Dot Dot Loans Review 2021 | Loan Limits, APR, And Eligibility

If you have ever been in a financial emergency with seemingly no way out, you might appreciate the role of short-term lenders like Dot Dot Loans. The lender offers loans to all kinds of borrowers, no matter the credit, with a fast approval and funding rate.

If you have ever been in a financial emergency with seemingly no way out, you might appreciate the role of short-term lenders like Dot Dot Loans. The lender offers loans to all kinds of borrowers, no matter the credit, with a fast approval and funding rate.

But before you sign up to the platform and get your first loan, how well do you know the lender? Our comprehensive review aims to give you all the answers you seek about the platform and much more.

We have undertaken a thorough analysis of the service provider and its practices to help you make the right decision. Read on to find out if it is the best choice for you.

-

-

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.What is Dot Dot Loans?

Dot Dot Loans is a short-term lender based in the UK, in Batley, West Yorkshire. They operate under the trading name Shelby Finance Ltd. The company belongs to Morses Club, one of the largest home collected loan companies in the UK, which has been operational for at least 130 years.

Dot Dot Loans is a short-term lender based in the UK, in Batley, West Yorkshire. They operate under the trading name Shelby Finance Ltd. The company belongs to Morses Club, one of the largest home collected loan companies in the UK, which has been operational for at least 130 years.The lender has been operational since 2017 and specifically targets customers who prefer fully online services. Dot Dot operates as a direct lender, meaning that you apply for funding and get it directly from them.

They are a fully online service provider with a focus on simplicity, fairness and speed. Like many other short-term lenders, they do not demand a perfect credit score. But they strive to practice responsible lending, which we will discuss in greater detail shortly.

A subsidiary of a seasoned UK lender, Dot Dot Loans is a direct online lender offering reliable services, albeit, on the expensive side. They have a simple loan structure and offer fast approval on every day of the week including weekends.Pros and Cons of a Dot Dot Loans Loan

Pros

- Fixed rate makes it easy to know exactly how much you will pay back

- Fast online processing

- Funds available within an hour of application if you apply during work hours.

- Flexibility in the repayment period

- Borrowers get quotes within minutes

- Funds loans throughout the week including weekends

- Offer remarkable transparency into costs

- Does not charge late payment fees, origination or prepayment fees

- As a direct lender, they do not share your data

Cons

- Low ceiling loans, especially for first-time borrowers

- Platform performs credit check which may impact your score

- High rates

How does a Dot Dot Loans loan work?

Dot Dot Loans does not offer the traditional payday loans that short-term borrowers often have to take for lack of a better option. Rather, they offer an alternative product that lets you pay back in installments over a period of time.

As such, borrowers can expect to make repayments in smaller, more manageable monthly installments. However, this makes the loan more expensive in the long haul.

Credit and affordability checks

New borrowers qualify to access loans between £100 and £600. Existing customers get access to more than double this amount, with loan limits capped at £1,250. The amount you qualify for varies by requirements, credit rating as well as your affordability.

Borrowers also get to enjoy flexibility when it comes to the loan terms. These vary from 3 months to 6 months, up to 9 months and 12 months. Another benefit, which may also be a downside, is the fact that it operates on fixed rates.

On one hand, that means that right from the start you know exactly how much you will need to pay back. But on the other hand, these rates are usually on the higher side.

Funds disbursement

When you apply for a loan on the platform, you will usually get a quote pretty fast. The quote shows all the important details including how much you will need to pay back over the desired period.

Unlike other lenders, the platform funds loans throughout the week, including Saturdays and Sundays. Any application that you make between 8:30 AM and 4:30 PM will usually mean getting your funds within an hour of the request. But any requests approved after 3:30 PM on weekdays or 5:00 PM get funding on the next day.

Credit checks

One aspect of responsible lending from the site is making sure that you meet the required criteria. They carry out thorough affordability and credit checks. As the site explains, this is so as to ensure you do not get into greater financial difficulty with a loan.

Whether you are new to the platform or an existing customer, they will always carry out these checks. The credit check helps the lender decide how much credit you would qualify for. They do this by looking at how you have managed any credits you have had prior to this one.

That does not mean you need a perfect score, it simply helps them determine whether you can manage the repayments.

Affordability checks involve looking at your income and expenses to make sure that repayments will not get you into problems.

Repayment

The lender strives to offer quick responses to applicants. In cases where they cannot, they usually request for more information so as to process the request. Though it is not mandatory, in some cases, you might need to upload documents following your application.

There are no fees on Dot Dot Loans other than the agreed upon fixed rate. They do not charge late payment penalties. Rather, they are willing to work with you on an alternative repayment plan if the current one seems not to work.

Once you settle on an amount and get the repayment amount and loan term, they will take repayments directly from your account on monthly basis. Note that the lender is transparent and will let you know exactly what to expect before you submit your application.

Being a direct lender, they will not share your data with any third-party service providers. It also means that you can contact them directly when issues or queries arise.

Dot Dot Loans Account Creation and Borrowing Process

Simplicity is at the core of the Dot Dot Loans platform and it is manifested in every process including account creation and borrowing.

1. To create your own account on the site https://www.dotdotloans.co.ukand borrow your first loan, start by clicking on the “Apply” tab.

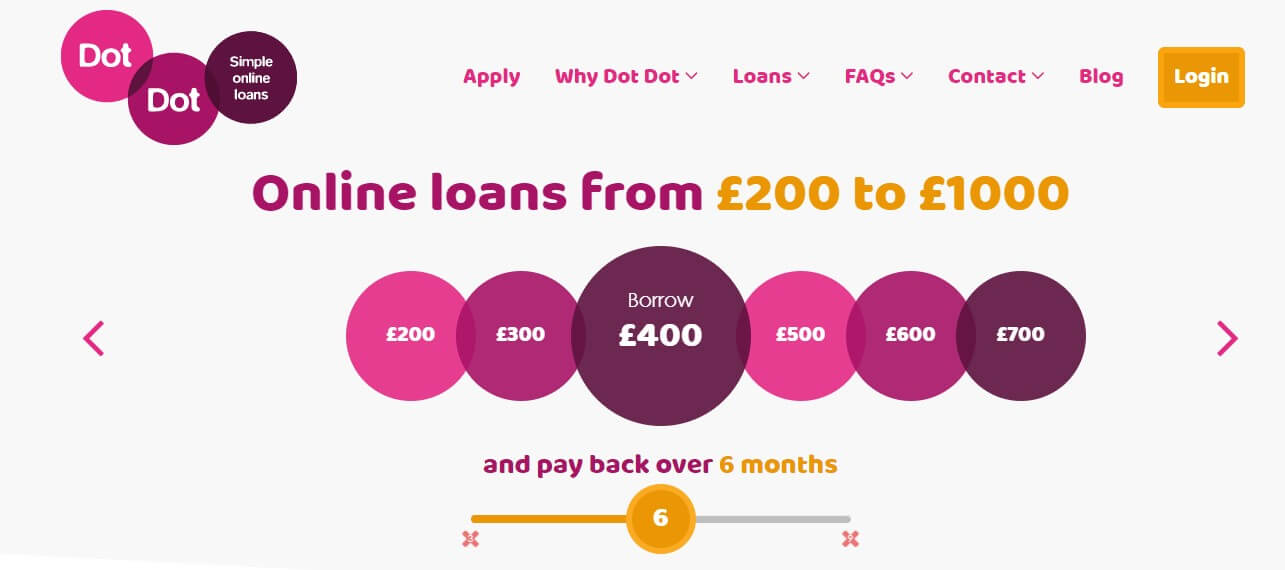

2. The very first step is to calculate your loan.

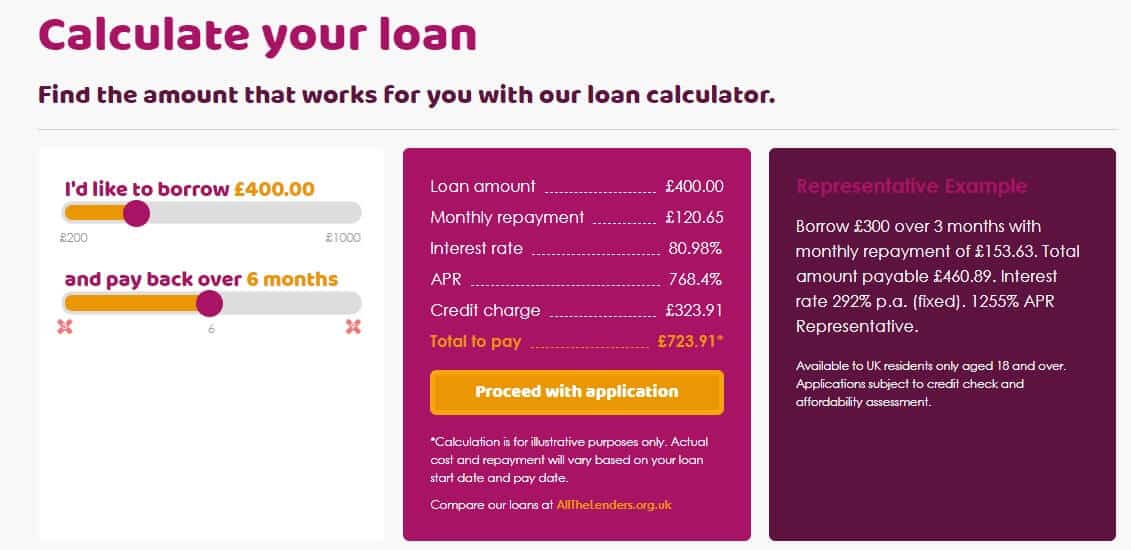

First, select the amount you want to borrow and then set the repayment period. You will get to see the monthly repayment figure, the interest rate applicable, the APR and the credit charge.

You can keep making adjustments until you find the terms satisfactory.

2. Once you are satisfied, click on “Proceed with application” to commence the online application process.

3. You will need to fill in the loan details, selecting the loan amount and the loan term.

Enter your personal information, starting with your name and date of birth. Enter your email address and phone numbers as well.

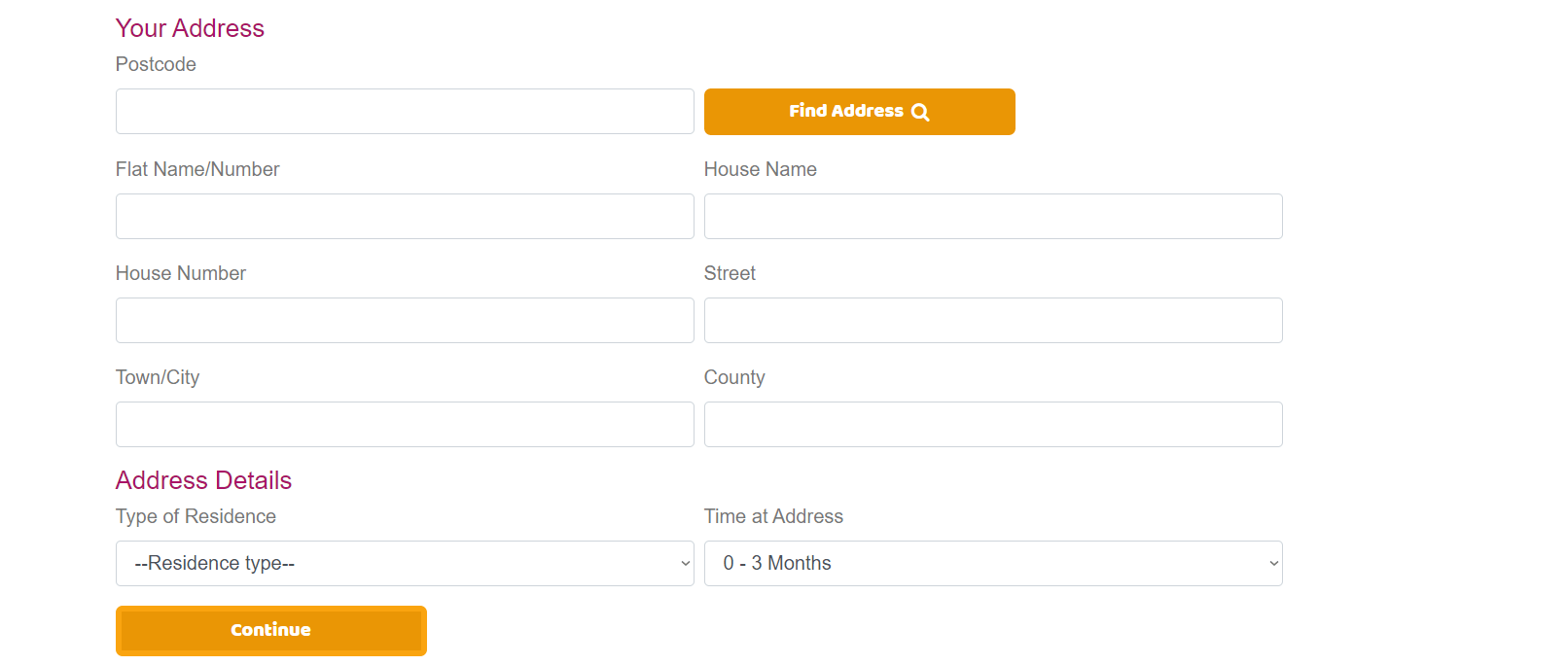

4. Once you are done with that, enter your address details which include residential info and the length of time you have lived at the address.

5. Enter your work details including employment status, company name, job type, telephone, payment type and frequency.

6. Finally, you will need to submit your bank details then your income and expenditure and that’s it. Read and accept the terms and conditions then submit the application form.

Note that after reviewing your application, the lender may offer a different amount and term that differ from what you applied for.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Dot Dot Loans Loan

In order to qualify for a loan on Dot Dot, here are the qualifications you need to meet. These include:

- Be at least 18 years

- Be a resident of the UK

- Have a minimum income of £14,400 annually

- Should not be self-employed

- Should get paid monthly

- Should have a valid mobile number and email address

Information Borrowers Need to Provide to Get Dot Dot Loans Loan

If you meet all of the above requirements, you will need to provide some details during the application process, including:

- Home address information for the past 3 years

- Debit card and bank account information

- Personal details

- Employment details

- Income and expenditure details

What are Dot Dot Loans loan borrowing costs?

Dot Dot Loans is a high-cost lender as compared to other similar lenders in the UK. Here are the costs you can expect to incur when you borrow from the platform:

- APR – varies by loan amount, term and other factors

- Arrangement fees – nil

- Prepayment fees – nil

- Late payment fees – nil

Representative Example:

- Borrowed Amount – £300

- Repayment Period – 3 months

- Monthly repayment amounts – £153.63

- Total amount to pay – £460.89

- Fixed interest rate p.a. – 292%

- APA (representative) – 1,255%

Dot Dot Loans Customer Support

A majority of short-term lenders outsource their customer support services and this often results in complaints from customers. But Dot Dot is an exception in that it has employed a UK customer service team.

According to online reviews, they are friendly and helpful and overall, are rated as excellent.

Is it safe to borrow from Dot Dot Loans?

Dot Dot Loans is authorized and regulated by the Financial Conduct Authority. Furthermore, its website uses industry-standard encryption to protect user information.

It is also associated with a big name in the lending industry, which further adds to its credibility. There are no safety concerns associated with borrowing from this lender.

Dot Dot Loans Review Verdict

Dot Dot Loans claims to offer simple, fast and convenient services to all types of customers. Though its rates are higher than average, it prides itself in offering flexible terms for its borrowers and almost immediate funding.

The fact that it funds loans even over the weekends is exceptional and it gets high marks for the excellent customer service.

First -ime customers access low amounts and every time you apply for a loan, they perform a credit check, which may impact your score.

In spite of being a relatively new company, Dot Dot is owned by a company with over a century of experience in lending. And their background shines through in the convenience and simplicity of their services. Generally speaking, it is a solid choice for a rainy day.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.Glossary of loaning terms

Credit Score

Credit ScoreA credit score shows your creditworthiness. It's primarily based on how much money you owe to loan or credit card companies, if you have ever missed payments or if you have ever defaulted on a loan.

Guaranteed Approval

Guaranteed ApprovalGuaranteed Approval is when, no matter how bad, your credit score its, your loan application will not get declined.

Credit Limit

Credit LimitA Credit Limit is the highest amont of credit a lender will lend to the borrower.

Collateral

CollateralCollateral is when you put up an item against your loan such as your house or car. These can be repossessed if you miss payments.

Cash Advance

Cash AdvanceA Cash Advance is a short-term loan that has steep interest rates and fees.

Credit Rating

Credit RatingYour Credit Rating is how likely you are to fulfill your loan payments and how risky you are as a borrower.

Fixed Interest Rate

Fixed Interest RateFixed Interest Rate is when the interest rate of your loan will not change over the period you are paying off you loan.

Interest

InterestThe Interest is a percentage based on the amount of your loan that you pay back to the lender for using their money

Default

DefaultIf you default on your loan it means you are unable to keep up with your payments and no longer pay back your loan.

Late Fee

Late FeeIf you miss a payment the lender will charge you for being late, this is known as a late fee.

Unsecured Personal Loan

Unsecured Personal LoanAn Unsecured Personal Loan is when you have a loan based solely on your creditworthliness without using collateral.

Secured Loan

Secured LoanA Secured Loan is when you put collateral such as your house or car up against the amount you're borrowing.

Prime Rate

Prime RateThis is the Interest Rate used by banks for borrowers with good credit scores.

Principal

PrincipalThe Principal amount the borrower owes the lender, not including any interest or fees.

Variable Rate

Variable RateA Variable Rate is when the interest rate of you loan will change with inflation. Sometimes this will lower your interest rate, but other times it will increase.

Installment Loan

Installment LoanAn Installment Loan is a loan that is paid back bi-weekly or monthly over the period in which the loan is borrowed for.

Bridge Loan

Bridge LoanA Bridge Loan is a short term loand that can last from 2 weeks up to 3 years dependant on lender.

AAA Credit

AAA CreditHaving an AAA Credit Rating is the highest rating you can have.

Guarantor

GuarantorA Guarantor co-signs on a loan stating the borrower is able to make the payments, but if they miss any or default the Guarantor will have to pay.

LIBOR

LIBORLIBOR is the London Inter-Bank Offered Rate which is the benchmarker for the interest rates in London. It is an average of the estimates interest rates given by different banks based on what they feel would be the best interest rate for future loans.

Home Equity Loans

Home Equity LoansHome Equity Loans is where you borrow the equity from your property and pay it back with interest and fees over an agreed time period with the lender.

Debt Consolidation

Debt ConsolidationDebt Consolidation is when you take out one loans to pay off all others. This leads to one monthly payment, usually with a lower interest rate.

Student Loan

Student LoanIf you obtain a Student Loan to pay your way through College then you loan is held with the Department for Education U.K.

Student Grants

Student GrantsFinancial Aid in the form of grants is funding available to post-secondary education students throughout the United Kingdom and you are not required to pay grant

FAQ

Does the lender have to conduct a credit search or can I get approval without a search?

You cannot get approval without a credit search. Every loan application on the platform gets credit checked. In keeping with the principle of responsible lending, Dot Dot Loans always want to ensure that borrowers meet the required criteria and can afford to repay the loan.

Why does the lender have to verify my income details?

As a responsible lender, they have to verify both your income and expenditure. The purpose is to ensure that you can afford to make repayments without getting into financial difficulty. Based on this information, they may adjust the loan amount and term.

Can I get a loan if I have a poor credit score?

Yes. The lender does not set a minimum credit score for loan approval. Rather, they make their decision on a case by case basis. They also take other factors into consideration apart from the credit score in order to approve or reject an application.

What if they decline my application?

A rejected application means that at the present time, the lender cannot offer you a loan because you did not meet the required criteria. However, you can reapply after a minimum of 30 days. But note that your circumstances need to have changed or the response will be the same.

Do I need to be a homeowner to qualify for a loan?

No. You can qualify for a loan even if you are renting your current place of residence. The lender does not look at homeownership. But rather, they look at income and expenditure together with other factors when approving loans.

What loan products does Dot Dot Loans offer?

The lender offers short-term installment loans ranging from £100 to £1,250 at a fixed rate.

Payday Loan Provider Reviews – A-Z Directory

-

Nica

Nica

Nica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...