Day Trading UK Guide 2026

Day trading is a trading technique that can be traced back to 1867 in the days of ‘off-the-floor’ day trading and has become particularly popular since the internet has emerged in the mid-late 90s and during the “Dot Com” bubble.

Nowadays, day trading is made available to any individual and can be carried out online on a computer or a mobile phone. But like any other trading strategy, day trading also carries some level of risk and has its pros and cons.

In this detailed guide to day trading for beginners, we cover the basics about day trading in the UK. Popular platforms for day trading, trading strategies and help you to get started quickly.

-

-

What is Day Trading?

In simple terms, day trading is the act of buying and selling a financial instrument with the intention to profit from small intraday fluctuations in price. A day trader makes multiple trades per day and must close all positions at the end of the trading day. Day traders typically use technical analysis and a set of trading strategies to try and develop a method that enables them to make profits in the market.

With the rise of the internet and technology improvements, it has become much easier for the average individual to get the right tools and knowledge to start day trading in the UK. All that is needed is an internet connection, a legit brokerage firm, and a strong computer or mobile phone.

But before you start day trading, you’ll have to understand the ins and outs of the products and markets you trade. As such, we have shortly reviewed each sector:

Day Trading Stocks

The stock market is one of the most popular avenues for day traders. This can be attributed to the fact that day traders need liquidity, volatility, and a vast array of assets. When you buy shares they are more prone to information-based trading such as earning reports and economic data. In comparison to other markets, the stock market offers many more trading opportunities.

Day traders particularly like to day trade penny shares, which are defined as shares trading at a share price below £5. These shares have the ability to make huge intraday moves and are cheap enough for day traders to open large positions.

Day Trading ETFs

ETFs are also a very popular market for UK day trading. For those unaware, Exchange Traded Funds (ETFs) are a type of investment fund that is traded much like any other tradable security on stock exchanges. Each Exchange-traded fund (ETF) typically has a different sector or area focus.

ETF funds offer a lot of diversification compared to other securities such as UK bonds and mutual funds and are popular among day traders because the ETF market is very liquid and heavily traded and the trading costs are relatively low .

Day Trading Cryptocurrency

The cryptocurrency market is still in its infancy, and as such, it has become a great marketplace for day traders. The high volatility, the lack of institutional trading, as well as the lack of High-Frequency Trading (HFT), make the cryptocurrency market an ideal playground to predict small price movements.

The two key concepts in picking digital assets trading pairs are liquidity and volatility. While there are more than 3000 crypto coins available in the market, it would be easier to start day trading on one of the most liquid and volatile crypto coins such as Bitcoin, Ethereum, Ripple, and IOTA.

Day Trading Forex

The forex market is the largest and most liquid financial market in the world with a daily volume of around $5.1 trillion. For that reason, it’s quite easy to start day trading currencies. The entry barriers are extremely low and the leverage ratio provided on forex trading in the UK is very high (up to 500:1 on some brokerage firms). The most popular currency pairs for day traders include the EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD, and USD/CHF.

Day Trading Options

While the day trading process of options remains largely the same, options offer several benefits for day traders. First and foremost, you can significantly reduce the amount needed to open a position as options are contracts that give you the right, but not the obligation, to buy or sell a certain asset. As such, options require a lower initial capital.

Secondly, trading options also involves hedging strategies that are used by day traders to reduce their exposure to risk and limit losses to a fixed amount.

Overall, options is a complex area but if used wisely, you can potentially make a profitable trading account when day trading options. If you are looking for a CFD platform that allows you to trade options, Plus500 is one of the few brokers out there that offer option CFD trading.

Why People Do Day Trading

Day trading in the UK has several advantages over swing and long term position trading. As such, many day traders will tell you that day trading is not gambling but instead, it is a method based on graphical patterns and statistical analysis. While it takes time and dedication to learn how to make money when day trading, you must be familiar with these benefits and make sure you never forget to apply them.

- You Avoid Overnight Risk

One of the most frustrating aspects of trading is when a position goes against you during times you are not in front of the computer. Holding a position after-hours can be sort of a gamble because once the market closes, you can never know what might happen. Hence, the basic rule of day trading is to take the profit or loss and begin trading from scratch the next day.

- No Short Sale Restrictions

Another advantage of UK day trading is the low margin requirements and the lack of restrictions when it comes to short sale financial assets. Day traders can take a short position as easily as a long position, meaning you can also speculate that the price will go down, and profit from that drop.

- Leverage

The high leverage provided by the brokerage firms is another major advantages of day trading via CFDs. Trading on margin (leverage) involves using borrowed money and since you are granted leverage, your buying power grows exponentially. For example, if the broker offers you 10:1 leverage on a certain asset, you can buy or short sell £1,000 worth of CFDs with just £100 in your account. Therefore, for day traders who are looking for short-term gains, margin trading can be a huge advantage.

Day Trading Strategies

There are lots of different day trading strategies to choose from, so a good place to start is to find and adapt your trading style. To help you get started, we have outlined below some of the most used and well-known day trading strategies.

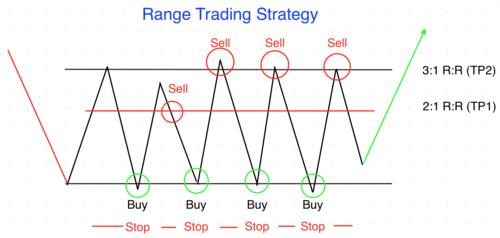

Range Trading

Range trading is a strategy that involves the identification of overbought and oversold areas in a certain asset or market. First, a trader must find major support and resistance levels and identifying them with horizontal trendlines. Then, a trader can buy the asset at the lower trendline support and sell it at the upper trendline resistance. In case the asset breaks below or above the support or resistance, then the trader can shift the strategy to a trend trading strategy. As a rule of thumb – The longer the range, the stronger the breakout.

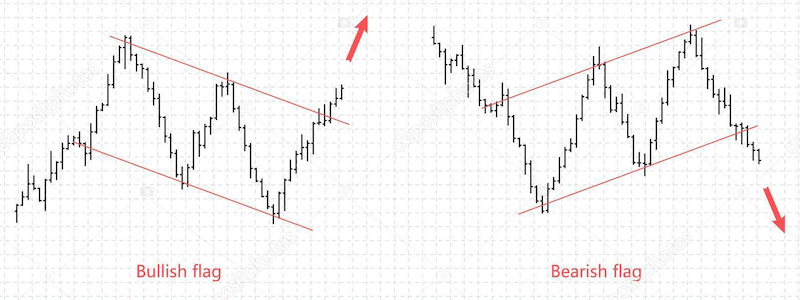

Source: Simpletradinglife.com Bull/Bear Flag Pattern

A bull flag is a technical continuation pattern that occurs when an asset is in a strong uptrend. This pattern formation occurs quite frequently across various time frames in different markets and products. A trader can enter a position when the price breaks above or below the upper or lower trendline of the flag.

Source: Forex Academy Scalping

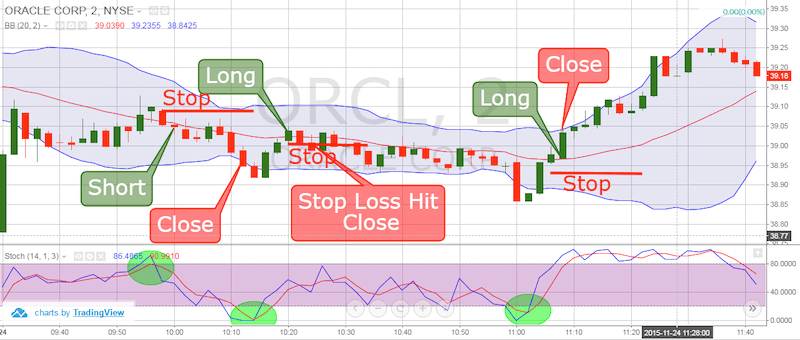

Scalping is one of the most popular trading strategies used by both new and experienced day traders. By using the scalping strategy, day traders limit their risk as they limit the time in which their position is exposed to the market.

Simply put, this trading strategy involves closing a position almost immediately once a trade becomes profitable. Scalpers often look for short term moves using both intuitions and technical analysis indicators such as Moving Average (MA), Bollinger Bands, and RSI.

Source: Tradingsim Gap Trading

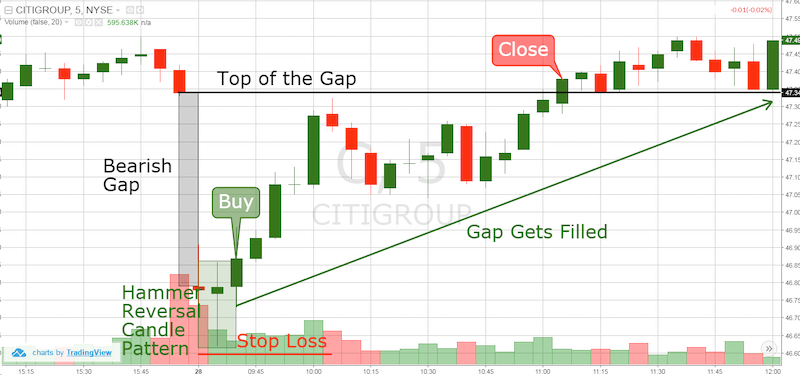

Gap trading is a simple but extremely efficient trading strategy. Essentially, a trader needs to find an instrument that has a price gap from the previous close, and exploit these gaps for profit as gaps usually tend to get filled.

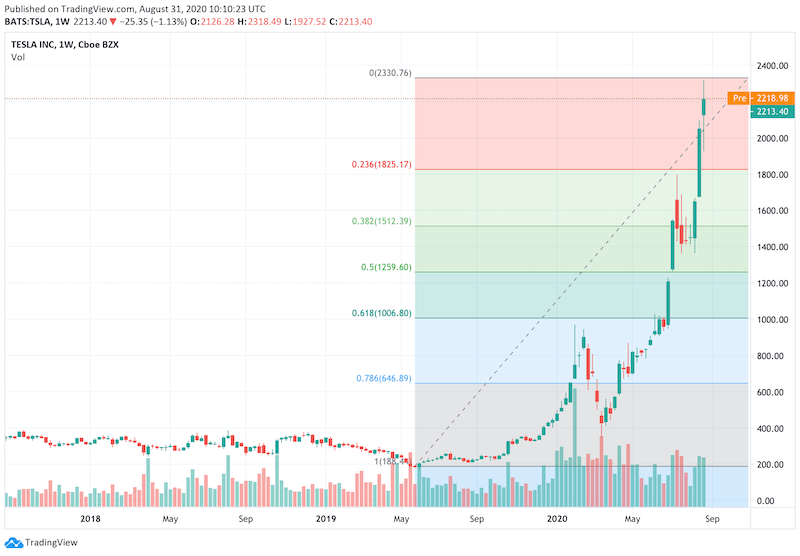

Source: Tradingsim Fibonacci Retracement Levels

Fibonacci retracements is another popular tool used by day traders. Once you have identified a trend on a certain timeframe, you’ll need to draw a Fibonacci Retracement lines from the high to the low of the trend (Fibonacci retracement levels indicator is available on most trading platforms). Once this is done, you can use the retracement levels as support and resistance levels.

Tesla Chart 1 Week Fibonacci How to Read Candlestick Chart for Day Trading

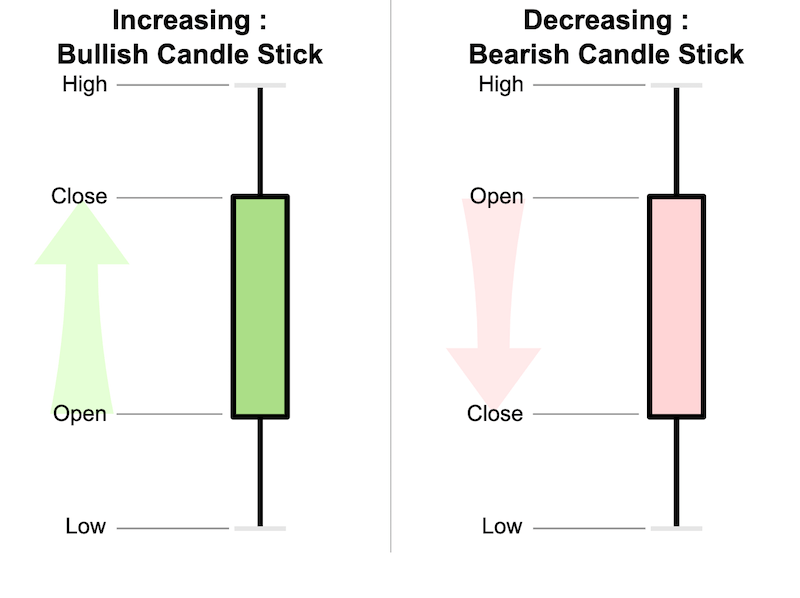

Candlestick charting is an ancient method of displaying price information in a market. It has been developed in the 18th century by Munehisa Homma, a Japanese rice trader, and since then became an essential tool for day traders to analyze the markets.

There are four data points in a candlestick: the open, high, low, and close.

The open line represents the first trade for the specific period and the close represents the last trade for the period. Each candlestick represents a specified period of time. In case the first trade is higher than the last trade in that period of time, then the body bar is an increasing bullish candle and therefore will be displayed in green color. Otherwise, the candle is red and represents a decreasing bearish candlestick.

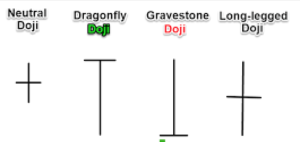

Source: Tradingstartegyguides Ultimately, candlesticks form patterns that many traders use to analyze price movements. Every candlestick on its own or candlestick pattern tells a story of the struggle between the buyers and sellers and helps traders to take trading decisions. For example, the Doji is a transitional candlestick formation that indicates the indecision between bulls and bears and often may signal a reversal of price direction.

Swing Trading vs Day Trading

In contrast to day trading strategies that look to make a large number of trades within the same day, swing traders take trades based on identifying swings that take place over a period of days. It’s difficult to determine which one of the trading strategies is safer but for some traders, swing trading is simply better. Indisputably, you may say that swing trading is more suitable for traders who have a long term vision and don’t have the time to trade a large number of trades, constantly analyze the market, and spend a few hours a day sitting in front of the computer.

But it’s also important to consider the high margin requirements since swing trading usually involves positions held at least overnight. Moreover, as swing traders hold their positions overnight and for a longer period of time than day traders, they are exposed to unexpected price movements.

Day Trading Software

Day trading software constitutes a computer program provided by brokerage firms to help traders to fulfil their day trading activities. These trading platforms usually equipped with screeners, advanced analytical tools, automatic take-profit and stop-loss mechanisms, charting package, and the latest technologies available in the market.

There are many stock brokers and CFD brokers in the UK that offer day trading platforms. But ultimately, you’ll have to find a trading platform that suits your needs by taking into consideration the cost of the software, functionality, ease-of-use, execution speed, features, web-based/desktop, mobile app availability, and the quality of the charting package.

Day Trading Risks

While day trading in the UK can be profitable, it is also a risky business. Even if you are a good trader, there’s always a possibility that you will lose some of your trades. That’s the main reason why day traders must exercise top-notch risk management skills in order to prevent big losses and maintain a profitable account. More importantly, day traders borrow funds from brokers to trade with a higher capital than initially deposited. This can increase your rewards, but it can also increase your risk.

Nevertheless, successful day traders manage to find a set of trading principals that minimize their risk. Some of them even backtest their trading strategy on a demonstration account to avoid trading the live markets on ’tilt’, a condition in trading (and poker) that happens when emotion seems to eliminate a trader’s ability to think clearly.

Tax on Day Trading UK

In the UK, there’s no set of tax for day trading. When day trading with a CFD account, you are exempt from a 0.50% stamp tax but you will, however, have to pay a capital gains tax. The rate of your capital gains tax depends on your individual tax situation.

While CFD trading is not exempt from the capital gains tax, there is no capital gains tax to be paid on spread betting accounts. Thus, a spread betting account is better suited to short term traders as it can provide a tax-efficient solution for high-frequency traders. You can open a spread betting account at some financial brokerage firms such as Plus500.

Day Trading Books

The most successful day traders never stop learning. Whether you are an experienced day trader or a newbie that wants to learn the basic terms and jargon, books can be a great way to study day trading. For that reason, below we suggest some of the best selling day trading books as of 2020.

For beginners

- How to Day Trade for a Living: A Beginner’s Guide to Trading – By Andrew Aziz

- A Beginner’s Guide to Day Trading Online by Toni Turner

- Mastering the Trade by John F. Carter

- Start Day Trading Now: A Quick and Easy Introduction to Making Money While Managing Your Risk by Michael Sincere

- The New Trading for a Living: Psychology, Discipline, Trading Tools and Systems, Risk Control, Trade Management by Alexander Elder

For professional day traders

- The Simple Strategy – A Powerful Day Trading Strategy For Trading Futures, Stocks, ETFs and Forex by Markus Heitkoetter

- Technical Analysis for the Trading Professional, Second Edition by Constance Brown

- The Intelligent Investor by Benjamin Graham

- The Disciplined Trader by Mark Douglas

- Pattern, Price and Time: Using Gann Theory in Technical Analysis by James A. Hyerczyk

Day Trading Tips

Before you start day trading in the UK, it’s important that you get a basic understanding of the market and the factors that impact day trading. You may even consider day trading courses before you risk real money. Here are some 10 tips to help you get started and find the right direction:

- Start with a small investment

- Use a risk-reward ratio between 1.0 and 0.25

- Focus on one-three markets and products

- Try a day trading simulator – Backtest your trading strategy on a demo account

- Use high leverage ratio for scalp trading and low-medium leverage ratio for other trading strategies

- Always manage your day trading risk

- Close all positions by the end of the day

- Keep a record of your trading activity and analyze it

- In the beginning, avoid trading when economic data is coming out

- Remember, the trend is your friend

Day Trading Platforms

The most important factor to consider before deciding on your day trading strategy is to find a brokerage account in the UK that will allow you to day trade with relative safety and low trading costs. Below, we have provided a review of a popular day trading platform.

1. Plus500

Plus500 is another popular day trading platform for UK investors. With Plus500, you can get access to more than 2000 financial instruments including shares, indices, commodities, ETFs, cryptocurrencies, forex, and options. Its web and mobile platforms are very intuitive, user-friendly, and suitable for all levels of traders.

One of the reasons we like Plus500 is the fact that it offers extremely tight spreads and low trading commissions. This is a crucial factor for day traders that execute a large number of trades every trading day. On top of that, Plus500 allows users to leverage their positions with up to 30:1 for retail traders and 300:1 for professional traders.

While Plus500 does not offer a desktop-based trading platform, its platform has been built for the modern-day traders with an advanced charting package and dozens of technical indicators. It also comes with useful trading tools, particularly for day trading purposes, such as price alerts, and risk management tools. For instance, you will be able to set a guarantee stop order and trailing stop order, two of the most important market orders for active day traders.

Finally, Plus500 is a well-regulated broker, with seven different regulations including the Financial Conduct Authority (FCA) in the UK. To get started, you’ll have to meet a minimum requirement of £100.

Our Rating

80.5% of investors lose money when trading CFDs. Sponsored ad

80.5% of investors lose money when trading CFDs. Sponsored adHow to Start Day Trading

Now that you have some basic understanding of what is day trading and how you can apply your trading technique in the market, let’s look at how to place your first trade in the market.

Step 1: Open an Online Trading Account

First, you have to open an online trading account with the broker of your choice. You’ll have to visit the broker’s homepage and click on the ‘Join Now’ button at the center of the screen. You’ll then need to create a username and password and fill in some basic personal details such as your full name, contact information, and birth date.

Step 2: Verify Your Account

As a regulated broker licensed by the FCA, you’ll have to verify your identity in order to start trading. But no worries, the process is actually quite easy. All you have to do is to upload a copy of your passport or driver’s license to provide proof of your identity and a copy of a utility bill or financial statement to provide a proof of your address.

Step 3: Deposit Funds

Now you can deposit funds to your trading account. In the UK, some stock brokers maintain a minimum deposit requirement of $200, which is around £160. A variety of payment methods are supported such as bank wire transfer, debit and credit cards, online wallets like PayPal, Skrill and Neteller.

Step 4: Start Day Trading

Once your account is funded, you can start day trading. If you are an experienced trader, then you will definitely find your way on the trading platform. For beginners, placing a trade on the platform is very straightforward – Simply navigate the dashboard and search for a specific asset. Then, click on the instrument and you will be transferred to the asset’s page.

On the instrument page, click on the ‘Trade’ button.

Then, you’ll be taken to an order form where you need to specify how much money you want to buy or short sell the asset, set the leverage ratio, and send the order to the market by clicking on the ‘Open Trade’ button.

Finally, navigate to the ‘Portfolio’ on the left side menu to view and manage your positions.

Conclusion

Day trading in the UK is a tough business and the majority of day traders quit relatively quickly within two years. As a matter of fact, no one can promise you that you will easily become a successful day trader and make a living from trading. Having said that, day trading is also an exciting way to make a living or at least make an additional income. Some day traders say that it is much like a game of chess against some professional skilled traders. Ultimately, if you play without a plan you do not have a chance so you’ll need to find one or a number of trading strategies that give you a competitive edge.

But like any other financial investment, day trading carries a high level of risk. So, it’s crucial that you understand the basic terms of day trading before you enter the market. We suggest that you read one of the day trading books above and backtest your trading strategy on a demonstration account before you risk your money.

FAQs

Can you do day trading for a living?

Yes, you can. But do not expect to become a profitable day trader on your first trading days. Day trading is a profession rooted in discipline and research and there’s a learning curve you must overcome before you can make a living from UK day trading. Around 80% of day traders stop trading within the first two years of trading, however, the remaining 20% can make a decent income.

How does day trading work?

Day trading involves buying and selling financial securities within the same day. Day traders typically use borrowed money from their broker to take advantage of small price movements and by applying a successful trading strategy, they can make consistent profits. Most day traders also use a risk/reward ratio that typically falls between 1.0 and 0.25, a tool that allows them to manage their capital and risk of loss during trading.

What is a popular day trading app?

For beginners in 2023, a popular platform is Plus500 because it has the edge for day trading and low trading costs.

What is pattern day trading?

In the United States, a pattern day trader is a financial industry regulatory designation for a market trader who executes four or more day trades in five business days using a margin trading account. In other areas of the world, the pattern day trading rule does not apply.

How much money do you need to start day trading?

The PDT (Pattern Day Trader) rule essentially states that traders must have at least $25,000 in their margin account to be authorized to make 4 or more day trades in a 5 day period. However, if you decide to trade with one the CFD brokers in the UK, you can simply start day trading with a minimum of around $100. These brokers offer lot fractions and low margin requirements that allow you to increase your purchasing power and use less capital.

How to scan stocks for day trading?

A popular method to scan stocks for day trading is to pick a handful of shares every week/month that meet the volume, news coverage, and volatility criteria you want and follow these shares repeatedly. You can also use some of the features offered by brokerage firms such as the most traded stocks on a particular platform, stocks market sentiments, and stock screeners.

Tom Chen

View all posts by Tom ChenTom is an experienced financial analyst and a former derivatives day trader specialising in futures, commodities, forex and cryptocurrency. He has a B.A. in Economics and Management and his work has been published on a range of publications, including Yahoo Finance, FXEmpire and NASDAQ.com.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up