How to Buy Rolls-Royce Shares UK in 2022 – A Beginner’s Guide

Rolls-Royce Holdings PLC (LON:RR) is one of the world’s most famous engineering companies and the world’s second-largest maker of aircraft engines and marine propellers. The company is listed on the London Stock Exchange and is a member of the UK’s FTSE 100 Index.

This guide will walk you through the basics before you invest in Rolls-Royce. This includes the company’s history, popular share brokers and how to buy Rolls-Royce shares today!

-

-

Where To Buy Rolls-Royce Shares

Before you can buy Rolls-Royce shares, you need to find a suitable UK stockbroker, and there are many to choose from. All stock brokers differ in terms of the shares they offer, fees and tools, so finding the right one for you isn’t always easy.

To help you out, we’ve reviewed some popular brokers that allow you to buy shares in Rolls-Royce.

Plus500

Plus500 is a UK-based CFD broker. This means that you can’t own shares in the traditional sense, but you can go short and trade share CFDs with 1:5 leverage. All this can be done at low cost, as Plus500 doesn’t charge commissions or withdrawal fees, and it boasts some of the most competitive spreads in the industry.

This broker has a proprietary platform that boasts some useful features and tools. These include custom price alerts that can be sent to your mobile via the Plus500 app, meaning you can easily keep track of the Rolls-Royce share price and never miss and investment opportunity.

You only need to deposit £100 to get started with this FCA-regulated broker, which is a fairly low amount in comparison to other brokers. There’s a variety of ways to fund your account, including e-wallets like PayPal, which is another benefit of trading shares with Plus500.

Our Rating

80.5% of retail investors lose money when trading CFDs with this provider. Sponsored ad

80.5% of retail investors lose money when trading CFDs with this provider. Sponsored adWhy People May Buy Rolls-Royce Shares

Rolls-Royce has faced some trouble recently but remains one of the world’s most admired and best-known engineering companies.

Deciding which shares or stocks to buy is never an easy decision, and it must be the result of thorough personal research.

1. Unparalleled technical knowledge and franchise

Rolls-Royce Holdings is one of the world’s most admired engineering companies, building engines and systems powering commercial and combat planes, helicopters, submarines and nuclear power plants. The technical expertise, the giant £60 billion backlog of orders and the web of contracts and relationships developed over the past 100 years offer Rolls-Royce a strong competitive advantage in its domain.

2. Strong liquidity to weather the crisis

While Standard & Poor’s downgraded Rolls-Royce from investment grade to junk, the company delivered an update saying it had drawn its lines of credits and added to its reserves to build a £6.7 billion cash pile.

With $500 million debt coming due in 2020 and only €750 million due until 2024, Rolls-Royce does not appear at risk of default.

3. A potentially lucrative bet on the recovery of the aerospace sector

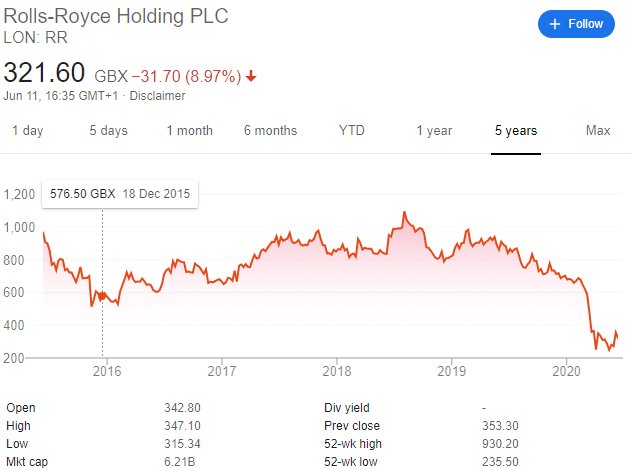

While Rolls-Royce’s Power Systems and Defense divisions have held steady during the Covid-19 crisis, Rolls-Royce shares fell over 50% since February on fears about the Civil Aerospace division’s woes.

Indeed, Rolls-Royce’s main operating segment experienced a slowdown both in the number of new engines sold to commercial airplanes and jets, but also on the demand of maintenance services for existing engines.

Nevertheless, with shares of the iconic engine-maker at a 10-year low, Rolls-Royce has the potential to display explosive returns should the aviation sector come back to normal faster than anticipated. e. At the time of writing, the average analyst consensus hovered around 975p, with Goldman Sachs reaffirming its “Buy” rating with a price target at 528p.

Interested in investing in other companies? Check out these guides on how to buy Netflix shares, Standard Life shares and Tesla shares.About Rolls-Royce Shares

Company History & Business Model

Rolls-Royce Holdings plc is a UK-based multinational engineering company established in 1904. It is headquartered in London, is listed on the London Stock Exchange and is an integral component of the UK’s FTSE 100 Index.

Unlike its eponymous but distant cousin Rolls-Royce Motor Cars, Rolls-Royce Holdings (simply “Rolls-Royce”) does not manufacture cars. Instead, it specializes in manufacturing aircraft engines and marine propellers. In 2019, Rolls-Royce holdings was the 24th largest defense contractor in the world with over £4.6 billion in defense contract revenues.

In 2019, Rolls-Royce’s continuing operations generated £15.5 billion in revenues (up 7% year-on-year), £2.3 billion in gross profits (+5%) and £810 million in operating profits (+28%). At year-end, it had a £61 billion order backlog and employed over 51,000 people in 50 countries.

Rolls-Royce operates in 3 major segments making up 93% of its revenues: Civil Aerospace (51% of 2019 revenues), Power Systems (22%) and Defense (20%).

The Civil Aerospace segment manufactures aircraft engines for large commercial planes, jets and various smaller aircraft. In 2019, the segment generated £8.1 billion in revenues (+10% year-on-year) and £44 million in operating profits, a net improvement over the negative margins of the prior year.

The Power Systems segment develops and sells engines and propulsion systems for the marine, defense, power generation (including civil nuclear power plants) and industrial markets. Over two-thirds of the segment’s revenues (£3.5 billion, +3% from 2018) were in original equipment manufacturing, the rest derived from maintenance & services. Operating profits were up significantly, with a 13% growth bringing them to £360 million in 2019.

Last, the Defense segment is a leader in engines for military transport, patrol & combat aircraft, helicopters and naval vessels. Among other high-profile contracts, the division supports the nuclear power plant of the Royal Navy’s submarine fleet. The segment’s revenues of £3.2 billion (+4% year-on-year) came from an equal mix of manufacturing and maintenance, and the operating margins remained at 12.8% despite a 0.9% decline from 2018.

Rolls-Royce Share Price History and Performance

Rolls-Royce shares are listed and traded on the London Stock Exchange under the LON:RR ticker.

The coronavirus crisis has hit Rolls-Royce shares hard, sending them sharply down from their January 2020 levels. In addition to a general economic slowdown, Rolls-Royce’s Civil Aerospace segment experienced a fall in demand from commercial aviation clients for new engines and for related maintenance services. Despite steady and as-expected results from the Power Systems and Defense segments, Standard & Poor’s downgraded Rolls-Royce from BBB- to BB, bringing the engineering giant from investment grade to junk status.

How To Buy Rolls-Royce Shares

Step 1: Search for Rolls-Royce Holdings (RR.L) shares

On the platform, use the search function to look for Rolls Royce or its ticker “RR.L”. In the search results, you will also see the names of other traders: the ability to browse other market participants is a key feature of popular social trading platforms.

Step 2: Click “Trade” to get started

Once you’re on the Rolls-Royce company page, you can browse the company’s newsfeed on the platform, its recent financials, and its share price performance.

Using your own money or a free demo account (for paper trading), click “Trade” to open the trading window and specify your order direction, type, amount, and any other options.

Step 3: Choose how much to buy and the options you want

Once you have done your research, understood Rolls-Royce’s business and the risks, you’re ready to place a trade.

In the trading window, you will first specify whether you wish to buy or short-sell Rolls-Royce shares. You can then choose how much to buy, in dollar amount or number of shares. f

The default order type is for the market rate.

Before placing your trade, make sure to review the exposure (in dollar amount and as a proportion of your equity) and the fees (for CFD trades). Once all this is done, you are ready to buy Rolls-Royce shares!

Simply click “Open Trade” (or “Set Order”) outside trading hours to get started!

Conclusion

In this guide, we showed you where & how to buy Rolls-Royce shares, reviewed the company’s history and business model. As an engineering giant with a unique franchise, a large backlog of contracts and strong liquidity.

FAQs

Where is Rolls-Royce listed?

Rolls-Royce Holdings PLC is headquartered in London and listed on the London Stock Exchange.

What’s the difference between Rolls-Royce Holdings and Rolls-Royce Motor Cars?

Rolls-Royce holdings is an engineering company that manufacture aircraft engines and power systems. It owns the rights to the Rolls-Royce name and logo, but licenses it to Rolls-Royce Motor Cars, a carmaker and wholly-owned subsidiary of German company BMW.

What business is Rolls-Royce in?

Rolls-Royce is composed of 3 major segments that represent 93% of 2019 revenues. Civil Aerospace makes and maintains engines for commercial planes and jets. Power Systems makes and maintain engines and systems to for the marine, defense and power generation (including civil nuclear) industries. Defense makes and maintains engines for combat planes, helicopters and navy vessels, including the Royal Navy’s fleet of nuclear submarines.

Can I buy fractional shares of Rolls-Royce?

Many of the brokers reviewed in this article allow you to buy or short fractional shares of Rolls-Royce, usually via CFDs.

Does Rolls-Royce pay a dividend?

Rolls-Royce has cut its dividend in light of the expected coronavirus-induced headwinds on its Civil Aerospace division. At the time of writing, there was no indication of intentions by the company to pay a dividend again in the near future.

A-Z of Shares

Alan Draper Lewis

View all posts by Alan Draper LewisAlan is a content writer and editor who has experience covering a wide range of topics, from finance to gambling.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com