Sunny Loans Review 2020 | Payday Loans | Read Before Applying

Are you looking for a fast financial solution to get you out of a fix? Then you may be considering signing up for funding from Sunny Loans.

Are you looking for a fast financial solution to get you out of a fix? Then you may be considering signing up for funding from Sunny Loans.

This UK provider has a lot to offer but like any other lender, has itsdownsides too. What are these? Do the benefits outweigh any potential demerits?

Read through our comprehensive analysis of the platform to find out all you need to know about Sunny Loans.

Based on this information, you will be in a position to decide whether or not they are the ideal lender for you.

-

- 1. To create an account and borrow your first loan from Sunny Loans, start by visiting the website and clicking on “Let’s Get Started.”

- 2. Click on “Continue” to get started on the actual application.

- 3. There are four steps in the application process. In the first step, you will need to provide your personal details. Start by indicating the amount you want to borrow, your name, date of birth and number of dependents.

- 4. Next, enter your contact details including email address, mobile number and home number (optional).

- 5. Enter your current address and create a password to secure your account.

- 6. Under the second step, you will enter the details of your income and expenses. And in the third stage, you need to submit bank details.

- 7. After you are done providing this information, you will need to wait for a decision from the team.

-

- 1. To create an account and borrow your first loan from Sunny Loans, start by visiting the website and clicking on “Let’s Get Started.”

- 2. Click on “Continue” to get started on the actual application.

- 3. There are four steps in the application process. In the first step, you will need to provide your personal details. Start by indicating the amount you want to borrow, your name, date of birth and number of dependents.

- 4. Next, enter your contact details including email address, mobile number and home number (optional).

- 5. Enter your current address and create a password to secure your account.

- 6. Under the second step, you will enter the details of your income and expenses. And in the third stage, you need to submit bank details.

- 7. After you are done providing this information, you will need to wait for a decision from the team.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.What is Sunny Loans?

Sunny Loans is a direct lender based in the UK and is a trading name of Elevate Credit International Ltd. The company is registered in Wales and England and has its head office on Eastcastle Street, London.

It is authorised and regulated by the Financial Conduct Authority (FCA). Elevate claims to have been “founded on a legacy of data and innovation coupled with fair lending practices.”

With that in view, it offers financing to what it refers to as non-prime customers, who may not be able to access services elsewhere. Its ultimate objective, according to the site, is to “create a fairer financial future for all.”

Its pricing is transparent and the platform makes use of advancements in technology as well as analytics to lower the interest rates its borrowers have to pay.

Sunny Loans offers a flexible blend between a payday loan and short term installment loan. It offers a relatively high loan limit with terms of up to 6 months during which you can pay back in installments. The application process is simple, and the approval process and funding, fast.Pros and Cons of a Sunny Loans Loan

Pros

- You get 5 days to change your mind and return the loan interest-free after getting funding

- Has a UK-based support team

- Website has an extensive FAQ section

- Use online loan calculator to estimate the cost of your loan and find a suitable fit

- Simple application process

- Fast approval and funding within 15 minutes

- Offers a payment holiday in December

- You can access up to four loans at a time, subject to affordability and affordability checks

Cons

- Lender carries out hard credit checks which will affect your score

- Loan terms are relatively short, with a maximum of 6 months

- Charges the maximum daily interest rate

How does a Sunny Loans loan work?

Sunny Loans offers services online, providing loans that range between £100 and £2,500. There are no fees whatsoever involved in applying for the loan or making repayments. You will only need to factor in the interest rates, which are capped at the statutory maximum.

Early repayments also do not attract charges and you can use this to your advantage to save on interest. Typically, you will get a maximum borrowing period of 6 months.

The loan application process is easy and fast, and you can get funding in as few as 15 minutes if you get approved.

A major highlight of the loan is that in case of buyer’s remorse, you can cancel the loan and return the principal within 14 days. The icing on this cake is that if you do so within the first 5 days, you will not pay a single penny in interest.

Credit Check

Before you apply for a loan from the platform, you can use the online calculator to estimate the cost. This is a useful resource that allows you to get a feel of the rates without having it affect your credit score. However, the final rate may be different from this estimate.

As a responsible lender, Sunny Loans will carry out a credit check before approving your loan. This will verify that you are who you say you are and will also reveal your money management history.

Whether it is your first loan on the platform or a subsequent one, the lender will always undertake this exercise. Before you go through the full application process, they can carry out a soft search to give you an indication of whether you might qualify.

A soft search will not impact your credit score and will not leave a visible footprint on your credit history. In case you learn from this search that you are likely to get approval, then you may continue with the application.

Once you apply for a loan, they will carry out a hard search, which will impact your score. Note that during this search, they will consider the number of recent searches on your report. A high number may indicate that you are struggling and may therefore not afford the loan.

If your loan application gets approved, you will receive a repayment schedule. They will also give you access to an online account area. You can use this to keep track of upcoming payments and your balance and make additional payments if you want to.

Repayment and interest rates

The lender is kind enough to send you reminders before your due date so that you can get your finances in order and avoid missing a payment. They make collection using a continuous payment authority (CPA).

A CPA authorizes them to collect payments directly from your bank account using the debit card details you provide during the application process. This differs from a direct debit, which needs authorization from your bank and will attract charges if you do not have sufficient funds.

If you would rather not use a CPA, you can cancel it at any time and instead make calls to pay over the phone, use online banking or pay through your online account on the platform.

Using this online account, you can also change your payment schedule and make it shorter so as to cut down on interests. It is also possible to increase the repayment amounts under “payment options.” To reduce this amount you would however need to contact the repayments team.

You can make one-off payments through the online account or by making calls to the team so as to reduce the overall interest amount. Any payment you make will trigger their automated system to send you a repayment email with an updated balance. This could take up to an hour, so give it time before you make an additional transaction such as another repayment.

December repayment holiday

An interesting highlight of Sunny Loans is the December payment holiday. In recognition of the fact that Decembers can be tough financially, they make a considerate provision. If your loan repayment falls between 14th and 31st December, you can postpone it.

To qualify for this, you need to select the option during the application process, so as to access a new repayment schedule. You cannot apply for the provision any time after application or funding.

What loan products does Sunny Loans offer?

Sunny Loans offer some of the best payday loans that differ from the traditional definition of this type of loan. Typically, payday loans involve borrowing a small amount of cash and repaying it in full on your next payday.

But the Sunny Loans alternative to this allows you to borrow a slightly higher amount than the average payday loan would offer. Furthermore, you can make repayments over a period of time in installments. Every month, you get to pay off a part of the capital as well as the interests accrued over the period.

Sunny Loans Account Creation and Borrowing Process

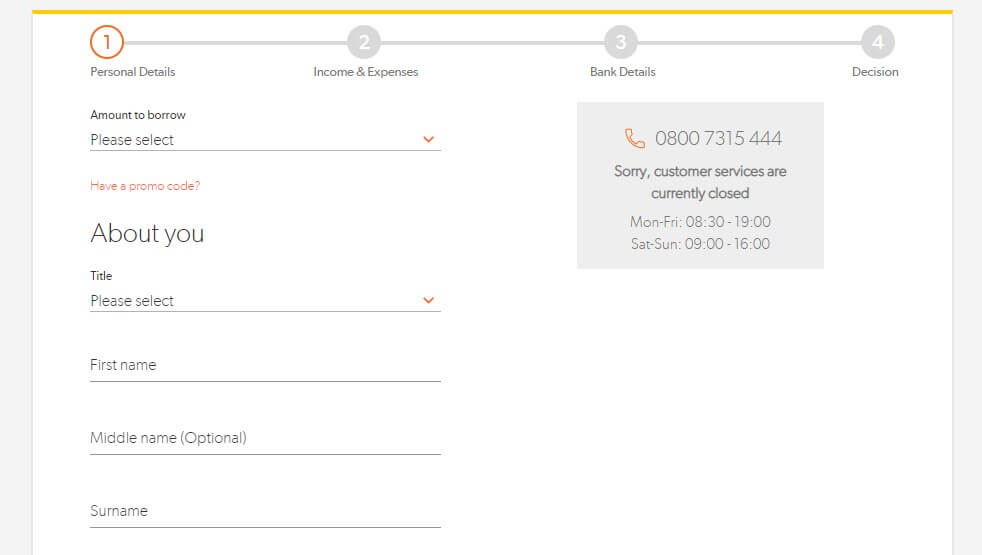

1. To create an account and borrow your first loan from Sunny Loans, start by visiting the website and clicking on “Let’s Get Started.”

It will take you to the online loan calculator, where you can select the amount you want to borrow and the loan period. Adjust both sliders until you get a loan package that seems suitable based on your circumstances.

2. Click on “Continue” to get started on the actual application.

3. There are four steps in the application process. In the first step, you will need to provide your personal details. Start by indicating the amount you want to borrow, your name, date of birth and number of dependents.

4. Next, enter your contact details including email address, mobile number and home number (optional).

5. Enter your current address and create a password to secure your account.

Click ‘Continue’ to proceed to the next step.

6. Under the second step, you will enter the details of your income and expenses. And in the third stage, you need to submit bank details.

7. After you are done providing this information, you will need to wait for a decision from the team.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Sunny Loans Loan

In order to qualify for a loan from Sunny, here are the requirements you would need to meet:

- Be a UK resident

- Be at least 18 years of age

- Provide proof of regular income

- Provide details of your residential address over the past 3 years

- Provide your bank account details

- Have a mobile phone

- Have an email address

- Not be bankrupt

- Submit to a credit and affordability check

Information Borrowers Need to Provide to Get Sunny Loans Loan

Here is the information you need to provide when applying for a loan here:

- Personal details

- Contact information

- Bank account details

- Employment information

- Debit card details

- Three years of address history

- Income and expenditure details including current financial obligations

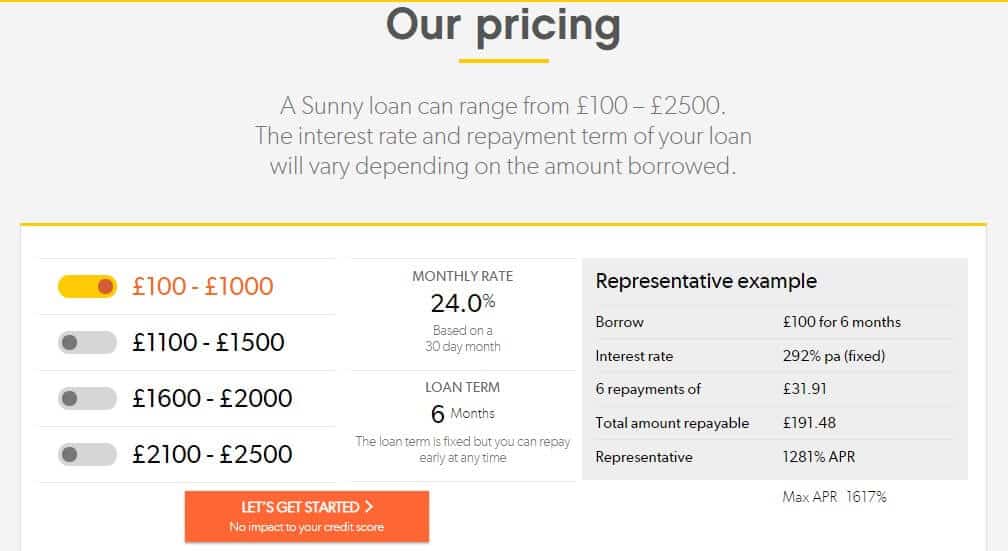

What are Sunny Loans loan borrowing costs?

Here are some of the costs associated with borrowing from this lender:

- Representative APR – 1,281%

- Maximum APR – 1,617%

- Application fees – nil

- Administration fees – nil

- Late payment fees – nil

- Early payment fees – nil

- Daily interest rate – 0.8%

Representative example:

- Loan amount – £100

- Loan term – 6 months

- Monthly repayment amount – £31.91

- Total repayment amount – £191.48

Sunny Loans Customer Support

According to online reviews, Sunny Loans has a great support team. Overall, the platform is rated 8.9 out of 10 on Trustpilot, with lots of comments citing the helpfulness of the team and their great service.

Is it safe to borrow from Sunny Loans?

Yes. Sunny Loans is a regulated entity authorised by the FCA. They are direct lenders and will not therefore share your sensitive data with third parties. Additionally, the website makes use of advanced encryption protocol to keep user data safe.

Sunny Loans Review Verdict

Like any other short term lender, Sunny Loans offers funding to a wide range of borrowers at a premium. You may qualify for a loan on the platform even without having a great credit score. And best of all, you can confirm this without going through the application process.

The lender has lots of user-friendly features such as the provision to borrow up to four loans at a time and the December payment holiday. They offer loan approval services and funding round the clock and even on holidays, which is great for emergency situations.

But even though their loan terms are short, they are a friendly choice for last resort borrowing.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.Glossary of loaning terms

Credit Score

Credit ScoreA credit score shows your creditworthiness. It's primarily based on how much money you owe to loan or credit card companies, if you have ever missed payments or if you have ever defaulted on a loan.

Guaranteed Approval

Guaranteed ApprovalGuaranteed Approval is when, no matter how bad, your credit score its, your loan application will not get declined.

Credit Limit

Credit LimitA Credit Limit is the highest amont of credit a lender will lend to the borrower.

Collateral

CollateralCollateral is when you put up an item against your loan such as your house or car. These can be repossessed if you miss payments.

Cash Advance

Cash AdvanceA Cash Advance is a short-term loan that has steep interest rates and fees.

Credit Rating

Credit RatingYour Credit Rating is how likely you are to fulfill your loan payments and how risky you are as a borrower.

Fixed Interest Rate

Fixed Interest RateFixed Interest Rate is when the interest rate of your loan will not change over the period you are paying off you loan.

Interest

InterestThe Interest is a percentage based on the amount of your loan that you pay back to the lender for using their money

Default

DefaultIf you default on your loan it means you are unable to keep up with your payments and no longer pay back your loan.

Late Fee

Late FeeIf you miss a payment the lender will charge you for being late, this is known as a late fee.

Unsecured Personal Loan

Unsecured Personal LoanAn Unsecured Personal Loan is when you have a loan based solely on your creditworthliness without using collateral.

Secured Loan

Secured LoanA Secured Loan is when you put collateral such as your house or car up against the amount you're borrowing.

Prime Rate

Prime RateThis is the Interest Rate used by banks for borrowers with good credit scores.

Principal

PrincipalThe Principal amount the borrower owes the lender, not including any interest or fees.

Variable Rate

Variable RateA Variable Rate is when the interest rate of you loan will change with inflation. Sometimes this will lower your interest rate, but other times it will increase.

Installment Loan

Installment LoanAn Installment Loan is a loan that is paid back bi-weekly or monthly over the period in which the loan is borrowed for.

Bridge Loan

Bridge LoanA Bridge Loan is a short term loand that can last from 2 weeks up to 3 years dependant on lender.

AAA Credit

AAA CreditHaving an AAA Credit Rating is the highest rating you can have.

Guarantor

GuarantorA Guarantor co-signs on a loan stating the borrower is able to make the payments, but if they miss any or default the Guarantor will have to pay.

LIBOR

LIBORLIBOR is the London Inter-Bank Offered Rate which is the benchmarker for the interest rates in London. It is an average of the estimates interest rates given by different banks based on what they feel would be the best interest rate for future loans.

Home Equity Loans

Home Equity LoansHome Equity Loans is where you borrow the equity from your property and pay it back with interest and fees over an agreed time period with the lender.

Debt Consolidation

Debt ConsolidationDebt Consolidation is when you take out one loans to pay off all others. This leads to one monthly payment, usually with a lower interest rate.

Student Loan

Student LoanIf you obtain a Student Loan to pay your way through College then you loan is held with the Department for Education U.K.

Student Grants

Student GrantsFinancial Aid in the form of grants is funding available to post-secondary education students throughout the United Kingdom and you are not required to pay grant

FAQ

Will the December payment holiday affect my repayment schedule?

Yes. If you select the feature, you will make the same number of repayments as before. But you will not need to have any due dates within the ‘holiday’ period. Click on the facility to view your new repayment schedule and choose whether or not to opt in.

Will there be any additional costs for opting in to the December payment holiday?

Any loans repayable within the standard 6-month period will not incur any additional costs. But if the repayment period is shorter, you will pay more than you would have paid without the holiday.

Why does the lender ask for both bank account and debit card details?

They use the bank account details to deposit the funds into your account if your application is successful. And they use the debit card to collect repayments on the due dates.

Can I apply for another loan when I already have an active loan from Sunny?

Yes. The lender allows you to have up to four loans at the same time, on condition that your credit and affordability checks are satisfactory.

Can I make an application and receive funds over the weekend?

Yes. You can have your application approved and funded 24/7. Sunny processes applications every day round the clock, even on bank holidays. You should have your funds within 15 minutes no matter when you apply.

What other store services does Sunny Loans offer?

Sunny Loans does not offer any other store services.

UK Payday Loan Reviews- A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up