Oil Trading UK Guide 2022

Oil is more than just an essential fuel powering the modern world. It’s also the most widely traded commodity across the globe. Traders in the UK and beyond can speculate on the future price of oil to profit off of changes in supply and demand.

If you’re interested in getting started with oil trading in the UK, this guide is for you. We’ll cover the basics about trading oil and reveal some oil trading strategies. We’ll also highlight five of the popular UK brokers you can use to start trading crude oil today.

-

-

What is Oil Trading?

Oil trading involves speculating on the future price of oil for profit. In an ideal scenario, traders will buy oil when the price dips and sell it when the price rebounds to realize a tidy profit.

Oil plays a key role in the global economy and in international politics, which makes it a prime target for traders. The market is easily accessible both in the UK and around the world. Plus, the global supply and demand balance for oil can be very easily affected by rumours or events across the globe. As a result, the price of oil is very volatile and it is one of the most active products targeted for commodity trading.

Oil plays a key role in the global economy and in international politics, which makes it a prime target for traders. The market is easily accessible both in the UK and around the world. Plus, the global supply and demand balance for oil can be very easily affected by rumours or events across the globe. As a result, the price of oil is very volatile and it is one of the most active products targeted for commodity trading.In particular, most UK oil trading revolves around trading crude oil. Crude oil is the precursor material that can be refined into different types of gasoline for, say, cars, trucks, and airplanes. While it is possible to trade the price of gasoline directly, you will be trading in a much smaller market compared to trading crude oil.

Not all crude oil is the same, either. There are many different crude oil standards, the most popular of which are Brent crude and West Texas Intermediate (WTI) crude. Brent crude is drilled offshore in the North Atlantic. It is generally the better indicator of gasoline prices since it can be more readily refined, Brent crude is also the most popular product for oil trading in the UK.

WTI crude comes from the Permian Basin in the US and WTI trading is more popular in the US. While the prices of WTI and Brent often move together, they don’t always move in lockstep. The two crude products are produced in different places using different technology, so supply can vary even as demand for the two types of oil remains consistent.

Oil Trading Price

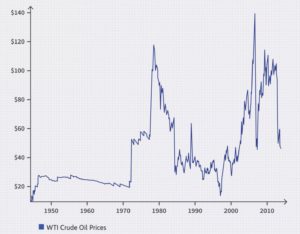

If you look at the long-term price of oil, it’s very different from the types of charts you’d see for equity trading. Instead of a gradual rise punctuated by brief falls during recessions, the price of oil can skyrocket up at one moment and plunge downwards at another.

The price of oil is extremely volatile – that’s part of what makes UK oil trading so exciting in the first place. Ultimately, this volatility stems from the fact that the price of oil is affected by so many factors.

On the supply side, politics is one of the biggest factors determining how much crude oil reaches the market. The OPEC (Organization of the Petroleum Exporting Countries) embargo in the 1970s, for example, cut off the flow of oil to the US and Europe and caused the price of crude to skyrocket. In 2020, a battle over oil prices led to Saudi Arabia and Russia, two of the world’s largest oil producers, to flood the global market with crude and drive the price down.

Technological development can also impact the supply of oil. The development of hydraulic fracturing in the US in the early 2000s led to a massive increase in the amount of WTI crude being produced. Offshore drilling technology has enabled the discovery and exploitation of Brent crude reserves in the North Atlantic. Technology being developed today could play a huge role in determining the price of oil tomorrow.

Global demand for oil also impacts the price of this commodity. Generally, demand for oil depends on the state of the global economy. For example, oil demand increased sharply in response to the industrialization of China over the past few decades. However, some analysts predict that demand for oil could fall over the long term as renewable energy sources replace traditional fossil fuels.

When trading oil, it’s important to remember that demand can also fluctuate on shorter timescales. A busy travel season or an economic boom or recession can dramatically change the global demand for oil. When that happens, expect the price of oil to react quickly.

Ways of Trading Oil in the UK

Trading oil typically doesn’t involve buying and selling physical barrels of oil. That’s a good thing for most oil traders, who don’t want to deal with the hassle of transporting and storing thousands of gallons of crude.

Rather, oil trading in the UK happens through a set of financial instruments known as derivatives. There are three common types of derivatives for trading oil: CFDs, futures, and options.

Oil CFD Trading

CFDs, or contracts for difference, are contracts that enable you to speculate on the future price of oil. CFD trading is coordinated by your broker, such that the value of a CFD contract is based on the market price of crude oil but your contract is only between you and your broker. CFD trading is often commission-free, but you pay a spread that is determined by your CFD broker.

Oil Futures Trading

Oil futures trading is a lot like CFD trading, except that contracts are traded on open market exchanges. Unlike for CFD trading, your broker acts only as an intermediary in your trade. You may pay a commission, but you get access to the highly liquid oil futures market and potentially much tighter spreads.

Oil futures trading requires you to trade in large lot sizes, meaning you have to buy contracts for a minimum number of barrels. As a result, trading oil futures requires you to commit a much larger amount of money compared to CFD trading.

Oil Options Trading

Oil options trading is more complex than either CFD or futures trading. You are speculating not just on whether the price of oil will go up or down, but by how much and when. The time element of options is extremely important for oil trading, since the timing of price changes can have a huge impact on the profitability of your trades. Options expire on a specified date, and they are worthless once expired.

The advantage of using options for UK oil trading is that you can create highly advanced trading strategies. For example, you can use options to profit even when the price of oil remains constant over time.

Oil Trading Companies

You can also speculate on the price of oil without trading oil directly. You can buy shares of oil companies, like British Petroleum or Royal Dutch Shell, whose share price often rises and falls with the price of oil. You can also take part in ETF trading that have exposure to oil or to oil companies.

You can also speculate on the price of oil without trading oil directly. You can buy shares of oil companies, like British Petroleum or Royal Dutch Shell, whose share price often rises and falls with the price of oil. You can also take part in ETF trading that have exposure to oil or to oil companies.There are several advantages to trading oil companies, particularly if you’re not day trading oil. To start, the share price of oil companies tends to be much less volatile than the price of oil. In addition, oil companies are often among popular dividend stocks. Dividend payouts can increase your returns and provide fixed income over time.

Why People Trade Oil

Oil trading in the UK is extraordinarily popular. It’s not just the UK, either – oil is the most heavily traded commodity around the world.

There are several reasons people may trade oil compared to other commodities or assets. First, the price of oil is extremely volatile, both on a day-to-day basis and over the long term. That volatility means that there is plenty of opportunity to speculate on the price of crude oil and potentially turn a profit from quick trades.

In addition, UK oil trading comes with high liquidity. Since this market is so popular, you’ll have no problem finding someone who will sell you an oil contract or someone who will buy a contract that you’re selling. In addition, spreads on oil trades are low because so many oil contracts are constantly changing hands.

Another benefit to oil trading in the UK is that it comes with leverage. Whether you trade futures, or options, you can easily multiply the effective size of your oil position. That means you can place bigger bets with small amounts of cash in your trading account. So, the bar for entry to UK oil trading is relatively low.

How to Potentially Make Money Trading Oil

With a good trading strategy, it’s possible to make a significant amount of money off of oil trading in the UK.

For this example, assume the current price of Brent crude is at £32 per barrel. With £200 in your trading account, you can buy £2,000 of oil CFDs with 10:1 leverage. If the price of Brent crude rises to £35 per barrel – a 9% increase – you could sell your position to realize a 90% profit (around £187).

Oil Trading Risks

Of course, there’s always the chance that an oil trade goes against you. If you were to buy oil CFDs as in the example above, only for the price of oil to fall afterwards, you would have to sell your position for a loss.

Keep in mind that just as leverage multiplies your profits, it also multiplies your losses. So, a small drop in the price of oil can lead to a significant loss when trading oil with leverage.

Oil Trading Strategies

Having a strong oil trading strategy is key to turning a profit. So, let’s take a look at some popular oil trading strategies.

Fundamental Analysis

Fundamental analysis involves using market data about supply and demand to determine the current fair price for oil. This can be tricky since so many factors affect the price of oil. However, you can account for all current oil reserves, expected future production, and current and future oil consumption around the globe.

Fundamental analysis is more suited for medium- to long-term oil trading. The price of oil may eventually reach its fair price, but it probably won’t happen in a single day.

Overbought/Oversold Trading

Another popular method for UK oil trading involves looking at overbought and oversold levels. These levels are often determined using a technical indicator like the relative strength index (RSI). When oil is oversold, take a position. When it is oversold, sell your position to exit before the price of oil drops back down.

Swing Trading

Oil is a particularly ripe target for swing trading, which profits off of short-term changes in momentum. Since the price of oil is so volatile, it will often run upwards for a few days or weeks at a time and then downwards for another stretch of time. Swing trading requires looking at price momentum and support and resistant levels to determine when the price trend will change direction.

Oil is a particularly ripe target for swing trading, which profits off of short-term changes in momentum. Since the price of oil is so volatile, it will often run upwards for a few days or weeks at a time and then downwards for another stretch of time. Swing trading requires looking at price momentum and support and resistant levels to determine when the price trend will change direction.Oil Trading Tips

Before you dive into oil trading in the UK, it’s important to fully understand how this type of trading works. Here are five of our top tips to help you start out on the right foot:

- Read an Oil Trading Book

This guide is a great place to start learning about oil trading. But if you want to really go into detail on how to trade oil, it can be useful to pick up a book. Two of our favourites are ‘Energy Trading and Risk Management’ by Iris Marie Mack and ‘An Insider’s Guide to Trading the Global Oil Market’ by Simon Watkins.

- Read Oil Trading News & Analysis

The price of oil can be strongly affected by breaking news and even by analysts’ reports on the future trajectory of oil prices. So, it’s important to stay on top of this news so you know what the market is doing.

- Learn How to Use Stop Losses

Unfortunately, not every oil trade will go your way. You can manage risk by ensuring that your losses don’t get so large that they wipe away your profits.

- Try Oil Trading Signals

Oil trading signals make it easier to spot opportunities for profitable trades. You can automate your trading strategy or get alerts when conditions align. Helpfully, using oil trading signals also eliminates some of the emotion that drives bad trades.

- Use Options for Custom Strategies

Options trading is complex, but it can also be key to developing a profitable oil trading strategy. You can buy and sell options contracts at the same time, for example. This allows you to limit your potential profit from a single trade in exchange for also limiting your maximum possible loss.

Oil Trading Platforms

Choosing the an oil trading platform in the UK is important. Your trading platform will determine what tools you have access to and what fees you’ll pay for trading crude oil. So, let’s take a closer look at five of the popular oil stock brokers you can get started with today:

Plus500

Plus500 offers CFD trading for WTI crude, Brent crude, and gasoline. What’s great about trading with Plus500 is that you can access leverage of up to 100:1 when trading WTI crude and 50:1 when trading Brent crude. That makes it easy to take large positions with just a small amount of capital in your trading account.

On top of that, Plus500 is incredibly competitive when it comes to pricing. The spread on its WTI crude CFD, for example, is just 0.11%. That’s a fraction of the industry average and there’s no commission for trading CFDs with this broker.

Plus500 offers a desktop trading platform along with a mobile investment app. The app stands out as one of the popular investment apps in the UK for offering price alerts that are pushed to your smartphone’s home screen. So, you can potentially stay on top of the oil market no matter where you are in the world.

Our Rating

80.5% of investors lose money when trading CFDs.

80.5% of investors lose money when trading CFDs.IG

IG is one of the most well-established brokers in the UK, and that shines through when it comes to oil trading. This broker offers CFD trading and spread betting for both WTI and Brent crude, as well as options trading for WTI crude through CFDs. So, you have a wide range of options for customizing your strategy with different types of financial instruments.

IG also offers a highly advanced trading platform for monitoring the oil market. You can set up trading signals and custom alerts based on indicators as well as price levels. You can also backtest a personalized trading strategy using historical oil price data.

The only downside to IG is that spreads for CFD trades in particular are higher than the industry average. If you’re trading oil options, you’ll also pay a fixed commission based on the size of your trade.

Oil Trading Broker Commission Deposit Fee Inactivity Fee Withdrawal Fee Plus500 £0 (variable spread) £0 £8 after 3 months £0 IG £0 (variable spread) £0 (0.5% on credit cards) £9 after 2 years £0 FinmaxFX £0 (variable spread) £0 £80 after 2 months 3.5% How to Start Oil Trading

Ready to jump into oil trading in the UK? We’ll show you how to get started with with a broker.

Step 1: Open an Oil Trading Account

To start trading , you’ll need to open a new trading account. Head to the broker’s homepage and click ‘Join Now.’ Then enter a new username and password, and fill in personal details like your name, email, and birthdate.

To comply with government regulations, trading platforms require that you verify your identity. You can do this online just by uploading a copy of your driver’s license or passport and a copy of a recent utility bill or financial statement.

Step 2: Fund Your Account

You can deposit funds into your account by debit or credit card, e-wallet (Neteller or Skrill), or bank transfer.

Step 3: Place Your First Oil Trade

Now you’re ready to place an oil trade. Search ‘Oil’ in the dashboard to find the WTI crude CFD contract, and then click ‘Trade’ to open a new order form.

Enter how much money you want to trade and how much leverage you want to use, if any. You can also enter a stop loss or take profit level in the order form. When you’re ready, click ‘Trade’ to place your first oil trade.

Conclusion

Oil is the most heavily traded commodity in the world, with a price that’s incredibly volatile thanks to its importance to the global economy. Depending on how you want to approach oil trading in the UK, you can trade CFDs, futures contracts, or options. Oil’s volatility makes it a potentially prime candidate for profit, but beware that volatility also increases your trading risk.

FAQs

What are the oil trading hours?

The hours for oil trading depend on whether you are trading CFDs or futures. Oil CFDs trade from 11pm Sunday night to 10pm Friday night. WTI oil futures trade 24 hours, except for an hour from 10pm to 11pm.

Can I trade gasoline?

Some UK commodity brokers allow you to trade gasoline CFDs. However, this market is much smaller than the market for crude oil.

Should I trade WTI or Brent crude?

The choice between WTI and Brent crude will likely be dictated by your broker’s offerings. Many UK brokers offer CFDs for both types of crude, but only WTI futures.

What is the spread in oil trading?

The spread is the difference between the bid and ask price for a CFD or futures contract. The difference is pocketed by your broker, and this is how many commission-free online oil brokers make money.

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up