If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes.

In this article, we review the ins and outs of the Halifax share dealing account. We cover everything from fees, commissions, tradable assets, user-friendliness, and safety.

-

-

eToro - Invest in shares with 0% commission

Our Rating

- 0% commission on stocks

- No markup, ticketing fees, management fees

- Fractional shares available

- Easy to use platform

75% of investors lose money when trading CFDs.

75% of investors lose money when trading CFDs.What is Halifax Share Dealing?

Halifax is a UK high street bank that offers personal and business accounts. Outside of its core retail banking services, the financial institution also offers a fully-fledged share dealing platform. You don’t need to be an account holder at Halifax to access the site, so its platform is suitable to all UK residents over the age of 18.

Halifax is a UK high street bank that offers personal and business accounts. Outside of its core retail banking services, the financial institution also offers a fully-fledged share dealing platform. You don’t need to be an account holder at Halifax to access the site, so its platform is suitable to all UK residents over the age of 18.The main asset classes offered by Halifax is that of UK stocks and shares. This includes most companies listed on the London Stock Exchange. You will also have access to international shares across six exchanges, including the US. This means that you can get your hands on popular companies like Apple, Nike, and Ford Motors.

Outside of traditional shares, you can also invest in ETFs (exchange-traded funds) and investment trusts. The platform is suited for those of you that that feel comfortable buying and selling assets on a DIY basis. With that said, Halifax also gives you access to more than 2,000 funds, which is ideal if you want to gain exposure to the financial markets but you don’t know which companies to pick.

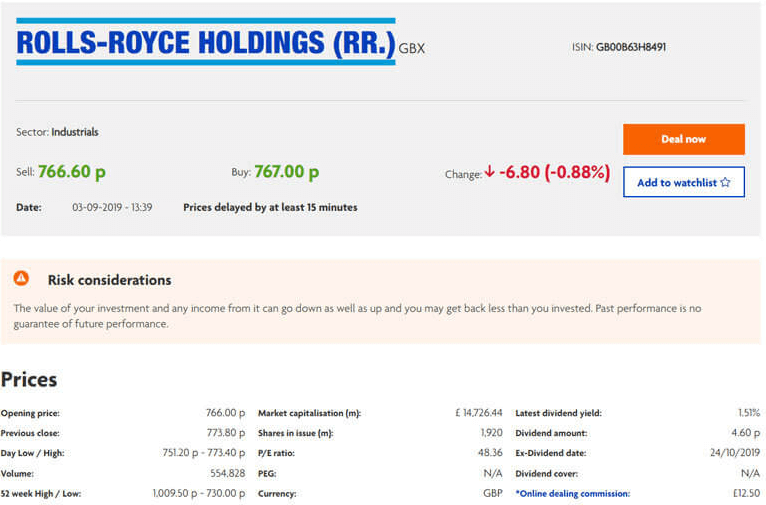

We also like the fact that Halifax offers a straight forward flat-fee pricing structure, as opposed to a more confusing variable rate. This stands at £12.50 per trade, which you will need to pay when you enter the position and again when you close it.

Pros and Cons of Halifax Share Dealing

Pros:

- Simple flat-fee cost to buy stocks and shares

- UK and international equities listed

- ETFs and more 2,000 funds

- Great for DIY investors

- User-friendly buying process

- No need to have a Halifax current account

- Regular promotions where share dealing charges are slashed

Cons:

- Not suitable for day trading or swing trading

- No CFD, forex, or spread betting

- Expensive for those placing regular trades

What can you Trade at Halifax?

Halifax offers a reasonably good selection of asset classes; all of which centre on a traditional buy and hold strategy. That is to say, the platform is suited to those of you that wish to invest in an asset, hold it for a number of months or years, and then (hopefully) sell at a profit.

Let’s break down your options in more detail.

Share Dealing

Halifax gives you unfettered access to the London Stock Exchange. This means that you will be able to buy and sell hundreds of UK-listed companies at the click of a button. Whether its equities involved in the energies, construction, retail, tobacco, or technologies sectors; you’re likely to find it at Halifax.

Outside of the UK trading space, you will also have access to six international stock exchanges. This includes the two main US markets of the New York Stock Exchange (NYSE) and NASDAQ, as well as the NYSE AMEX. Regarding the latter, this covers small-to-medium-sized American companies.

Then you have the XETRA exchange (Germany), MTA (Italy), and Euronext (Europe). This gives you a good opportunity to diversify into several global equity markets.

Funds

If you’re the type of individual that doesn’t know how to pick companies to invest in, or you simply don’t have time to perform your own research you’ll be pleased to know that the Halifax share dealing platform offers more than 2,000 funds. This allows you to have your money managed by a third-party provider. This isn’t Halifax itself, but large-scale institutions like iShares and Vanguard.

Halifax also gives you access to a number of sustainable funds. These are companies that operate in eco-friendly and socially responsible industries. We also like the partnership that Halifax has formed with online research site Morningstar. The partnership ensures that you are presented with the best performing funds of the month.

ETFs

Halifax is also strong in the ETF department. This is great if you plan to invest in wider stock exchanges like the FTSE 100 or S&P 500. In doing so, you can add hundreds of companies to your portfolio via a single click. Best of all, you will still be entitled to dividends. If and when they are distributed by the company in question, the cash will paid into your Halifax account. ETFs are also available in other sectors, such as oil, gas, and gold.

Investment Trusts

Investment trusts are somewhat similar to funds, insofar that the provider will buy heaps of assets. This means that you will be able to buy and sell assets without lifting a finger. But, investment funds actually trade on stock exchanges like the NYSE, meaning that the price will fluctuate throughout the day. Price movements are not only based on the real-time value of instruments held by the investment fund, but the demand and supply of the fund itself.

Bonds and Gilts

If you’re main desire if to invest in assets that general fixed income, Halifax holds a good selection of bonds. This includes government treasuries like UK Gilts and US T-Bills, which typically yield very small amounts. They pay a secure rate of interest that is virtually risk-free. Halifax also covers UK corporate bonds. These are much riskier than government bonds, but in turn, pay a more competitive yield.

No CFDs, Forex, or Spread Betting

If you’re the type of the trader that likes to buy and sell orders on a short-term basis, Halifax won’t be the right platform for you. This is because it does not offer forex, CFD, or spread betting services. This also means that you will not have the option of short-selling companies, nor can you apply leverage.

Payments at Halifax

Once you have opened a share dealing account with Halifax and had your identity verified, you can deposit funds with a debit card or UK bank account. If opting for the former, Halifax will initially attempt to authorize the card with £1 to ensure it matches the name and address you provided in your application.

After that, you are free to use the card as and when you wish, up to a maximum of £100,000. Bank accounts are much slower at the platform, often taken 1-2 working days before the funds are credited.

The other option that Halifax gives is to set up a monthly direct debit. This is a great way to invest a bit of cash at the end of each month. In doing so, you’ll stand the best chance possible of averaging out the ups and downs of the financial markets.

Account Types at Halifax

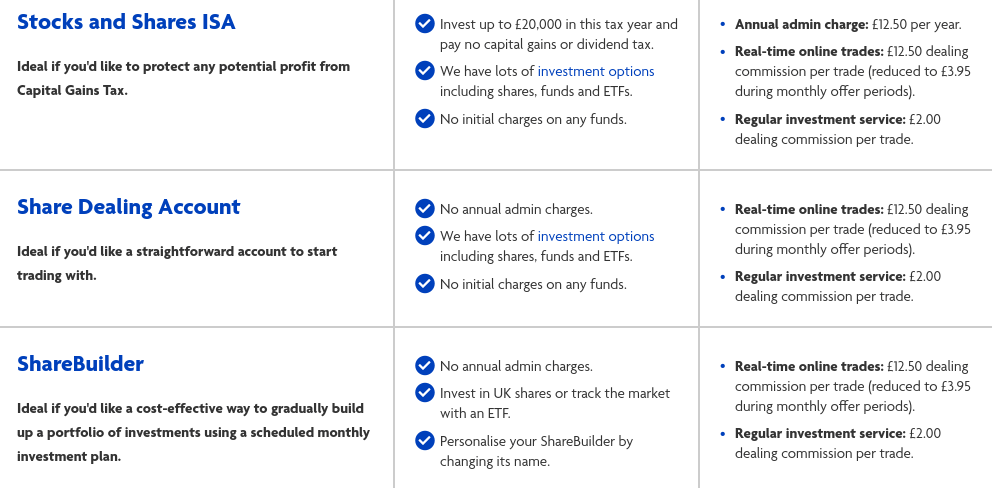

The Halifax share dealing platform offers a number of account types for you to choose from. This includes:

Share Dealing Account

The bog-standard plan offered by Halifax is that of its native share dealing account. This is suited to those of you that simply wish to buy and sell shares yourself. This means that you will need to actively manage your portfolio.

Stocks and Shares ISA

If you are yet to open a stock and shares ISA; this is most definitely the account type for you. In a nutshell, the account works in exactly the same way as the standard stocks and shares account, insofar that you will be investing on a DIY basis. However, the first £20,000 that you invest in the tax year will be exempt from capital gains tax. Although the account is charged at £12.50, it’s a no brainer when you factor in the tax-efficient savings that you will be making.

ShareBuilder

The ShareBuilder account at Halifax is suited to those of you that plan to engage in a long-term investment strategy by injecting a small amount of capital each month. The account gives you access to UK shares and ETFs only, all of which you will need to select yourself.

In order to qualify for the account, you will need to set up a direct debit. However, the minimum investment required is just £20 per month. Best of all, there are no annual platform charges on this account type, and you will get your share dealing costs to a super-competitive £2.

Investment ISA/Account

The investment account at the Halifax share dealing platform comes in two types; both of which allow you to invest in a pre-made portfolio. If you are yet to use up your annual ISA allowance, you can open up an investment ISA account. If that’s not an option, you will just be opting for a standard investment account.

Either way, Halifax gives you three investment portfolios to choose from. This is a choice between a low-risk, medium-risk, and high-risk fund. The overarching benefit of going for this account type is that you won’t need to pick companies yourself. Instead, everything is taken care of by Halifax.

Fees and Share Dealing Charges at Halifax

Although you will always have the option of sticking with a basic, flat-fee share dealing system, a number of pricing alternatives do exist. We cover this in more detail in the subsections below.

Annual Fees

If you are on a share dealing or ShareBuilding account type, you will not pay any annual fees. Those of you on the stocks and shares ISA at Halifax, you will need to pay £12.50 per year. As noted above, the tax savings that you make from opening an ISA account far exceed this minute annual cost.

Things get a bit more complex is you opt for an investment account – as you have three variable fees to take into account. To make things even more complicated, the exact rate is not only dependent on the amount you invest each year but also the type of assets that Halifax adds to your pre-made portfolio.

With that said, Halifax does list its maximum charges, so this at the very least gives us a rough idea:

- Service Fee: 0.24%

- Ongoing Charge: 0.26%

- Transaction Costs: 0.17%

Based on the maximum charges, this is actually quite expensive. But, you need to look at the bigger picture. That is to say, while you will avoid an annual charge by investing on a DIY basis, you need to take full responsibility by actively managing your own money. On the contrary, the pre-made portfolios require no knowledge or input from you, so you can sit back and invest in a passive manner.

Dealing Charges

When it comes to dealing charges at Halifax, this relates to each and every trade that you place. As Halifax operates a flat-fee system, this means that you will pay the same fee when you buy stocks and shares, and then again when you sell them. This stands at £12.50 at Halifax, meaning you are effectively paying £25 per investment.

Whether or not this is competitive will ultimately depend on two key factors, the amount you typically invest per trade, and the frequency in which you trade. We cover a couple of examples below to illustrate how a flat-fee of £12.50 per trade can be both good and bad.

Example Costs

If you are the type of person that simply wants to invest in a few companies every now and then – and hold on to the stocks for a number of years, Halifax is ideal.

For example, let’s say that you invest £2,000 in four different companies throughout the year.

- Across a total investment of £8,000 – you will pay £50 in dealing charges.

- This works out at a minute percentage of 0.625%.

- You will need to pay £50 again when you sell the stocks.

At the other end of the spectrum, let’s say that you are more of an active trader that typically buys and sells 10 companies per month.

- Let’s say that you typically invest £500 per trade

- You would be placing a total of 20 trades per month and 240 per year

- Over the course of 12 months, your total share dealing charges would amount to £3,125

This is a monumental amount of money to be paying on an average trade size of £500. Instead, you would be much better off using a broker that offers a variable commission model, as your trading costs would be reduced considerably.

Reduced Dealing Commission

From time to time, the Halifax share dealing platform will offer a reduced dealing commission promotion. This is typically offered one day per month, between the hours 12.15 pm and 2.15 pm. Crucially, any stocks and shares that you buy during this short window will bring your dealing charges down to just £3.95. In even better news, you will get the £3.95 rate on international stocks and shares all day. You won’t, however, get the reduced rate on funds or ETFs.

Stamp Duty and Currency Conversion Fees

You will need to pay a 0.5% stamp duty fee on all UK purchases other than the Alternative Investment Market (AIM). Additionally, if you plan to purchase shares from international markets, an additional 1.25% will be added to your costs in the form of a currency conversion. This can make it somewhat expensive to buy non-UK stocks.

Which Regulators Govern Halifax?

When choosing a new online stock brokers platform, one of the first things that you need to look out for is the regulatory standing of the provider. In this respect, it will come as no surprise to learn that your money is safe at Halifax. First and foremost, the platform is backed by a leading UK bank that was first established in 1853.

On top of a long-standing track record in the UK financial arena, you will also benefit from the protections of the Financial Conduct Authority (FCA). Failure to comply with the regulations outlined by the FCA can lead to severe sanctions. With that being said, the most important safeguard that you will benefit from by using the Halifax share dealing platform is that of the Financial Services Compensation Scheme (FSCS).

The scheme protects your invested funds by £85,000 in the unlikely event Halifax went bankrupt. This is great news, as the FSCS limit was recently capped at £50,000 for investments. Take note, the FCSC will not compensate you in the event you lose money on the back of an investment that went wrong. Instead, it’s there to protect you from a brokerage collapse.

Getting Started with Halifax Sharing Dealing

If you think that Halifax is right for your long-term investing goals, we are now going to show you how to get started with a share dealing account today.

Step 1: Choose Your Account Type

Your first port of call is to head over to the Halifax share dealing website and choose an account type. Although we discussed account types earlier in our review, this includes:

Your first port of call is to head over to the Halifax share dealing website and choose an account type. Although we discussed account types earlier in our review, this includes:- Stocks and Shares ISA

- Share Dealing Account

- ShareBuilder

- Investment ISA/Account

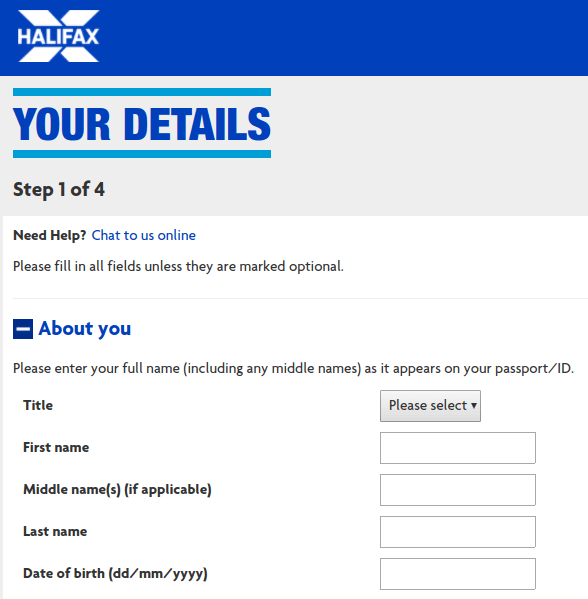

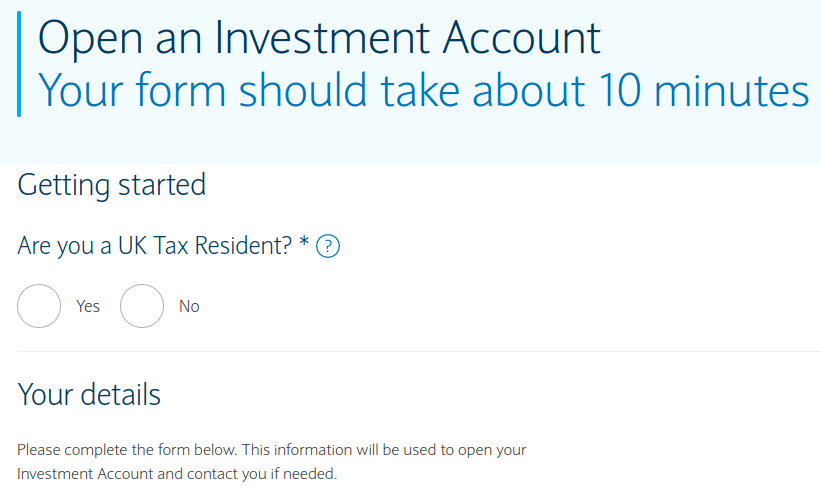

Step 2: Apply for an Account

Once you have selected your preferred account type, you will then need to click on the ‘Open Account’ button. Take note, if you already have a current account with Halifax, you won’t need to complete this step. Simply log in to your online banking portal and follow the steps to get set up instantly!

Nevertheless, assuming you do not have an account with Halifax, you will need to provide a range of personal information as if you were opening a bank account for the first time.

Nevertheless, assuming you do not have an account with Halifax, you will need to provide a range of personal information as if you were opening a bank account for the first time.This includes:

- First and Last Name

- Home Address (addresses for last three years if you have recently moved)

- Nationality

- Date of Birth

- National Insurance Number

- Occupation

- Email Address

- Mobile Number

Step 3: Verify Your Identity

Halifax notes that is most cases, the bank will be able to verify your identity with third-party sources. If this is the case, you won’t need to upload any documents. If Halifax does need more information from you, the bank will ask you for two documents. Firstly, you’ll need to upload a copy of your passport to provide your identity. Secondly, you’ll need to provide a proof of address, which can be a utility bill or banks account statement.

Step 4: Deposit Funds With Debit Card

Your first deposit must come via your UK debit card. The reason for this is that the Halifax will install attempt to authorize £1 from your card as an additional verification step. Essentially, the bank is looking to ensure that your name and address match the details you gave in the application. All being well, you will then be prompted to enter the amount that you wish to deposit.

Step 5: Choose Your Investments

Once your debit card deposit has been credited (which is typically instant), you can process to make an investment. The Halifax share dealing portal is super easy to use, so have a browse before parting with your money. You can search for assets by entering the instrument into the search box. Alternatively, you can browse the platform by the asset class – for example, UK stocks, US stocks, ETFs, etc.

Finally, when you are ready to place a trade, you will need to enter the amount that you wish to buy. Upon confirming your order, the funds will be debited from your cash balance. If you have purchases stocks in a company that pays dividends, you should get the funds 1-2 days after they are distributed.

Platform Features

Outside of its core share dealing services, Halifax doesn’t much in the form of core features. At the forefront of this is the lack of a mobile trading app. Although this is something that Halifax has noted is a work-in-progress, for the time being, you will need to use the mobile web-based version of the site if you wish to buy and sell assets on the move.

Below you will find a brief overview of the select number of features offered at the platform.

Web Trading Platforms

As we briefly noted earlier, the web trading platform at Halifax makes it a seamless task to buy and sell stocks. You simply need to search for the company that you wish to invest in, enter the number of shares you want to buy, and then confirm the order. If you don’t know what company to invest in, it’s also very straight forward to browse through the main trading platform.

SIPP Accounts

While we have made ongoing reference to the ISA accounts offered by Halifax, we are yet to mention it’s Self Invested Personal Pension (SIPP) offering. This allows you to shield your pension investments from capital gains and income tax, and receive up to 45% tax relief on contributions.

Research

Although Halifax does not generate its own research analysis, the platform has partnered with two leaders in this space; Morningstar and Web Financial Group.

Customer Support

The customer service team at Halifax share dealing work six days per week. Between Monday and Friday, telephone support is available between 8 am and 9 pm. On Saturday’s, support is available between 9.30 am and 12.30. The direct share dealing contact number is 0345 722 5525.

Conclusion

If you are a casual investor that plans to buy a few stocks or ETFs, and then hold on to your investment for a number of years, the Halifax share dealing platform is right up your street. Crucially, at a flat-fee of just £12.50 per trade, this allows you to gain exposure to the financial markets without getting hit with high charges.

You will also benefit from a platform that is heavily regulated – including a full partnership with the FSCS. This ensures that no matter what happens, your investments are protected up to the first £85,000.

The platform won’t be suitable for you if you are a short-term trader that typically places a dozen or more orders throughout the month. Instead, you’ll be suited for a platform that charges a variable commission rate. This is also the case if you are looking to place more sophisticated trades such as short-selling or leverage.

All in all, Halifax is a good entry-level share dealing platform that can be utilized by investors of all sizes, as long as you do not plan to buy and sell investments frequently!

eToro - Invest in shares with 0% commission

Our Rating

- 0% commission on stocks

- No markup, ticketing fees, management fees

- Fractional shares available

- Easy to use platform

75% of investors lose money when trading CFDs.

75% of investors lose money when trading CFDs.FAQs

How much does it cost to trade at Halifax?

Halifax share dealing platform charges a flat-fee of just £12.50 per trade. You will need to pay this at both ends of the trade. There i no annual charge unless you opt for an ISA stocks and shares account or an investment account.

Is the Halifax shares trading platform regulated?

Yes, Halifax is regulated by the FCA and partnered with the FSCS.

Do I need to upload ID to trade at Halifax?

In most cases, no. However if Halifax is unable to verify your identity from its third-party sources, you will need to upload a copy of your passport and a proof of addess.

What payment methods can I use at Halifax?

When you first sign up you will need to use your debit card. After that, you will also have the option of funding your account with a bank transfer or direct debit.

Does Halifax offer international shares?

Yes, Halifax gives you access to six international stock exchanges. This includes markets in the US, Italy, and Germany.

See Our Full Range Of Brokers Reviews – Brokers A-Z

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Most Popular News

Latest News

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

Credit Card Lending to UK Individuals Hit a Record £54.16 Billion Last Quarter

According to data gathered by LearnBonds.com, credit card lending to individuals in the United Kingdom (UK) reached £54.16 billion in Q3 2019. This represents the 13th consecutive quarter with growth in the gross lending value on credit cards to individuals in the UK. Credit Card Lending Grew Last Quarter Credit card lending in the UK...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Question & Answers (0)