How to Buy Pfizer Shares UK in 2022 – A Beginner’s Guide

Pfizer is an American multinational pharmaceutical company based in New York City. With almost $52 billion in 2019 revenues and 88,000 employees worldwide, Pfizer is one of the world’s largest pharmaceutical companies. Pfizer shares are listed on the New York Stock Exchange and Pfizer has been a member of the Dow Jones Industrial Average index since 2004, so it’s easy to see why many investors want to buy Pfizer shares.

-

-

Where to Buy Pfizer Shares?

When it comes to finding a platform on which to buy shares, there are loads of different brokers to choose from. Whilst this means you have plenty of choice, it can also make it tricky to find stock brokers for you.

You should also consider whether you want to buy Pfizer shares and hold the assets, which is the traditional way of investing, or trade share contracts for difference (CFDs). CFDs allow you to trade shares without actually owning the assets.

To help you find where to buy Pfizer shares, below we’ve reviewed some of the most popular UK share brokers. Let’s take a look at what they have to offer.

Plus500

Plus500 is a specialist CFD broker that is well known for its low fees, with no commissions and some of the tightest spreads in the industry. There are no fees when it comes to deposits or withdrawals, either.

Trading on Plus500 takes place on the broker’s proprietary platform. One of the things about this is that you can create custom price alerts that can be sent to your mobile via the Plus500. This means you’ll never have to worry about missing out when Pfizer shares hit a certain price. The platform also has plenty of technical indicators and some basic charting tools.

Plus500 has a minimum deposit of just £100, which is lower than most brokers, and accepts a range of payment methods including PayPal. This broker is licensed by numerous authorities, including the FCA, so you know you’re in safe hands.

Our Rating

80.5% of retail investors lose money when trading CFDs with this provider. Sponsored ad

80.5% of retail investors lose money when trading CFDs with this provider. Sponsored adFXCM

If you don’t fancy being restricted to a single trading platform, you should check out FXCM. While the likes of Plus500 only offer their own proprietary platforms, FXCM supports the likes of MetaTrader 4, Ninja Trader and Zulu Trade, the last one offering social trading.

These platforms provide a range of advanced trading and backtesting tools that you can use to take your trading to the next level. Alternatively, you can use FXCM’s proprietary charting software for quick technical analysis.

FXCM doesn’t offer as many shares as other brokers, with companies mostly based in the US and Europe, but you can trade Pfizer CFDs on this platform. On the plus side, it doesn’t charge commission and the spreads are lower than the industry average, while non-trading fees are also kept low.

Our Rating

There is no guarantee you will make money with this provider. Sponsored ad

There is no guarantee you will make money with this provider. Sponsored adWhy Do People Buy Pfizer Shares?

Pfizer is one of the world’s largest pharmaceutical companies, with over $50 billion in sales spread over 125 countries. Thanks to its leadership, its large R&D pipeline, its strong cash flows for M&A and its remarkable dividend yield.

Deciding which shares or stocks to buy is never an easy task, whether you’re investing in Pfizer, want to buy Amazon shares or are interested in any other company, but the ultimate decision is strictly yours to make. We cannot give you personalized investment advice or make the investment decision for you.

Strong profitability and cash flows

Despite slightly shrinking revenues in 2019 ($52 billion vs. nearly $54 billion in 2018), Pfizer’s profit margins stood in excess of 30%, significantly up from 2018.

While sales and profits can vary significantly in a business where old drugs lose their patents while new ones come to market, strong cash flows are key to continue growing and to reward shareholders. With over $12.5 billion in cash from operating activities, Pfizer has ample ability to invest in its R&D pipeline and pursue lucrative M&A deals.

The spinoff of its Upjohn and Consumer Health businesses will shrink Pfizer’s size significantly. Nevertheless, it will keep large stakes in the new businesses that will continue to contribute to its bottom line.

Large drug pipeline and a history of innovation

Pfizer is one of the most prolific pharmaceutical companies in terms of number of new drugs coming to market every year. At the end of 2019, it had 95 products in the pipeline, and marketed or distributed over 300 products in the US and worldwide.

Pfizer’s 171-years long history of innovation in all domains, from disease-specific drugs to antibiotics, vaccines and over-the-counter remedies is remarkable.

Refocusing of the group on the core business

Pfizer’s spinoff of its Upjohn division gives its shareholders a controlling stake in a new world leader in generic manufacturers. The merger of Upjohn with Mylan, one of the largest generic drug manufacturers in the world. Consequently, buying Pfizer shares before the merger will entitle the holder to a double dividend: one from Pfizer and one from Upjohn-Mylan.

Similarly, the decision to merger Pfizer’s and GSK’s consumer healthcare businesses will create a world leader in many over-the-counter remedies and supplements.

Consequently, the “new Pfizer” will be able to focus on its core business of Biopharmaceuticals while receiving dividends and participating in the growth of two category leaders in generics and consumer healthcare.

A strong position in the race for a coronavirus vaccine

Since the beginning of the coronavirus crisis, Pfizer has partnered with NASDAQ-listed biotech firm BioNTech to develop a Covid-19 vaccine using novel mRNA technology. At the time of writing, the Pfizer-BioNTech partnership was among the front-runners in the race to develop the vaccine, with human testing beginning in Germany in April and a US study in May.

In April, both firms announced their plan to produce millions of vaccine doses by the end of 2020, and hundreds of millions by the end of 2021. Pfizer is rumored to be ready to enter Phase III studies as early as July.

Large and growing dividend paired with strong share buybacks

In 2019, Pfizer paid $8 billion in dividends to shareholders and spend another ~$9 billion in share buybacks, bringing shareholder remuneration at almost $17 billion. Pfizer’s generous and steadily growing dividend gives Pfizer shares a strong income component, even though the company may slow down its share repurchase program for optics.

At the time of writing, the dividend yield on Pfizer shares was over 4.5%, an attractive proposition for investors looking for yield. In addition to the growth potential of the company, from vaccines and new drugs to participation in new generics and consumer healthcare giants.

About Pfizer Shares

Company History & Business Model

Pfizer is one of the world’s largest pharmaceutical companies, with 2019 revenues approaching $52 billion and over 88,000 employees worldwide. Its products are sold in 125 countries. In 2018, eight of Pfizer’s drugs generated over $1 billion in global sales.

Founded in 1849, Pfizer is headquartered in New York City and is listed on the New York Stock Exchange. Pfizer shares are a component both of the Dow Jones Industrial Average and the S&P 500 indices. Pfizer’s business is split into 3 divisions: Biopharmaceuticals, Upjohn (soon to merge with Mylan) and Consumer Healthcare. In 2019, 46% of its revenues came from the US, 9% from China, 8% from Japan and 37% from the rest of the world (with no market >8% of global sales).

Biopharma is Pfizer’s largest division, with just under $40 billion in 2019 revenues (up by almost $2 billion, or 5%, year-on-year). Pfizer develops and sells drugs in 6 key therapeutic areas: internal medicine, oncology, hospital, vaccines, inflammation & immunology and rare diseases, and had 6 products with 2019 sales exceeding $1 billion.

Upjohn, Pfizer’s second-largest division with $10 billion in 2019 revenues, is set to be merged with generic drug-maker Mylan in 2020. Pfizer will spin off Upjohn and merge it into Mylan via a tax-light structure called a Reverse Morris Trust, thus giving Pfizer shareholders 57% of the combined entity. With over $20 billion in revenues, the new company would become the uncontested global leader in generic drugs, giving it a strong advantage in a brutally competitive market.

Last, Consumer Healthcare represented $2 billion in revenues in 2019. In July 2019, Pfizer announced the completion of a merger between its Consumer Healthcare division and UK-based pharma giant GlaxoSmithKline’s consumer business. The new entity, owned 32% by Pfizer, is a world leader in overt-the-counter (i.e. prespriction-free) pain relief, respiratory medicines, oral health products vitamins, minerals and supplements.

As a leader in branded and patented drugs, Pfizer faces several challenges including patent cliffs (large drop in sales when patents expire), threats from generics and FDA approvals that can prove exceedingly lengthy. Yet, in 2019, Pfizer had 95 products in its R&D pipeline, including 26 in Phase I, 37 in Phase II, 23 in Phase III and 9 products in the registration phase.

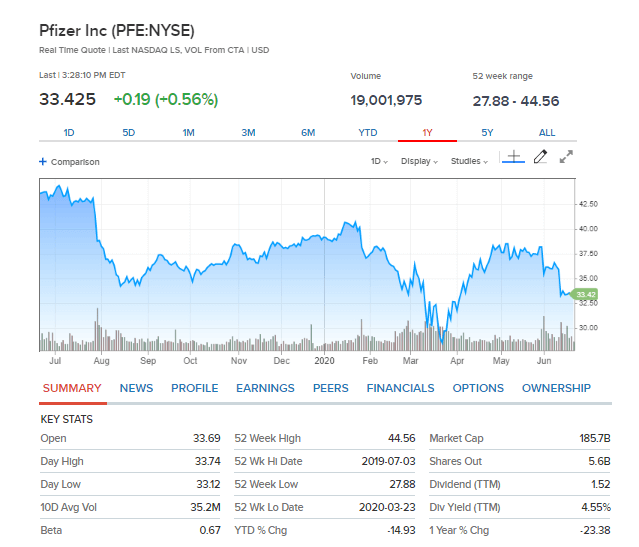

Pfizer Share Price

Pfizer is listed on the New York Stock Exchange under the NYSE:PFE ticker, and is a component of the Dow Jones Industrial Average and the S&P 500.

Since January 2020, prior to the coronavirus crisis, Pfizer shares have lost a little over 17%, primarily due to the loss of exclusivity of its billion-dollar epilepsy and nerve pain Lyrica and the spinoff-plus-merger of the Upjohn division into Mylan.

With a 95-drugs strong pipeline, including 32 products in Phase III and registration phase.

Further, a merger between Upjohn and Mylan will create a world leader in generics, better position to compete in the market than Upjohn or Mylan alone. Similarly, the merger of its Consumer Healthcare business with that of GSK allows Pfizer to focus on its core Biopharma segment while retaining a large stake in a new consumer healthcare world leader.

At the time of writing, the analyst consensus on Pfizer shares was between “Buy” and “Hold”, with price targets for the next 12 months ranging from $35–$53 (average of $40.3).

How To Buy Pfizer Shares

Now that we’ve provided you with some background information on Pfizer shares, you may to want to invest in stocks for yourself. If you do want to buy Pfizer shares, you can use this step-by-step walkthrough to learn how to invest in Pfizer.

If you choose to use a different platform, the process remains largely the same.

Step 1: Search for Pfizer (PFE) shares

On the stock trading platform, use the search function to look up Pfizer or its ticker (PFE). You will see two kinds of search results: markets and people. The first one concerns tradable instruments such as shares or commodities. The second allows you to find other users, see their profiles and portfolio as well as their P&L statistics.

Step 2: Select “Trade” to get started

After doing your research carefully, including reading annual reports, press coverage and analyst commentaries, you are ready to buy Pfizer shares! Before clicking “Trade”, make sure you are using your own portfolio. If you simply wish to try your hand at trading, you can also use free demo account for free paper trading.

When you are ready, click “Trade” to open the trading window and specify the direction, amount and options of your order.

Step 3: Buy Pfizer Shares

Once you’re in the trading window, the first step is to specify whether to sell (including short-selling) or buy Pfizer shares. Long (“buy”) orders with no leverage are executed directly while leveraged and short orders are made via CFDs.

Next, specify how much you want to trade. You can set a specific number of shares (including fractions of shares) or a dollar amount to buy or sell. You will see the number of units and the exposure (in percentage and dollar amount) that the trade involves.

The default order type is a market order, but you can specify limits and use special trade features such as leverage, stop-loss and take-profit,

Last, review the fees at the bottom if your trade is via CFDs (no commissions on trades otherwise) and click “Open Trade” or “Set Order” outside of market hours to complete your trade!

Conclusion

As mentioned many times in this article, Pfizer is one of the largest pharmaceutical companies in the world. With a renewed focus on biopharmaceuticals, strong margins and a healthy dividend, Pfizer shares are an attractive buy proposition.

We strongly recommend that you read Pfizer’s annual reports, press coverage and analyst commentaries to understand the company’s business and key risks. This is particularly important in the pharmaceutical sector, where the risks and business dynamics are not always easy to grasp at first glance.

FAQs

Where is Pfizer based and listed?

Pfizer is headquartered in New York City and is listed on the New York Stock Exchange. It is a component of the SP500 and the Dow Jones Industrial Average.

What business is Pfizer in?

Pfizer’s core business is the development and distribution of biopharmaceuticals, with a focus on 6 key therapeutic areas: internal medicine, oncology, hospital, vaccines, inflammation & immunology and rare diseases. Its Upjohn and consumer healthcare businesses are set to be merged with Mylan (Upjohn) and GSK’s consumer health business respectively.

Can I buy Pfizer shares if I am not based in the US?

Absolutely. You simply need to use a broker that offers shares listed on the NYSE. The popular brokers in this guide do!

Can I buy fractional shares of Pfizer?

Many of the brokers reviewed in this article allow you to buy or short fractional shares of Pfizer, mainly via CFDs.

Does Pfizer pay a dividend?

Pfizer has paid a large and growing dividend over the years, coupled with very large share buyback programs. In 2019, Pfizer spend a total of $17 billion in dividends and buybacks. At the time of writing, Pfizer shares had a dividend yield of just over 4.5%.

A-Z of Shares

Alan Draper Lewis

View all posts by Alan Draper LewisAlan is a content writer and editor who has experience covering a wide range of topics, from finance to gambling.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com