How to Buy Samsung Shares UK in 2022 – A Beginner’s Guide

Samsung electronics and appliances can be found in virtually every home. This South Korean electronics giant makes everything from televisions and ovens to smartphones and tablets. In fact, Samsung controls nearly 19% of the global smartphone market and produces around 300 million phones each year.

Want to buy Samsung shares but don’t know how to get started? In this guide, we’ll explain the basic of how to buy shares of Samsung in the UK and compare some popular brokers.

-

-

Where to Buy Samsung Shares

The easiest way for most UK traders and investors to buy shares of Samsung is to go through a licensed and registered brokerage. A broker will match your purchase order with a sale of Samsung shares from another investor on the London Stock Exchange and then hold the shares in your account.

Alternatively, you can buy and sell contracts for difference (CFDs) for Samsung shares through a CFD broker.

Looking for a trustworthy, low-cost UK share broker? Here is a good option that you can use:

Plus500

Plus500 is one of the popular brokers if you want to buy CFDs instead of shares. The platform offers trading on hundreds of shares for companies around the world, and you can apply leverage up to 20:1 to increase the size of your positions.

This broker doesn’t charge any trade commissions for buying and selling share CFDs. It also keeps the spreads impressively low, which is a huge plus if you’re trying to minimize the cost of share trading. Watch out for an inactivity fee, though, which is charged if you don’t place a trade for more than three months.

Plus500 doesn’t include any social trading features, but the trading platform does have a lot else to offer. Account holders get access to price alerts, an economic calendar, and some basic technical charts.

Our Rating

80.5% of retail investor accounts lose money when trading CFDs with this provider. Sponsored ad

80.5% of retail investor accounts lose money when trading CFDs with this provider. Sponsored adWhy Do People Invest in Samsung?

Samsung has established itself as one of the largest consumer electronics producers in the world. The company produces kitchen appliances, home entertainment systems, computers, smartphones, and much more. In total, Samsung produces more than $200 billion US in revenue each year.

Diversification

A popular thing about investing in Samsung is that the company has so many branches and divisions. With this one company, you get exposure to the tech industry, the shipbuilding industry, construction, consumer goods, and more.

This diversification has also been a major revenue driver for Samsung. If the company’s profits from selling home appliances were to drop, for example, that could be compensated for by a rise in smartphone or shipbuilding sales.

Future Growth

Samsung also re-invests a significant portion of its revenue into research and development. That’s helped this conglomerate stay at the forefront of emerging fields like smartphone technology, virtual reality, and artificial intelligence.

Smartphone development has already paid off in a big way for Samsung, but technologies like VR and AI could pave the way for future growth in the company. While even Samsung can’t predict future market trends, this company has the resources to invest in whatever the next big technology is.

About Samsung Shares

Company and Share History

Samsung, which means “three stars” in English, was founded by Lee Byung-chul in Seoul, South Korea, in 1938 as a trading company. The business was largely focused on food processing, fabrics, insurance, and retail until the 1960s, when it entered the electronics market along with the construction and shipbuilding industries. The company has been publicly trading on the Korean Stock Exchange since 1973.

Most consumers are familiar with Samsung Electronics, just one of Samsung’s many subsidiaries and the world’s largest consumer electronics company by revenue. But, Samsung Heavy Industry is also the world’s second-largest shipbuilding company and Samsung Engineering is the world’s 13th largest construction company. Samsung even operates a theme park in South Korea.

Samsung is so large that the company makes up nearly one-fifth of South Korea’s total GDP. It’s a multinational company with large presences in North America, Europe, and numerous countries in Asia.

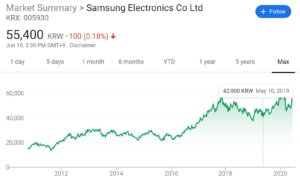

Samsung Share Price

Samsung trades on the Korean Stock Exchange in Seoul. However, Samsung shares are available on the London Stock Exchange as global depository receipts. These enable you to buy the shares just like you would for any UK company, except that you’re really buying a derivative that represents shares on the Korean Stock Exchange. There is no difference in the process or price in practice.

The price of Samsung shares has steadily increased since the tech boom in the late 1990s. At the start of the 21st century, Samsung shares were trading for just under £4 per share. The price increased steadily to around £17 per share by the end of 2015, and then it nearly doubled in less than two years. Samsung hit an all-time high of £40.60 in February 2020, before dropping to its current price of £37 per share in the wake of the coronavirus pandemic.

How to Buy Samsung Shares

To demonstrate how to buy Samsung shares through a broker, we’ll walk you through the process. This is one of the popular stock brokers for buying Samsung shares because you can choose between buying them outright or trading CFDs.

If you want to use another investment platform, don’t worry. The process for buying Samsung shares is largely the same across different UK brokers.

Step 1: Search for Samsung Shares

Stock brokers usually offers trading for more than 800 global shares. To search for Samsung shares, enter ‘Samsung’ in the text bar at the top of the page and click on the company when it appears in the drop-down menu.

Step 2: Click on ‘Trade’

From the Samsung share page, click on ‘Trade’ to open a new order.

Step 3: Buy Samsung Shares

Now you’re ready to enter your order for Samsung shares. There are several things you’ll need to decide on before entering your trade.

- Amount: How much money do you want to invest in Samsung? You can enter an amount in US dollars or specify how many shares you want to buy by clicking the ‘Units’ button.

- Set Rate: You can either buy Samsung shares at the current market price or enter the maximum amount you’re willing to pay. If you enter a price, your order to buy shares will only be fulfilled if the price of Samsung drops below your maximum price.

- Stop Loss: A stop loss is triggered if the price of Samsung shares drops below the price you enter. If that happens, the platform will automatically sell all your shares to limit your maximum loss.

- Take Profit: This is the price at which you would like the platform to sell your shares so you can realize a profit. You may want to leave this empty if you are investing in Samsung for the long term.

When you’re ready to complete your purchase, click ‘Trade’ to buy Samsung shares.

Conclusion

Samsung is a massive, highly diversified company that exposes you to a lot of different market sectors. When you buy Samsung shares, you can collect a sizable dividend each quarter and know that you’re investing in a company that is actively developing tech to continue its leadership role in that industry.

FAQs

Does Samsung issue a dividend to shareholders?

Yes, Samsung pays out a significant portion of its profits to shareholders in the form of quarterly dividends. You are eligible for dividends if you hold Samsung shares or Samsung Global Depository Receipts, but not if you trade Samsung CFDs.

Can I invest in specific divisions of Samsung?

Some subsidiaries of Samsung, such as Samsung Electronics, are publicly traded companies in their own right. You can buy shares of Samsung Electronics, then, which is different than buying shares of Samsung. Note that the prices of these subsidiaries’ shares move independently of Samsung shares, so you’ll need to do your research.

A-Z of Shares

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com