Mr Lender Loan Review 2020 – Flexible Repayment Options

If you have ever experienced a financial emergency, then you might appreciate the value of short-term loans. A great example of a loan provider that may come to mind at such times is Mr Lender.

If you have ever experienced a financial emergency, then you might appreciate the value of short-term loans. A great example of a loan provider that may come to mind at such times is Mr Lender.

But before you go signing up for a loan on the platform, it would be best to carry out some background research.

To help you in the process, we have carried out a thorough analysis of the platform. In this review, we will take a look at all the important things you need to know about the service provider.

Read on to find out if it is the best choice for you.

-

- 1. If you are applying for your very first loan with Mr Lender, you can get started by entering the required loan amount and loan term.

- 2. On this form, there is a loan details section, employment details section, affordability, personal details, address and bank details section. Fill out all the required details and then submit your application.

- 3. Wait for the response and then sign the electronic agreement form to complete the process.

-

- 1. If you are applying for your very first loan with Mr Lender, you can get started by entering the required loan amount and loan term.

- 2. On this form, there is a loan details section, employment details section, affordability, personal details, address and bank details section. Fill out all the required details and then submit your application.

- 3. Wait for the response and then sign the electronic agreement form to complete the process.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.What is Mr Lender?

Mr Lender is a leading UK-based direct lender operating under the authorization and regulations of the Financial Conduct Authority (FCA). It is a trading name of PDL Finance Ltd, which is registered in London and has been in operation since 2009.

The lender claims to have a focus on clarity, making it simple for anyone to select a loan and access funding. With this in mind, they strive to be transparent and flexible. They provide short-term loans which borrowers can tailor to suit their needs and circumstances.

Mr Lender is a highly reputable lending platform with lots of positive customer reviews. They are transparent and flexible and seek to adhere to responsible lending habits. Loan amounts are a bit low but it is a great choice for short-term financial emergencies.Pros and Cons of a Mr Lender Loan

Pros

- No late repayment fees

- Easy, straightforward and transparent loan application process

- No upfront fees

- Flexible repayment options

Cons

- Low loan limit

- Strict assessment before approval

How does a Mr Lender loan work?

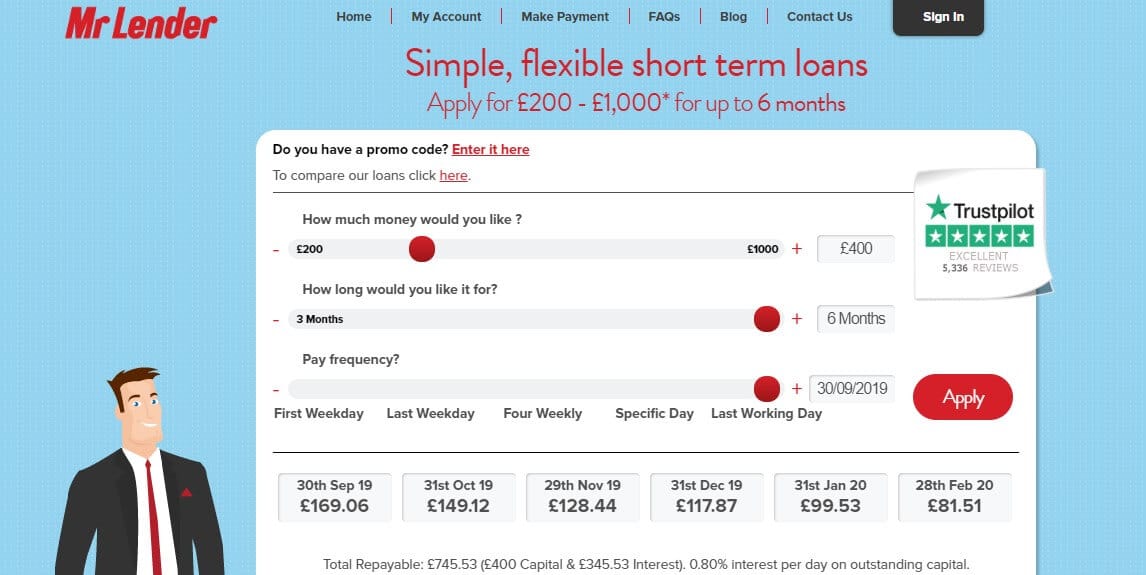

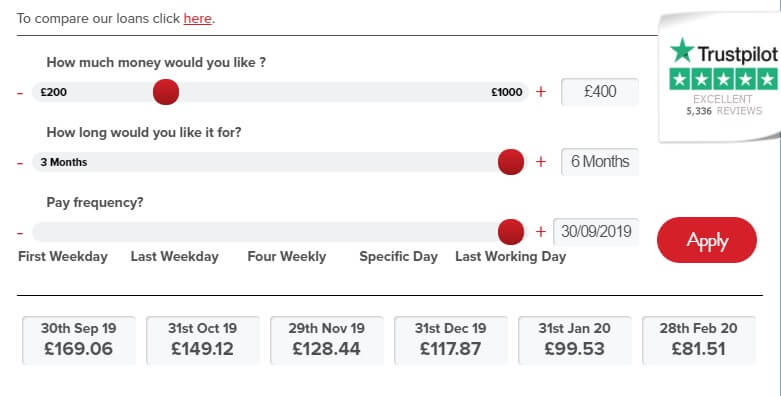

Borrowers can access a minimum of £200 and a maximum of £1,000 from Mr Lender. Note though that for first-time applicants, you will only be able to access a maximum of £500. You can make repayments in the form of installments for periods spanning 3 to 6 months.

They operate under the Treating Customers Fairly (TCF) initiative, providing prompt outcomes to users. As such, they assess applications and provide immediate feedback.

If necessary, they will call you for additional checks and if approved, you will typically have funds within an hour. They only offer loans to applicants after confirming their ability to repay. Thus, there is no guarantee of approval.

Transparency

In the spirit of transparency, the platform provides a loan calculator which allows you to select the amount you want to borrow and the term. Once you set these, it automatically calculates the breakdown of installment amounts, the interest due and the total amount you will repay.

You can adjust these to suit you and once you find a suitable package, you can start the application process. Among the qualifications you need to meet is having full-time or part-time employment and earning a minimum of £600 monthly.

They run credit checks on all applicants and also conduct an affordability assessment and then make a decision. However, the decision at this point is only provisional and can change later in the application process.

Credit check

In addition to the credit check, they will also assess other aspects of an applicant’s financial status. Taking into account all aspects of their circumstances, they determine whether or not a loan is suitable for the applicant.

The assessment process is thorough and involves thorough credit vetting based on the information submitted on the application form. In case you want to know the types of information they consider when making their decision, the team is happy to provide it.

Note that you cannot qualify for a loan on the platform if you happen to be in financial difficulties which would make it difficult to make repayment. They will also set limits on your borrowing to ensure you do not overstretch your financial capabilities.

But if you were to experience difficulties in the loan prepayment process, they strive to be accommodating and forbearing. Consequently, they do not charge any late payment fees, but rather, work on an alternative repayment schedule.

Unlike many short-term lenders, Mr Lender works on Saturdays and Sundays from 8:00 AM to 3:30 PM. Since financial emergencies can strike at any time, this makes it convenient for times when you need cash urgently over the weekend.

Another differentiating feature is that the lender recalculates interest rates based on the outstanding amount. This means that as you make repayments and the amount reduces, so does the interest you need to pay.

To showcase an example of their flexibility, Mr Lender has been known to freeze interests for borrowers who were struggling to make repayment. That is a great provision for limiting the damage of financial problems on your borrowing ability and credit score.

Repayment

If you get approval for a loan, you get the options of making a full repayment on your next payday, over the aforementioned repayment period or at any point. They typically collect repayments on your pay date. But during the application process, you can set a custom repayment date, which will reflect in the loan agreement.

On the days leading up to this date, they will always send a text message or email message as a reminder. But you can change this date by speaking to the customer service team any time beforehand.

The lender typically collects repayments from borrowers’ accounts using a Continuous Payment Authority (CPA). During the application process, they validate your debit card. This way, when the repayment date arrives, they simply need to collect the money from your account.

They can however also accept repayments via cash or even cheque. But they do not accept credit card repayments as this is comparable to the use of credit to pay for credit. As a responsible lender, they do not want to create debt problems for borrowers.

In case of extreme circumstances, they might also accept repayments from another person such as a spouse, parent or friend.

What loan products does Mr Lender offer?

Payday Loans

If you only need a few hundred pounds, you can borrow a payday loan and make a full repayment on your next payday. This loan product is ideal for times when you simply need a small cash injection to get out of a fix.

By the next payday, you would typically have the required amount to repay fully and cover the interests due. Therefore, the loan term may be only a few days or weeks if you want and you would not have to be tied down longer than necessary.

Short-Term Loans

If you would rather get a little more money and a little more flexibility, the short-term installment loan is a better alternative to the payday loan. It could be that making a full repayment on the next payday will take a toll on your finances.

In that case, you have the option of repaying over a span of 3 to 6 months in smaller amounts that are more manageable. Though most lenders divide the repayment amounts equally, Mr Lender offers an opportunity to repay in decreasing amounts.

Mr Lender Account Creation and Borrowing Process

1. If you are applying for your very first loan with Mr Lender, you can get started by entering the required loan amount and loan term.

Set the desired pay frequency as well and then click “Apply.” This will give you the total amount repayable, the reducing installments for the period you entered and other terms of the loan. You can keep adjusting this to fit your circumstances. Once you click apply, you will now get access to the online application form.

2. On this form, there is a loan details section, employment details section, affordability, personal details, address and bank details section. Fill out all the required details and then submit your application.

3. Wait for the response and then sign the electronic agreement form to complete the process.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Mr Lender Loan

To qualify for a loan on Mr Lender, here are some of the qualifications you need to meet:

- Be at least 18 years of age

- Be a UK resident

- Be in full time or part-time employment

- Have a minimum monthly net of £600

- Have an active mobile number

- Have a personal email address

- Have no bankruptcy, County Court Judgments (CCJs) or Individual Voluntary Agreements (IVAs) in the past 3 years

- Have a valid debit card

Information Borrowers Need to Provide to Get Mr Lender Loan

Here are some of the details you will need to provide during the application process:

- Name

- Age

- Location

- Employment details

- Income details

- Bank account details

- Marital status

- Gender

- Approximate monthly expenditure

- Contact details

What are Mr Lender loan borrowing costs?

One of the key features of Mr Lender is transparency. The service provider offers you a chance to access the borrowing costs before going through the application process. Take a look at its rates:

- Representative APR – 1,256.3%

- Maximum APR – 1,462.3%

- Standard daily interest rate – 0.8%

- Late repayment fees – nil

- Early repayment fees – nil

- Missed payment fees – nil

Representative Example:

- Borrowed amount – £500

- Loan term – 6 months

- Installment 1 – £203.33

- Installment 2 – £183.23

- Installment 3 – £163.13

- Installment 4 – £143.33

- Installment 5 – £123.24

- Installment 6 – £1103.14

- Total repayment amount £919.40

Fixed interest rate – 292% per annum

Mr Lender Customer Support

Mr Lender has a sterling reputation in as far as its support team is concerned. As a result of their approach and model, the platform won Customer Service Champion in 2018, 2017 and 2016 from the Consumer Credit Awards. They also won the Best Short Term Loan Provider 2016 award from the same platform.

According to the website, they have at least 16,000 5-star reviews and over 98% of customers awarding them 4 stars or more.

Is it safe to borrow from Mr Lender?

The platform makes use of advanced encryption protocol to keep customer information confidential. It also works in adherence with data protection legislation and limits the access of staff members to the minimum required to perform their duties.

Additionally, it is authorized and regulated under the FCA. Therefore, it is reasonable to conclude that there are no safety concerns associated with the platform.

Mr Lender Review Verdict

Mr Lender offers remarkable flexibility and its services have a focus on the customer. They strive to balance responsible lending and addressing customer needs. As a result, their approval process is a bit strict, but understandably so.

Their customer support team is friendly and useful and services are available round the clock, even on weekends.

Little wonder, the platform has lots of positive reviews on various online platforms and has won multiple awards for excellent customer service.

As a short-term lender, its rates are obviously high but it does not charge any processing, late or early payment fees.

Overall, it is a great platform for times when you need emergency services.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.Glossary of loaning terms

Credit Score

Credit ScoreA credit score shows your creditworthiness. It's primarily based on how much money you owe to loan or credit card companies, if you have ever missed payments or if you have ever defaulted on a loan.

Guaranteed Approval

Guaranteed ApprovalGuaranteed Approval is when, no matter how bad, your credit score its, your loan application will not get declined.

Credit Limit

Credit LimitA Credit Limit is the highest amont of credit a lender will lend to the borrower.

Collateral

CollateralCollateral is when you put up an item against your loan such as your house or car. These can be repossessed if you miss payments.

Cash Advance

Cash AdvanceA Cash Advance is a short-term loan that has steep interest rates and fees.

Credit Rating

Credit RatingYour Credit Rating is how likely you are to fulfill your loan payments and how risky you are as a borrower.

Fixed Interest Rate

Fixed Interest RateFixed Interest Rate is when the interest rate of your loan will not change over the period you are paying off you loan.

Interest

InterestThe Interest is a percentage based on the amount of your loan that you pay back to the lender for using their money

Default

DefaultIf you default on your loan it means you are unable to keep up with your payments and no longer pay back your loan.

Late Fee

Late FeeIf you miss a payment the lender will charge you for being late, this is known as a late fee.

Unsecured Personal Loan

Unsecured Personal LoanAn Unsecured Personal Loan is when you have a loan based solely on your creditworthliness without using collateral.

Secured Loan

Secured LoanA Secured Loan is when you put collateral such as your house or car up against the amount you're borrowing.

Prime Rate

Prime RateThis is the Interest Rate used by banks for borrowers with good credit scores.

Principal

PrincipalThe Principal amount the borrower owes the lender, not including any interest or fees.

Variable Rate

Variable RateA Variable Rate is when the interest rate of you loan will change with inflation. Sometimes this will lower your interest rate, but other times it will increase.

Installment Loan

Installment LoanAn Installment Loan is a loan that is paid back bi-weekly or monthly over the period in which the loan is borrowed for.

Bridge Loan

Bridge LoanA Bridge Loan is a short term loand that can last from 2 weeks up to 3 years dependant on lender.

AAA Credit

AAA CreditHaving an AAA Credit Rating is the highest rating you can have.

Guarantor

GuarantorA Guarantor co-signs on a loan stating the borrower is able to make the payments, but if they miss any or default the Guarantor will have to pay.

LIBOR

LIBORLIBOR is the London Inter-Bank Offered Rate which is the benchmarker for the interest rates in London. It is an average of the estimates interest rates given by different banks based on what they feel would be the best interest rate for future loans.

Home Equity Loans

Home Equity LoansHome Equity Loans is where you borrow the equity from your property and pay it back with interest and fees over an agreed time period with the lender.

Debt Consolidation

Debt ConsolidationDebt Consolidation is when you take out one loans to pay off all others. This leads to one monthly payment, usually with a lower interest rate.

Student Loan

Student LoanIf you obtain a Student Loan to pay your way through College then you loan is held with the Department for Education U.K.

Student Grants

Student GrantsFinancial Aid in the form of grants is funding available to post-secondary education students throughout the United Kingdom and you are not required to pay grant

FAQ

Do I need to send any documents to access funding?

The platform works on a paperless model so in many cases you might not need to send any documents. But when there are verification challenges you might be required to send in more documents.

What is the representative APR?

This refers to the highest APR at which a minimum of 51% of loans on the platform are processed at.

Will borrowing from Mr Lender affect my credit score?

Yes. They conduct credit checks and also report repayments to credit bureaus, and this affects your score.

What if I cannot repay the loan?

Contact the customer support team at the earliest possible time. They will make a fresh agreement on a repayment plan to suit your circumstances and which you can afford.

What if I don’t get approved for a loan?

The lender may, with your consent, pass your information to a third party lender who may facilitate other options for you.

What other store services does Mr Lender offer?

Mr Lender does not offer any other store services.

UK Payday Loan Reviews- A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up