-

Trade with eToro - 0% Commission

- Supports social trading, copy trading and copy portfolio features

- Trade on the go via the eToro mobile trader

- Highly transparent fee structure

- A wide range of advanced trading tools and analytics

75% of investors lose money when trading CFDs.

What Criteria do we Apply When we Review a Forex Broker?

The online UK forex broker space is now oversaturated. There are literally hundreds of brokers active in the global markets in 2021, with most of these regulated in the UK. As such, knowing which platform to open an account with is no easy feat. Crucially, you need to make sure that the broker is right for your individual trading needs. This is why we publish highly in-depth reviews of the best UK forex and CFD brokers in the market.

Here are the main factors that we look for when reviewing a forex broker.

- The number of payment methods supported

- How easy is the KYC process?

- What trading fees will you need to pay?

- How many forex pairs can you trade?

- The reputation and regulatory standing of the platform

What is ETX Capital?

Launched in 1965, ETX Capital is a broker that allows retail and institutional clients to buy and sell a range of financial instruments. This includes a fully-fledged CFD department that consists of more than 2,500 assets. Whether it’s CFDs in the form or you buy shares, indices, ETFs, commodities, bonds, or cryptocurrencies – ETX Capital has you covered. The broker also allows you to trade forex, with 58 currency pairs currently listed.

On top of boasting a long-standing track-record that exceeds 50 years, ETX Capital is also regulated by a number of leading licensing bodies. This includes the UK’s FCA, meaning you’ll be covered by its £85,000 investor protection scheme. When it comes to fees, the spread on EUR/USD can be as low as 0.7 pips, which is competitive. However, CFD trading fees are often high.

Note: The exact price that you pay when trading forex and CFDs will depend on the type of account that you hold. Crucially, those trading larger amounts will benefit from tighter spreads and lower commissions.

For example, you’d end up paying $32 in commission if holding an Apple stock CFD for 7 days. On the flip side, the broker offers free deposits and withdrawals across multiple payment methods. We also like the fact that traders have several options when it comes to choosing a trading interface.

This includes its own TraderPro platform, alongside the more popular MetaTrader4 (MT4). You can also trade via your web browser, desktop, or mobile device. Finally, ETX Capital is also strong in the educational department. This includes a number of monthly webinars and in-depth trading guides.

Pros and Cons of ETX Capital

The Pros

- Launched way back in 1965

- Regulated by the FCA

- 58+ forex pairs

- 2,500+ CFDs

- EUR/USD from just 0.7 pips

- Great educational tools

- Trade via its web platform, desktop, or mobile

The Cons

- Stock CFD commissions are quite high

- Fewer forex pairs than its main market rivals

How to Sign-Up at ETX Capital: Step-by-Step Walkthrough

If you like the sound of what ETX Capital offers for your long-term trading goals, we are now going to show you how you can get started. The step-by-step guidelines outlined below explain how you can open an account, verify your identity, deposit funds, and start trading.

Step 1: Open an Account

First and foremost, you’ll need to head over to the ETX Capital homepage and open an account. You will need to enter some personal information that will later need to be verified, so make sure everything is correct. This will include your full name, home address, date of birth, nationality, and tax number. You’ll also need to provide your email address and primary telephone number.

As a responsible broker with a track record that exceeds five decades, ETX Capital will ask you questions to determine whether or not you are suitable for online trading. More specifically, CFD instruments and forex are highly risky asset classes, especially if applying leverage. As such, you’ll need to state your prior trading experience, and the types of assets you’ve previously invested in.

In order to determine affordability, ETX Capital will also ask for your employment status, annual salary, and your estimated net worth. Finally, you’ll need to go complete a basic questionnaire regarding key trading terms, such as the risks associated with margin accounts and overnight financing.

Step 3: Verify Your Identity

ETX Capital is licensed by the FCA, meaning that it is required to verify the identity of all traders that uses its platform. As such, you’ll need to upload some documents before you can start trading. To verify your identity you can upload a copy of your passport or driver’s license. You will also need to verify your residency status. You can do this by uploading a copy of a bank statement, utility bill, or tax statement.

Note: If you have a tendency to open multiple broker accounts, it’s always worth keeping your ID and residency documents on your device. In doing so, you’ll be able to upload the required documents straightaway and thus – avoid any delays.

In most cases, the ETX Capital system will be able to validate your documents automatically. However, if the documents are not clear enough you might be asked to upload them again.

Step 4: Deposit Funds

As soon as your ID documents have been validated, you can then proceed to deposit some funds. The good news is that ETX Capital offers heaps of payment methods. This includes a debit/credit card, bank transfer, and even an e-wallet like Skrill. All deposits and free, which is an extra bonus, but to get started you’ll need to deposit at least £100. If using a debit/credit card or e-wallet, the funds should be credited to your ETX Capital account instantly.

Step 5: Start Trading

Now that your ETX Capital account has been funded, you are now ready to start trading. If you want to test the platform out before risking real money, you can trade via the broker’s demo account. Alternatively, you might want to consider trading with small amounts before you get more comfortable.

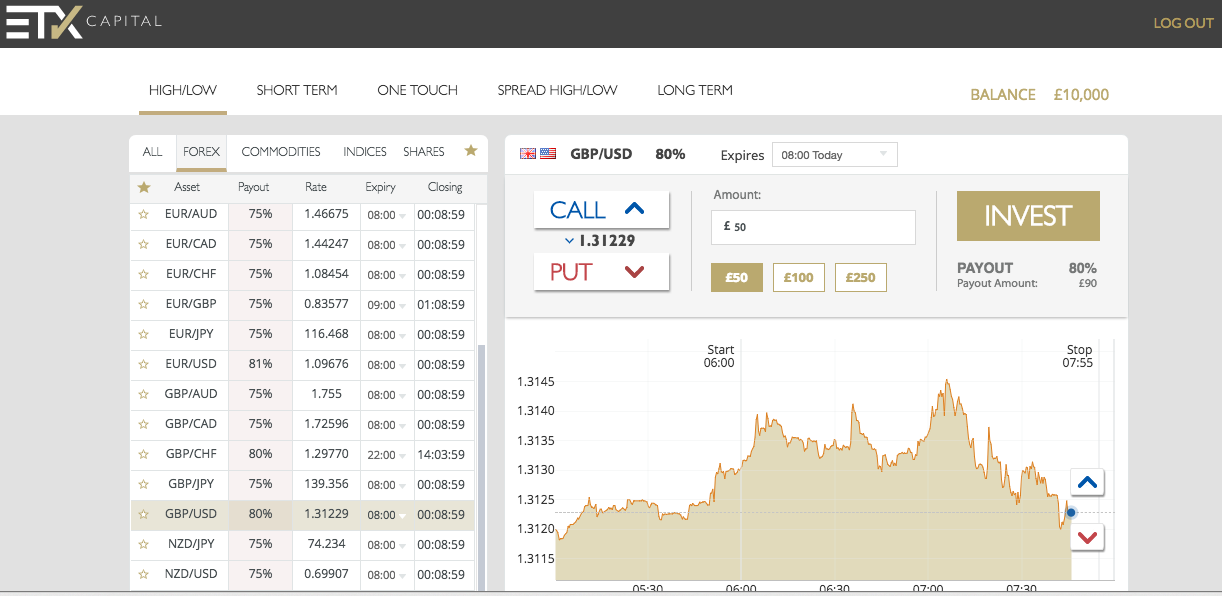

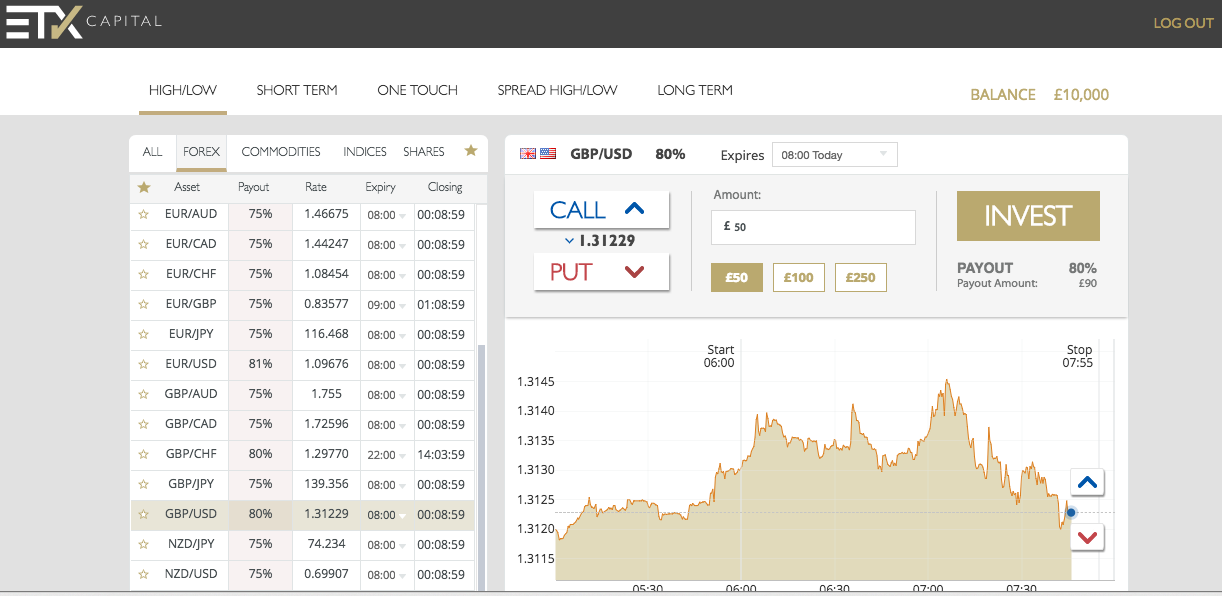

Either way, you can search for the specific instrument that you want to trade (for example S&P 500 indices or GBP/USD) in the search box.

What can I Trade at ETX Capital?

Although ETX Capital doesn’t have the most extensive forex department in the online space, it does offer more than 2,500 CFD instruments. This covers most asset classes available in the traditional investment scene, which we’ve listed below.

CFDs

- Stocks and shares

- Indices

- Bonds

- Metals

- Energies

- ETFs

- Cryptocurrencies

Forex

- 58 forex pairs

- Supports majors, minors, and some exotics

Note: It is also worth considering the

spread betting department at ETX Capital, which covers heaps of financial instruments. If you’re based in the UK, profits made via spread betting products are not liable for tax. On the contrary, you’ll need to pay tax on capital gains made on CFD and forex trades.

ETX Capital Broker Fees

As is the case with most UK brokers operating in the space, understanding the trading fees charged by ETX Capital is no easy feat. The reason for this is that fees will depend on the type of asset you are trading, as well as the specific account you hold. Nevertheless, we’ve listed the most pertinent points on fees below.

- ETX Capital does not charge any commissions if you are trading forex. Instead, everything is built into the spread. This is fairly standard with most forex brokers. As such, you need to pay attention to the width of the spread. You can get EUR/USD down to just 0.7 pips, which is good. The spreads will increase when you start trading less liquid currency pairs.

- When it comes to trading CFDs, you will need to pay a commission. This is based on the amount that you wish to trade. In terms of the spread, ETX Capital is competitive on major indices markets. For example, the S&P 500 comes with an average spread of just 0.5 pips.

- However, some CFD products come with less competitive spreads. For example, the Europe 50 market comes with a spread of 2.0 pips. Individual stock CFDs also come with high spreads.

- In terms of non-trading fees, ETX Capital will charge you a $10 fee if requesting more than 5 withdrawals per month. If your account remains inactive for more than 6 months, then you will start to pay $25 per month until you start using your account.

Deposits and Withdrawals

As we briefly noted earlier, ETX Capital supports a good number of everyday payment methods. There are no deposit fees to consider, although you’ll need to fund your account with at least £100. Below we have listed the payment methods that ETX Capital supports.

- Debit Cards

- Credit Cards

- Bank Transfer

- Skrill

- GiroPay

- Neteller

- China Union Pay

- Sofort

Note: If you decide to use your credit card to deposit funds at ETX Capital, you might be best to check whether or not the issuer deems the transaction as a ‘cash advance’. If it does, then the credit card company is likely to charge you 3%, with the interest being applied to your account instantly.

While fees and payment methods are super important when considering a new forex broker, you also need to explore what features the main trading platform offers. Below we have listed the stand-out benefits that ETX Capital offers.

- TraderPro: ETX Capital has designed and built its very own trading platform. Known as TraderPro, the platform is available via your web browser or mobile device but doesn’t come in the form of desktop software. With that said, the TraderPro platform is really easy to use, making it perfect for newbie traders.

- MetaTrader4 (MT4): If you’re an experienced forex trader that prefers to use a legacy platform like MT4, then you’re in luck. The platform at ETX Capital looks and feels like any other MT4 interface available in the market.

- Technical Indicators: ETX Capital currently lists 56 technical indicators. These are great to judge market sentiment, moving averages, and volumes.

- Market Orders: The platform offers lots of basic and more sophisticated market order types. Regarding the former, this includes the usual offering of limit orders and stop-loss orders. ETX Capital also offers stop trailing orders, which is useful if you’re looking to automate your profit-taking endeavors. You’ll also find GTC (good ’til canceled) and GTD (good ’till date) orders.

- Alerts and Notifications: ETX Capital allows you to set-up pricing alerts on all of the financial instruments that it hosts. You can set a pre-defined trigger price on your chosen asset, and then ETX Capital will send you an alert when your price-point is met. When it does, you can trade the asset manually, or watch your automated orders in action. Alerts can come to your mobile phone in the form of a notification, or via email.

- Portfolio Report: If you’re the type of investor that places a large number of trades, you’ll want to use the portfolio report feature that ETX Capital offers. This will give you a full break down of your previous and current trades, alongside profits and losses.