Best Same Day Loan Providers & Sites in 2021

If you’re in a position where you need access to fast cash – then you’ll likely need to consider a same day loan. To clarify, a same day loan – or instant loan as it is often called, is usually packaged as a payday loan. By this, we mean that you’ll likely need to use a payday loan provider that specializes in smaller sized loans, albeit, they often have the capacity to release the funds in as little as one hour.

On the flip side, this will come at a cost – a much higher APR rate than what you will find by using an alternative funding source, such as a personal loan or credit card. Nevertheless, if it is fast funding that you are looking for, then be sure to read our in-depth Same Day Loan Guide. Within it, we’ll cover everything that you need to know – such as how a same day loan works, how much it is likely to cost you, how quickly you will get your hands on the funds, and more.

-

-

Apply Now for a Payday Loan With Piggy Bank

Our Rating

PiggyBank Loans have now gone into AdministrationNote: If you have the capacity to wait a bit longer for your loan funds – say, 1-2 working days – then you are best advised to go with a more conventional personal loan. This is because the interest rate that comes with a personal loan is likely to be much lower.

PiggyBank Loans have now gone into AdministrationNote: If you have the capacity to wait a bit longer for your loan funds – say, 1-2 working days – then you are best advised to go with a more conventional personal loan. This is because the interest rate that comes with a personal loan is likely to be much lower.What are the Pros and Cons of Same Day Loans?

The Pros

- Perfect for emergency funding – get your hands on the funds in a speedy manner

- Some lenders can release the funds in just one hour

- Suitable for credit profiles of all sizes

- Great if you only need to borrow a small amount of money

- FCA caps limit the amount of interest that you can pay

The Cons

- Interest rates still much higher than a personal loan

How to Apply for a Same Day Loan? Read our Step-by-step Guide:

Terminology in the online loan space is often used interchangeably. In this respect, we mean that same day loans, instant loans, and payday loans are typically similar in what they offer. Although this includes super-fast funding times, this is usually at the cost of smaller loan sizes and higher APR rates. Nevertheless, if you’ve never applied for a same day loan before, then we would suggest reading the step-by-step guide that we have outlined below.

Step 1: Find a suitable lender

Your first port of call will be to find a suitable same day loan provider. You’ll initially need to check the provider’s website to assess how quickly they typically release the funds. Don’t forget, even if the lender does market funding on a same day basis, they will still need to verify your information before they can do this.

You also need to make some considerations regarding fees and loan sizes. It is all good and well if your lender is notable with its funding times, but you also need to make sure that they are able to lend you the required funding amount. Moreover, you also need to assess what the provider’s fee structure is like.

Note: On top of checking the same day loan provider’s funding time-frame, loan size capacity, and underlying interest rates – you also need to make sure that the platform is authorized and regulated by Financial Conduct Authority (FCA).Step 2: Start the application process

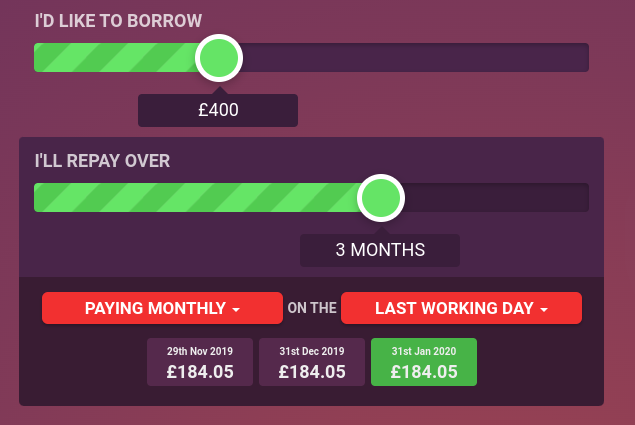

Once you have found a lender that meets your individual needs, you will then need to start the online application. In the vast majority of cases, you will need to get the ball rolling by entering the amount that you wish to borrow, and for how long, via the homepage. You’ll then be taken the main application page.

Step 3: Enter your personal and financial information

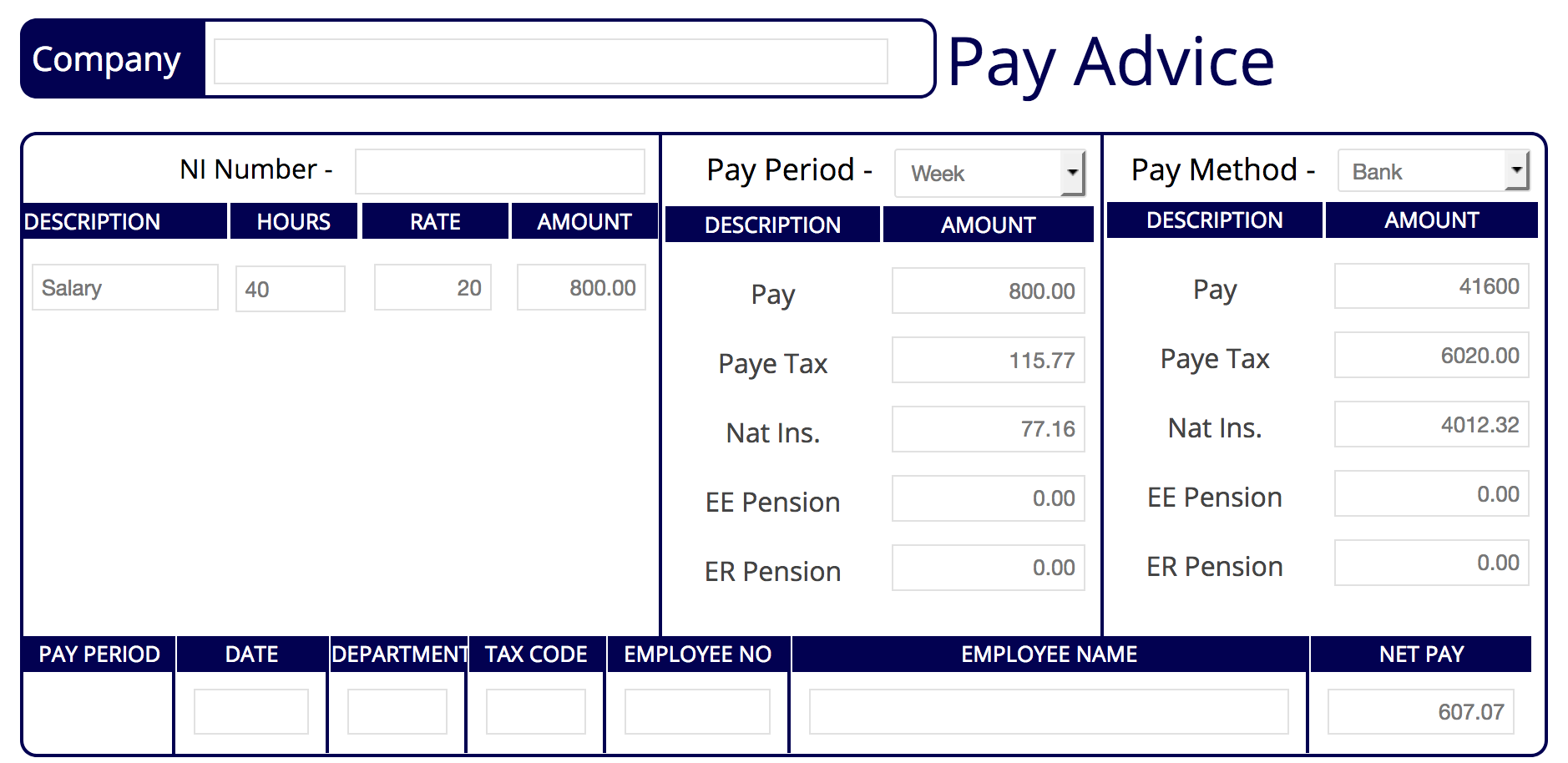

As is the case with all credit-based applications, you will now need to provide the lender with your personal information. This will include your full name, home address, date of birth, driver’s license or passport number, telephone number, and email address. After that, you’ll then need to enter some information about your income.

Not only will this include your employment status, but also the amount of money that you bring home each month, and the frequency at which you receive your salary (for example the last day of the month). You will also need to provide details about the place that you work, such as the name of the company, the address, and your direct line manager.

Step 4: Read the digital loan agreement and sign it

Once you have entered your personal and financial information, the same day loan provider will then run its electronic checks. They do this by cross-referencing your data with third-party sources – including that of credit bureaus. The key point here is that because you require the loan funds on the same day, they will attempt to verify your information without asking for supporting documentation.

As such, if you are in possession of a good credit score with the main three bureaus, then you stand the best chance possible of having your application approved instantly. Once a decision has been made (which usually takes no more than a couple of minutes), you will then be able to view your pre-approval rates. This covers the interest payable on the loan, as well as when you will be required to pay it back. If you’re happy with the terms outlined in the loan agreement, sign it to complete the application.

Step 5: Satisfy the verification checks

If the lender was unable to verify your information automatically via its third-party sources, you’ll likely need to provide supporting documentation. Don’t worry, as this will usually consist of a recent payslip or bank account statement – which is hopefully something you have access to. Once you upload the document, the same day loan provider will manually verify it, before sending you the digital loan agreement to read and sign.

Reviewer’s choice of best same day loan providers

Reviewers Choice

Piggy Bank RatingAvailable Loan Amount£100 - £1000Available Term Length7 days to 5 MonthsRepresentative APR1,255% up to 1698.1%Product Details

RatingAvailable Loan Amount£100 - £1000Available Term Length7 days to 5 MonthsRepresentative APR1,255% up to 1698.1%Product Details- Try our feature Payday Loan Supplier Instead

Pros- This company has now gone into administration

Key Facts- Piggy Bank are a Direct Lender

- Available for Bad Credit Scores

Car Cash PointPeachy Loans RatingAvailable Loan Amount£100 - £1000Available Term Length1 Month to 1 YearRepresentative APR720%Product Details

RatingAvailable Loan Amount£100 - £1000Available Term Length1 Month to 1 YearRepresentative APR720%Product Details- Peachy Are A Direct Lender

Pros- Spread Payments Over Multiple Months

- Funds within 1 hour of processing

- Unavailable for those with current CCJs

- Minimum Monthly Income of £1000 Required

Key Facts- Loan application Accessible on any platform or device

- Peachy Claim Now Hidden Fees

- See Fees Upfront On Their Calculator

Best 8 Same Day Loan Providers 2021:

So now that you know how to apply for a same day loan, you’re now ready to begin the online application with your chosen lender. However, if you’re unsure which lender to go with, we have outlined the best three providers currently active in the UK market. To gauge the type of factors that we look out for before listing a recommended lender on our site, be sure to read the following criteria.

Criteria used to rank the best same day loan lenders

- How quickly can the provider release the loan funds to you

- The minimum and maximum loan sizes available

- The minimum eligibility requirements to get the loan

- How much APR you’ll be paying on the same day loan

- Registered with the FCA as an approved UK lender

7. Ocean Finance – Access to a very wide pool of same day loan lenders

Much like in the case of Very Merry Loans, Ocean Finance is a third-party loan platform that has the capacity to match you with suitable same day lenders.

However, the overarching selling point to Ocean Finance is that they are able to facilitate loans to those with credit scores that fall within the 'poor' or 'very poor' range. As such, if you need fast cash to cover a financial emergency, but your credit profile is damaged, Ocean Finance is potentially your best bet. In terms of the fundamentals, you can apply for a same day loan from just £100, with the maximum loan size capped at £10,000.

However - and as we discussed with Very Merry Loans, larger loan sizes will require enhanced checks on your financial standing, which will likely delay the same day funding process. Nevertheless, you can apply for a same day loan with a term of just 3 months, up to a maximum of 5 years.

Our Rating

- Extended repayment period of up to 5 years

- Perfect for those with bad credit

- Performs a soft-credit enquiry that won't hurt your credit score

- Ocean Finance is not a direct lender

8. Peachy – Best direct lender - Loans within the hour

Peachy is a UK based direct lender that allows borrowers to apply for same day funding entirely online. The overarching benefit to using Peachy is that in some cases, you will have access to your loan funds in less than 1 hour.

This makes Peachy one of the fastest same day loan providers in the space. However, this does come at a cost. First and foremost, the lender advertises a representative rate of 720% APR. Not only is this expensive, but as you might well know, representative rates are typically the best rates on offer - meaning that unless your credit score is in good health, you'll likely pay more.

It is also important to note that Peachy loans are capped at £1,000, so if you require a larger funding amount, then you might need to consider one of the other same day loan providers that we have discussed thus far.

Our Rating

- Limited loan repayment period

- Most loans are transferred to your bank account within 1 hour of being approved

- High representative rate of 720% APR

- One is required to have a minimum monthly income of at least £1,000

What is a Same Day Loan?

As the name suggests, a same day loan is simply a loan that allows you to access the funds on the same day that you make the application. As we noted earlier in our guide, such loans are also labelled as ‘instant loans’, although in reality, they are merely payday loans.

The reason for this is that unlike a more conventional personal loan or credit card application, same day loan providers will usually perform watered-down checks on your financial standing, which is why they are able to release the funds so quickly. However, this is also why the APR rates on same day loans are much higher, and why the size of the loans are much smaller.

Same Day Loans: How much can I borrow? APR fees?

As we have noted throughout our guide, same day loans will usually come with a much higher APR rate, as well as smaller loan sizes. This is to offset the risk of releasing the funds in such a fast amount of time. Nevertheless, we have broken down the size of the same day loan that you will likely be able to get, as well as its respective fees.

- Small loan sizes

If you require emergency cash on a same day basis, then this is likely because you need to cover an unexpected event. This could be anything from covering the costs of repairing your vehicle, or seeing you through the last few days of the month before you next get paid.

Either way, it is likely that the size of the required loan amount is much smaller than what would be required via a personal loan. Nevertheless, same day loan providers will typically cap the amount that you can borrow to £1,000. If you do need more than this, then the lender will likely need to perform additional checks, which can include supporting documentation. If they do, then same day funding is probably going to be out of the question.

- Higher APR rates

If you are happy to borrow an amount below £1,000 in order to obtain same day funding, then you also need to make some serious considerations regarding the underlying APR fees. While the specific amount payable will depend on the provider in question – as well as your current creditworthiness, you should expect to pay a rate of between 100% APR and 1,000 APR%.

In fact, you could end up paying even more, with the likes of Very Merry Loans explaining that some of their partnered providers charge up to 1,333% APR. However, the good news is that in late 2018, the FCA installed new regulations that caps the amount of interest that payday loan providers can charge. This amounts to £24 per £100 that you borrow, with the total interest payable never exceeding twice the amount borrowed. While this still represents a sky-high rate in APR terms, it does at the very least put some limitations on how much you end up paying on your same day loan.

Am I eligible for a Same Day Loan?

Whether or not you are eligible for a same day loan will depend on a number of factors. This includes the same day loan provider themselves, as well as your current credit score and income amount. In order to give you a clearer picture as to some of the metrics that same day loan companies look for when assessing your eligibility, check out the following list.

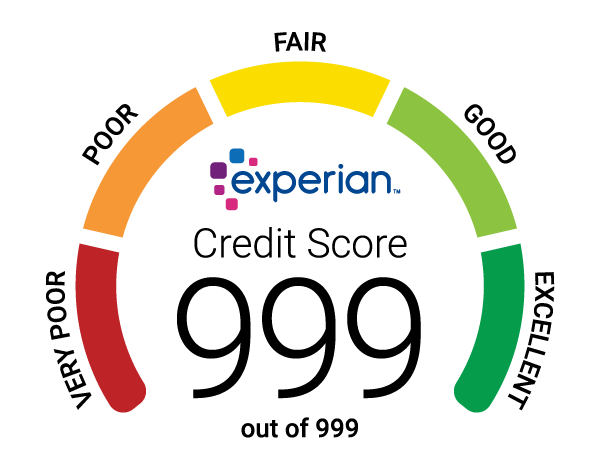

i) Credit score

If you are currently in possession of a healthy credit score, then you will likely have no issues at all in being approved for a same day loan. On the contrary, if your score falls within the ‘poor’ or ‘very poor’ threshold, then the chances of having your application approved are much lower. If you think that your credit score is less than ideal, then you might best off going with a lender that doesn’t run credit checks, and instead looks at other metrics such as your income.

ii) Annual Income

Regardless of whether the same day loan provider looks at your credit score, they will always assess your affordability levels by asking you how much you earn. Some lenders will state the minimum annual income amount, while others judge this on a case-by-case basis. With that being said, you will likely need to be earning at least £10,000 per year to stand a chance of being approved for a same day loan.

iii) Historical Relationship With Debt

Same day loan lenders will also need to look at your historical relationship with debt. On the one hand, if you have always paid your previous debt obligations back on time and thus – never missed a repayment, then you will stand a very good chance of obtaining a same day loan. On the other hand, if your credit report highlights multiple late or missed payments, or worse – defaults, then you might find it difficult to get a same day loan.

Apply Now for a Payday Loan With Piggy Bank

Our Rating

PiggyBank Loans have now gone into Administration

PiggyBank Loans have now gone into AdministrationGlossary of loan terms

Credit Score

Credit ScoreA credit score shows your creditworthiness. It's primarily based on how much money you owe to loan or credit card companies, if you have ever missed payments or if you have ever defaulted on a loan.

Guaranteed Approval

Guaranteed ApprovalGuaranteed Approval is when, no matter how bad, your credit score its, your loan application will not get declined.

Credit Limit

Credit LimitA Credit Limit is the highest amont of credit a lender will lend to the borrower.

Collateral

CollateralCollateral is when you put up an item against your loan such as your house or car. These can be repossessed if you miss payments.

Cash Advance

Cash AdvanceA Cash Advance is a short-term loan that has steep interest rates and fees.

Credit Rating

Credit RatingYour Credit Rating is how likely you are to fulfill your loan payments and how risky you are as a borrower.

Fixed Interest Rate

Fixed Interest RateFixed Interest Rate is when the interest rate of your loan will not change over the period you are paying off you loan.

Interest

InterestThe Interest is a percentage based on the amount of your loan that you pay back to the lender for using their money

Default

DefaultIf you default on your loan it means you are unable to keep up with your payments and no longer pay back your loan.

Late Fee

Late FeeIf you miss a payment the lender will charge you for being late, this is known as a late fee.

Unsecured Personal Loan

Unsecured Personal LoanAn Unsecured Personal Loan is when you have a loan based solely on your creditworthliness without using collateral.

Secured Loan

Secured LoanA Secured Loan is when you put collateral such as your house or car up against the amount you're borrowing.

Prime Rate

Prime RateThis is the Interest Rate used by banks for borrowers with good credit scores.

Principal

PrincipalThe Principal amount the borrower owes the lender, not including any interest or fees.

Variable Rate

Variable RateA Variable Rate is when the interest rate of you loan will change with inflation. Sometimes this will lower your interest rate, but other times it will increase.

Installment Loan

Installment LoanAn Installment Loan is a loan that is paid back bi-weekly or monthly over the period in which the loan is borrowed for.

Bridge Loan

Bridge LoanA Bridge Loan is a short term loand that can last from 2 weeks up to 3 years dependant on lender.

AAA Credit

AAA CreditHaving an AAA Credit Rating is the highest rating you can have.

Guarantor

GuarantorA Guarantor co-signs on a loan stating the borrower is able to make the payments, but if they miss any or default the Guarantor will have to pay.

LIBOR

LIBORLIBOR is the London Inter-Bank Offered Rate which is the benchmarker for the interest rates in London. It is an average of the estimates interest rates given by different banks based on what they feel would be the best interest rate for future loans.

Home Equity Loans

Home Equity LoansHome Equity Loans is where you borrow the equity from your property and pay it back with interest and fees over an agreed time period with the lender.

Debt Consolidation

Debt ConsolidationDebt Consolidation is when you take out one loans to pay off all others. This leads to one monthly payment, usually with a lower interest rate.

Student Loan

Student LoanIf you obtain a Student Loan to pay your way through College then you loan is held with the Department for Education U.K.

Student Grants

Student GrantsFinancial Aid in the form of grants is funding available to post-secondary education students throughout the United Kingdom and you are not required to pay grant

FAQs:

How quickly can same day loan providers transfer the funds?

There is no one size fits all answer to this question, as there are simply too many variables to consider. On the one hand, if your credit profile is in good standing and the lender is able to verify your identity electronically, then you might be able to obtain a same day loan in less than 1 hour. On the flip side, if your credit profile is less than ideal, and/or the lender is unable to verify your identity, then this can delay the process by a couple of days.

How much can I borrow via a same day loan?

Due to higher risks of performing watered-down verification checks, same day loan lenders typically limit the funding amount to £100-£1,000.

How much do same day loans cost?

Same day loan providers are essentially payday lenders in all but name. As such, you could be paying anywhere between 100% APR and 1,000% APR – sometimes more.

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up