How to Buy Tesco Shares UK in 2022 – A Beginner’s Guide

Tesco is best known for its sprawling grocery and department stores. The company controls more than one-quarter of the grocery market in the UK and is a dominant player in food shopping in countries throughout Europe and Asia.

As one of the UK’s largest companies, Tesco is also a member of the FTSE 100.

If you want to buy Tesco shares but don’t know how to get started, this guide is for you. We’ll walk you through the basics of buying Tesco shares and compare some popular brokers.

-

-

Where to Buy Tesco Shares

But before you dive into buying shares, it’s important to note that online brokers differ in what you’re actually purchasing. Some brokers enable you to buy shares outright, which gives you exposure to the share price and makes you eligible for dividends.

Other brokers enable you to buy and sell contracts for difference (CFDs), which are derivatives that give you exposure to the share price without actually owning the shares themselves.

With that difference in mind, let’s dive into a comparison of some popular UK share brokers.

Plus500 offers CFD trading for hundreds of global shares. It’s ideal if you only have a small amount of money to invest since you have the option to leverage your trades at up to 1:20. The broker doesn’t charge any trading commissions and the spreads on share trades are well below market average.

One of the main things about Plus500 is the trading platform. You get access to dozens of useful technical indicators, drawing tools, and beginner-friendly charts. Plus, the platform includes price alerts that you can customise so you never miss the opportunity to buy Tesco shares on a pullback.

The only downside to Plus500 is that it doesn’t offer all the tools that some advanced investors need. You cannot create custom indicators with the charting software, and there is no way to backtest a strategy. However, you can try out a new strategy in real time using the free demo platform.

Our Rating

80.5% of retail investor accounts lose money when trading CFDs with this provider. Sponsored ad

80.5% of retail investor accounts lose money when trading CFDs with this provider. Sponsored adWhy Do People Invest in Tesco?

Tesco is the single largest grocer in the UK and one of the top 10 largest retailers in the world by revenue. While size is in some respects an indicator of success, it’s important to consider what the future may bring for Tesco before you decide whether or not to invest.

Dividend

Tesco shares come with a dividend. The company makes two dividend payments per year, and the amount of each payment has been increasing rapidly. The last dividend, in October 2019, was 2.65p per share. The next dividend, scheduled for July 2020, is expected to be 6.5p per share. That is the equivalent to a 4% return on Tesco shares each year.

About Tesco Shares

Company and Share History

Tesco was founded in 1919 by Jack Cohen as a set of food stalls in the UK. The first storefront opened in Middlesex in 1931, and Cohen opened more than 100 Tesco stores across the UK by the start of World War II. The company prospered during the 1940s and listed on the London Stock Exchange in 1947.

By the end of the 1960s, Tesco acquired or opened more than 800 stores. It outbid its closest competitor, Sainburys, for the Scotland-based chain William Low in 1994. Tesco also expanded internationally throughout the 1990s, although it pulled out of the US market in 2013.

Tesco also slowly diversified its range of products over the course of decades. The company has sold petrol since the 1960s and began selling retail goods online in the late 1990s. Tesco also introduced the Clubcard, which has enabled it to maintain customer loyalty and provided it with data that has been critical in giving it an advantage over competitors.

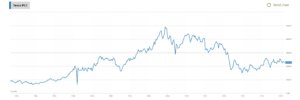

Tesco Share Price

Tesco began trading in 1947 on the London Stock Exchange at a price of 25p per share. Tesco shares rose quickly in value during the 1990s as the company expanded into new markets, both at home in the UK and abroad, and the share price reached an all-time high of 491p in 2007.

However, Tesco declined for several years after the financial crisis amid lacklustre revenue growth and failure in the US grocery market. Today, Tesco shares trade for around 226p.

How to Buy Tesco Shares

To help you get started with buying Tesco shares through a UK stock brokers, we’ll show you how the process works.

Step 1: Search for Tesco Shares

Enter ‘Tesco’ in the search bar at the top of the page. Click on the company when it appears in the drop-down menu.

Step 2: Click on ‘Trade’

From the Tesco company page, click on ‘Trade’ to open a new order.

Step 3: Buy Tesco Shares

You should now see an order form that needs to be filled out with the following information:

- Amount: How many shares of Tesco do you want to buy? You can enter an amount to invest in US dollars, or click the ‘Units’ button and specify a number of Tesco shares.

- Set Rate: If you select ‘Market’ then the platform will buy Tesco shares for you at the current market price. You can also choose to create a limit order by setting the maximum amount you’re willing to pay for Tesco shares. Your order will only be executed if the price of Tesco falls below your maximum price.

- Stop loss: We highly recommend setting a stop loss with every trade. This is a price below the price you pay for Tesco.

- Take Profit: If you want to sell your shares after a certain amount of profit, you can include a take profit level in your order. When Tesco shares reach this price, the platform will sell all your shares. Don’t enter a take profit price if you plan to hold Tesco for the long term.

You can also specify how much leverage you want to use when trading share CFDs. We recommend against using leverage if you are new to share trading since it significantly increases your financial risk if a trade goes poorly.

When you’re ready to buy Tesco shares, click ‘Trade’ to complete your order.

Conclusion

Tesco is the largest grocer in the UK and operates grocery chains in a number of global markets. It is considered a defensive stock that is relatively resistant to economic downturns.

Tesco stock also has a dividend yield of more than 4%. That said, the company has struggled since the share price peaked in 2007, so potential investors should look carefully at what the future has in store for Tesco.

FAQs

Has Tesco’s dividend been consistent?

Tesco’s dividend has been less consistent than many investors would like. The company suspended the dividend altogether for a number of years as the share price and revenue fell in the mid-2010’s. Tesco reinstated its dividend in 2018, and the dividend is intended to grow until half of the company’s profits are paid out to shareholders.

Who are Tesco’s competitors?

The grocery market in the UK and worldwide is highly competitive. In the UK, Tesco competes closely with Sainbury’s, another grocery chain, as well as Aldi and Ocado. Tesco may also increasingly compete with Amazon as the eCommerce behemoth moves into online grocery sales and delivery.

Do I need to use a UK-based broker to buy Tesco shares?

You do not need to use a UK broker to buy Tesco shares, but your broker must be recognised by the UK’s Financial Conduct Authority (FCA) in order to trade shares of companies on the London Stock Exchange. FCA approval is also a good sign that a broker is trustworthy.

A-Z of Shares

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com