Scalping Trading UK Guide 2026

Scalping is a popular trading strategy that seeks to profit from ultra-small pricing movements. The trader will often place dozens, if not hundreds of buy and sell orders throughout the day.

Due to the small profit margins being targeting, alongside the short amount of times that positions remain in play, scalping trading is often viewed as a low-risk strategy.

With that in mind, this guide will explain the basics about scalping trading in the UK. We unravel how the strategy works in simple terms – alongside a walkthrough of how you can start scalping assets online today.

-

-

What is Scalping Trading?

In a nutshell, scalping is a popular online trading strategy that is typically utilised by seasoned investors. With that said, by having a basic understanding of the fundamentals, scalping is potentially suitable for traders of all shapes and sizes. The main concept is that scalpers look to target super-small profit margins.

In order to do this, the scalping trader will often open a position and then close it just a few minutes later. In some cases, the trade might remain in play for a matter of seconds.

- Although the scalping trader will target minute margins, the individual will likely place dozens of positions throughout the trading day.

- In theory, as long as the trader has more successful trades than losing ones, they will finish the day in profit.

It is important to note that for scalping to be successful, the trader must have a strict set of entry and exit conditions. That is to say, the trader must ensure that sensible stop-loss and take-profit orders are deployed. In doing so, the trader will lock in their gains if or when the take-profit price is triggered.

This means that there is no requirement to manually close a position. Equally, if the trade doesn’t go to plan, the stop-loss order will ensure that the scalper’s losses are kept to an absolute minimum. After all, a sizable loss could wipe out all previous gains – especially considering the ultra-small margins that are being targetted.

Example of Scalping Trading

Scalping trading can be a confusing strategy to understand if you’re new to the online investing scene. Let’s look at a quick example in order to clear the mist.

- You are using a UK forex trading platform to scalp GBP/USD

- The current price of GBP/USD is 1.3208

- You place a buy order with an entry price of 1.3210

- You set up a stop-loss order at 1.3209

- You set up a take-profit order at 1.3212

Once the above orders are placed, only one of two things can happen:

- If your take-profit price is triggered at 1.3212, you make a profit of 2 pips

- If your stop-loss price is triggered at 1.3209, you make a loss of 1 pip

As you can see from the above example, scalping trading in the UK not only targets super-small profit margins, but stop-loss parameters are also small. This is why scalping is such a low-risk strategy – as, in this example, the potential loss stands at just 1 pip.

What Assets are Most Suited to Scalping?

In most cases, a scalping trading strategy can be deployed in any asset class.

This includes:

- Stocks

- Indices

- Commodities

- Forex

- Cryptocurrencies

With that being said, there are some clear conditions that must be met in order to utilise a scalping strategy. We will cover this in the next section.

Requirements for Scalping Trading UK

Unlike day trading, swing trading, or buy and hold strategies – scalping demands conducive trading conditions for the process to be effective.

These include:

0% Commission

You will find it very difficult to make a profit from scalping if you don’t use a broker that offers a 0% commission. After all, the amount of money that you will be looking to make from each buy or sell order is going to be minute.

For example, let’s suppose that you are using a UK forex broker that charges a commission of 0.1% per trade. This means that you will pay 0.5% when you place an order, and again when you close it. Let’s then suppose that you place a £100 buy order, and your scalping strategy make a 0.3% profit.

This translates to a gross gain of £0.30. However, we then need to factor in the 0.5% commission. As such, you would actually be making a net loss on this – even though you sold your chosen asset for 0.3% then you originally paid.

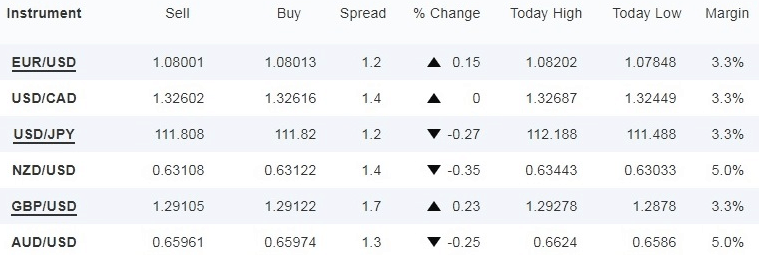

Tight Spreads

The spread is the difference between the ‘buy’ and ‘sell’ price of an asset, and it’s what ensures the broker always make a profit. You need to make gains of at least the spread just to get back to the break-even point.

When investing in an asset on a medium-to-long-term basis, the spread isn’t an overly important metric to take into account (within reason). This is because the spread will often amount to a small percentage, so it doesn’t have much of an impact on your potential profit.

However, this isn’t the case when scalping trading in the UK. After all, you will be looking to make super-low profit margins. With this in mind, it is crucial that you choose a UK scalping stock brokers that offers tight spreads.

High Trading Volume

A byproduct of high trading volume is a platform that benefits from sufficient liquidity levels. In simple terms, this means that there is enough money being traded on the market to enter and exit a position with ease.

As UK scalping traders are working with such small profit margins, it is imperative that you only trade assets with large trading volumes.

This might include blue-chip stocks, commodities like gold and oil, and major forex pairs. Similarly, you should also restrict your scalping trading endeavours to standard market hours, as this is when trading volumes are at their highest.

Avoid Market Orders

By placing a market order, you are instructing your chosen broker to execute your position at the next available price. The key problem with this is that you will often suffer from ‘slippage’.

This is when the execution price is different from the market price that you were hoping to get. In turn, this is likely to make your scalping strategy unviable.

Instead, always opt for limit orders. This is where you get to specify the exact price that you want your order executed at. Your position will only go live when the limit order price is triggered. Until then, the order will remain pending until cancelled.

Leverage is Required

Leverage allows you to amplify the value of a trade. For example, if you apply the leverage of 1:20 on a £500 buy order on gold, you are effectively trading with £10,000. Although newbies should avoid high leverage limits when first starting out, the exception to this rule is scraping.

This is because you will be targeting super-low profit margins. In other words, making average gains of 0.1-0.2% per winning trade is not going to earn you enough money to make trading worthwhile. Of course, this won’t be the case if you have a substantial bankroll.

But, if you are looking to deposit less than £50,000, you will need to consider applying leverage. The good news is that with the right risk management tools in place, leverage doesn’t have to be a high-risk manoeuvre.

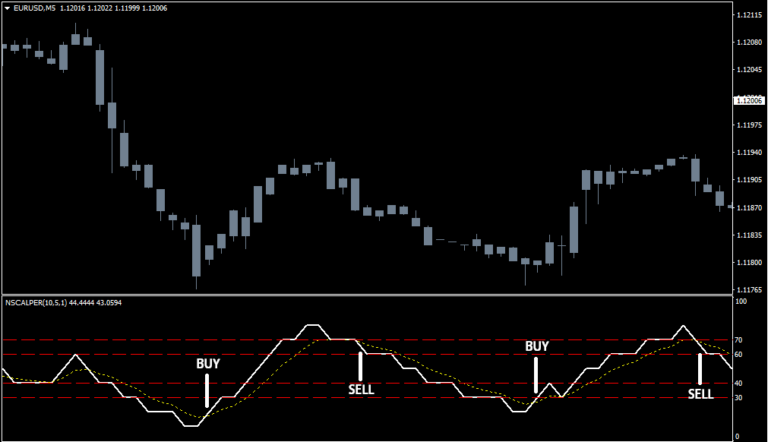

Scalping Trading Strategies

Although scalping itself is a trading strategy popular with UK investors, there are many different ways to approach it.

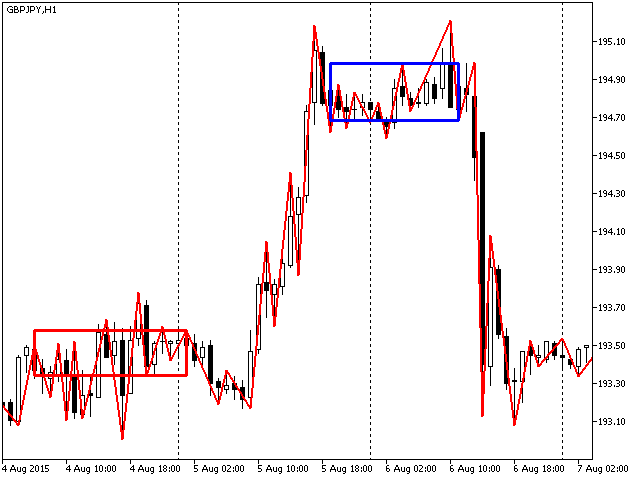

Consolidation Strategy

One of the popular scalping trading systems for entry-level investors is that of a consolidation strategy. When an asset trades within a tight range, this is known as a consolidation period.

For example, let’s suppose that Facebook stocks have been trading between $250 and $255 for several weeks. This means that the stocks have not moved below $250 or above $255. Amounting to a pricing range of just 2%, this is highly conducive for a seasoned scalping trader.

The trader would look to target two particular positions over and over again until Facebook stocks break out of the aforementioned consolidation period.

- A buy order would be positioned just above the bottom end of the range at $250

- A sell order would be positioned just below the upper end of the range of $255

In theory, for as long as the range remains in play, the scalping trader will continue to capitalise. Of course, the trader will need to ensure that they are protected from the eventual break out that will occur. As such, stop-loss orders would need to be positioned just below the bottom end of the range, and just above the upper end of the range.

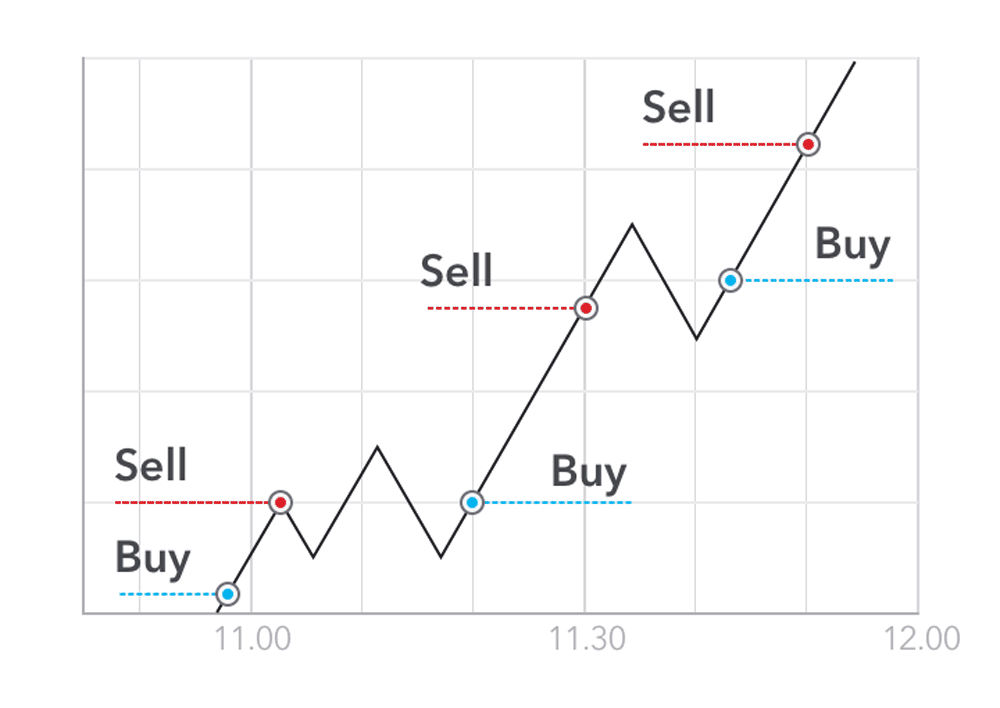

Low-Risk, High-Reward Ratios

An additional UK scalping strategy that is worth considering as a newbie investor is that of a low-risk, high-reward ratio strategy. In simple terms, when you set up both a stop-loss and take-profit order (which you should always do when scalping trading in the UK, there will be a ratio in how much you can potentially win and lose.

For example:

- Let’s suppose that you are trading oil – which is currently priced at $40.14 per barrel

- You place a buy limit order at $40.16

- Your take-profit order is set to $40.36

- Your stop-loss order is set to $40.14

As you can see from the above example, if your stop-loss order is triggered at $40.14, you will make a total loss of 2 pips. However, if your take-profit price is triggered, you will make a profit of 20 pips. In this example, your ratio is 2-20.

One the one hand, it is all-but-certain that are going to encounter more losing trades than winning ones. After all, your position will be closed as soon as it goes 2 pips into the red. On the other hand, you only need one winning trade to return 20 pips. In this sense, you need to win one trade for every 10 losing ones to break even. But, by winning 2 trades (40 pips profit) for every 10 losing ones (20 pips loss), you will be 20 pips in the green.

Scalping Trading UK Risks

Although scalping strategies allow you to trade in a low-risk environment, there are several risks that you need to consider before taking the plunge.

This includes:

Difficult to Implement

In truth, UK scalping trading systems can take many months, if not years, to deploy successfully. You will need to constantly run test-drives via a brokerage demo account on a trial-and-error basis.

Even then, market conditions can change at the drop of a hat, so you will need to constantly rethink your strategy. As such, if you’re a complete newbie in the world of online trading, scalping might not be for you.

Large Bankroll Required

As we have noted throughout this guide, scalping traders will look to make ultra-small profit margins. With that in mind, a low-to-medium level trader likely won’t have a large enough bankroll to make the process worthwhile. For example, let’s say that you have a £1,000 account balance.

You would need to have a substantial number of winning positions throughout the trading day for scalping to be viable. The only exception to this rule is if you apply leverage to your trades. This in itself comes with additional risks if sensible exit strategies are not deployed.

An Error can be Costly

Most scalping traders in the UK will enter dozens of buy and sell positions throughout the day. However, this can be somewhat overwhelming if the trader is inexperienced. As such, a single error could be extremely costly for the trader.

For example, if you are looking to scalp profits of 3 pips per trade, but an error results in a loss of 30 pips, you will need to hit 10 winning trades in a row just to make the money back.

UK Scalping Trading Platforms

If you want to benefit from scalping trading, you need to take particular care to ensure your chosen broker is suitable. As we covered earlier, you need to ensure that your choice of broker offers commission-free trading and tight spreads. Liquidity and trading volumes need to be high, and leverage facilities must be on the table.

Taking all of this into account, below we have listed a selection of UK scalping trading platforms that are worth considering.

1. Plus500

Plus500 meets all of the requirements that scalping trading requires. For example, you will have access to thousands of financial instruments - all in the form of CFDs. This covers stocks, bonds, interest rates, hard metals, energies, digital currencies, and more.

Irrespective of what financial instruments you decide to trade, Plus500 charges no trading commissions. Spreads are also very tight during standard market hours - especially on major asset classes like indices, gold, and oil. You will have access to several order types at Plus500, subsequently enduring that scalping strategy can be executed in a risk-averse manner.

Plus500 is licensed by several regulatory bodies, including the FCA. It has a small minimum deposit of just £100. You can get money into and out of your account with a UK debit/credit card or PayPal - which are both instantaneous. Bank transfers are also supported but expect to wait several days for the deposit to be credited.

Our Rating

80.5% of retail investor accounts lose money when trading CFDs with this provider. Sponsored ad

80.5% of retail investor accounts lose money when trading CFDs with this provider. Sponsored ad2. IG

IG is an FCA broker that was first launched in 1974. The platform seems to offer it all, from share dealing services to spread betting and of course CFD trading. In fact, the platform hosts over 17,000+ tradable instruments across dozens of asset classes - so you'll never be short of a profit-making scalping opportunity.

IG allows you to trade CFDs on a commission-free basis unless you are looking to scalp stocks. Although this comes with a rather competitive 0.10% commission, this might make stock scalping unviable. Nevertheless, IG also offers tight spreads and free deposits when using a debit card or bank wire.

What we also like about IG is that you can scalp via MT4. This third-party platform is hugely popular with UK scalping traders, as you'll have access to advanced order types and lots of technical indicators. You can also employ the services on an algorithmic robot to scalp assets on your behalf. Minimum deposits start at £250 with IG.

Our Rating

There is no guarantee you will make money with this provider. Sponsored ad

There is no guarantee you will make money with this provider. Sponsored adHow to Start Scalping Trading in the UK

If you’re keen to give scalping trading, then go with a trusted FCA broker. To show you how simple it is to get started:

Step 1: Open a Trading Account

To get the ball rolling, you will need to open a trading account.

This shouldn’t take you more than a few minutes – and simply requires the following personal information:

- Full name

- Home address

- Date of birth

- National insurance number

- Mobile number

- Email address

As an FCA regulated broker, you will also need to upload a copy of your:

- Passport of driver’s license

- Utility bill or bank account statement (issued in last 3 months)

You can upload the above documents at a later date, as long as you don’t intend on depositing more than £1,800-ish.

Step 2: Deposit Funds

If you want to start off with a demo account, some platforms offer a pre-loaded balance of $100,000. Alternatively, if you are ready to trade with real money, you can deposit funds with the following payment methods:

- Debit card

- Credit card

- PayPal

- Skrill

- Neteller

- Bank Transfer

You’ll need to meet a $200 account minimum, which is about £160.

Step 3: Place a Trade

You are now ready to place your first scalping trade. In our example, we are looking to trade Alphabet (Google) stocks – so we enter the name of the asset into the search box at the top of the page.

Then, by clicking on the ‘Chart’, you will be presented with some technical pricing data. You’ll want to change the timeframe from 1 day to 1 minute if you wish to scalp small pricing movements.

When you are ready to place some orders, click on the ‘Trade’ button.

You will now see an order box. First, you need to enter your stake in US dollars and select your leverage multiple. In our example, we are looking to risk $500 with leverage of 1:5.

As we have noted throughout our guide, you also need to set up a stop-loss and take-profit order when scalping. In our example, we have our stop-loss set to $2.50 and our take-profit at $5.00. This presents a risk vs reward ratio of 1-2.

Finally, confirm the order. Your position will remain open until either your stop-loss or take-profit order is triggered.

Conclusion

Scalping trading is a great way to make financial gains in a risk-averse manner. When installing sensible stop-loss losses, alongside other risk management strategies, your potential losses are kept to an absolute minimum. Even though you will be targeting micro-profit margins, scalpers typically place dozens of buy and sell positions throughout the day.

With that said, if you want to make a success of your scalping endeavours, you will need to use a UK trading platform that offers commission-free trades, tight spreads, and heaps of tradable assets.

FAQs

What is a popular time frame to use when scalping?

As you will be looking to scalp super-small profit margins, it’s usual to stick with the 1-minute timeframe.

What fees are involved in scalping?

You will need to use an online trading platform if you wish to deploy a scalping trading strategy. As such, check to see what commissions and spreads your chosen broker offers. This is why we suggest using Plus500, as you’ll be able to buy and sell financial instruments from the comfort of your own home.

How many pips should I try and make when scalping?

On average, seasoned scalping traders in the UK will target gains of 5-10 pips per position.

Are there any scalping trading systems that are automated ?

Yes, there are hundreds of automated scalping trading systems available in the online space. You will need to download the software and install it into a third-party platform such as MT4/5. Then, the software will scalp assets on your behalf. Just make sure you do lots of homework on the provider before signing up.

How many trades do scalpers place per day?

Experienced scalping traders will often place dozens, if not hundreds of trades each and every day. They will often need the assistance of a software package to help with this goal.

How much capital do scalping trading require?

You will often need a substantial bankroll to make scalping trading worthwhile. With that said, you do have the aid of leverage if you only have a few hundred pounds at your disposal.

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up