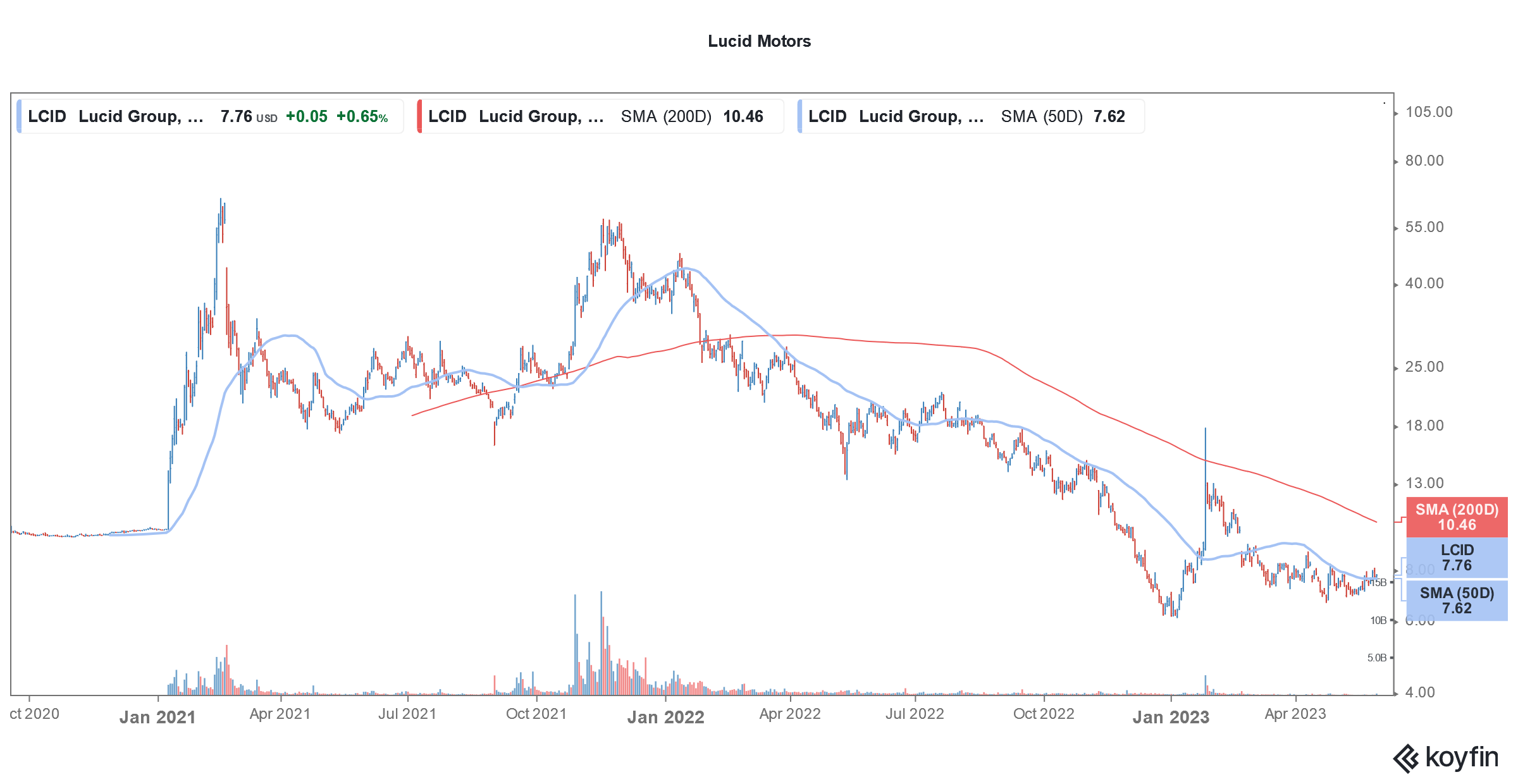

Lucid Motors stock (NYSE: LCID) is trading sharply lower in US post-market price action today after the company announced a $3 billion capital raise – its second stock sale in less than a year.

The company announced a public offering of 173,544,948 shares through which it would raise around $1.2 billion. It would raise another $1.8 billion through a private placement of shares to Ayar Third Investment Company which is an affiliate of Saudi Arabia’s PIF (public investment trust).

Lucid Motors stock sinks on $3 billion capital raise

The structure is similar to the $1.5 billion stock offering that Lucid Motors completed in the fourth quarter of 2022.

In that stock offering, Lucid Motors sold shares at an average price of $10.7 for gross proceeds of around $600 million. As agreed, PIF invested $915 million at similar terms.

Post the current stock sale, PIF would maintain its nearly 60.5% stake in Lucid Motors.

PIF is LCID’s largest stockholder

PIF is Lucid Motors’ biggest stockholder and first invested in the company in 2018 months after Tesla CEO Elon Musk tweeted that he intends to take “Tesla private” – believing he had the backing of Saudi Arabia.

That wasn’t the case and Musk and Tesla both individually paid a fine of $20 million to the SEC. As part of the settlement, Musk needs a “Twitter sitter” – something he has been trying to do away with, albeit unsuccessfully.

Saudi Arabia has placed a massive order for Lucid cars

Saudi Arabia has placed an order for upto 100,000 cars with Lucid Motors.

Responding to an analyst question on the delivery timeline for these cars, Rawlinson said, during the Q1 2023 earnings call, “We are in active dialogues. We’re in the process of building out the specs for the first vehicles that they want to receive later this year.”

The company is also building its second factory in the kingdom and said that the facility to build 5,000 cars is “nearly complete and equipment installation will begin next month.”

Lucid Motors stock soared earlier this year on rumors that Saudi Arabia is considering taking the company private. During the Q4 2022 earnings call, the company refused to comment on the rumors.

During the Q1 2023 earnings call Lucid CEO Sherry House said, “The PIF has been a committed investor and a strategic partner for many years, and we’re very grateful for their partnership and support.”

Lucid Motors would increase its runway

Meanwhile, with the $3 billion capital raise Lucid Motors would increase its runway. It ended the first quarter with total cash of $3.4 billion and total liquidity of $4.1 billion – which it said would fund its loss-making operations until at least Q2 2024.

Startup EV companies are burning a lot of cash towards both operating losses as well as capex. Lucid Motors for instance posted an operating loss of $772 million in Q1 2023 – wider than the $597 million that it posted in the corresponding quarter last year.

It reported a per-share loss of 43 cents – which was much wider than the per-share loss in Q1 2022 – and also higher than what the markets were expecting.

Its revenues came in at $149.4 million which was below the $209.9 million that analysts were expecting.

Lucid Motors lowered its 2023 production guidance

In his prepared remarks, Lucid Motors CEO Peter Rawlinson said, “We are on track to produce over 10,000 vehicles in 2023, with company-wide initiatives ongoing that will enable Lucid to pivot to higher volumes as market conditions allow.”

Notably, during the previous quarter, the company provided a 2023 delivery guidance of between 10,000-14,000 vehicles. It has now toned down the guidance and expects it to be near the lower end of the guidance.

Incidentally, when it went public in 2021 through a reverse merger with Churchill Capital IV, Lucid guided for 2023 deliveries of 49,000. However, like fellow EV startups, it is also struggling with meeting those forecasts that looked lofty at the onset only.

Lucid Motors as well as Rivian have stopped providing reservation numbers in a sign that the demand is probably not as strong. Incidentally, Lucid reported a fall in reservation numbers for two quarters before it announced that it won’t provide the metric going forward.

Startup EV companies have failed to live up to the hype

Almost all the startup EV companies including Lucid Motors have failed to live upto the hype. Looking at other EV names, Lordstown Motors has warned of bankruptcy if Foxconn walks out from the funding deal. Arrival flagged bankruptcy risks before it went for a second SPAC merger which gave it a second life of sorts.

Rivian’s market cap is now only about 8% of what it was at the peak. Nikola too has received a delisting notice from Nasdaq for failing to comply with the minimum listing conditions.

“Tesla-killers” face an uphill task

Lucid Motors compared itself to Tesla and Rawlinson, a former Tesla employee himself, predicted the EV industry to be a two-horse race between itself and Tesla. Several analysts also branded Lucid Motors as a potential “Tesla killer.”

Fast forward to 2023 and several “Tesla killers” are fighting for relevancy. The backing from cash-rich PIF is nothing short of a boon for Lucid Motors as several other startup EV companies are struggling to raise funds amid the tough market conditions.

All said, while the capital raise would increase the runway for Lucid Motors, the company still needs to address the demand problem. The lowering of 2023 guidance did not reflect positively on the demand environment even as the company said it is working on brand awareness which would help it increase the sales of its cars.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account