Best UK Forex Broker Compared in 2021

Forex trading is big business for banks and other financial institutions, with trillions of pounds worth of currencies changing hands each and every day. With that being said, the industry is no longer reserved just for institutions. On the contrary, the best forex trading brokers now allow you to buy, sell, and trade dozens of currencies at the click of a button.

In fact, there are literally hundreds of UK forex brokers now operating in the UK forex market, most of which offer trading platforms via a desktop and mobile device. However, this makes it difficult to know which broker to go with.

As such, we have created the ultimate guide to the Best Forex Brokers of 2021. We’ll start by discussing our top broker picks, each of which will come with a list of pros and cons to consider. We’ll then explain the fundamentals surrounding the industry, such as how forex trading works, how you can get started, and what risks you need to be made aware of.

The Best Forex Brokers For The UK Available in 2021

Before we look at UK forex brokers in more detail, here’s a list of the best forex brokers right now.

- Plus500 – Tight forex spreads

- Capital.com – Great educational resources

- Forex.com – Excellent charting

- FinmaxFX – High leverage broker

- FXCM – Reputable and trusted broker

- AvaTrade – Supports MT4/5

- IG – Great range of pairs

- Markets.com – Best forex app

- CMC Markets – Best forex fees

-

-

What is a Forex Broker?

The best Forex brokers are firms or companies that provide a platform through which currency traders can access the international forex exchange markets. They may be independent retail forex trading brokers advancing their services to smallholder currency traders or large investment banks that offer the service to institutional investors like hedge funds or smaller commercial banks.

By providing the trading platform, the forex broker makes it possible for the currency trader to open and close currency trading. Most are online-based and integrate all the important resources needed to help the trader make informed trade decisions within this platform. These include trade/market analysis, technical indicators, real update on market data, financial news (Economic calendar), leverage, and adequate risk management tools.

The broker earns in either of these two ways – or both. First is the bid-ask spread of every pair traded on their platform. There is no standard spread for forex brokers, and it varies from one platform to another. Secondly, UK forex brokers may impose a fixed or variable commission (fee) for every trade executed on their platform.

What makes a good forex broker?

When vetting the best forex brokers, you have to take into account a host of security, operational, and regulatory measures. The bare minimum qualifications for a good broker include:

Regulation: A good broker is adequately licensed by different regulatory authorities and adheres to all the security measures stipulated by the operating license. These include encrypting user data and maintaining segregated bank accounts for client funds.

Advanced trading platform: The best forex broker should also work consistently towards improving their platform. They should include updated trading, market analysis, and risk management tools while maintaining the fastest order execution speeds and supporting a reasonable number of currency pairs.

Considerate pricing model: The good broker must also be considerate with their fees. In the recent past, most brokers have abolished trade commissions and lowered their bid-ask spreads.

Readily accessible: Registering a trading account with the best forex broker should also be easy and straightforward. They should also make it possible to access the account on multiple devices like web trading, desktop and mobile apps on both proprietary and conventional platforms like MT45/5.

What are the pros and cons of Forex Trading Brokers?

Pros:

- Avenue for market access: UK Forex brokers act as a crucial interlink between you and the larger forex exchange market

- Free trading/analysis tools: Every broker presents you with a wide range of both basic and premium trading, market analysis, and risk management tools

- Support leverage trading: UK Forex trading brokers support leverage trading making it possible for you to enter into large positions while risking minimal capital

- Protect you from fraud: By trading through licensed and regulated exchanges, you can avoid the numerous online forex trading scams

- Provide training and support: Some brokers provide you with educational and training resources as well as demo accounts to help you perfect your skills

- Updates you on market conditions: The best forex brokers have an economic calendar and finance news pinned within the trading platforms

Cons:

- Exorbitant charges: Some demand exorbitant minimum initial deposits while others have high trading fees

- Poor platforms lose you money: Poorly maintained and sluggish UK forex trading platforms tend to lose you money through slippage

- No deposit protection: Some brokers employ minimal management measures exposing you to huge losses

Best Forex Brokers In The UK For 20201- Best Brokers Compared

Who are the best forex brokers in 2021 and who wins the UK forex broker comparison?

The following list covers brokers that are tailored to both beginners and seasoned traders. As such, choose a broker that best meets your skill level. By the way, most brokers now come with fully-fledged investing apps, so you can also trade currencies on the move.

Plus 500 – Comprehensive CFD Web Trading Platform

Founded in 2008, Plus 500 has gradually morphed into one of the largest online CFD brokerages in the UK. Plus 500UK LTD is authorized and regulated by the Finacial Conduct Authority in addition to being listed and publicly traded on the LSE.

We like Plus 500 because, firstly, their platform hosts a huge selection of share CFD pairs, all of which can be bought and sold 24/7. Their platform appeals to experienced traders looking for a mix of affordability and access to a huge resource of technical tools. Additionally, the user interface for their proprietary platform is super user-friendly, and you can customize it to meet your individual requirements.

It is also notable that Plus 500 does not charge any commissions to trade forex, only variable but competitive spreads. To start trading with the Plus 500 platform, you need a minimum deposit of just £100, and you'll also have the option of applying leverage to certain trades.

Plus 500 is available as a web browser trader or mobile app that you can download to both Android and iOS devices.

Our Rating

- Holds multiple licenses and is listed on the LSE

- User-friendly trading platform

- Trade via your desktop or mobile device

- One may consider their overnight trader fees high

- Minimal research tools

76.4% of retail investor accounts lose money when trading CFDs.Capital.com – Highly sophisticated and AI-Powered trading platform

Capital.com is a highly advanced broker that takes pride in the competitiveness of its trading fees and the sophistication of its trading platform. The broker doesn’t charge trade commissions, and though the bid-ask spread for the over 100+ currency pairs supported here is variable, it is also highly competitive. Capital.com accounts are also hosted on the highly intuitive and AI-powered proprietary platform.

It has some of the fastest order execution speeds, a decongested and easy to use interface, hosts numerous technical indicators, features advanced trading and charting tools, and provides traders with real-time updates market data and financial news. For instance, you can sort pairs based on the most volatile, most trader, top gainers, and top losers. Capital.com accounts are also hosted on the highly intuitive and AI-powered proprietary trading platform.

Our Rating

- Offers a leverage of up to 1:30 to UK traders

- Features a highly advanced and AI-powered platform

- Supports a wide of both popular and second-tier currency pairs

- Easy and straightforward account opening on their proprietary trader platform for web-based trading or desktop and mobile app users

- Highly secure and regulated by the Financial Conduct Authority

- Isn't compatible with conventional trader platforms like MT4/MT5

- One may consider the education and training content on the broker's site limited

Forex.com – Trade with world’s largest MetaTrader broker

On their website, Forex.com describes itself as the world’s largest meta trader broker. Here, forex traders have access 90+ currency pairs and thousands of other financial securities like spot metals and crypto. The broker doesn’t charge trading commissions for forex trades and also maintains some of the most competitive bid-ask spreads.

Registering and verifying a forex trading account with the broker is also easy and straightforward. The minimum initial deposit is £50 with the minimum trading set at £1. Retail traders get access to leverage of up to 1:30, some of the most advanced technical indicators, trading and management tools. And though it is biased towards experienced traders, the broker provides them a demo account where they can horn their skills.

Our Rating

- Get to trade on either their proprietary trading platform or the all-popular Metatrader (web trader, desktop, and app)

- Interact with a diverse range of trading and market analysis tools

- Access free premium risk management tools like trailing stop loss, one-cancel-other, and good-till-cancelled limit orders

- Diversify your portfolio by trading numerous other trading instruments

- Charges a £15 inactivity fee monthly after12 months of inactivity

- Account verification is manual and may take up to 3 days

- Broker doesn’t provide negative balance protection

FinmaxFX – Best MT5 trading platform

FinmaxFX accounts will only be traded on the highly advanced MetaTrader 5 platform (web trader and mobile app). But this is not the only thing setting FinmaxFX apart. FinmaxFX also advances some of the most attractive leverages and has integrated the most valuable risk measures.

Here, forex traders don’t just get access to commission-free currency trades but are also free to apply leverages of up to 1:200. The spreads are attractively low and the broker accounts are hosted on one of the most updated platforms.

Registering a forex trading account with FinmaxFX is relatively easy and only requires a minimum initial deposit of $100. You get to interact with some of the most advanced indicators, 250+ trade and market analysis tools, weekly educational webinars, and premium management measures and negative balance protection.

Our Rating

- Traders have access to attractive leverages of up to 1:200

- Trade 45 of the most popular currency pairs alongside 400+ other financial assets

- Perfect your trading strategy on the broker's demo account and gain insights from the weekly live webinar

- Trade on the move with the MT5 app without losing access to all the advanced trading tools

- FinmaxFX isn't FCA-regulated

- The maximum leverage is only available to professional traders

- One may consider the number of currency pairs supported here limited

FXCM – Trade with one of the most reputable forex CFD broker

FXCM, also known as Forex Capital Market, was established in 1999 and is one of the pioneers in the Forex CFD trading niche. It has a solid reputation for its transparent fees, fast order execution speeds, and competitive trading fees. The broker is highly regulated by several tier-one financial authorities like Financial Conduct Authority in the UK, ASIC in Australis, America’s CFTC, and CySEC in Cyprus.

Registering and verifying a forex trading account with the broker is easy. And the account is accessible via two of the most sophisticated trading platforms; FXCM’s proprietary platform – TradeStation – and the all popular MT4.

The broker platforms feature hundreds of advanced trading and market analysis tools, give you real access to the forex market data, updated economic calendar, critical market news, and a demo account to practice and perfect your strategy. FXCM does not charge trade commissions or deposit or withdrawal processing fees.

Our Rating

- Traders get access to leverages when trading forex

- Beginner trading can integrate Zulutrade platform to enjoy social/copy trading features

- The broker platform integrates key trading and risk control tools as well as new and market updates

- Gives you access to 80+ major and exotic pairs alongside hundreds of other financial instruments

- Supports a wide range of deposit and withdrawal methods

- Maintains a prohibitive minimum initial deposit of £300

- The leverage levels offered by the broker are fixed

- The leverage levels offered by the broker are fixed

AvaTrade – Trader with a broker that reimburses your lost positions

AvaTrade is arguably one of the most versatile forex brokerages on this list. Account registration and verification is straightforward, and you only need a £100 initial deposit. Their accounts are accessible on three different trading platforms, their proprietary AvaOptions, the conventional MT4 trader, and the social platform – DupliTrade.

In addition to the 50+ currency pairs traded on the platform, AvaTrade also supports hundreds of other tradable financial instruments like stock and cryptocurrency CFDs.

There are no trading commission, free withdrawal requests/deposit fees, and forex spreads are highly competitive. AvaTrade clients also interact with some of the most sophisticated trading/market analysis and risk management tools. They also have access to leverages of up to 1:400. Plus, there are no restrictions on hedging and scalping trading strategies or the use of expert advisors.

Our Rating

- AvaTrade is available in 100+ countries and licensed by seven financial regulatory agencies

- Supports some of most popular deposit/withdrawal options including debit/credit cards and eWallets like PayPal

- Beginner traders can social trade and earn from copying trades using DupliTrade platform

- No trade commissions and highly competitive spreads

- It features a great selection of highly advanced trading and risk control tools

- Charges inactivity fees of £50 per quarter after 3 months of inactivity

- Charges £100 in administration for dormant accounts (after 12 months of inactivity)

- No phone support

IG – Great for Research and Educational Tools

IG is a UK broker that was launched way back in 1974. As such, it is one of the most trusted platforms in the market, with more than 195,000 clients under its belt. IG also holds a plethora of trading licenses from multiple jurisdictions, including that of the Financial Conduct Authority. With 80 currency pairs listed at the broker, IG doesn't have the most extensive forex department in the arena.

However, it more than makes up for this in other ways. For example, IG offers the much sought-after MT4 platform, which comes jam-packed with advanced charting tools. We also like the research and education department at the platform. This includes daily expert analysis from DailyFX, as well as user-friendly guides on key trading principles.

- One of the most established brokers in the UK

- Heaps of advanced charting tools

- Great educational and research tools

- Could do with adding more pairs

- Imposes inactivity fees

Markets.com – Best Mobile Forex Platform

Mobile trading is getting more and more popular in the UK forex space. At the forefront of this is Markets.com, which now offers one of the most intuitive mobile trading departments in the industry. Launched in 1999, it has a global presence, with thousands of assets under its belt.

This includes dozens of pairs from the major, minor, and exotic markets. You can open an account in less than a few minutes, and minimum deposits are set at £100. Moreover, the platform allows you to make deposits with debit/credit cards, although it can take 24 hours for the funds to be processed.

One of the main drawbacks of using an established broker like Markets.com is that its fees are a bit expensive. It is also somewhat difficult to know exactly what you are paying, not least because fees are based on the account type that you hold. Finally, Markets.com is heavily regulated, and its parent company Playtech is listed on the London Stock Exchange (LSE).

Our rating

- Great reputation and holds multiple trading licenses

- Accepts debit and credit cards

- Extensive selection of forex pairs

- More expensive than other brokers in the space

- Limited product portfolio

CMC Markets – Best Broker For super-competitive Fees

Launched in 1989, CMC Markets is a UK broker with a long-standing reputation in the financial sphere. Among many other jurisdictions, the platform is fully regulated by the Financial Conduct Authority.

The overarching advantage of choosing CMC Markets as your go-to broker is that it offers some of the lowest fees in the space. For example, some of the major currency pairs come with a spread of just 0.7 pips. The platform is also competitively priced if you plan to keep your positions open overnight.

If you're an experienced trader that likes to employ sophisticated trading strategies, CMC Markets offers heaps of technical indicators. This also includes a good number of drawing tools and chart types, as well as a fully customizable trading screen. Although phone support is only available on a 24/5 basis, we really like the 30-second average waiting time for live chat.

Our Rating

- Trade major forex pairs from just 0.7 pips

- Great mobile trading department

- Heaps of technical indicators

- Phone support only available 24/5

- High stock CFD fees

OANDA – Best for a full-service mobile trading app

Oanda broker has one of the most comprehensive and feature-rich platform. It is easy to use and highly customizable. The broker features 10+ charting options and numerous technical indicators/trading tools. It also features a range of educational and training resources, hosts weekly live webinars online, and offers a demo account. In addition to these is their full-service mobile trading app that mirrors the desktop and web-trading platforms. These make it suitable for both beginner and expert forex traders.

The Forex CFD specialist features two types of accounts; the standard account has no minimum initial deposit while a commercial forex trading account requires a minimum deposit of £20,000. Oanda charges a commission and spreads on each forex trade initiated here, both of which are variable but highly competitive. It also has one of the most responsive customer support that’s available via email address, social media networks, live chat, and on the phone.

Our Rating

- Gives you access to over 70 trading pairs

- Accounts are hosted on the highly versatile MT4 trading platform (web trader, desktop and mobile apps)

- Broker platforms integrate all the important trading, market analysis, and risk management tools

- Appeals to both expert and inexperienced forex traders from around the world

- Charges an inactivity fee of £10 monthly (after 12 months of inactivity)

- Account opening may be relatively slow (verification takes up to 3 days)

Saxo Capital – Great for Experienced Investors

Saxo Capital is another UK broker that has an excellent reputation. Launched in 1992, the platform holds a range of regulatory licenses. You will need to deposit at least £1,500 to get started with the broker, although this shouldn't be a problem is you're a seasoned trader. If trading on leverage is your thing, Saxo Capital offers fully-fledged margin accounts. Just make sure that you understand the risks of margin trading.

We also like Saxo Capital because of its involvement in other areas of the financial markets. This includes stocks and shares, indices, and options. Finally, the Saxo Capital trading arena also comes with a number of technical analysis tools.

Our Rating

- Great for experienced traders

- Lots of advanced trading tools - including leverage

- Massive collection of assets listed

- Minimum account balance £1,500

- Minimum account balance £1,500

Interactive Brokers – Best Forex Platform For Liquidity

If you're looking for a highly established trading platform that is home to heaps of liquidity, you might want to check out Interactive Brokers. Launched way back in 1977, the parent company is now listed on the NASDAQ stock exchange, and it holds multiple regulatory licenses. This includes the UK's Financial Conduct Authority (FCA). In terms of the forex department itself, you can trade over 100 currency pairs.

This covers major, minor, and exotic pairs, and the platform is operational 24 hours per day. Interactive Brokers also offers a fully-fledged trading platform that can be accessed via your web browser, desktop computer, or mobile phone. Trading fees will depend on the type of account you have.

With that said, if you're trading less than $100,000 per month, or you haven't paid at least $10 in monthly commissions, you will need to make up the difference. As such, Interactive Brokers is best suited to those of you that are looking to trade large volumes.

- Fees are low, although the specifics will depend on your account type

- More than 100+ currency pairs listed

- Excellent research tools

- Charges an inactivity fee if less than $100,000 per month is traded

- No fixed spread trading accounts

How We Rank Online Stock Brokers

In order to provide you with an accurate and up-to-date analysis of each broker that we list, we personally open accounts and test the platform out for ourselves. This allows us to give you an in-depth overview of how each broker operates. All of our reviews are independent and impartial, meaning that we never allow a third-party platform to influence our findings.

Below we have listed the main metrics that we look for when reviewing a new forex broker.

- Fees and commissions

- Number of currency pairs listed

- Offers and promotions

- Research and analytics tools

- Trading platforms

- User-friendliness and customer support

Number of markets offered to the trader

How do UK Forex Brokers work?

Below we have outlined a more in-depth overview of how the broker platforms work.

- When you find a broker that meets your individual needs, you will then need to open an account. This works in the same way as opening a new bank account, insofar that you will need to verify your identity. Most forex brokers will ask for your full name, home address, date of birth, and if applicable – tax number. You will also need to supply some contact details.

- Just like a bank account application, UK forex brokers will then ask you to supply some documentation. This is to ensure the broker remains compliant with anti-money laundering laws. In the UK, the FCA requires all forex brokers to verify the identity of its clients. As such, you’ll need to upload a clear copy of your government-issued ID. This can be either a driver’s license or passport.

- Now that you have verified your identity, you can proceed to deposit some funds. Most brokers will have a minimum deposit amount in place, although this will vary from site-to-site. Deposit methods will also depend on your broker of choice. Some platforms allow you to deposit with a credit/debit card, bank transfer, and even an e-wallet like PayPal.

- At this stage of the process, you should now have a fully verified and funded broker account. If so, you can now place your first trade. Brokers will typically list dozens of pairs for you to choose from. If you have a particular trading pair in mind, you can search for it. Once you are on the trading screen for the pair you wish to buy or sell, you’ll need to decide which way you think the market will go.

- If you think the left-handed currency of the pair will increase, then you will place a ‘buy’ order. Placing a ‘sell’ order would indicate that you believe the right-handed currency will increase. For example, if trading GBP/USD, and you think that GBP will increase in value, you’d need to place a buy order. On the contrary, if you were more confident on USD, you would sell the pair. Once the trade is placed, you can close the order at any time.

How do Forex Broker Fees Work?

The fees charged by forex brokers can appear somewhat confusing at first glance. The reason for this is that a number of different pricing structures are utilized by brokers. We’ve outlined the fundamentals below.

- Most forex brokers will charge a commission. This can be charged on a fixed-fee basis, meaning that you will pay a standard fee every time you place a trade. For example, the broker might charge £1 for every trade that you make. You would pay this fee when you open the trade, as well as when you close it. Large volume traders will usually benefit from a lower fixed fee.

- Some forex brokers will instead charge a variable fee. This will be calculated against the total size of your order. For example, if the broker charges 0.5%, and the size of your forex order is £1,500, you would pay £7.50 in fees. This particular model is best suited for those that trade really small amounts.

- A number of forex brokers advertise commission-free trading. However, you still need to keep an eye out for the spread. This will have a direct impact on your ability to make a profit. In other words, although you are not paying a trading fee per-say, a high spread would make it more difficult to make small profits.

- You also need to make some considerations regarding funding fees. This is only applicable if you are looking to engage in margin trading. Depending on how much leverage you require, the broker will charge you a fee for holding positions overnight. This is charged as a percentage of the total amount that you borrow from the broker.

Trading Forex Example

If you’re just starting out in the world of forex trading, it’s crucial that you have a firm understanding of how the space actually works. To help you along the way, we’ve listed the steps that you will need to take.

Step 1: Choosing a Currency Pair

First and foremost, you will need to choose a pair to trade. Don’t forget, you are speculating how one currency will change in price against another. For example, if trading EUR/USD, you need to decide whether EUR will go up or down in price against the USD.

It is also important to note that pairs come in three different bands – majors, minors, and exotics.

Major Pairs

Major pairs are the most traded currencies in the world. Think along the lines of the US Dollar (USD), Pound Sterling (GBP) and the EURO (EUR).

Minor Pairs

Minor pairs will contain one major currency and one less liquid currency. For example, NZD/JPY is a minor pair, as is GBP/CAD.

Exotic Pairs

Exotic pairs contain an emerging currency alongside a major currency. These typically struggle for liquidity, so you’ll find that the spread is often higher. This includes the likes of USD/TRY and USD/ZAR.

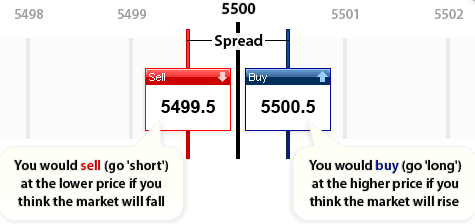

Step 2: Check the Spread

Before you start trading your chosen forex pair, you need to assess what the spread is. This is the difference between the ‘buy’ and ‘sell’ price. For example, let’s say that you are trading EUR/USD.

If the buy price is 1.13606, and the sell price is 1.13598, this leaves us with a difference of 0.0006. Forex traders identify the difference in ‘pips’. In the case of EUR/USD, the pip is taken after the fourth digit. As such, the spread in this example would be 0.6 pips. The higher the pips, the more you are indirectly paying in trading fees.

Step 3: Decide Whether you Want to Buy or Sell

So now that you’ve calculated the spread, you need to decide which way you think the market will go on your chosen forex pair. Let’s stick with EUR/USD as our example. If you think that EUR will ‘increase’ in price against the USD, you need to place a ‘buy’ order.

On the contrary, you think that EUR will ‘decrease’ against the USD, then you need to place a ‘sell’ order. Make sure you understand how this works before you start trading, as a mistake could be costly.

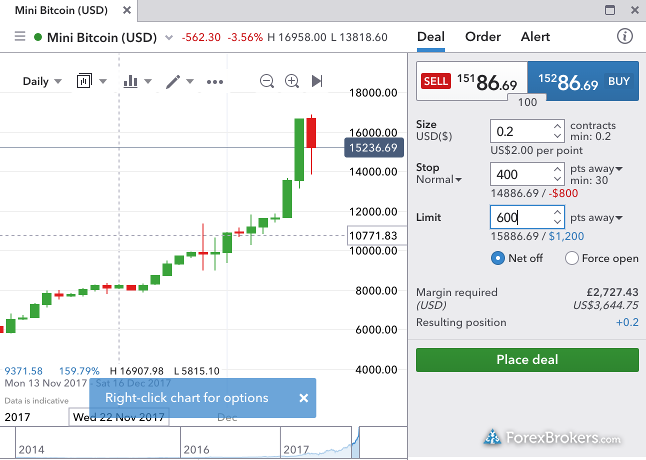

Step 4: Select Your Position Size

You now need to determine how much you want to stake on your trade. This is known as the ‘position size’. The calculation is a lot more complex in comparison to buying traditional stocks and shares, as you’ll need to choose how much you want to stake per pip. You also need to consider the size of the lot that is associated with your chosen pair.

Step 5: Install Stop-Losses

Ask any seasoned trader and they will tell you the importance of setting up a stop-loss order. This is where your trade is automatically closed when the price goes against you. For example, let’s say that you’re trading at GBP/USD. The current price is $1.34, and you believe that the USD will increase against GBP.

As such, you place a ‘sell’ order. However, the trade goes against you and GBP/USD hits $1.40. Fortunately for you, by setting up a stop-loss order at $1.36, your losses were kept to a minimum.

Leverage at a UK Forex Broker

If you have a tendency to take higher risks when investing, you might be considering applying leverage to your trades. This is where you purchase more forex than you actually have in your account. On the one hand, leverage can be great if things go your way, not least because you can amplify your profits. However, if a leveraged trade goes wrong, you could lose a lot of money. Once again, this is why you should always install a sensible stop-loss order on all of your forex trades.

ESMA: In 2018, the European Union created a new body to govern the rules surrounding online trading. The European Securities Markets Authority (ESMA) implemented a number of regulations as to the amount of leverage that you can apply to forex trades. This amounts to a limit of 30:1 on major pairs, and 20:1 on minors/exotics.It is important to note that the UK will soon be leaving the European Union. Nobody knows how this will impact forex trading in the UK, not least because it will no longer be bound by ESMA regulations.

Factors to Consider When Choosing an Online Forex Broker

- Account minimum – Forex brokers will stipulate the minimum account balance that you need to keep to trade on the platform. This will vary depending on the broker you use. Most platforms will require at least £100.

- Fees or commissions – Fees are really important when choosing a new forex broker, not least because they will eat into your potential profits. Things to look out for is the size of the commission charged, and how large the average spread is on your chosen pair.

- Availability of forex analysis tools – Regardless of the experience levels you have in the forex space, analysis tools are crucial. This should include fundamental live news analysis, and a range of technical indicators to help you read charts.

- Number of pairs: You should stick with platforms that offer an extensive number of trading pairs. This should include a good mixture of major, minor, and exotic currencies.

- Payment Methods: Assess what payment methods the broker supports prior to registering an account. Possible options include a credit/debit card, bank account, or e-wallet.

- Leverage: If you’re the type of trader that likes to apply leverage, check to see whether the broker supports margin accounts.

- Customer service and support – You are best off using a broker that offers top-notch customer support. On top of offering 24/7 customer service, we prefer brokers that provide live chat and telephone support.

Conclusion

You should now have a really good understanding of the types of factors that you need to look out for when choosing a UK broker. Whether its Financial Conduct Authority regulation, trading fees, the spread, customer support, or the number of pairs listed – you now have the required tools to find a broker that is right for you.

To help you along the way, we also listed our top picks for the best forex brokers currently in the UK market. This includes the best broker for newbies, mobile trading opportunities, trust, and low fees. Crucially, even if you do decide to go with one of the brokers we have recommended, you still need to perform your own research prior to making a deposit.

FAQs

What is a forex broker platform?

Forex broker platforms allow you to buy and sell currency pairs from the comfort of your own home. The platform matches your trades with other buyers, which is how liquidity remains strong in the forex space.

What is the easiest forex pair to trade?

There is no such thing as an ‘easy’ pair to trade, as you still need to have a good understanding of how forex works. However, if you’re looking for pairs with low levels of volatility, you should stick with major currencies.

What is the minimum deposit required at a forex broker?

Minimum deposit amounts will vary from platform-to-platform. Some allow you to get started with just £10, while others will require £1,000 or more.

Who regulates forex brokers?

Forex broker regulation in the UK is the responsibility of the FCA. However, for as long as the UK remains a member of the European Union, UK brokers must also comply with ESMA.

How much leverage can I trade with at a UK broker

forex brokers must comply with the leverage rules outlined by ESMA. This means a maximum leverage amount of 30:1 on major pairs, and 20:1 on minor/exotic pairs.

What is an exotic currency pair?

An exotic currency pair is typically made up of one major currency, and a currency from an emerging market. USD/ZAR is an example of an exotic pair.

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up