CFD Trading UK Guide 2026

An ever-increasing number of traders are moving away from buying stocks and other assets outright and moving towards contracts for difference (CFDs). With CFD trading, you can speculate on the price of a share, currency, or commodity without owning the asset itself.

In this guide, we’ll cover the basics about CFD trading in the UK. We’ll explain how it works and what you can trade. In addition, we’ll reveal the UK’s popular CFD trading platforms in 2022.

-

-

What is CFD Trading?

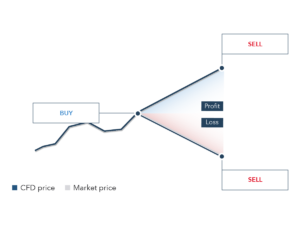

CFD trading involves buying and selling contracts for an asset rather than the asset itself. CFD trading means that you and your broker agree to exchange the difference between the value of the underlying asset when the CFD contract is bought and when it is sold.

To understand how CFDs work, let’s use stock CFDs as an example. When you buy a stock CFD, the value of your CFD contract rises as the price of the stock increases. The price of the CFD is the same as the price of the underlying stock at all times, so a 1% rise in the share’s value causes a 1% rise in the CFD’s value. However, you never actually own the stock itself – only the CFD, which is a contract between you and your broker.

To understand how CFDs work, let’s use stock CFDs as an example. When you buy a stock CFD, the value of your CFD contract rises as the price of the stock increases. The price of the CFD is the same as the price of the underlying stock at all times, so a 1% rise in the share’s value causes a 1% rise in the CFD’s value. However, you never actually own the stock itself – only the CFD, which is a contract between you and your broker.CFD Trading Fees

Like most types of trading, CFD trading isn’t free. However, it can be very cost effective compared to trading assets directly

Most of the CFD brokers in the UK operate on a commission-free model. That means that you don’t pay a flat fee of several pounds per trade regardless of how much money you trade.

Instead, you pay for your trades through a spread, which is the difference between the price you can sell a CFD contract for and the price you can buy it for. Typically, this difference is small – it may be a fraction of a pence for many share and forex trades. Typical stock brokers that offers CFD trading charges a spread of around 0.1% per trade.

Instead, you pay for your trades through a spread, which is the difference between the price you can sell a CFD contract for and the price you can buy it for. Typically, this difference is small – it may be a fraction of a pence for many share and forex trades. Typical stock brokers that offers CFD trading charges a spread of around 0.1% per trade.An important thing to keep in mind is that CFDs often carry extra fees if you hold positions overnight.

CFD Trading Example

How does CFD trading work in practice? Let’s look at how to buy Tesco shares using CFDs to illustrate the process.

One Tesco CFD costs the same as one share of Tesco – around 223p. Let’s say you buy one CFD at 223p, and then the price of Tesco shares rises to 250p. Your CFD would now be worth 250p as well, and you can sell it to realize a profit of 27p (11%). You never actually own Tesco shares at any point during this trade, rather only the contract with your broker to exchange the difference in the share price over the course of your position.

What Financial Instruments Can You Trade as CFDs?

One of the exciting things about CFDs is that you can trade almost any financial instrument with CFDs. Most online CFD trading is for common assets like shares, forex, commodities, and cryptocurrencies. Many CFD brokers in the UK offer CFDs for hundreds to thousands of global stocks, dozens of forex pairs, and a handful of top commodities like oil, wheat, and gold.

But you can also trade CFDs for UK bonds, ETFs (exchange-traded funds), index futures, and stock options. CFDs can even be used to speculate on the value of less frequently traded assets like real estate.

Why People Trade CFDs

CFD trading in the UK has grown in popularity over directly trading assets. Let’s take a look at some of the key reasons why many traders are turning to CFDs:

Leverage

One of the biggest reasons why people may want to start trading CFDs is that they unlock leverage. When you trade CFDs, you have two options. You can use the money in your CFD trading account to fully fund your position. Or you can establish a position that is several times larger than the size of your trading account. With 10:1 leverage, for example, you can buy £1,000 pounds worth of CFDs with just £100 in your account.

One of the biggest reasons why people may want to start trading CFDs is that they unlock leverage. When you trade CFDs, you have two options. You can use the money in your CFD trading account to fully fund your position. Or you can establish a position that is several times larger than the size of your trading account. With 10:1 leverage, for example, you can buy £1,000 pounds worth of CFDs with just £100 in your account.There are two reasons for this. First, you may be able to magnify your profit from a successful trade. When you apply 10:1 leverage, you see a return on investment of 10% for every 1% move in the price of the underlying asset. This is critical for forex trading, since currencies often only move a fraction of a percent at a time. With leverage, you can multiply those tiny movements into returns of several percent or more.

Second, leverage enables you to diversify your portfolio. Say you have £1,000 in your trading account. With 10:1 leverage, you can buy £1,000 pound each of 10 different stocks through CFDs.

Another big reason why many turn to CFD trading in the UK is that it’s relatively inexpensive. Most CFD trading platforms are commission-free, so you save money every time you place a trade.

CFDs are widely available, which makes online CFD trading for beginners a popular option. You can sign up for a single CFD trading account and get access to stocks, forex, commodities, and more. CFDs are easy to trade and don’t come with any of the logistical headaches that otherwise come with trading physical assets.

Bi-directional Trading

You don’t necessarily have to bet that the price of an asset will rise. You can also speculate that the price will drop, and profit from that drop. This involves short selling CFD contracts to your broker rather than buying them.

Note that betting against an asset with CFDs comes with some additional risks since it requires you to trade on margin. Beginners should be very cautious about short selling CFDs.

CFD Trading Risks

CFD trading comes with the same risk as trading assets directly. If the value of the underlying asset falls after you buy a CFD contract, you can lose money. You can either realize a loss immediately, or hold the CFD contract in the hope that its value increases again.

CFD trading can be riskier than trading assets directly if you use leverage. With leverage, any loss in the value of the underlying asset is magnified. With 10:1 leverage, for example, a 1% drop in the price of a stock can lead to a 10% drop in the value of your CFD position.

On top of that, since you’re borrowing money from your broker, you have to pay interest fees on leveraged positions. This can further add to the magnitude of losses when trading CFDs. Depending on how much leverage you use and how long you hold a leveraged CFD position, it is even possible that interest fees can wipe out a profitable trade.

Given these risks, it’s important for traders to be very cautious when trading with leverage.

CFD Trading Tax UK

Trading CFDs has some important tax implications in the UK. Notably, when CFD trading in the UK, you’re not responsible for the stamp tax. This is a 0.50% tax that’s normally levied on stock trades. So, you automatically save 0.50% on the value of your trade every time you use CFDs to buy shares.

However, CFD trading doesn’t get you out of the capital gains tax like spread betting does. Your capital gains tax rate will depend on your individual tax situation. But beware that the capital gains tax can be as high as 20% for any profits you make from CFD trading, regardless of what assets underlie your contracts.

Popular CFD Trading Platforms 2026

There are dozens of stockbrokers but you could also choose a UK forex broker that offer CFD trading in the UK. Some of these are brokers with CFD trading platforms and commission-free trades, while others charge hidden fees and offer a limited range of assets. So, it’s important to choose a broker that matches your needs.

To help you pick, let’s take a look at three of our favourite UK brokers for CFD trading:

1. Plus500

Plus500 is another popular UK CFD trading platform. This broker offers trading on more than 500 stocks from the US and UK along with dozens of forex pairs and commodities. All trades are commission-free and Plus500 charges some of the tightest spreads we’ve seen from any CFD broker.

This broker sports an advanced, yet easy to use trading platform. It comes packed with nearly 100 technical indicators and versatile price charts. You can also access an economic calendar and news feed from inside your CFD trading account.

Even better, Plus500 has a mobile CFD trading app to help you trade CFDs from anywhere (Find out more about the trading apps here). You can set price alerts on your mobile device, too, so that you never miss an opportunity to buy CFDs at a discount.

Our Rating

- Doesn’t support custom technical studies

80.5% of investors lose money when trading CFDs. Sponsored adHow to Start CFD Trading in the UK

Ready to start trading CFDs? We’ll show you how to get started in just three steps using a regulated CFD broker.

Step 1: Sign Up for a UK CFD Trading Account

To sign up for an online CFD trading account with a regulated broker, just head to the broker’s homepage and click ‘Join Now.’ You’ll need to create a new username and password for your account, then fill in some basic personal details like your name, contact information, and birth date.

You have to verify your identity to start trading. To complete this step, upload a copy of your passport or driver’s license and a copy of a utility bill or financial statement.

Step 2: Fund Your Account

Now you can fund your trading account. Regulated CFD brokers accepts a wide variety of payment methods, including debit and credit cards, e-wallets, and bank transfers. Just note that the broker requires a minimum initial deposit of £140.

Step 3: Place a CFD Trade

Once your account is funded, you’re ready to place your first CFD trade. From the dashboard, search for a specific asset (like a stock or forex pair) or browse popular assets to trade. When you’ve found what you want to trade, click ‘Trade’ to open a new order form.

In the order form, you’ll need to enter how much money you want to trade in CFDs. You can also specify how much leverage to use for your trade, if any.

Once your trade is ready, click ‘Trade’ to complete your CFD order.

Conclusion

CFD trading offers a way to trade stocks, forex, commodities, and more without owning the underlying asset. This type of trading offers several important benefits, including the ability to trade with leverage and the option to bet that the price of the underlying asset will drop. For many traders, buying and selling CFDs is actually less expensive than buying stocks or forex pairs outright.

Like all trading, CFD trading carries risk. So, it’s important to approach every trade with a clear strategy and to practice good risk management techniques.

FAQs

What is the difference between CFD trading and spread betting?

CFD trading and spread betting are very similar in that both enable you to speculate on the price of an asset without owning it. Importantly, profits from spread betting are not subject to capital gains tax in the UK, whereas profits from CFD trading are.

Do stock CFDs pay dividends?

Stock CFDs do pay dividends, the same as if you owned the underlying stock outright. Your CFD trading platform will credit any dividends directly to your account.

Is CFD trading halal?

CFD trading is not halal. However, some brokers offer Islamic trading accounts that are halal. These accounts remove all overnight fees and commissions to remain in compliance with Islamic law.

What are some popular books on CFD trading?

If you’re looking to learn more about UK CFD trading, ‘CFDs Made Simple: A Beginner’s Guide to Contracts for Difference Success’ by Jeff Cartridge and Ashley Jessen and ‘Making Money From CFD Trading: How I Turned $13K Into $30K in 3 Months’ by Catherine Davey.

Is it possible to take a CFD trading course?

Yes, you can take a CFD trading course to learn more about CFDs and to practice day trading strategies. Some brokers offer interactive online courses, or you can sign up for an online course taught by expert traders.

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up