CMC Markets Broker Review 2021

Looking for a new online trading platform to buy and sell assets? If so, it might be worth considering CMC Markets. The UK-based broker hosts thousands of financial instruments, and accepts traders from most jurisdictions. Crucially, the broker is heavily regulated, so you should have no concerns with the safety of your funds.

But, before signing up to CMC Markets we would suggest reading our in-depth review. In doing so, you can be 100% sure that the platform is right for your personal investment needs.

-

-

What is CMC Markets?

CMC Markets is a UK-based broker that was first launched in 1989. The platform is home to just under 10,000 financial instruments, which is split across traditional CFD products, and a fully-fledged spread betting facility. Across both investment streams, you’ll get to trade forex, indices, cryptocurrencies, commodities, shares, and treasuries.

CMC Markets is a UK-based broker that was first launched in 1989. The platform is home to just under 10,000 financial instruments, which is split across traditional CFD products, and a fully-fledged spread betting facility. Across both investment streams, you’ll get to trade forex, indices, cryptocurrencies, commodities, shares, and treasuries.In terms of fees and commissions, this all depends on the type of account you decide to open, as well as the specific asset class you are trading. With that said, CMC Markets is known to offer some of the most competitive spreads in the space. For example, you get spreads of just 0.3 pips when trading gold, and 0.7 pips when trading major currency pairs like EUR/USD. Commissions on share CFDs start from 0.1%.

As we cover in more detail later, these low commissions might be more suited for larger trade sizes, as CMC Market installs a minimum commission threshold. When it comes to the platform’s regulatory standing, CMC Markets is licensed by a number of tier-one bodies. This includes the FCA, UK’s FCA, as well as regulators in Australia, Singapore, Canada, and New Zealand. This ensures that you can trade in a safe and secure environment.

An additional stand-out selling point of the CMC Markets platform is that there are no account minimums to contend with. This means that you can get started with really small amounts, and get a feel for the broker before making a larger financial commitment. CMC Markets also ensures that you are able to get money into and out of the platform with ease, with a number of everyday payment methods supported. This includes debit/credit cards and bank wire transfers.

Pros and Cons of CMC Markets

Pros:

- Just under 10,000 financial instruments to choose from

- Most asset classes covered

- Choose from CFDs or spread betting facilities

- Heavily regulated

- No minimum deposit amounts

- Debit/credit cards and bank accounts supported

- Very extensive research department

- Upfront about what it charges

Cons:

- High commission minimums when trading stocks

- Does not offer traditional share dealing services

What can you Trade at CMC Markets?

CMC Markets offers just under 10,000 financial instruments. This is split between its main two divisions; CFDs and spread betting.

CFD Trading

CMC Markets offers CFD trading in the form of stocks, indices, commodities, treasuries, cryptocurrencies, and more. Each and every instrument can be traded on leverage, with limits in-line with ESMA regulations for retail traders. You can also short-sell assets at the platform. There is no capacity to purchase assets like stocks or bonds outright, meaning you won’t be able to earn passive income in the form of dividends or coupon payments.

Spread Betting

The vast bulk of financial instruments available in the CFD department are also present in the CMC Markets spread betting facility. With that being said, the overarching benefit of spread betting your preferred asset class is that you might benefit from tax-exempt profits. In the UK, for example, spread betting is classed as gambling, which is why your profits are not liable for capital gains tax. You should, however, check this with a qualified tax specialist that in your country of residence.

Payments at CMC Markets

CMC Markets allows you to deposit funds with a:

- Debit Card

- Credit Card

- Bank Transfer/Wire

Unfortunately, e-wallets like Paypal and Skrill and not supported. As noted earlier, CMC Markets does not install a minimum deposit amount, which is perfect for starting off with small stakes. Similarly, there are no deposit fees to contend with, unless you decide to use a credit card.

This isn’t a fee charged by CMC Markets themselves, but a ‘cash advance’ fee that most credit card providers charge when you use your card at an online broker. There are no fees to get funds out of CMC Markets, unless you require a same-day withdrawal or an international wire. If you do, you’ll pay a flat fee of £15 (or local currency equivalent).

Fees, Spreads, and Commissions at CMC Markets

As is the case with any online broker you are using for the first time, you need to have a firm grasp of what you will be required to pay at CMC Markets. Potential fees come in the form of the spread, commissions, and overnight financing.

Spreads

The spread refers to the difference between the ‘buy’ price of a financial instrument, against that of its ‘sell’ price. In the case of CMC Markets, the platform offers some of the lowest spreads in the forex space. But, the platform is somewhat expensive in other asset classes like indices. With that said, the specific spread that you pay will not only vary depending on what you are trading but the time of day that you access the market.

Below we have listed some example spreads available at CMC Markets.

- A headline rate of 0.7 pips on major forex pairs like EUR/USD and USD/JPY. GBP/USD is slightly higher at 0.9 pips.

- Indices such as the FTSE 100 and Germany 30 start at 1 pip, while the Dow Jones comes out at 1.6 pips.

- Cryptocurrency pairs like ETH/USD and BCH/USD can be traded at 1.4 and 1.8 pips, respectively.

- In the commodities department, gold can be traded at a super-low spread of just 0.3 pips. Crude oil is much more expensive at 3 pips.

- Treasury bills like Euro bonds and UK gilts come with a spread of 2 pips. Surprisingly, US T-bonds are more expensive at 3 pips.

Overall, the likes of forex and gold CFDs come with very competitive spreads. Other asset classes, such as indices and cryptocurrencies, are less competitive. However, and as we cover in the next section, some instruments at CMC Markets can be traded commission-free, so this must be taken into account.

Trading Commissions

First and foremost, CMC Markets does not charge any trading commissions when you buy and sell CFDs, as long as you are not trading stocks. This means that the likes of indices, energies, hard metals, and cryptocurrencies can be traded by just paying the spread.

In a way, this offsets some of the above-average spreads that we discussed in the prior section. This is also the case when using the CMC Markets spread betting facility, insofar that you won’t need to pay commissions on non-stock trade.

However, if you do plan to trade CFD stocks listed on major exchanges like the NYSE, NASDAQ, or London Stock Exchange, a commission-based policy will apply. The specific rate that you pay will depend on which marketplace you wish to access.

Some examples of non-US and Canada stocks commissions have been listed below:

- If trading stock CFDs that are listed in the UK, Australia, Austria, Germany, Hong Kong, Portugal, and a number of other countries, you will pay a commission fee of just 0.10%. As great as this sounds, a small catch applies, you will need to meet a minimum commission of 9 GBP/EUR.

- So, at a commission of 0.10%, this means that you unless you trade more than 9,000 GBP/EUR on a single stock CFD, you always end up paying the minimum. To put this £9 fee into perspective, a £200 trade on a UK stock would work out at a real-term commission 4.5%!

Some examples of US and Canada stocks commissions have been listed below:

- If trading equities that are listed on US and/or Canada stock exchanges, you will instant pay a flat fee of 2 cents per share. Once again, a minimum commission charge applies, standing at $10. So, unless you are trading 500 shares, you will always pay the $10 minimum.

- To highlight how expensive is, buying 500 shares in Disney at $100 per stock would amount to a total investment of $50,000. In this sense, you are getting a very good deal at an all-in commission of $10.

- However, let’s say you only want to buy 20 shares, which would amount to a total investment of $2,000. As you will need to meet the $10 minimum commission, this works out at a real-term rate of 0.5%.

All in all, whether or not you are getting a good commission deal at CMC Markets will depend on your trading activities. For example, if you stick with major forex pairs or gold, it doesn’t matter how much you trade, as you will benefit from super-low spreads and a zero-commission policy. At the other end of the spectrum, if you decide to trade stock CFDs with small stakes, it’s likely that your potential profits will get eaten away at by high commissions!

Financing Fees

You will also need to pay financing fees at CMC Markets when you keep positions open overnight. This is standard practice in the online CFD ad spread betting space, so do bear this in mind. As is often the case when trading on leverage, attempting to work out how much you are actually being charged is somewhat difficult to quantify.

This is because the actual formula that is used to calculate your overnight financing fees is super-complex. With that said, CMC Markets does let you know what you will be required to pay in dollars and cents or your local currency for each day that you keep the position open.

This at the very least allows you to gauge how much you will be required to pay before placing the order.

Inactivity Fee

CMC Markets has one of the strictest inactivity policies that we have ever seen. In a nutshell, your account will be classed as dormant if no trading activity is identified for just one month. If this is the case, you will need to pay £10 per month until you re-activate the account. This once again highlights that CMC Markets is best suited for short-term day trading or at best, swing trading.

Leverage and Margin Trading

With more than 9,900 CFDs and 180+ forex pairs, CMC Markets offers you the chance to apply leverage on most of the instruments it hosts. The specific limits that you are offered will depend on a number of variables. For example, those with a professional account will be able to risk much more in comparison to a basic account. On top of ESMA regulations, limits will depend on the type of asset class, too.

- Major Forex Pairs: 30:1

- Minor/Exotic Pairs, Major Indices, and Gold: 20:1

- Minor Indices and Non-Gold Commodities: 10:1

- Stock CFDs: 5:1

- Cryptocurrencies: 2:1

Note: The above leverage limits fall in-line with ESMA regulations. This is an independent body set up by the European Union. UK traders are also governed by the regulations even though they are no longer part of the EU block – for the time being, at least.With that being said, CMC Markets permits leverage trading of up to 500:1 for its professional clients. This is a monumental amount of margin to be trading on, even for those with heaps of experience.

Which Regulators Govern CMC Markets?

With CMC Markets first launched way back in 1989, it will come as no surprise to learn that the platform has an excellent regulatory standing.

Below we have listed the tier-one licenses that the broker currently holds:

UK – Financial Conduct Authority (FCA)

One of the most respected licenses globally, the FCA governs the UK financial markets. A key requirement is that brokers must keep client funds in segregated bank accounts.

Canada – Investment Industry Regulatory Organization of Canada (IIROC)

The IIROC governs trading firms and investment dealers in Canada.

Australia – Australian Securities and Investment Commission (ASIC)

ASIC not just a government investment firms and online brokerage platforms in Australia, but across a number of Asia-Pacific nations.

New Zealand – Financial Markets Authority (FMA)

The FMA is a New Zealand based regulator that governs the domestic banking and financial markets.

Singapore – Monetary Authority of Singapore (MAS)

Much like in the case of ASIC, MAS is known to have a presence with online brokers both domestically and across the wider Asia-Pacific region.

If you do not live in one of the jurisdictions above, then it is likely that your trading activities will be governed by an alternative body. CMC Markets will notify you of this when you go through the account opening process. Regardless of where you are based, CMC Markets keeps clients from separate from its own working capital. In theory, this means that your investments should be ringfenced even if the broker went out of business.

To add further weight to the broker’s reputation, CMC Markets is publicly-listed on the London Stock Exchange. This ensures that the broker meets a range of additional regulatory expectations, such as making its accounts public.

Getting Started with CMC Markets

If you’re keen to get started with CMC Markets straightaway, check out the step-by-step guidelines we have listed below. We’ve covered the entire end-to-end process of opening an account, verifying your identity, and depositing funds.

Step 1: Open an Account

Head over to the CMC Markets homepage to get the ball rolling. As is the case with any online broker platform regulated in the UK, you will need to open an account. You will first need to enter some basic information, such as your name, home address, date of birth, and contact details. You also need to provide information about your tax status. If you’re an everyday employee that gets paid via PAYE, enter your national insurance number.

Step 2: Financial Information and Trading Experience

You will now need to provide CMC Markets with some information about your financial standing. First, state your employment status and the industry you work in. You’ll also need to state your annual income band. The platform will also need to know how much prior experience you have in trading securities online.

Not only will you need to state the types of asset classes you have previously purchased, but also the size of your average trades. Next, you’ll then need to answer some multiple-choice questions. This is to gauge your understanding of key trading principles. Crucially, you’ll be asked about your knowledge of applying leverage, and whether or not you understand the risks.

Step 3: Verify Your Identity

Any UK forex broker is required to identify the customers that use its services. This is to comply with anti-money laundering regulations, as well as the licensing conditions stipulated by the FCA. Unlike other brokers operating in the space, CMC Markets is not able to verify your identity automatically with third-party sources. Instead, you’ll need to manually provide the platform with supporting documents.

Note: Although you don’t need to verify your identity straightaway, you won’t be able to request a withdrawal until you do. As such, it’s best to get it out of the way so that you don’t encounter any delays when it comes to cashing out.This needs to include a clear copy of your government-issued ID (passport or driver’s license) and a proof of address (bank statement, utility bill, etc.) If you’re looking to open a professional trading account, CMC Markets will likely ask for additional information. The verification process can take 1 working day to complete, although you can proceed to deposit funds in the meantime.

Step 4: Deposit Funds

Unless you are looking to use the platform’s live demo account, you will need to deposit some funds. CMC Markets allow you to deposit funds via a debit/credit card or bank transfer. If you’re looking for an instant deposit, you’ll need to go with the former. The good news is that there is no minimum deposit amount, so you’re fine to start with small amounts.

Step 5: Start Trading

As soon as your deposit has been credited, you can start trading. The trading arena is really well laid out, meaning it’s super easy to find the asset class you’re after. You can also search for the specific instrument that you want to trade by entering it into the search box.

Ultimately, just make sure that you’re comfortable with the trading screen before risking your own money. With that said, CMC Markets allows you to fully customize the layout, which is great.

Platform Features

So now that we have covered the fundamentals, we need to take a close look at the main features offered by CMC Markets.

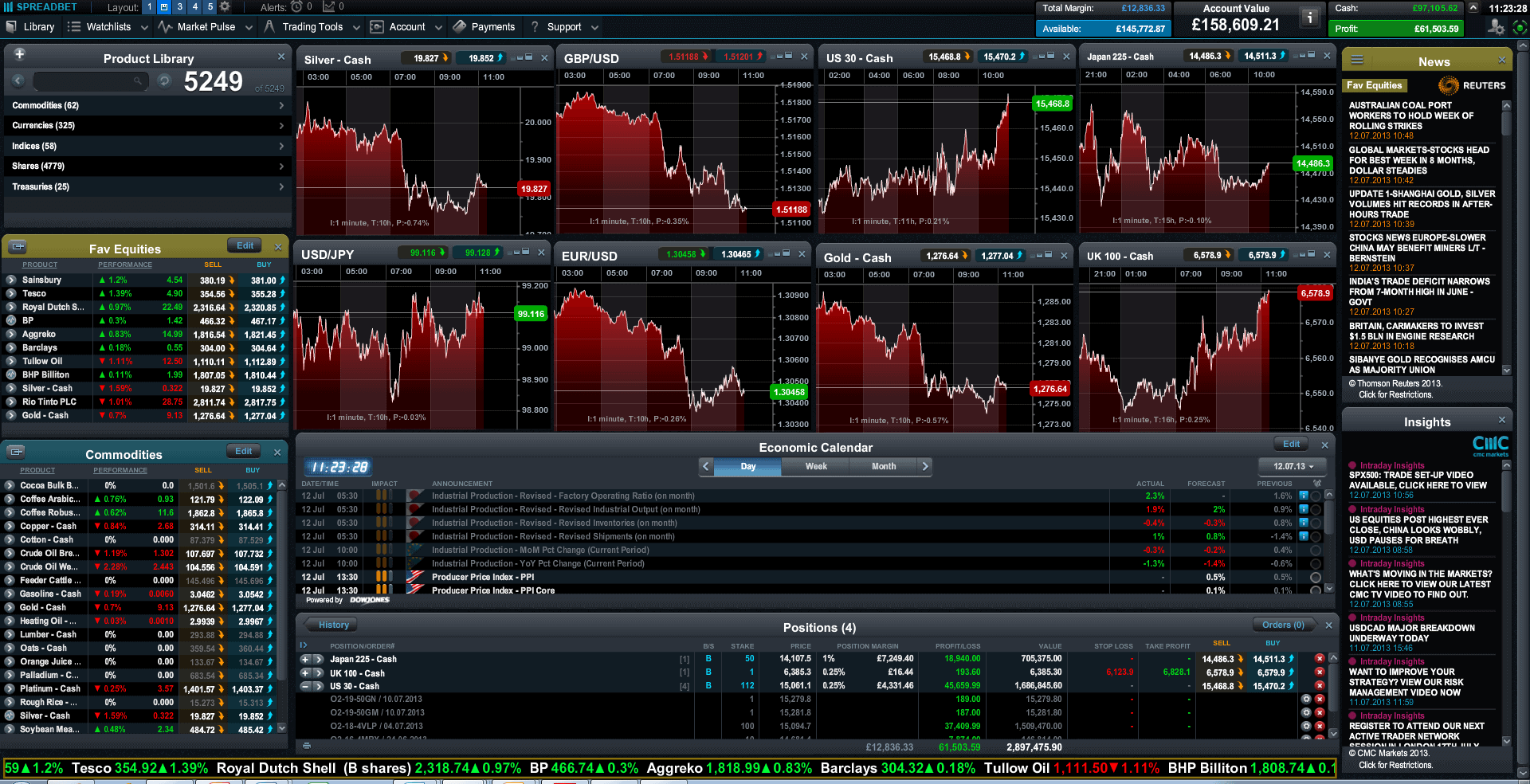

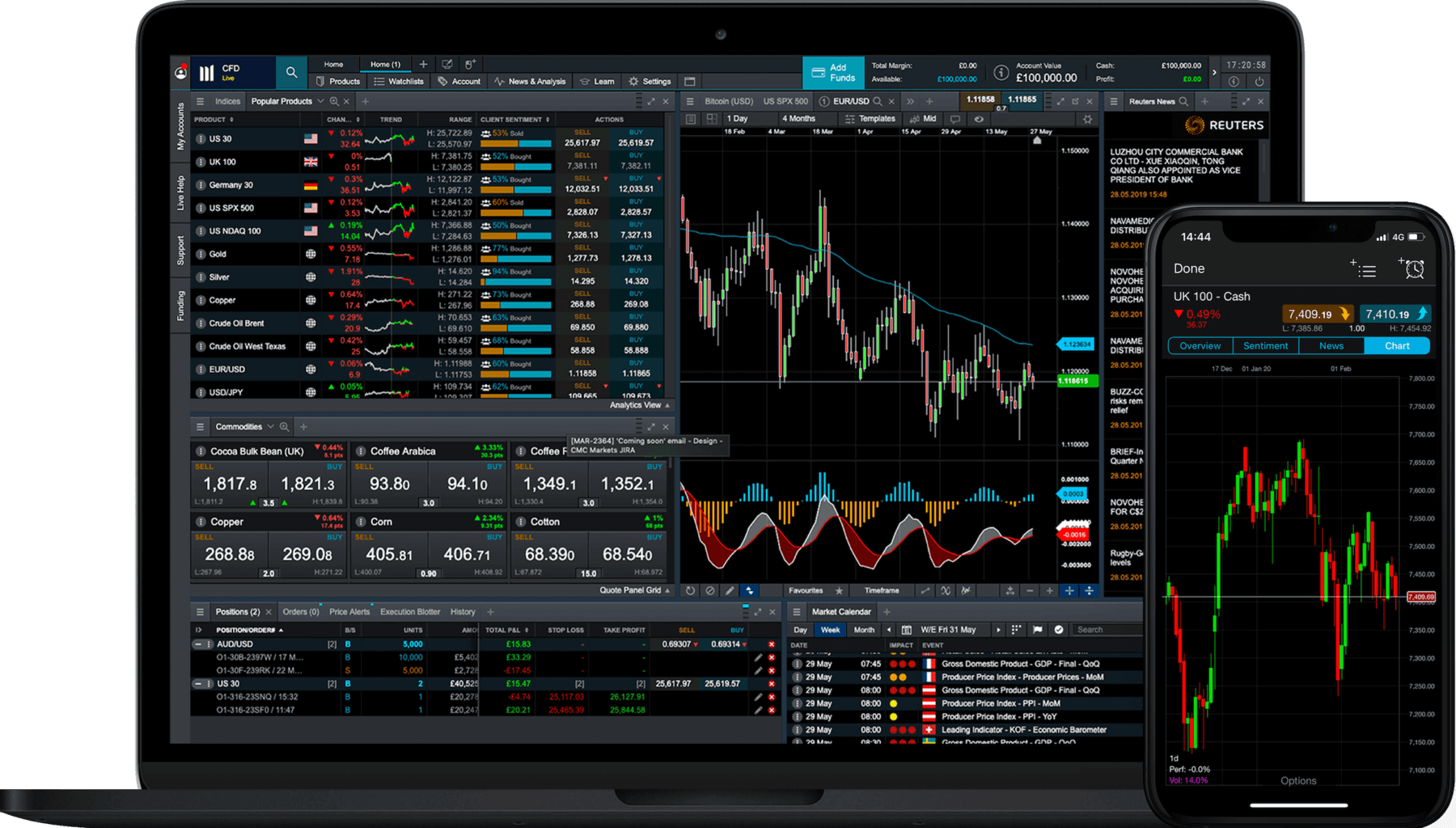

Trading Platforms

When it comes to the trading platform itself, you get two options. Firstly, for those of you that have a passion for MetaTrader 4 (MT4), you’ll be pleased to know that CMC Markets offers full support. This only covers the forex and CFD trading aspect of the broker, and not spread betting. Alternatively, you might decide to use the proprietary trading platform that was created by CMC Markets.

Regardless of which platform you opt for, CMC Markets allows you to trade via its main desktop website, meaning there is no requirement to download any software. You will also have the option of using the CMC Markets mobile trading arena.

The application is available on all Android and iPhone devices, including that of tablets. This is ideal if you have a tendency to buy and sell assets on the move. If you don’t have a supported device, you can still access CMC Markets via your mobile web browser.

Order Types

CMC Markets offers a significant amount of flexibility when using its native trading platform, especially when it comes to orders. For example, you’ll have access to the likes of guaranteed stop-loss orders, price ladders, and trailing stops. Boundary orders and 1-click trading is also supported. What we really like is that CMC Markets supports long and short orders simultaneously. This is something that a lot of well-known brokers fail to offer, meaning you can’t place from more sophisticated positions.

Chart Reading Tools

CMC Markets is extremely strong in the chart reading department, with more than 115 technical indicators and advanced drawing tools. On top of this, you’ll also get to choose from 70 different chart patterns and 12 chart types. In other words, your CMC Markets trading platform can be 100% customized to meet your personal preferences. In fact, in an Investment Trends survey of 2019, CMC Markets ranked as the best online broker for charting.

Alerts and Notifications

If you’re looking to take your trading activities to the very next level, you’ll be pleased to know that CMC Markets offers real-time notifications. This allows you to receive an alert when a pre-defined pricing trigger has been met. For example, let’s say that you’re watching GBP/USD, and you want to trade it when the price hits $1.34. CMC Markets will post a notification straight to your phone as and when the price is triggered.

Demo Account

CMC Markets allows all traders to make full use of its in-house demo facility. Even better, there is no requirement to deposit any funds to gain access to it. Instead, you simply need to provide your email address and choose a strong password. After that, select whether you want to try the spread betting or CFD trading platform and you’re good to go. When you do use the demo account, you will be using the proprietary CMC Markets platform. This allows you to get a full grasp of how the broker works before risking your own capital.

Research and Analysis

The research department at CMC Markets is nothing short of top-notch. Firstly, the platform is ultra-strong in the fundamental news department, with key market developments being posted to the site through the day. Each publication will then contain a piece of analysis on how the development could impact certain markets.

The platform also hosts a number of educational videos, which are great if you are just starting out in the world of online trading. What we also like is that the team at CMC Markets will also host regular webinars. This gives you the chance of asking questions to expert traders from the comfort of your own.

Customer Support

Although CMC Markets does not offer customer support on a 24/7 basis, it does ensure that global stock exchanges are covered throughout the week. For example, the team works non-stop from 21:00 on Sunday (opening of Asian markets) to 22:00 on Friday (closing of US markets).

You can reach the customer service team via telephone support, email, or live chat. Waiting times are relatively low when opting for phone support, and email replies usually come back on a same-day basis. Most importantly, CMC Markets notes that its response times on live chat average just 30 seconds.

Conclusion

By reading our CMC Markets review from start to finish, you should now have a firm grasp of whether or not the platform is right for your trading needs. All in all, the broker has a lot of positives going for it. With an established track-record that dates back to 1989, alongside heaps of regulatory licenses, CMC Markets is trusted by traders of all sizes.

We really like the fact that the platform does not charge any minimum deposit amounts, and trading fees are super-competitive. This is especially true with the EUR/USD and GBP/USD pairings, where spreads average just 0.7 pips. Gold CFDs are also competitive with spreads of just 0.3 pips. On the flip side, commissions are somewhat expensive when trading stock CFDs at low volumes.

This is because the platform has a minimum commission amount that you will need to pay if you fall beneath the threshold. Finally, CMC Markets is extremely strong in the research and analysis department, covering both the technicals and fundamentals.

FAQs

How much does it cost to trade at CMC Markets?

This depends on what you are trading, as fees can vary quite widely at the broker. For example, all CFD and spread betting trades are executed on a commission-free basis – apart from stocks and shares. Spreads are as low as 0.3 pips on gold and 0.7 pips on major forex pairs, which is very good. But, the spreads on US treasury bonds are as high as 3 pips. All in all, CMC Markets is relatively competitive, but not across all of its asset classes.

Is CMC Markets regulated?

Yes, CMC Markets is regulated by a number of tier-one licensing bodies. This includes bodies in the UK, Australia, Singapore, New Zealand, and Canada.

Do I need to upload ID to trade at CMC Markets?

CMC Markets is a heavily regulated online broker – meaning that it needs to verify the identity of all trades that use its site. As such, you will need to upload a copy of your government-issued ID, and a proof of address.

What payment methods can I use at CMC Markets?

CMC Markets supports debit and credit cards for instantly deposits. If you want to use a bank account, you’ll get higher limits, but the deposit can take a few days. Irrespective of your chosen payment methods, CMC Markets does not charge any deposit fees.

What trading platforms does CMC Markets offer?

CMC Markets offers its own proprietary trading platform, alongside MT4. You can trade via its web-based platform, or on your mobile/tablet device.

See Our Full Range Of Forex Brokers Resources – Brokers A-Z

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up