% less than the initial IPO price of 390p. In turn, this gives Deliveroo a market capitalization of £5.1 billion – which is a significant drop from its IPO valuation of £8.8 billion.

Does Deliveroo Pay Dividends?

Deliveroo does not pay dividends – which is standard for a company that’s still at the very start of its stock exchange journey. Like most tech startups, all retained profits will be reinvested back into the company. If you do buy Deliveroo shares, this means that the primary focus will be on capital gains via an increased stock price.

Why People May Buy Deliveroo Shares

Bad Timing

First and foremost, it must be noted that the timing of the Deliveroo IPO was badly considered by management. This is because the UK is slowly but surely coming out of lockdown measures and thus – restaurants and other food establishments will once again reopen their doors to the public.

As a result of this, demand for home food deliveries will likely begin to fall. This will, of course, hit Deliveroo’s bottom line – much like it will with major competitors Uber Eats and Just Eat. Perhaps this was one of the main drives behind the IPO capitulation.

Poor Working Conditions

There are ongoing concerns from ethical investors that Deliveroo employees are subjected to poor working conditions. At the forefront of this is a recent study by the Bureau of Investigative Journalism that one-third of Deliveroo employees are earning less than the minimum wage.

This is why many large-scale players – such as Aviva and Legal General, announced that they would not be investing in the Deliveroo IPO.

No FTSE 100 Listing

Even taking into account is capitulated market valuation, the firm is still worth enough to be listed on the FTSE 100 index. However, as management at Deliveroo are opting for a dual-listing, this means that the shares are not eligible for the FTSE.

The reason for this is that large-scale ETFs that track the FTSE 100, will personally buy shares in all companies that form the index. In turn, this has the desired effect of generating high levels of liquidity and generally speaking – increases demand for the respective shares. However, Deliveroo will not benefit from this.

Competition is Fierce

There is no denying that the online and app-based food delivery industry is growing year-on-year. This is the case not only in the UK – but globally. However, Deliveroo isn’t the only player in this space. On the contrary, there are other major home food delivery companies to consider – some of which have a much larger market share.

In particular, Just Eat has a wider market reach in the UK than Deliveroo. There is also strong competition from Uber Eats – which has access to much larger financial resources and is active on more of a global scale.

Invest at a Discount

While many investors in the UK will be put off by the 30% IPO collapse, others will view this as a great way to buy Deliveroo shares at a major discount.

After all, Deliveroo still has a solid business model that operates in an ever-growing market. If you believe that in the long-term the shares will eventually recover – then now is as good a time as any to make a purchase.

Step 3: Open a Brokerage Account and Make a Deposit

Once you have researched the ins and outs of Deliveroo and decided that you want to process with an investment – it’s then time to open a brokerage account. As we covered earlier, there are popular stock tradings platform in the UK where people can buy shares.

As such, the guidelines below show you how to open an account and deposit funds.

- So, head over to the website and click on the ‘Join Now’ button.

- You will then be taken through the registration process and asked to enter your personal information and contact details.

- You also need to verify your mobile number and email address, and choose a username and password.

Then, the site will ask you to upload a copy of your passport or driver’s license. This is because the broker is regulated by the FCA and as such – must comply with anti-money laundering laws. You can actually upload your ID documents at a later date – but this does need to be done before you can make a withdrawal or deposit more than $2,250.

- Now it’s time to make a deposit.

- You can instantly deposit funds with a debit/credit card, PayPal, Skrill, or Neteller

- Bank transfers are also supported

Once you have made a deposit you can then proceed to the final step of the process – which is to buy Deliveroo shares.

Step 4: Buy Deliveroo Shares

If at the time of reading this guide Deliveroo shares have hit the secondary market – you can process to make a purchase.

Until then, you will need to wait.

- Once the shares do become available, all you need to do is search for ‘Deliveroo’.

- Then, you will be asked to set up a ‘buy order’.

- This simply requires you to enter the amount of money that you want to invest into Deliveroo shares..

Finally, click on the ‘Set Order’ button to complete your Deliveroo investment.

Are Deliveroo Shares a Buy or Sell?

The general market sentiment at the moment is that the Delivroo IPO was heavily overvalued and overhyped. This mainly centers on its initial listing price of 390p per share – which gave Deliveroo a market valuation of £8.8 billion. This is especially the case when you consider that Deliveroo is yet to make a profit.

On the contrary, the firm reported a loss of over £223 million in 2020. This is particularly concerning when you consider that the food delivery space was booming last year as per the coronavirus restrictions.

Conclusion

In summary, the unconditional Deliveroo IPO was nothing short of a major failure. Although the IPO was expected to be the hottest listing since Royal Mail, the stocks dropped by 30% on the first day of trading. Nevertheless, if you want to buy Deliveroo shares online in the UK you can do so at a stock broker.

FCA brokers allows you to invest from just $50 (about £35) and you won’t pay any dealing fees or stamp duty when you buy Deliveroo shares. You will, however, need to wait until the shares hit the secondary market before you can make an investment.

FAQs

Can I buy Deliveroo shares?

Yes, you can buy Deliveroo shares online in the UK. But, you will need to wait until the shares are listed on the London Stock Exchange. When this does happen, all you need to do is open an account with an FCA broker.

Does Deliveroo make a profit

Even with an initial IPO valuation of £8.8 billion, Deliveroo is yet to make a profit. In fact, the home delivery firm made a loss of over £223 million in 2020.

Does Deliveroo pay dividends?

No, Deliveroo does not pay dividends. The firm is yet to make a profit, so all retained revenues are reinvested back into the growth of Deliveroo. If you’re a dividend-seeking investor, Deliveroo will not be right for your stock portfolio as it could be many years before the shares generate income.

What is the minimum amount I can invest in Deliveroo shares?

This depends on the stock broker that you decide to buy Deliveroo shares from.

Can you short-sell Deliveroo shares?

If you want to short-sell Deliveroo shares because you think the firm is overvalued, this can be achieved by using a broker that offers stock CFDs.

What was the Deliveroo IPO price?

Deliveroo shares opened at 390p when the unconditional IPO went live on March 31st, 2020.

A-Z of Shares

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up