Lloyds Share Dealing Review | Platform, Fees, Pros and Cons

If you’re located in the United kingdom and looking for an online broker that connects you directly to the financial markets, Lloyds should be high up in your list of brokers to consider. This British financial institution that was founded in 1765 gives you access to a wide range of financial products, including individual shares (UK and International), funds, exchange-traded funds (ETFs), and Investment Trusts.

In this review, we cover everything you need to know about Lloyds bank. We will explore their share dealing service, the available investment options, fees and commission, trading platform and features, pros and cons to trade with Lloyds, and more.

-

-

eToro - Invest in shares with 0% commission

Our Rating

- 0% commission on stocks

- No markup, ticketing fees, management fees

- Fractional shares available

- Easy to use platform

75% of investors lose money when trading CFDs.

75% of investors lose money when trading CFDs.What is Lloyds?

Lloyds Bank is a British retail bank established in 1765 in Birmingham at the time the city was a dominant force of the Industrial Revolution. Since then, Lloyds has largely expanded its services, and today, it is one of the largest retail and commercial banks in the United Kingdom and globally with more than 30 million customers. In 2009, the Lloyds Banking Group was formed following the acquisition of well-known investment banks that include Lloyds, Halifax, Bank of Scotland, and Scottish Widows.

Lloyds Bank is a British retail bank established in 1765 in Birmingham at the time the city was a dominant force of the Industrial Revolution. Since then, Lloyds has largely expanded its services, and today, it is one of the largest retail and commercial banks in the United Kingdom and globally with more than 30 million customers. In 2009, the Lloyds Banking Group was formed following the acquisition of well-known investment banks that include Lloyds, Halifax, Bank of Scotland, and Scottish Widows.Apart from being a retail bank, Lloyds also offers clients access to thousands of assets to trade on and research tools to help investors find the right securities and understand market sentiment. This includes UK shares that are listed on the London Stock Exchange (LSE), and international shares from various stock exchanges including New York, Paris, Frankfurt, Milan, Amsterdam and Brussels. Additionally, Lloyds Bank offers investor to trade Funds, ETFs, ETCs, Investment Trust, FX currency pairs, and Bonds and Gilts.

In terms of the regulation, you would rightfully expect Lloyds to be regulated by top-tier regulatory agencies in the UK and internationally. Lloyds Bank plc is authorized by the Prudential Regulation Authority at the Bank of England and regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) under registration number 119278.

What does Lloyds Bank do?

Simply put, Lloyds Bank provides a variety of ways to help clients investing through their platforms. Apart from being one of the biggest retail and commercial banks in the world, Lloyds Bank offers investment accounts for investing in shares, funds, FX pairs, Investment Trust, and more. While the investment platform is available for current banking clients, the service is also available for clients of other UK banks.

What are the Pros and Cons of Lloyds

Pros:

- Lloyds offers a huge selection of tradable assets (UK and six international exchanges)

- Informative education material for beginners

- A selection of more than 2000 funds

- Offers the Share Dealing ISA account that is completely free from UK tax

- Offers a wide selection of account types

- Highly regulated by the FCA and PCA

- Established in 1765

- Relatively low fees and commissions

- Offers the Ready-Made Investment Account

- Excellent customer support

Cons:

- Offers a basic trading platform

- Limited trading tools and features

- Does not offer CFD nor Spread Betting

- No leverage trading

- Lloyds does not offer a mobile trading app

- Navigation on the platform/website is a bit confusing and unclear

What can you Trade at Lloyds?

In terms of available tradable assets, Lloyds offers a wide range of markets and products to trade on. Those include individual shares, funds, investments trust, forex, and bonds.

With that being said, you should take into consideration the fact that CFDs and spread betting are not available on any of the Lloyds trading account. If you are looking for a CFD regulated broker, we advise that you visit our CFD brokers comparison page.

Individual Shares – UK and International Shares

Investors on the Lloyds platform have access to all shares from the London Stock Exchange as well as shares from six international exchanges that include New York, Paris, Frankfurt, Milan, Amsterdam, and Brussels. In that aspect, Lloyds Bank offers a great platform for investors that are seeking all types of shares, including penny stocks, arbitrage trading, and exotic securities.

Forex Trading

At Lloyds, investors can get access to forward/spot exchange contracts that allow users to buy and sell currency pairs as with any typical UK forex broker. Lloyds is a commercial bank, meaning it has a better connection to the market and therefore, it can offer seamless access to FX pricing and trade execution.

Lloyds commercial banking offers a trading platform called ‘the Arena’ – FX and money market trading platform. On the Arena, you can get trade spot, forwards, swaps, and FX options in over 50 major, minor and exotic currencies. You can also use charts and historical market data to get a better indication of the market.

However, you should note that Lloyds FX trading service is different than CFD brokers that allow you to trade with leverage, and offer unique trading tools.

Funds – ETFs and ETCs

This is where Lloyds Bank excels. The bank offers a range of over 2,000 funds, including Exchange Traded Funds (ETFs), and Exchange Traded Commodity (ETCs). Moreover, Lloyds offers the Funds Centre where users can easily find a specific fund based on their preference. The data on the Lloyds funds centre is sourced from Morningstar, one of the leading and most respected data providers of global research.

Investment Trusts

Lloyds also offers Investment Trusts. For those who are not familiar with this type of security, an Investment Trust is simply a fund of a publically listed company that is traded on the stock exchange, just like shares. The major advantage of investing in Investment Trusts Funds is the cost-effectiveness. Unlike other funds, when you invest in Investment Trusts Funds, you avoid the fund platform fees that brokers usually charge.

We do like the fact that Lloyds has created a centre for Investment Trusts funds where you can search for Trusts. Note that you can focus your search on a certain sector or ratings given by Morningstar’s analysts. In terms of fees, you’ll have to pay a dealing commission of £11, and an average percentage of 0.45% for management fees and 0.65% for ongoing charges.

Bonds and Gilts

Bonds and Gilts are securities issued by the British government or a private company. When you invest in a bond, you are essentially lending money to a government or a company in return to a fixed interest payment. The downside is that you have to contact Lloyds in order to start trading Bonds and Gilts on their platform.

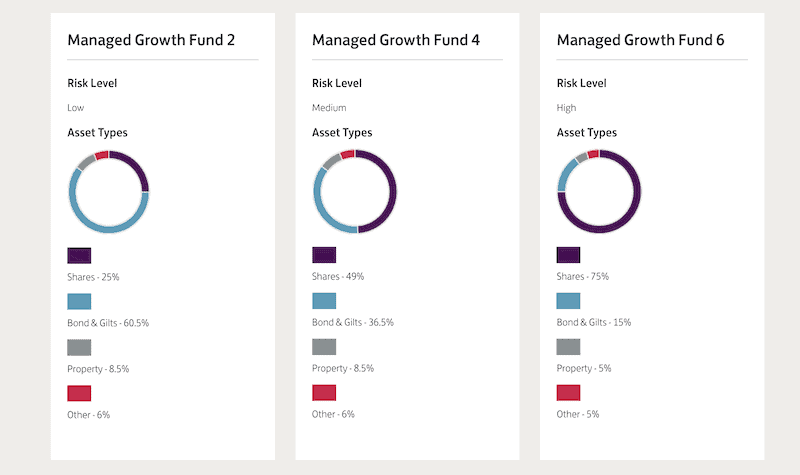

Ready-Made Investments

Another attractive option is to invest in a Ready-Made Investment portfolios from Lloyds Bank e-Investments. Essentially, these portfolios have been created by professional fund managers and allow you to get access to a wide range of sectors and markets without having to pick the securities on your own. The ready-made investments are categorized based on a risk level – low, medium, or high risk.

Fees, Costs, and Charges at Lloyds

Lloyds Bank Share Dealing account is certainly ideal if you are looking for competitive trading costs. Below you will find a summary of Lloyds’ online charges and dealing commission:

Account admin charge

£20 per six months (covers your Share Dealing Account and ISA)

Real-time online trades

£11 dealing commission per online trade

Frequent trader dealing commission

£8 dealing commission when you trade 8 or more times per quarter

Buying or selling funds

£1.50 dealing commission per online trade

Scheduled regular investments

£1.50 dealing commission per online trade

Trading Commissions

Overall, Lloyds’ trading costs are considerably cheap compared to competitors. However, the trading commission structure at Lloyds is unclear and there are additional charges you should take into account. Some of the charges include:

Dealing Costs

- Telephone Trade: £35 per deal

- Dividend Reinvestments: 2% of dividend (max £100)

- Foreign currency charges (International Trades): 1% of exchange rate

- Stamp Duty Reserve Tax (SDRT) for UK stocks: 0.5% of the value

Account Administration Charges

- Share Dealing/Share Dealing ISA Account Charge: £20 six-monthly

- Withdrawal of stock in certificate form: £25 per stock

- Admin charges: £12.50 for each service

This does not make Lloyds’ trading costs more expensive than other competitors in the industry. In fact, on Lloyds’ website, you can find a brokers comparison table of trading costs and charges.

In the case of stocks, the comparison is based on an investment of £20,000, and 4 trades a year in UK shares:

Broker Total Cost Lloyds Bank £84 Hargreaves Lansdown £92.80 Interactive Investor £119.88 Fidelity £85 In the case of funds, the comparison is based on an investment of £20,000, and 6 trades a year in UK shares:

Broker Total Cost Lloyds Bank £49 Hargreaves Lansdown £90 Interactive Investor £119.88 Fidelity £70 Lloyds Bank Account Types

Before you start trading with Lloyds, you will have to decide the account type that suits your needs.

Share Dealing Account

The Share Dealing Account is the basic account offered by Lloyds, enabling investors to buy shares and trade in a range of financial instruments such as shares, funds, ETFs, options, and more. Traders that choose the Share Dealing Account will get access to stocks in the UK and six international stock markets.

Share Dealing ISA Account

The Share Dealing ISA Account is similar to the Share Dealing Account with the exception of tax benefits. With the Share Dealing ISA Account, the investments will be completely free from the UK tax including the profits you make. Basically, the British government provides an allowance (£20,000 in 2020) to save or invest in an ISA trading account.

Ready-Made Investment Account

The Ready-Made Investment Account is perhaps the most unique trading account offered by Lloyds. It simply allows you to choose a pre-made portfolio created by Lloyds’ fund managers. Lloyds offers a choice between three funds with a different level of risk – Low, Medium, and High. Furthermore, the fees associated with the Ready-Made Investment Account are a yearly service fee of 0.24%, a maximum Ongoing Charge of 0.26%, and transaction costs that vary depending on the fund but cannot exceed 0.17%.

Which Regulators Govern Lloyds Share Dealing Markets?

When it comes to the regulation and safety of your funds, you can rest assured that your funds are protected. Firstly, the Lloyds Bank group was founded in 1765, making it one of the oldest and leading banks in the UK and worldwide. More importantly, Lloyds Banking Group is a public company traded on the London Stock Exchange under the ticker symbol LLOY and has a market cap of $24.13B.

The Lloyds Bank Direct Investments Service that is in charge of the Share Dealing account is operated by Halifax Share Dealing Limited which is authorized and regulated by the Financial Conduct Authority under registration number 183332. Lloyds Bank plc itself is regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PCA) under registration number 119278.

Furthermore, investors are protected by the Financial Services Compensation Scheme (FSCS), meaning clients could be entitled to compensation of up to £85000 in the case of insolvency.

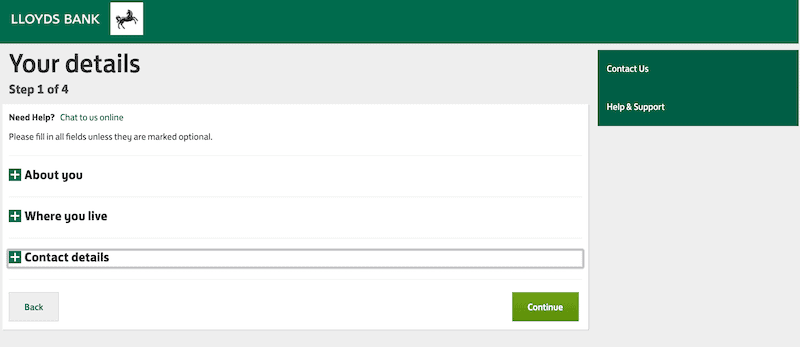

Getting Started with Lloyds Share Dealing

According to Lloyds, the account creation process takes a few minutes and you will be able to trade immediately once the account has been approved. Keep in mind that there are certain requirements you must have in order to apply for one of the available trading accounts. These include providing your personal details, submit your national insurance number, your home address over the last 3 years, and a debit card. In some cases, Lloyds require you to submit additional documentation such as proof of ID.

On another note, if you are a UK resident and wish to trade US securities, you will need to complete and send back a US Tax form, also known as W-8BEN form, before you can start trading.

Step 1: Choose an Investment Account

First, you will have to choose an account type. As previously mentioned, Lloyds Bank offers a selection of three account types – The Share Dealing Account, Share Dealing ISA Account, and the Ready-Made Investment Account.

Step 2: Enter Personal Information

Once you have selected your preferred account type, you will have to fill in your personal details. As you can see in the image below, the personal details registration process involves four steps. On the first step, Lloyds require you to enter your personal details that include your name, occupation, residency, country of birth, country of tax residency, email address, and phone number.

Step 3: Submit Documentation

Lloyds is a regulated broker, and as such, it must require you to submit documentation that verifies your identity. You will be required to upload a proof of address and in some cases, a Government-Issued ID, and a photo of your debit card.

Step 4: Fund Your Account

If you want to trade on real money than you need to fund your account. But one of the benefits as to trading with banks is that you can have a bank account at Lloyds which makes your life much easier. Lloyds offers a ‘Transfer Us’ section which allows you to transfer your account from another bank to Lloyds in three easy steps. Then, Lloyds simply allows you trading with the funds you own on your account balance.

Note that in order to apply for the Ready-Made Investment account, you will need to be an existing customer of the bank. That does not apply for the Share Dealing/Share Dealing ISA Accounts.

Step 5: Trade

Now, you can start trading. Once the funds have reached the destination, you can immediately start trading. If you are a beginner, it’s advisable that you use the educational material offered by Lloyd as they offer a beginner guide section and Boost Your Skills section that includes more than 20 articles, a quiz, and a jargon booster.

As a side note, Lloyds does not offer a demo trading account, meaning you will have to start trading in real money as soon as the account was approved and therefore, you should be careful when you make your first trades.

Platform Features

The Lloyds Bank share dealing account lacks advanced trading platforms and tools, however, we can say that Lloyds’ platform was designed in a way that users can get the most relevant market news and make fundamental research before choosing to invest in a security.

Web Financial Group and Morningstar power the research area for Lloyds Bank Share Dealing, with Web Financial Group is in charge of the information on Lloyds’ platform including market news, content and insights while Morningstar fuels operational and portfolio data.

In this section, we will review the Lloyds platform and highlight its key features.

Share and Fund Centre

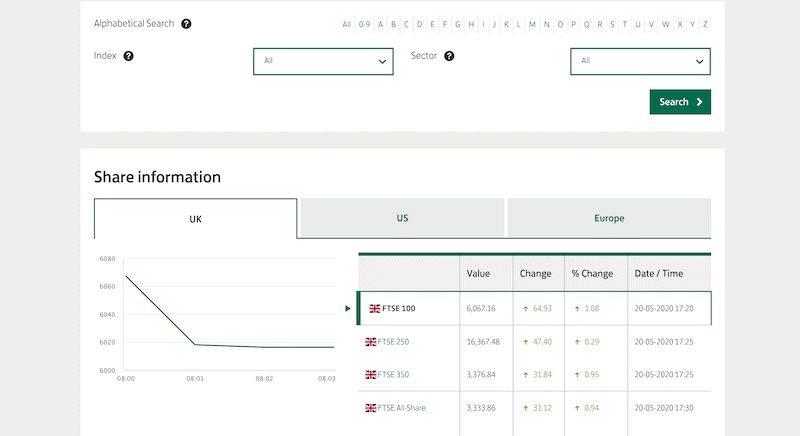

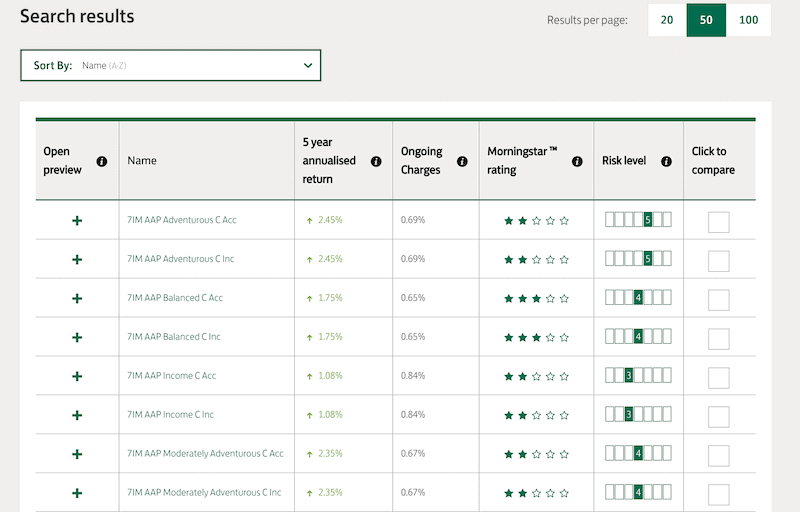

The Share and Fund centre are two different pages, however, both pages are quite similar and have the same options available. The Share center simply allows you to search a stock from thousands of available shares on the UK (including AIM), US, and European stock markets. Apart from finding shares of companies, the Share center also provides a range of Exchange Traded Funds (ETFs) tracking an index, sector, commodity, or currency as well as a selection of over 200 Investment Trusts funds.

The Funds Centre includes a list of over 2,000 funds with convenient navigation and a filtering tool that includes 5 years annualized return, ongoing charges, Morningstar rating, risk level, and a ‘click to compare’ tick box.

A Watchlist Tool

Investors at Lloyds Share Dealing can use the watchlist tool that collects all the instruments you have traded or wish to save on your watchlist. That way, you can create your own market overview page.

Furthermore, Lloyds has an email alert service when your target price or volume is triggered, or a company announcement is made.

Trading Platforms

Lloyds isn’t compatible with conventional popular trading platforms and essentially offers a simple to use trading platform, like most of the other banks in the industry. Overall, the platform should be able to simplify the trading experience and is and intuitive enough for beginners as well as professionals. The downside of Lloyds is that it offers a desktop web-based trading platform but does not support a mobile app.

If you are keen to trade the forex markets, Lloyds offers a more professional trading platform called ‘The Arena’. The Arena enables users to trade the foreign exchange markets with a high-speed execution, get valuable insights from Lloyds’ Economics and Market Insight team, and receive news feed, charts, and economic events as part of the platform.

Charts

Surprisingly, Lloyds has a powerful charting package compatible with its web-based trading platform. In comparison to other similar platforms, Lloyds offers a better charting in every aspect: An extensive range of 91 technical analysis indicators, 17 drawing tools, and the ability to display market events. Users can also choose a chart type (line, candlestick, etc), and compare different instruments on the same chart.

Research Tools and Analysis

Lloyds offers a great Research Centre to help investors make an informed investment decision. The Research Center includes the Share and Fund Center and a section of ‘Investment Ideas’.

Investment Ideas

On the Investment Ideas section, investors can get access to a large number of articles and videos updated daily to help you understand the available investment options and improve your investment skills. This section is full of useful information and resources for those who are in a constant search for something new.

Market News

Most traders prefer getting a live feed of relevant financial market news displayed within the platform. That makes the trading experience easier and much more convenient. Lloyds made an effort to provide as many tools and resources as possible including the Market News section. Keep in mind that news and data provided on the Lloyds Bank platform is provided by Morningstar and Web Financial Group, two well-known advisory services in the financial industry.

The Market News page is separated into News and Insights. Under the News section, you will be to navigate headlines, market news, company news, economic news, and RNS. Under the Insight section, you can navigate between economy and markets.

In terms of market research, the only drawback of the Lloyds platform is that you will have to find additional news and data on other sources. Even though Lloyds covers most of the news very fairly, the platform lacks an economic calendar and a stock analyst rating consensus and price target.

Education

Besides the research center, Lloyds provides an education section where you can learn the basic rules of investments, whether you are a beginner or experienced investor. On the platform, you will be able to find around 25-30 articles on a variety of topics for all levels of investors.

Customer Support

As a highly reputable bank, Lloyds Bank provides an excellent customer support service. You will be able to contact the support team via phone, email, and online chat. The Share Dealing support team is available Monday to Friday from 8 am to 9 pm; Saturday, 9.30 am to 12.30 pm. Lloyds also supports a text phone service for customers with hearing or speech impairment.

Moreover, traders can get access to a Share Dealing Web Chat, and Ready-Made Investments Web Chat.

Conclusion

Overall, with over 250 years of experience, Lloyds has not only built a strong reputation but also created a versatile investment platform that supports a variety of markets, products, and account types. Trading costs and charges are competitive and there’s no doubt that Lloyds has made an effort to create an informative and useful trading environment.

If you are looking for a broker with an easy-to-use web-based trading platform that connects you to a wide range of markets, the Lloyds share dealing account should be a priority. Further, traders should have no concerns when dealing with Lloyds as it is one most reputable and regulated banks in the world.

In conclusion, Lloyds Bank Share Dealing account might be ideal for current banking clients or inactive investors that tend to “set and forget” their long-term investments.

eToro - Invest in shares with 0% commission

Our Rating

- 0% commission on stocks

- No markup, ticketing fees, management fees

- Fractional shares available

- Easy to use platform

75% of investors lose money when trading CFDs.

75% of investors lose money when trading CFDs.FAQs

How much does it cost to trade at Lloyds?

The trading fees vary depending on the tradable asset and the account type you choose. With that being said, if you are trading stocks the commission is £11 per trade (£8 if you’re an active trader). If you trade funds, you will pay a £1.50 dealing commission per online trade.

Is Lloyds regulated?

Yes, Lloyds is one of the oldest banks in the worlds and as such it holds licenses from top-tie regulators that include the Financial Conduct Authority (FCA0, and the Prudential Regulation Authority (PRA). Additionally, other Lloyds Banking Group companies are highly regulated in other regions in the world.

What are the requirements in order to open a Share Dealing account at Lloyds?

In order to apply for a share dealing you will have to be over 18 years old, be a UK resident, not be a US citizen or tax resident, submit your National Insurance number, your home address over the last 3 years, and a debit card.

What trading platform does Lloyds offer?

Lloyds offers a web-based trading platform that is easy to use and suitable for all type of traders. Lloyds also offer a professional trading platform for forex trading called the Arena.

See Our Full Range Of Brokers – Brokers A-Z

Adam Green

Adam Green

Adam Green is an experienced writer and fintech enthusiast. He he worked with LearnBonds.com since 2019 and covers a range of areas including: personal finance, savings, bonds and taxes.View all posts by Adam GreenLatest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up